Form RI-1041 Fiduciary Rate Worksheet - Rhode Island

What Is Form RI-1041?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

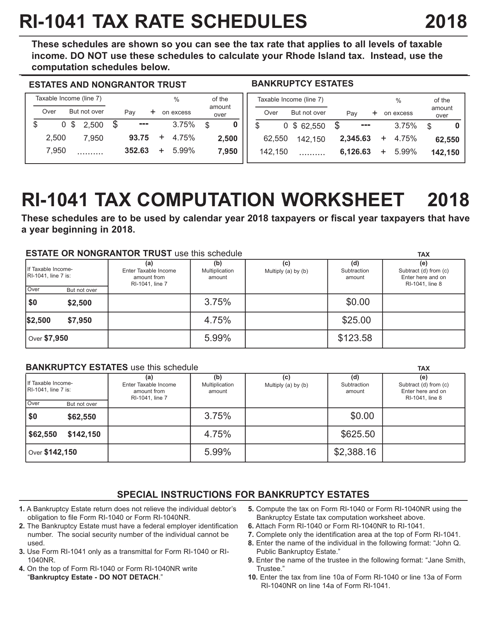

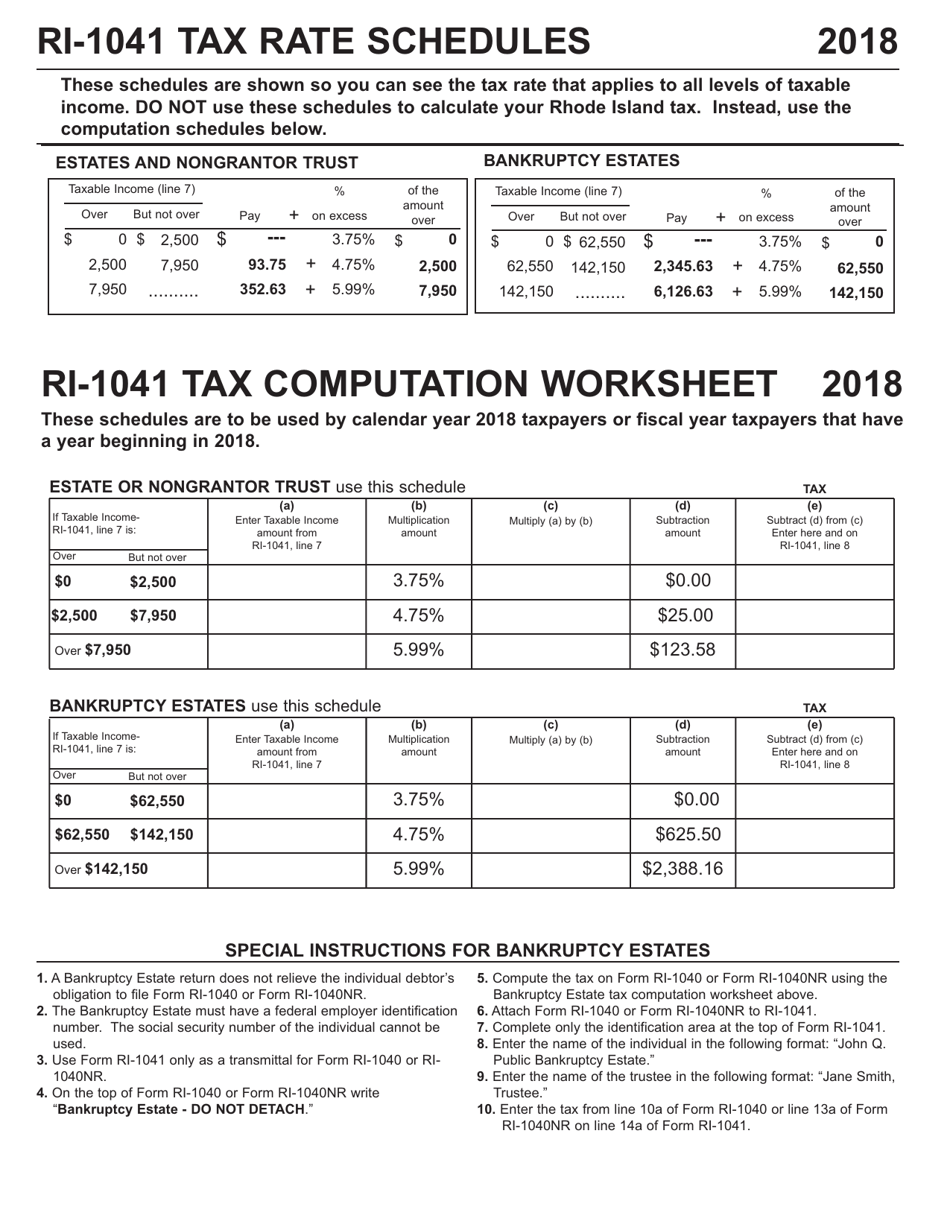

Q: What is the RI-1041 Fiduciary Rate Worksheet?

A: The RI-1041 Fiduciary Rate Worksheet is a tax form used in Rhode Island for calculating the tax rate applicable to the income of a fiduciary estate.

Q: Who needs to fill out the RI-1041 Fiduciary Rate Worksheet?

A: The RI-1041 Fiduciary Rate Worksheet needs to be filled out by individuals or entities acting as fiduciaries of an estate.

Q: What is a fiduciary?

A: A fiduciary is a person or entity that is responsible for managing assets or property on behalf of another, such as an executor, administrator, or trustee of an estate.

Q: What is the purpose of the RI-1041 Fiduciary Rate Worksheet?

A: The purpose of the RI-1041 Fiduciary Rate Worksheet is to determine the tax rate applicable to the income of a fiduciary estate in Rhode Island.

Q: Are there any specific instructions for filling out the RI-1041 Fiduciary Rate Worksheet?

A: Yes, the RI-1041 Fiduciary Rate Worksheet comes with instructions that should be carefully read and followed while filling out the form.

Q: When is the deadline for filing the RI-1041 Fiduciary Rate Worksheet?

A: The deadline for filing the RI-1041 Fiduciary Rate Worksheet is typically April 15th, unless an extension has been granted.

Q: Is the RI-1041 Fiduciary Rate Worksheet the only form required for filing taxes as a fiduciary in Rhode Island?

A: No, in addition to the RI-1041 Fiduciary Rate Worksheet, fiduciaries may also need to file other tax forms, such as the RI-1041 Fiduciary Income Tax Return.

Q: Can I e-file the RI-1041 Fiduciary Rate Worksheet?

A: No, currently the RI-1041 Fiduciary Rate Worksheet can only be filed by mail and cannot be e-filed.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-1041 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.