This version of the form is not currently in use and is provided for reference only. Download this version of

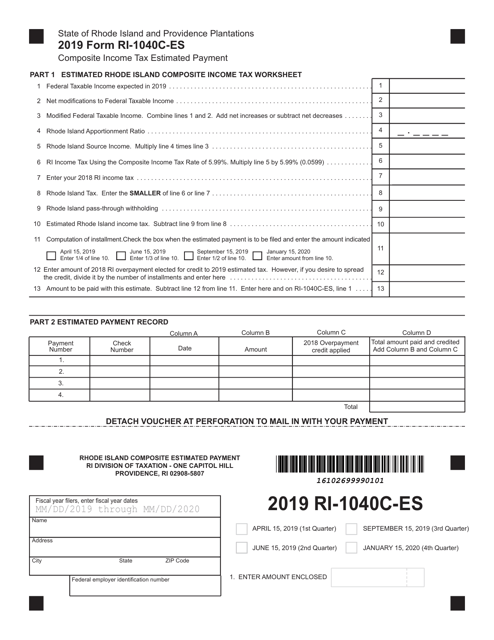

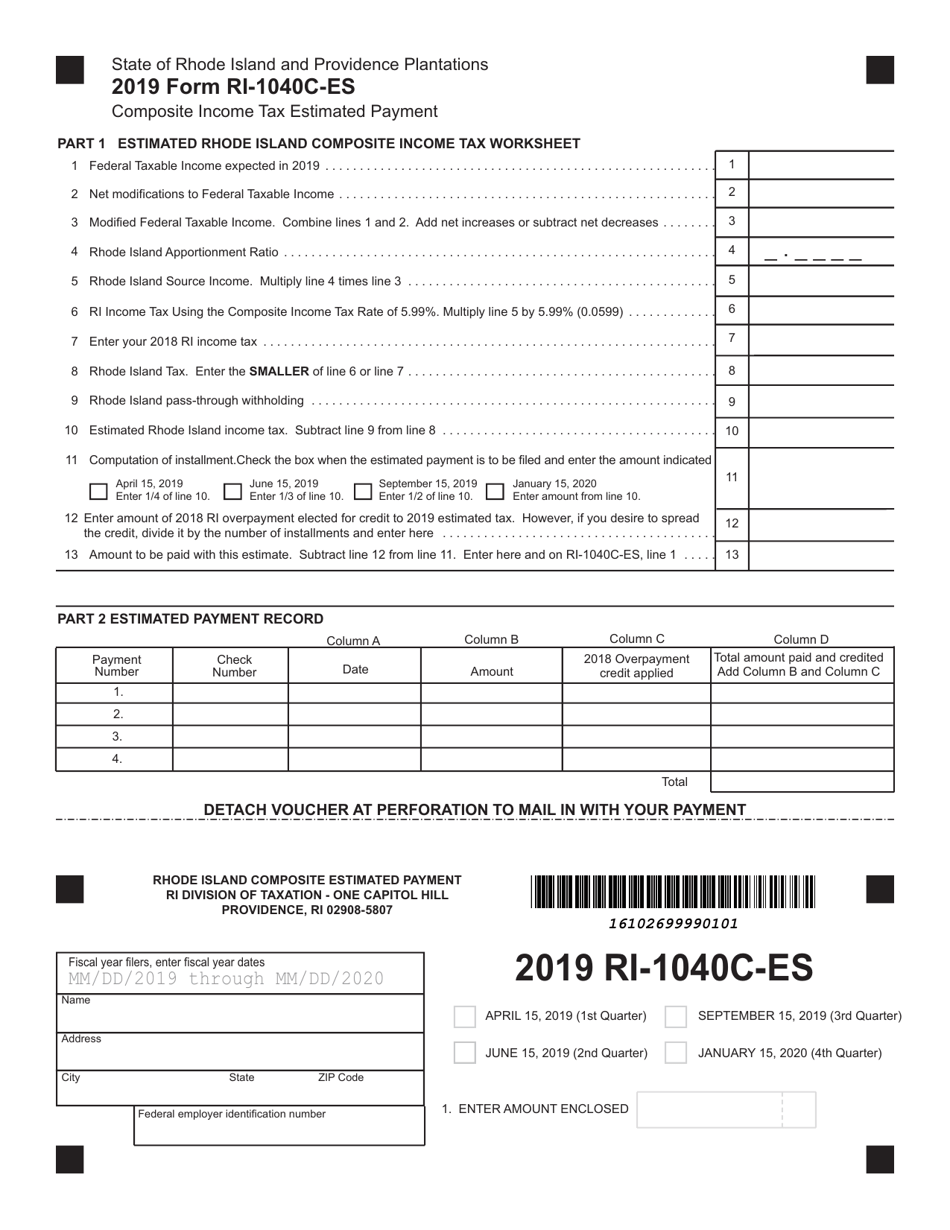

Form RI-1040C-ES

for the current year.

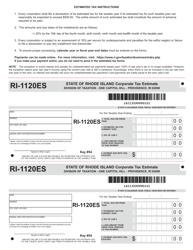

Form RI-1040C-ES Composite Income Tax Estimated Payment - Rhode Island

What Is Form RI-1040C-ES?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1040C-ES?

A: Form RI-1040C-ES is the Composite Income Tax Estimated Payment form for Rhode Island.

Q: Who should use Form RI-1040C-ES?

A: Form RI-1040C-ES should be used by individuals or entities who are nonresident members of a pass-through entity subject to Rhode Island Composite Income Tax.

Q: What is the purpose of Form RI-1040C-ES?

A: The purpose of Form RI-1040C-ES is to make estimated tax payments on behalf of nonresident members of a pass-through entity.

Q: When should Form RI-1040C-ES be filed?

A: Form RI-1040C-ES should be filed and paid by the 15th day of the 4th, 6th, 9th, and 12th months of the taxable year.

Q: Is Form RI-1040C-ES mandatory?

A: Form RI-1040C-ES is mandatory for nonresident members of a pass-through entity subject to Rhode Island Composite Income Tax.

Q: What happens if I don't file Form RI-1040C-ES?

A: If you don't file Form RI-1040C-ES or underpay your estimated tax, you may be subject to penalties and interest.

Q: Can I make electronic payments for Form RI-1040C-ES?

A: Yes, you can make electronic payments for Form RI-1040C-ES using the Rhode Island Business Tax Payment System.

Q: Can I amend my Form RI-1040C-ES?

A: No, you cannot amend Form RI-1040C-ES. If you need to make changes, you should file a new Form RI-1040C-ES.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040C-ES by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.