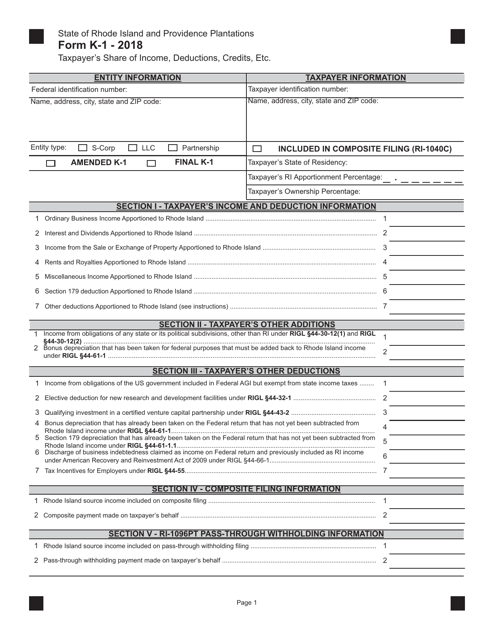

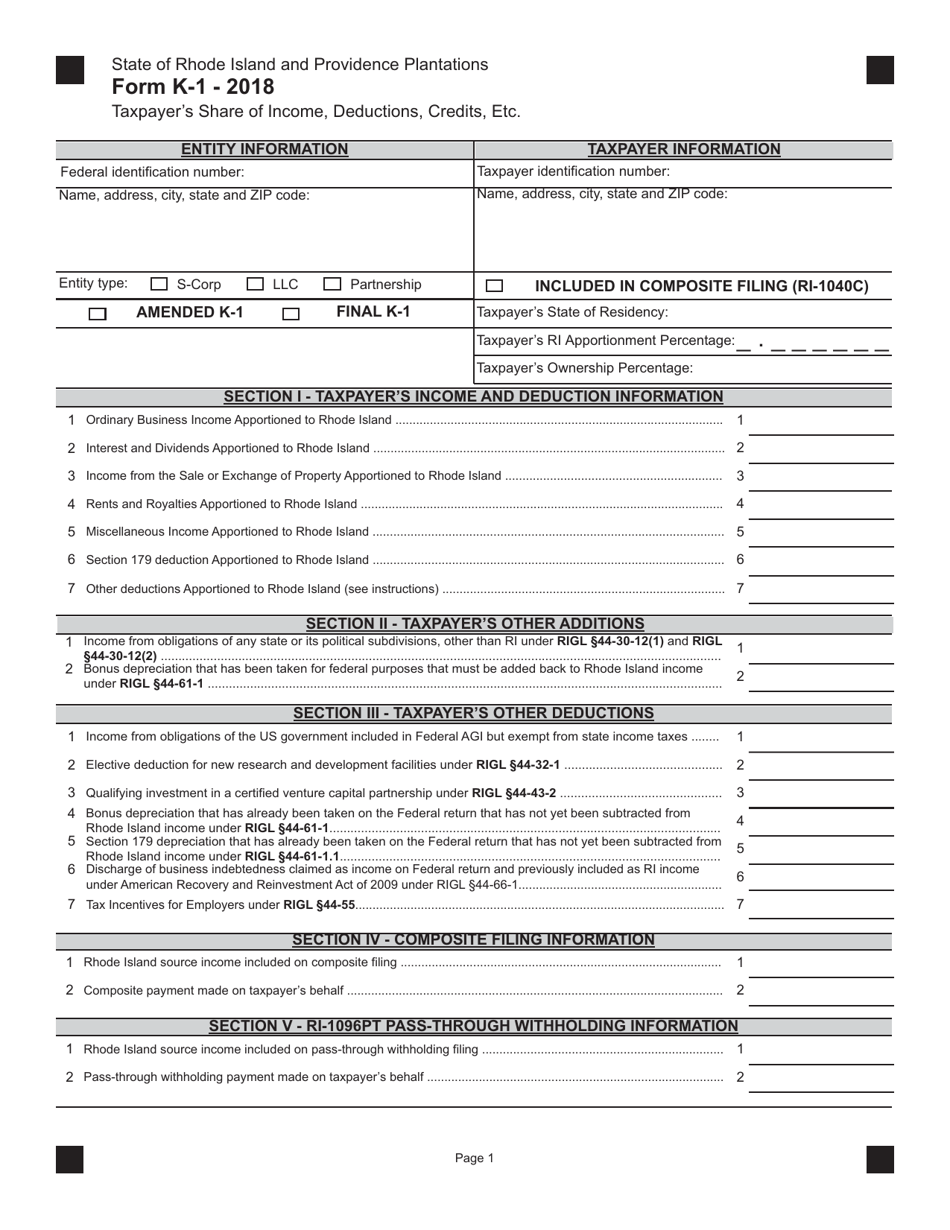

This version of the form is not currently in use and is provided for reference only. Download this version of

Form K-1

for the current year.

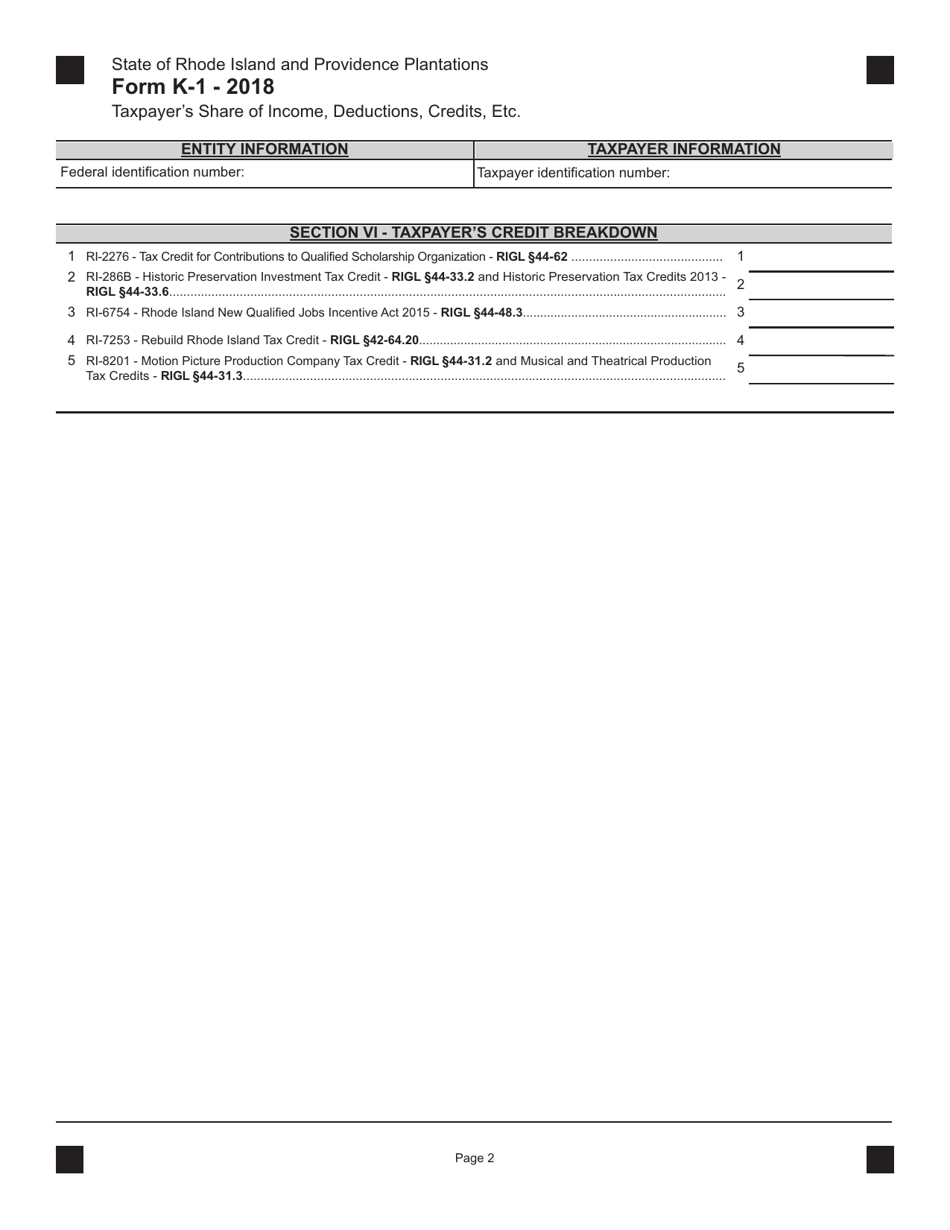

Form K-1 Taxpayer's Share of Income, Deductions, Credits, Etc. - Rhode Island

What Is Form K-1?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-1?

A: Form K-1 is used to report a taxpayer's share of income, deductions, credits, etc. from a partnership, S corporation, or estate or trust.

Q: Who needs to file Form K-1?

A: Partnerships, S corporations, estates, and trusts must file Form K-1 to report the share of income, deductions, credits, etc. to the taxpayers.

Q: What is the purpose of Form K-1?

A: The purpose of Form K-1 is to provide taxpayers with the information they need to complete their individual tax returns.

Q: Is Form K-1 specific to Rhode Island?

A: No, Form K-1 is a federal tax form that is used nationwide. State-specific information may need to be included depending on the state's tax laws.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form K-1 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.