This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Schedule B-CR

for the current year.

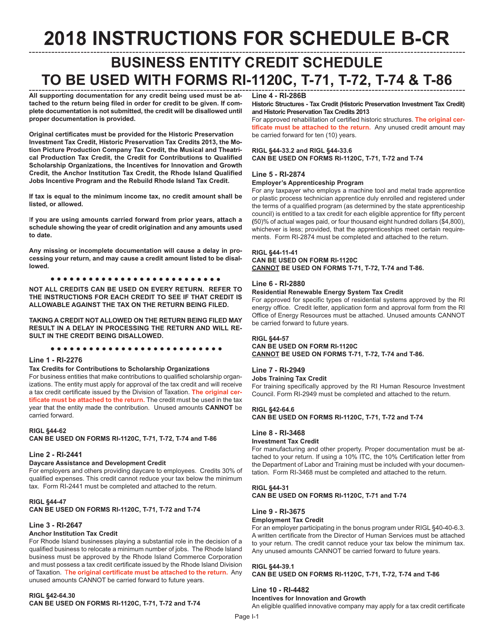

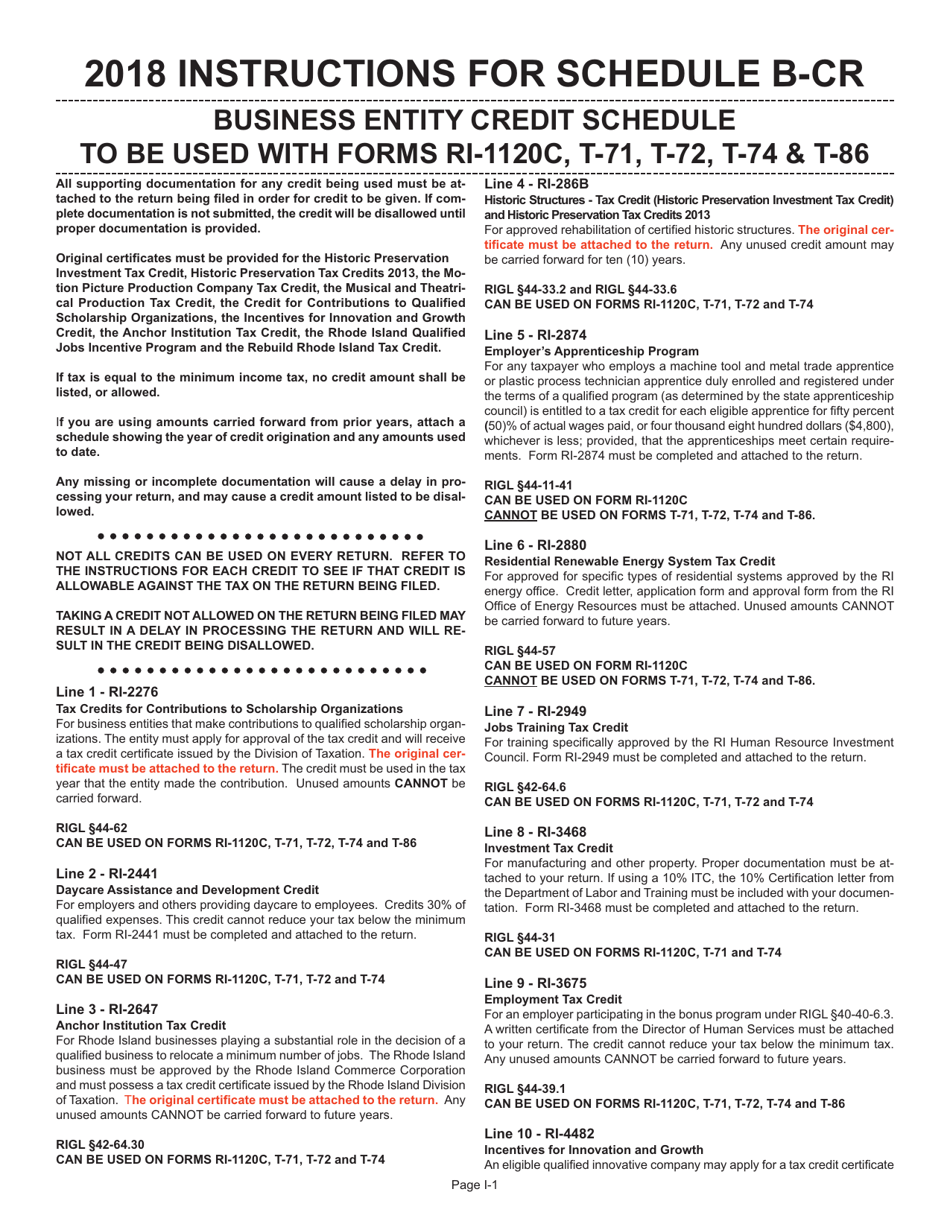

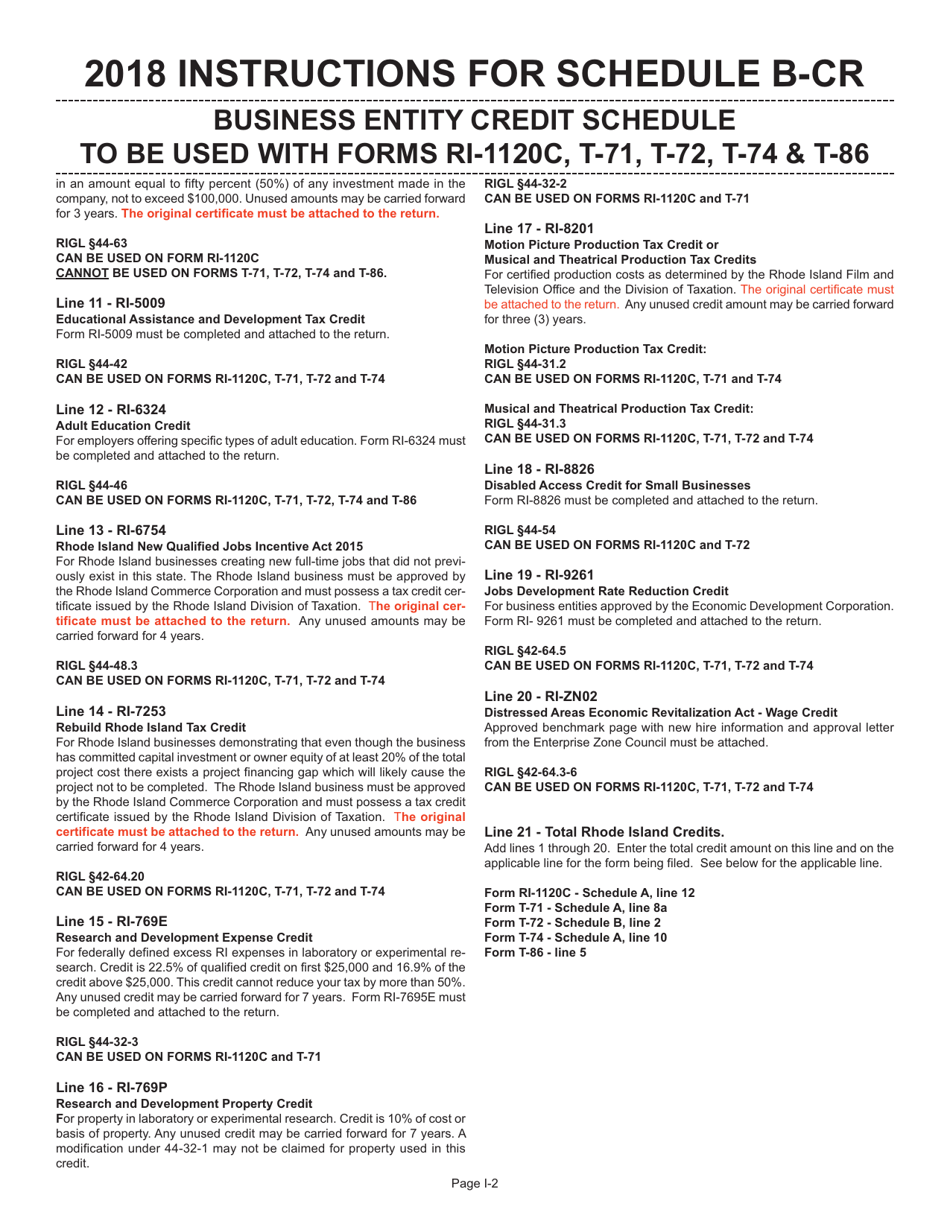

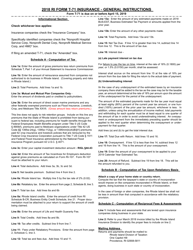

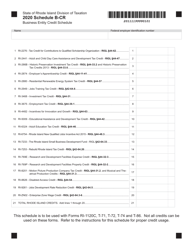

Instructions for Schedule B-CR Business Entity Credit Schedule - Rhode Island

This document contains official instructions for Schedule B-CR , Business Entity Credit Schedule - a form released and collected by the Rhode Island Department of Revenue - Division of Taxation.

FAQ

Q: What is Schedule B-CR?

A: Schedule B-CR is the Business Entity Credit Schedule for Rhode Island.

Q: What is the purpose of Schedule B-CR?

A: The purpose of Schedule B-CR is to calculate and claim credits for business entities in Rhode Island.

Q: Who needs to file Schedule B-CR?

A: Business entities in Rhode Island who want to claim credits need to file Schedule B-CR.

Q: What information is required on Schedule B-CR?

A: You will need to provide detailed information regarding the credits you are claiming, including any supporting documentation.

Q: When is Schedule B-CR due?

A: Schedule B-CR is typically due with your Rhode Island tax return, which is generally April 15th.

Q: Are there any specific eligibility requirements for the credits claimed on Schedule B-CR?

A: Yes, each credit may have specific eligibility requirements, which should be carefully reviewed before claiming.

Q: Can Schedule B-CR be filed electronically?

A: Yes, Rhode Island allows electronic filing of Schedule B-CR.

Q: Is Schedule B-CR required for all business entities in Rhode Island?

A: No, not all business entities are eligible for the credits listed on Schedule B-CR. It is important to determine your eligibility before filing.

Q: Can I amend Schedule B-CR if I make a mistake?

A: Yes, you can amend Schedule B-CR if you make a mistake. File an amended return with the corrected information.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Rhode Island Department of Revenue - Division of Taxation.