This version of the form is not currently in use and is provided for reference only. Download this version of

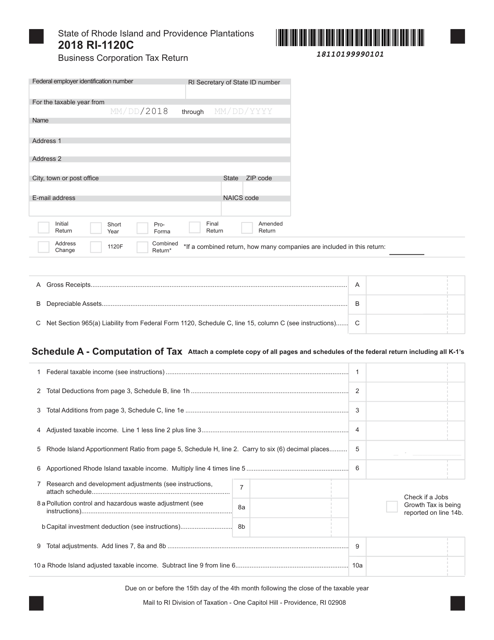

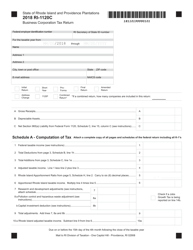

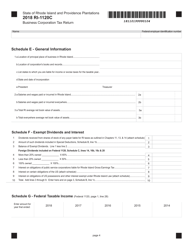

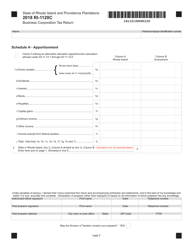

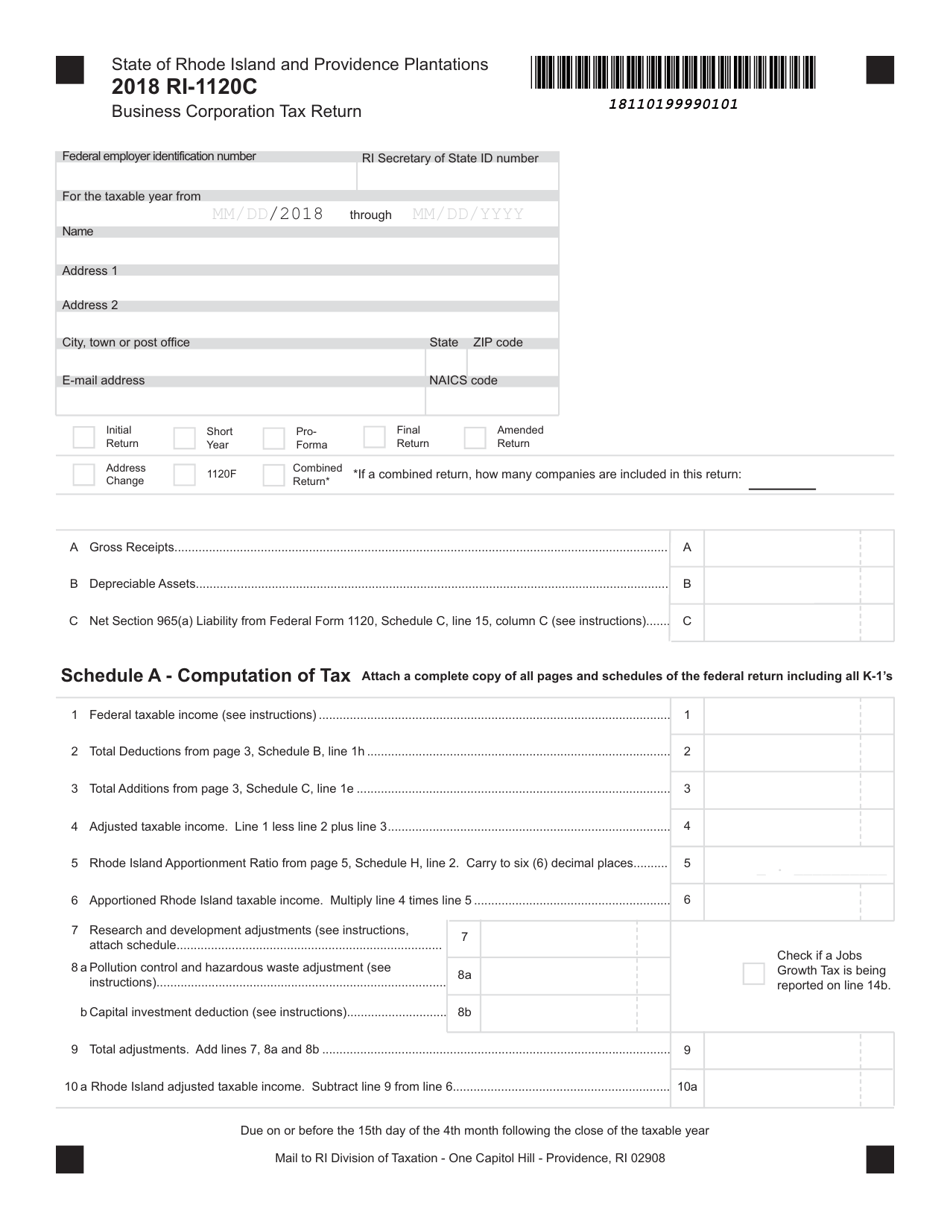

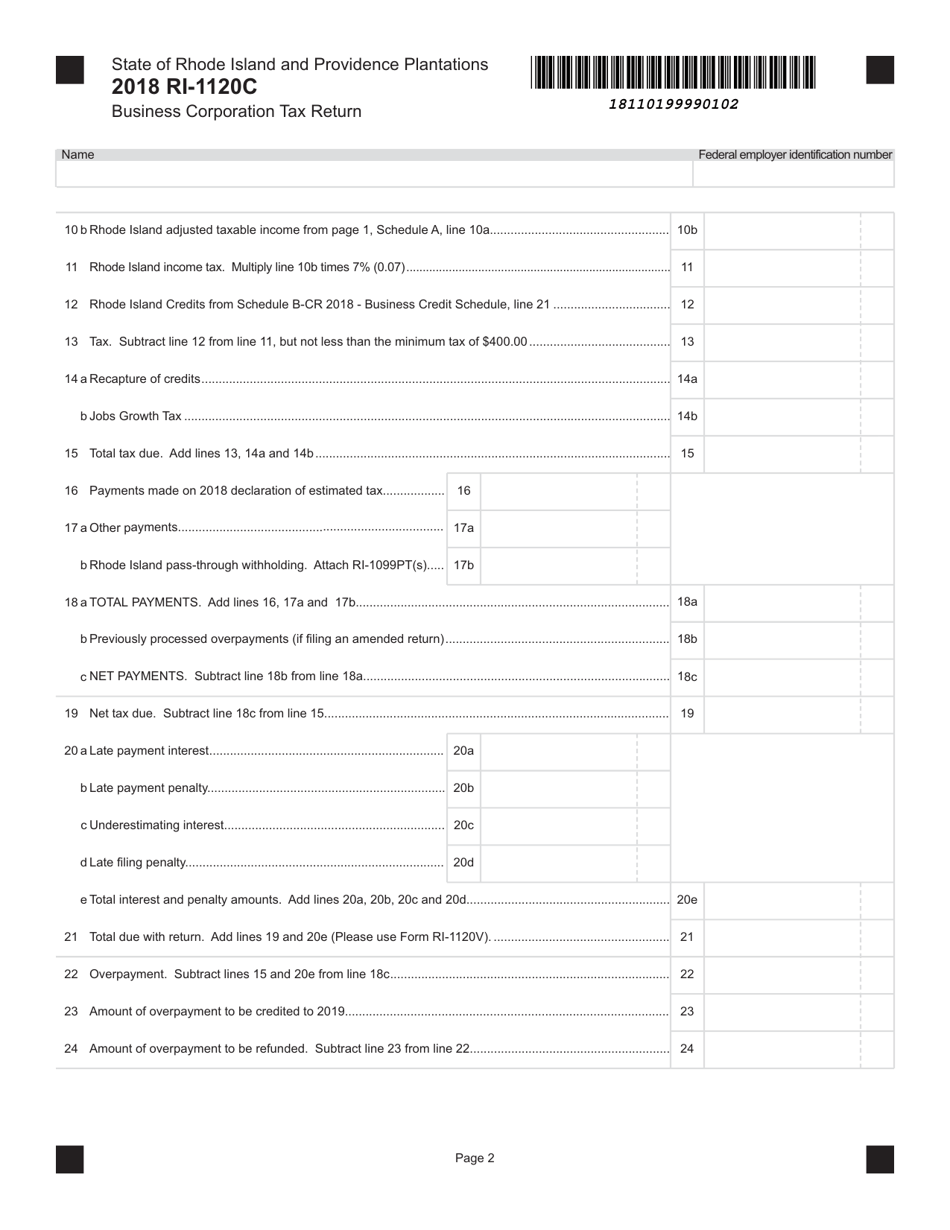

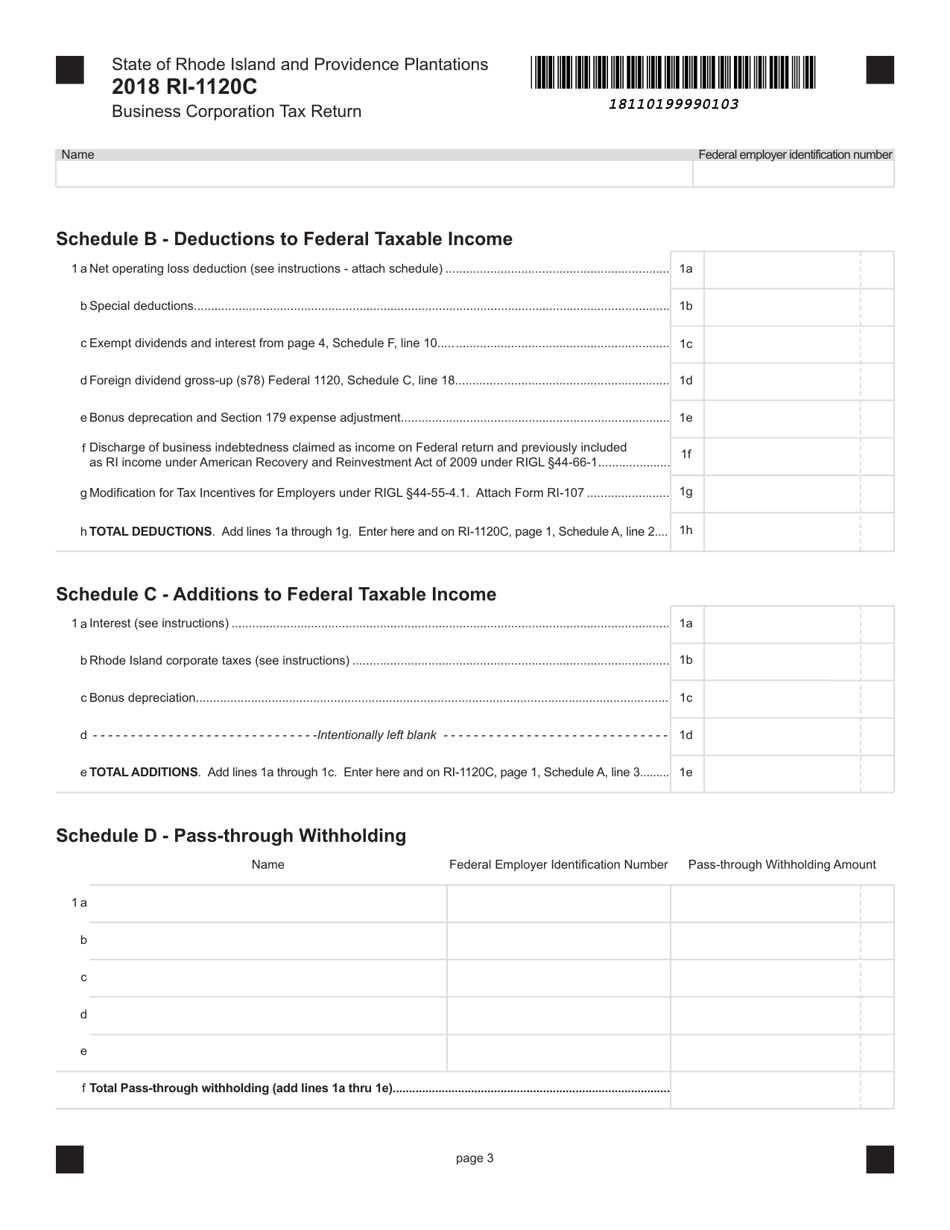

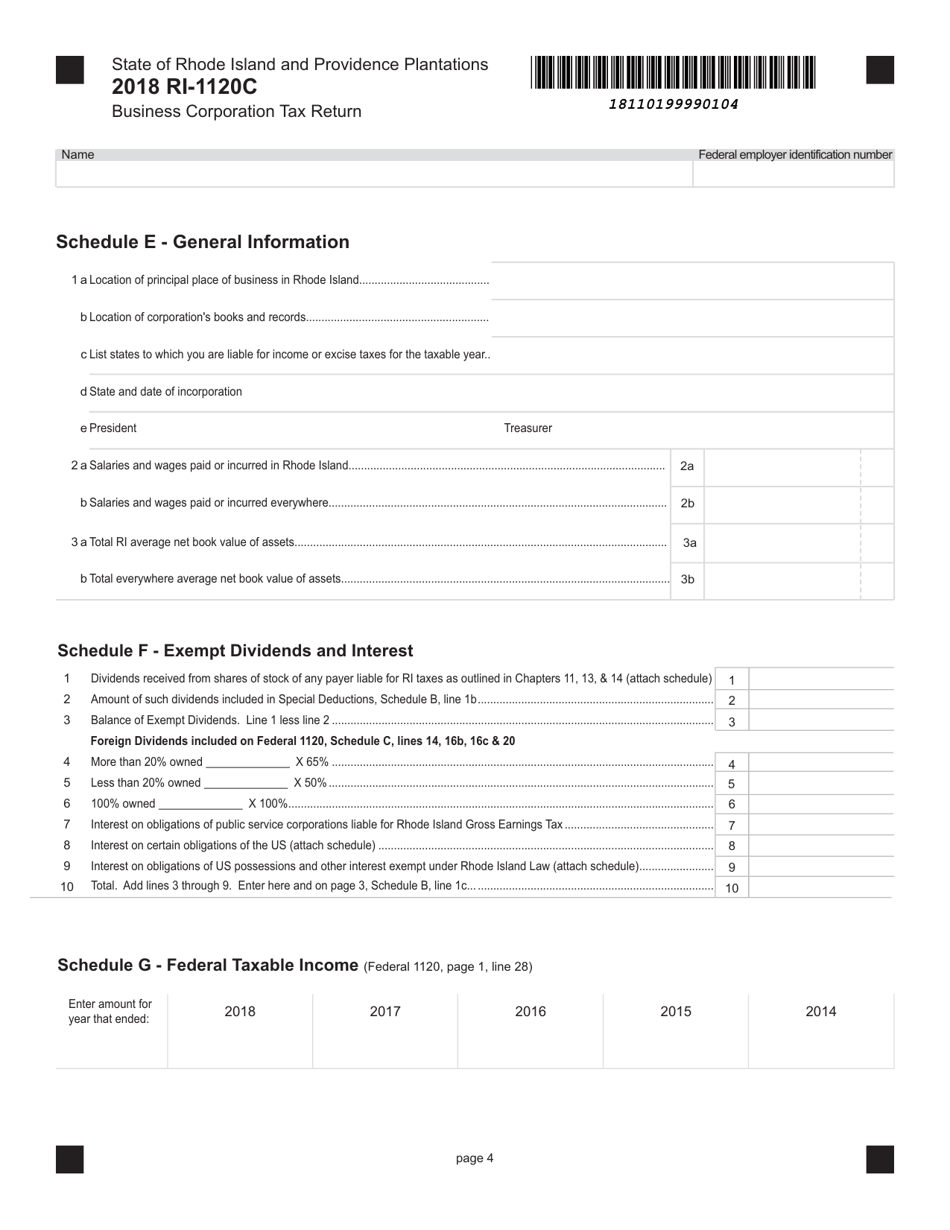

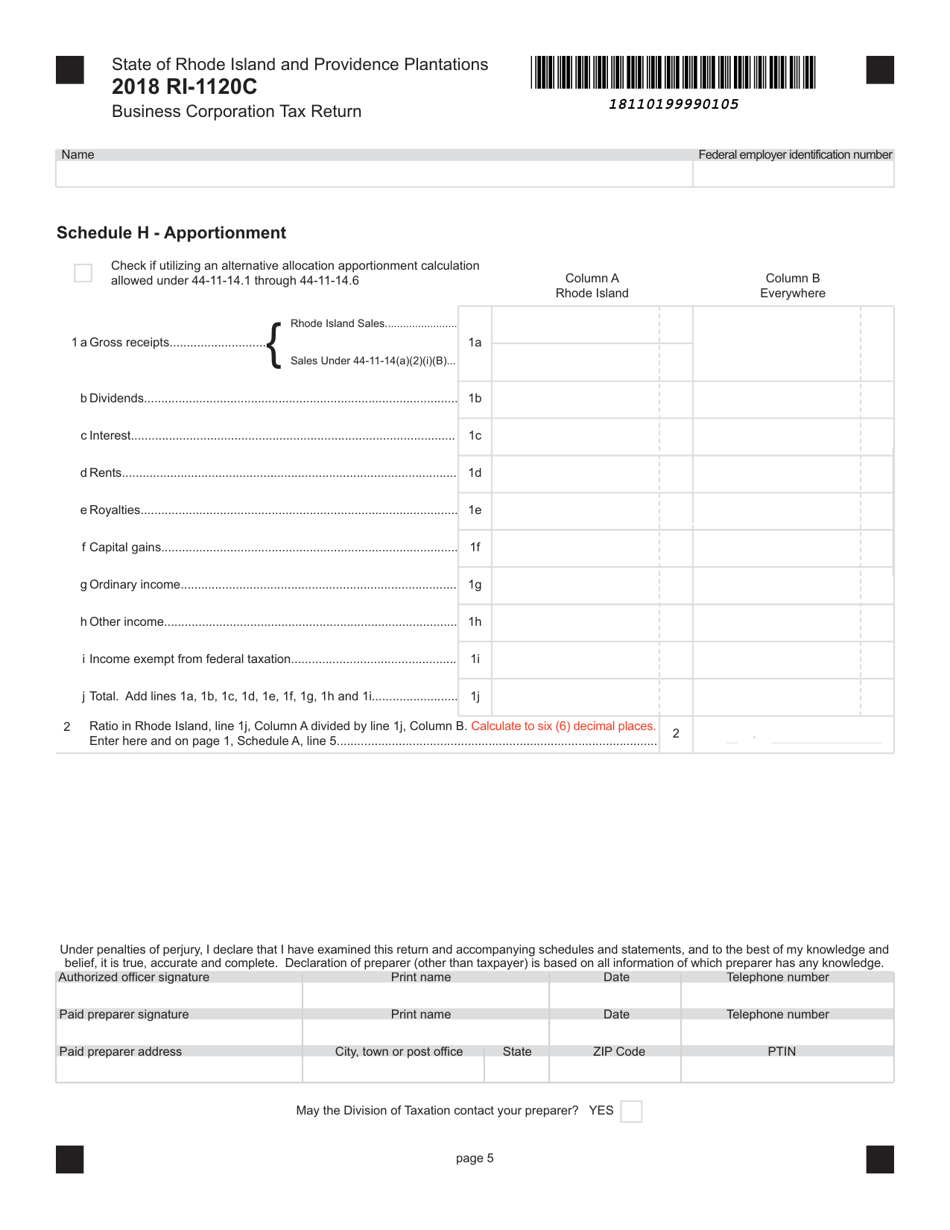

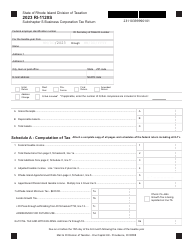

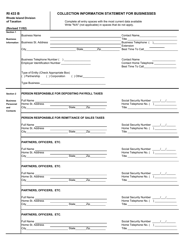

Form RI-1120C

for the current year.

Form RI-1120C Business Corporation Tax Return - Rhode Island

What Is Form RI-1120C?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1120C?

A: Form RI-1120C is the Business Corporation Tax Return for Rhode Island.

Q: Who needs to file Form RI-1120C?

A: Business corporations operating in Rhode Island need to file Form RI-1120C.

Q: When is Form RI-1120C due?

A: Form RI-1120C is due on the 15th day of the 4th month following the close of the tax year.

Q: What information do I need to complete Form RI-1120C?

A: You will need information about your business's income, expenses, deductions, credits, and other relevant financial information.

Q: Are there any filing fees for Form RI-1120C?

A: No, there are no filing fees for Form RI-1120C.

Q: What happens if I don't file Form RI-1120C or file it late?

A: Failure to file Form RI-1120C or filing it late may result in penalties and interest charges.

Q: Can I request an extension to file Form RI-1120C?

A: Yes, you can request an extension to file Form RI-1120C. The extension request must be filed by the original due date of the return.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120C by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.