This version of the form is not currently in use and is provided for reference only. Download this version of

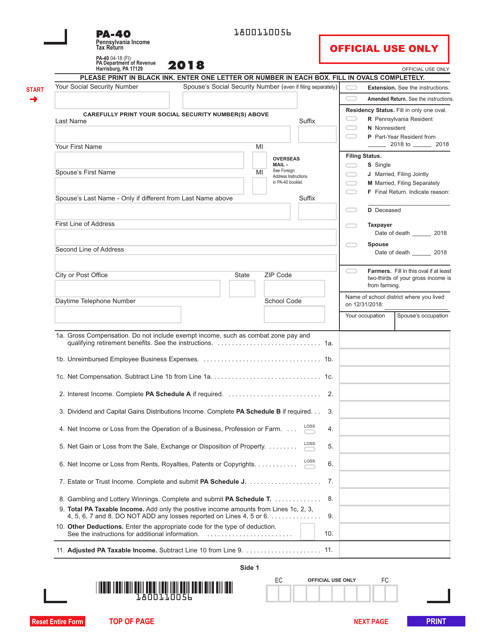

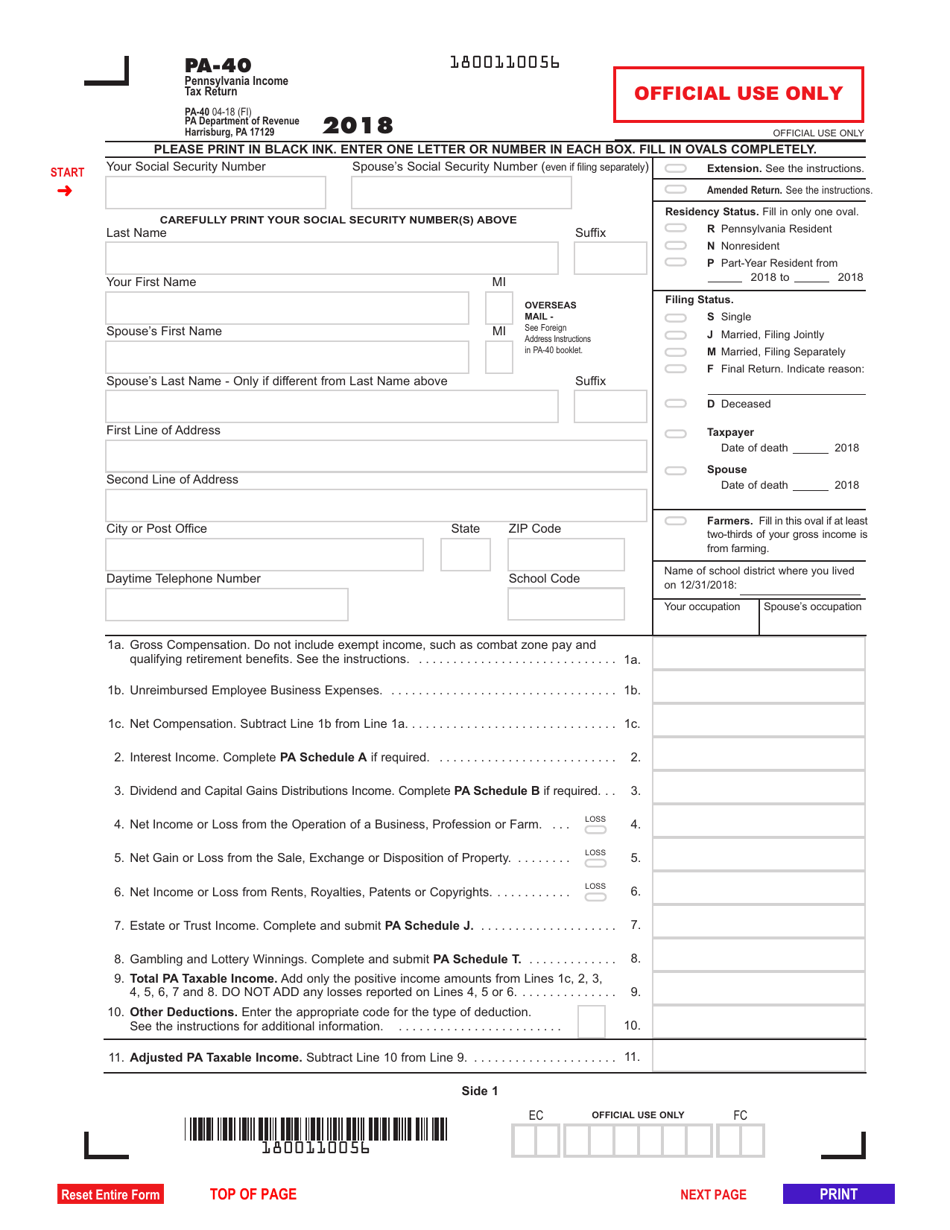

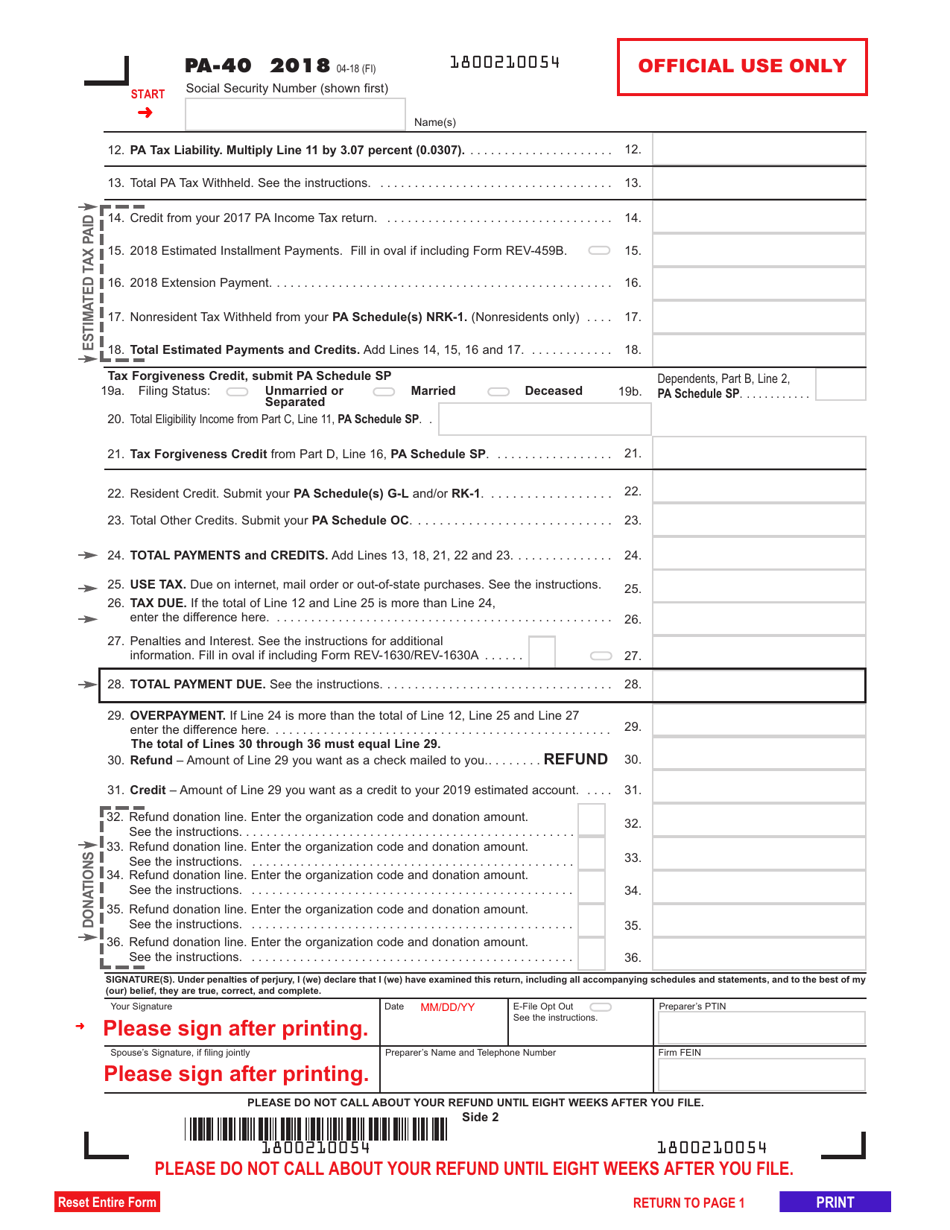

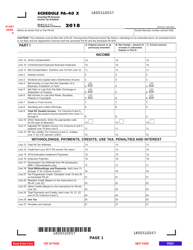

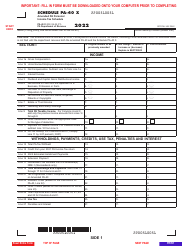

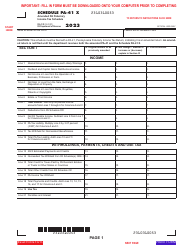

Form PA-40

for the current year.

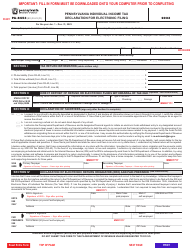

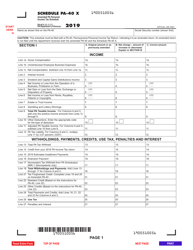

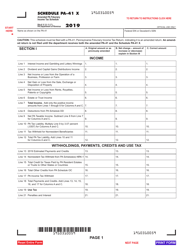

Form PA-40 Pennsylvania Income Tax Return - Pennsylvania

What Is Form PA-40?

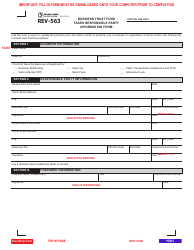

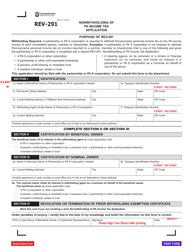

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-40?

A: PA-40 is a form used to file Pennsylvania income tax return.

Q: Who needs to file PA-40?

A: Pennsylvania residents and non-residents who earned income in Pennsylvania need to file PA-40.

Q: When is the deadline to file PA-40?

A: The deadline to file PA-40 is typically April 15th, but it may vary depending on certain circumstances.

Q: What information do I need to complete PA-40?

A: You will need information about your income, deductions, and any credits or exemptions you may qualify for.

Q: Can I file PA-40 electronically?

A: Yes, Pennsylvania offers electronic filing option for PA-40.

Q: What if I can't pay the full amount of taxes owed?

A: If you are unable to pay the full amount of taxes owed, you should still file PA-40 and then contact the Pennsylvania Department of Revenue to discuss payment options.

Q: Are there any penalties for late filing of PA-40?

A: Yes, if you fail to file PA-40 or pay the taxes owed by the deadline, you may be subject to penalties and interest.

Q: Can I amend my PA-40 after filing?

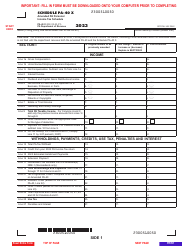

A: Yes, you can file an amended PA-40 using Form PA-40X if you need to correct any errors or make changes to your original return.

Q: Is there a phone number I can call for help with PA-40?

A: Yes, the Pennsylvania Department of Revenue has a taxpayer helpline that you can call for assistance with PA-40.

Q: Is PA-40 the only tax form I need to file in Pennsylvania?

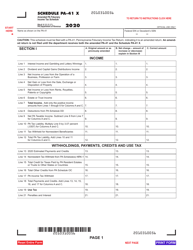

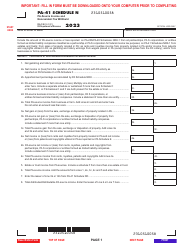

A: No, in addition to PA-40, you may also need to file other forms such as Schedule PA-40 or PA-40 Schedule UE.

Q: Can I file PA-40 if I didn't earn any income in Pennsylvania?

A: If you didn't earn any income in Pennsylvania, you may not need to file PA-40. However, it is always recommended to consult with a tax professional or the Pennsylvania Department of Revenue to confirm.

Q: What if I move out of Pennsylvania during the tax year?

A: If you move out of Pennsylvania during the tax year, you may still need to file PA-40 if you earned income in Pennsylvania. You may also need to file a part-year resident return in your new state.

Q: Are there any deductions or credits specific to Pennsylvania on PA-40?

A: Yes, Pennsylvania offers various deductions and credits that you may be eligible for. These can include deductions for property taxes, rent, or contributions to the Pennsylvania 529 college savings program.

Q: Can I file PA-40 jointly with my spouse?

A: Yes, you can file PA-40 jointly with your spouse if you are married.

Q: What is the purpose of PA-40?

A: The purpose of PA-40 is to report and pay income taxes to the state of Pennsylvania.

Q: Can I file PA-40 if I am a nonresident of Pennsylvania?

A: Yes, if you earned income in Pennsylvania as a nonresident, you may need to file PA-40.

Q: Is there an income threshold for filing PA-40?

A: Yes, the income threshold for filing PA-40 may vary depending on your filing status and age. It is recommended to refer to the instructions or consult with a tax professional.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.