This version of the form is not currently in use and is provided for reference only. Download this version of

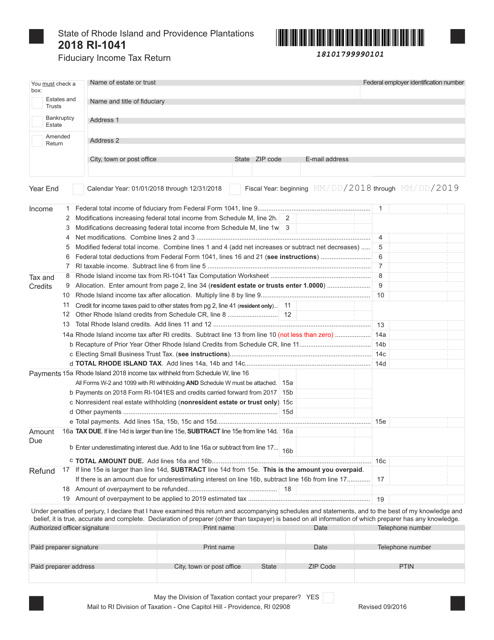

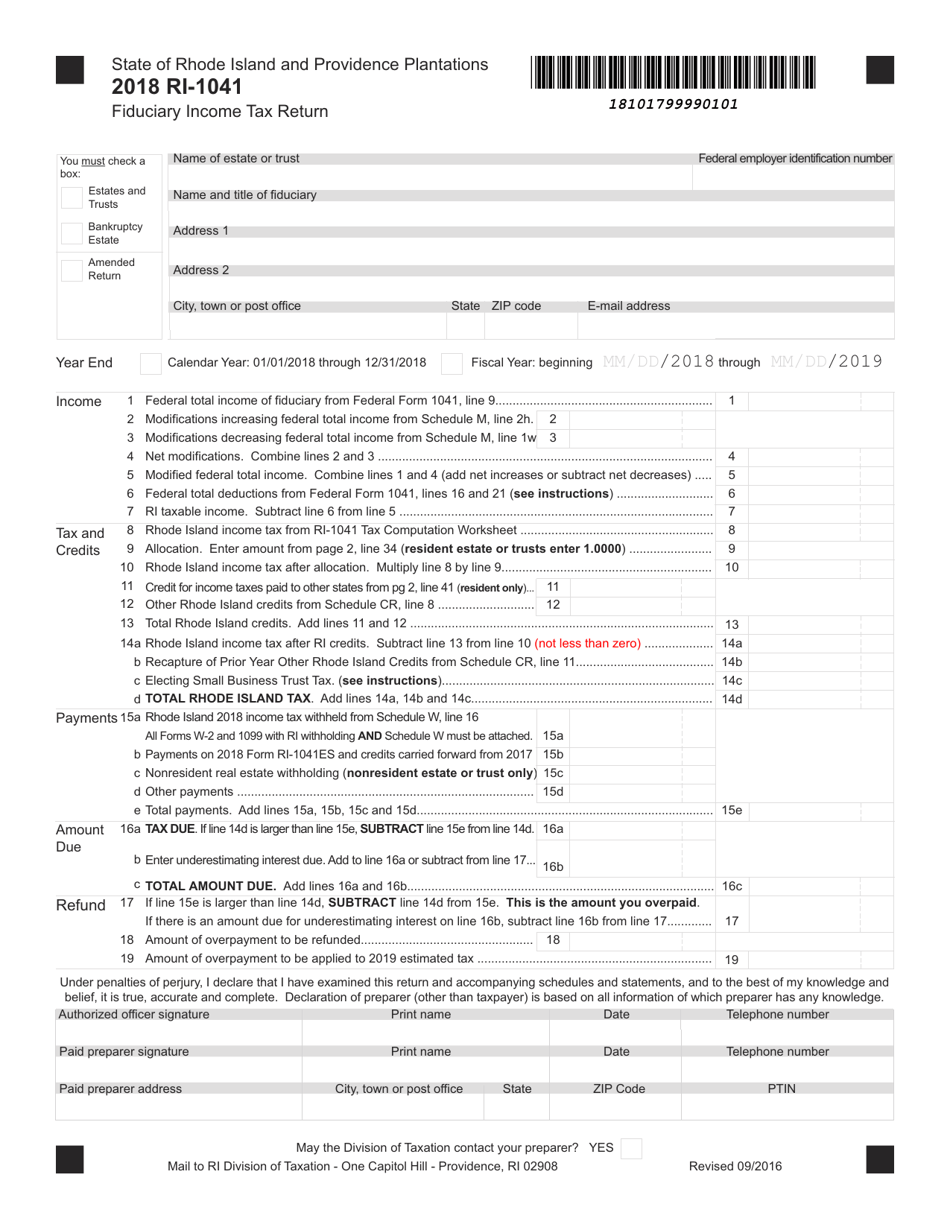

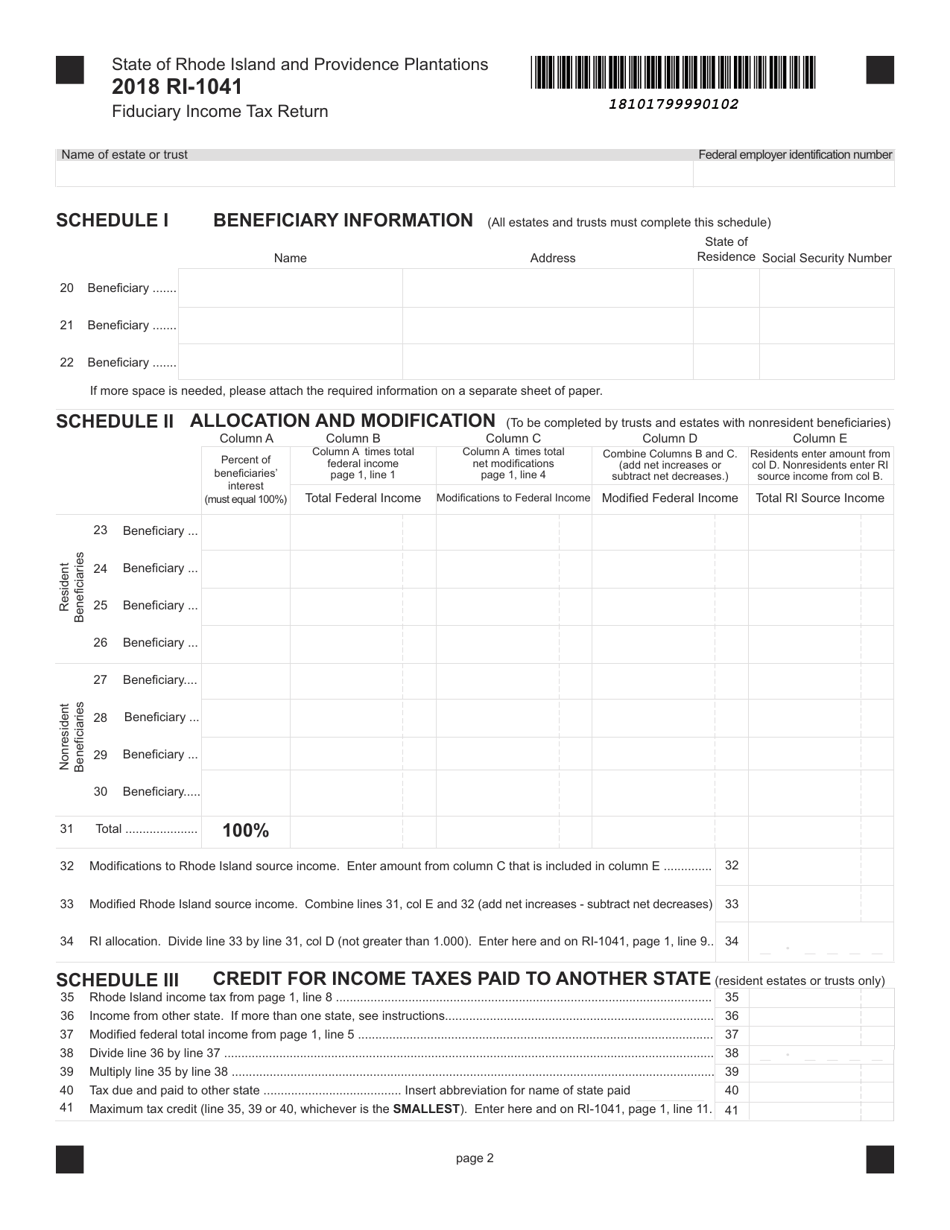

Form RI-1041

for the current year.

Form RI-1041 Fiduciary Income Tax Return - Rhode Island

What Is Form RI-1041?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-1041?

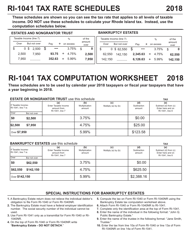

A: The Form RI-1041 is the Fiduciary Income Tax Return for the state of Rhode Island.

Q: Who needs to file Form RI-1041?

A: Fiduciaries, such as executors, administrators, or trustees, who are responsible for the income of an estate or trust in Rhode Island, need to file Form RI-1041.

Q: What is the purpose of Form RI-1041?

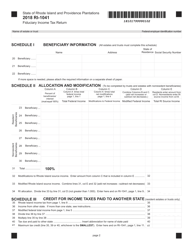

A: Form RI-1041 is used to report the income, deductions, and credits of an estate or trust in Rhode Island.

Q: When is Form RI-1041 due?

A: Form RI-1041 is due on or before the 15th day of the fourth month following the close of the tax year for which the return is being filed.

Q: What should I do if I need help filling out Form RI-1041?

A: If you need assistance in completing Form RI-1041, you can consult the instructions provided with the form or seek the help of a tax professional.

Q: Are there any penalties for late filing of Form RI-1041?

A: Yes, there may be penalties for late filing or failure to file Form RI-1041. It is important to file the form by the due date to avoid any penalties.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1041 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.