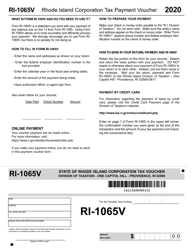

This version of the form is not currently in use and is provided for reference only. Download this version of

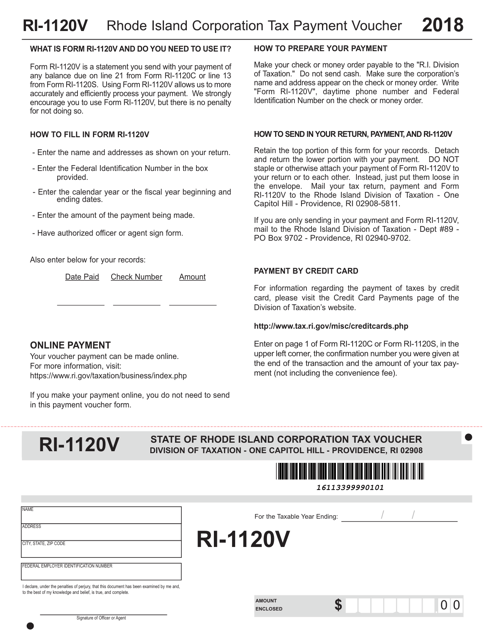

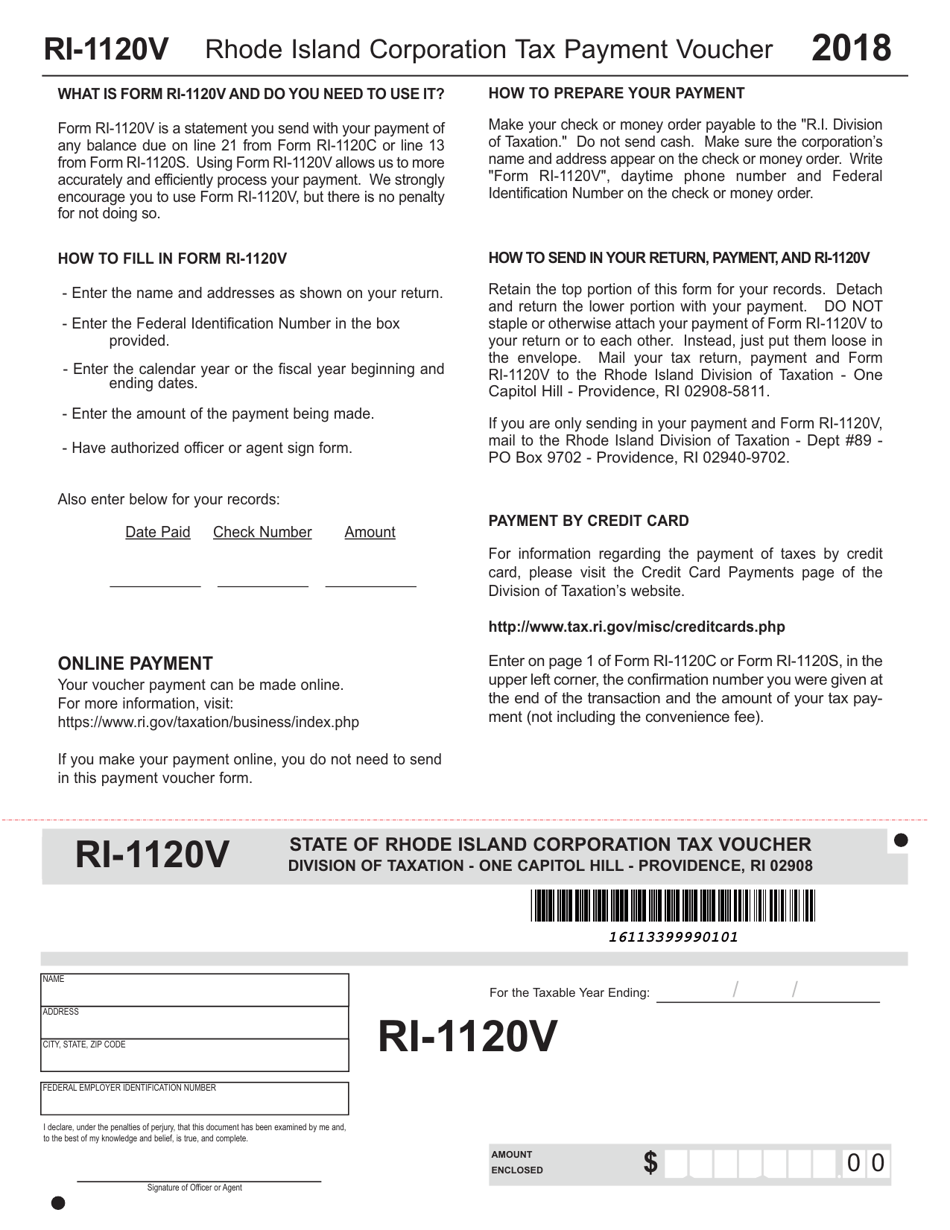

Form RI-1120V

for the current year.

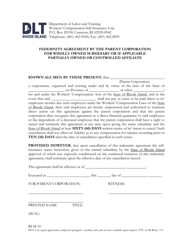

Form RI-1120V Corporation Tax Payment Voucher - Rhode Island

What Is Form RI-1120V?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RI-1120V?

A: RI-1120V is a Corporation Tax Payment Voucher form for Rhode Island.

Q: What is the purpose of RI-1120V?

A: The purpose of RI-1120V is to submit payments for corporate taxes in Rhode Island.

Q: Who needs to fill out RI-1120V?

A: Corporations in Rhode Island who owe taxes are required to fill out RI-1120V.

Q: How do I fill out RI-1120V?

A: You need to provide your corporation's information and the amount you are paying.

Q: When is RI-1120V due?

A: RI-1120V is generally due on the same day as the corporation tax return, which is the 15th day of the fourth month following the close of the corporation's tax year.

Q: Are there any penalties for late payment?

A: Yes, there are penalties for late payment of corporation taxes in Rhode Island.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120V by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.