This version of the form is not currently in use and is provided for reference only. Download this version of

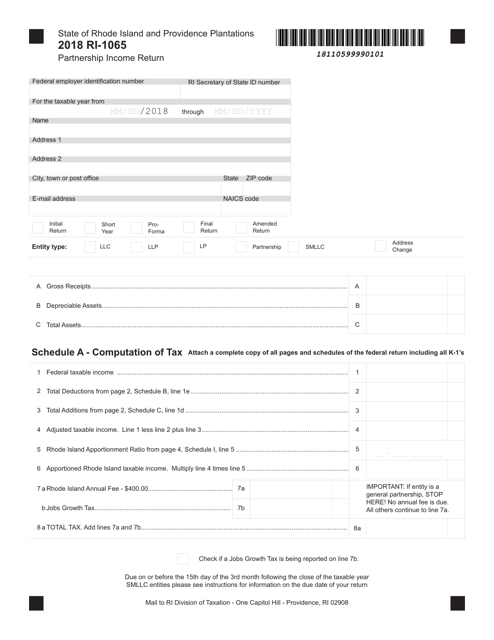

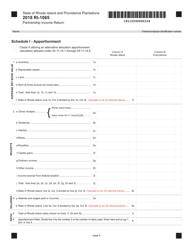

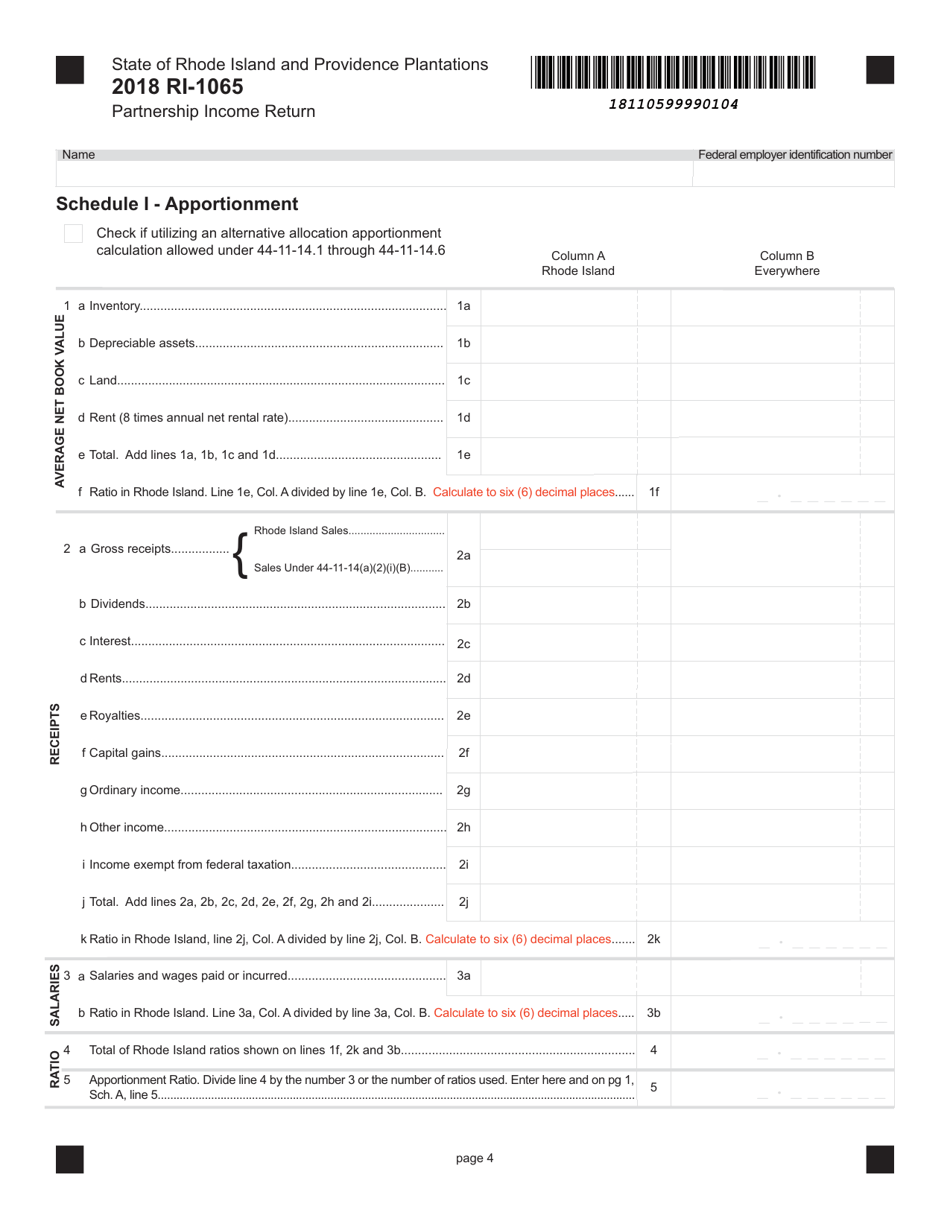

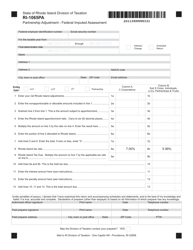

Form RI-1065

for the current year.

Form RI-1065 Partnership Income Return - Rhode Island

What Is Form RI-1065?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1065?

A: Form RI-1065 is the Partnership Income Return for the state of Rhode Island.

Q: Who needs to file Form RI-1065?

A: Partnerships operating in Rhode Island must file Form RI-1065.

Q: When is Form RI-1065 due?

A: Form RI-1065 is due on or before the 15th day of the fourth month following the close of the partnership's tax year.

Q: Are there any extensions available for filing Form RI-1065?

A: Yes, the partnership may request a six-month extension to file Form RI-1065, but any tax owed must still be paid by the original due date.

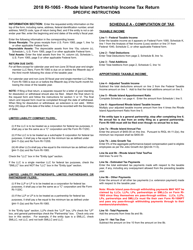

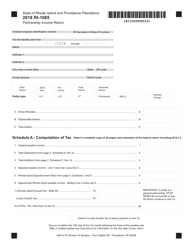

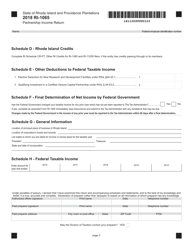

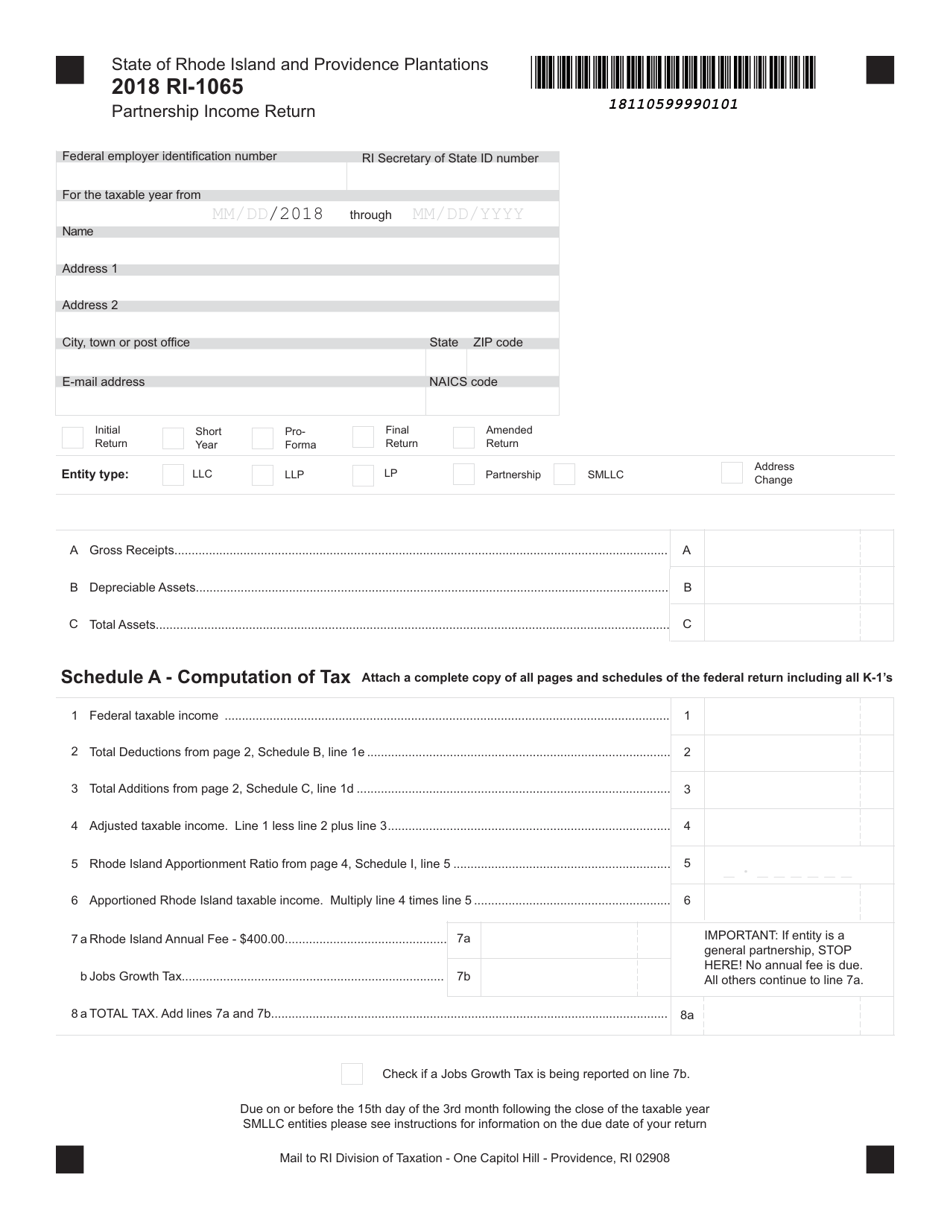

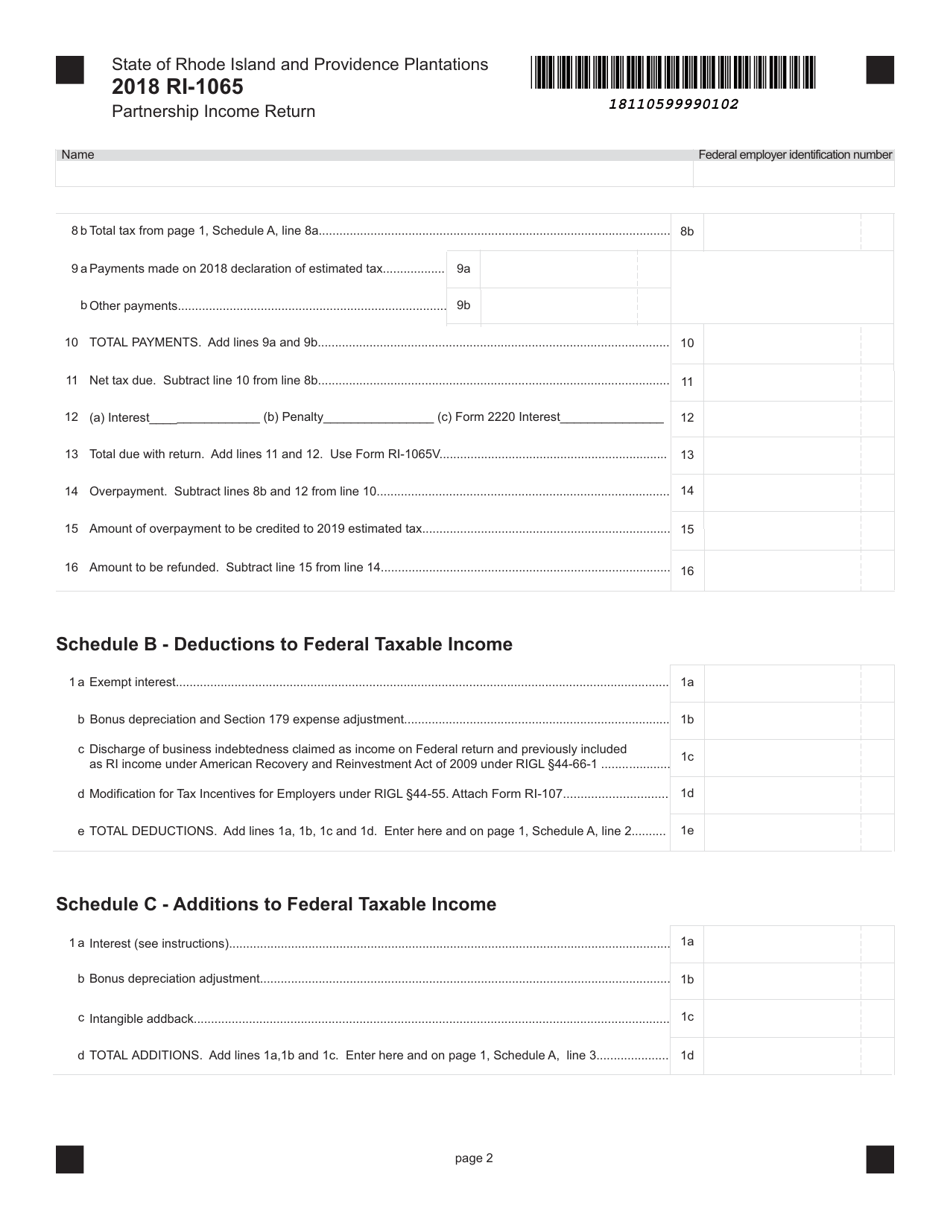

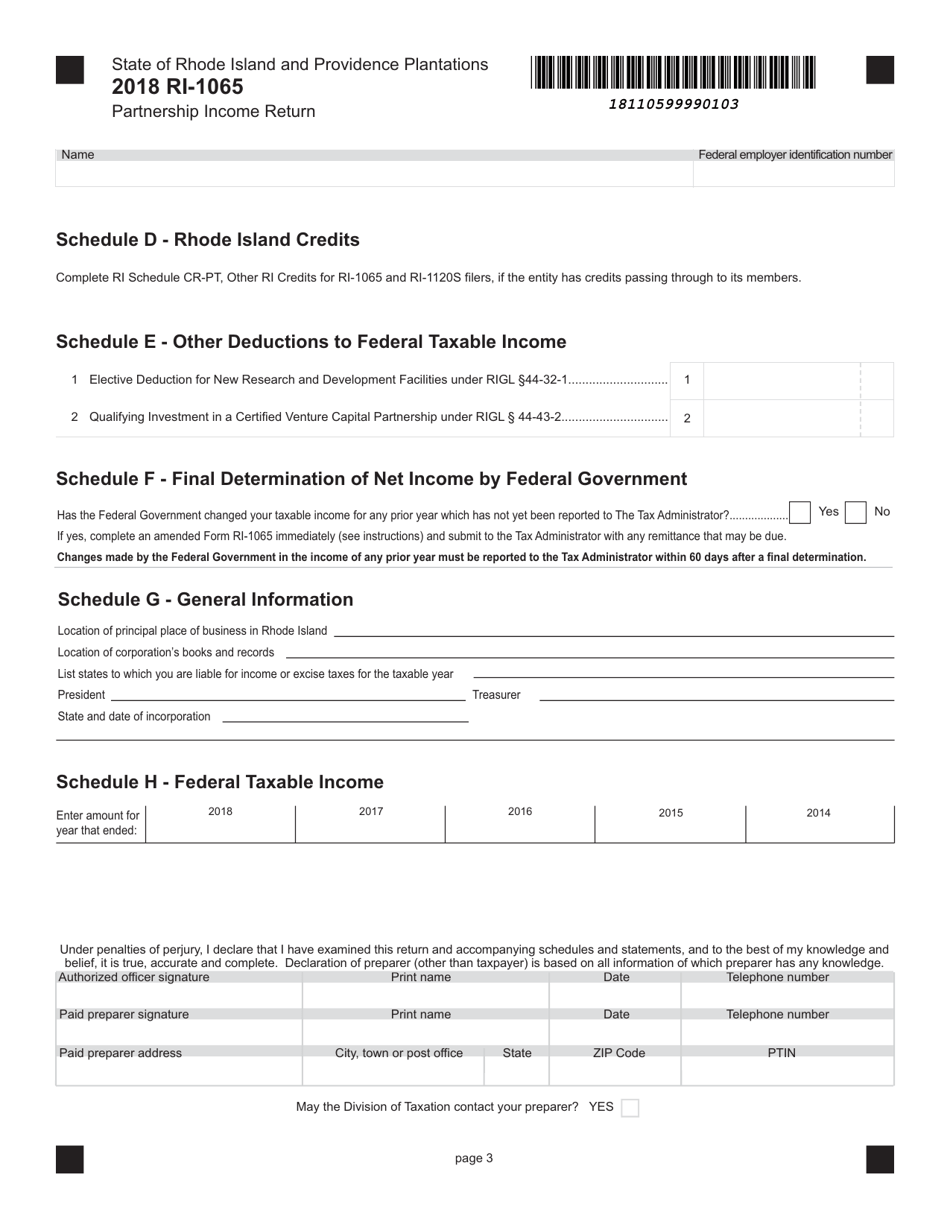

Q: What information is required on Form RI-1065?

A: Form RI-1065 requires the partnership's income, deductions, credits, and other relevant information.

Q: Are there any specific requirements for Form RI-1065?

A: Yes, the partnership must include a copy of its federal Form 1065 with the Rhode Island return.

Q: Is there a separate Form RI Schedule M required?

A: Yes, partnerships must complete and attach Form RI Schedule M to Form RI-1065.

Q: Is electronic filing available for Form RI-1065?

A: Yes, partnerships can choose to electronically file Form RI-1065 if they prefer to do so.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1065 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.