This version of the form is not currently in use and is provided for reference only. Download this version of

Form RI-2220

for the current year.

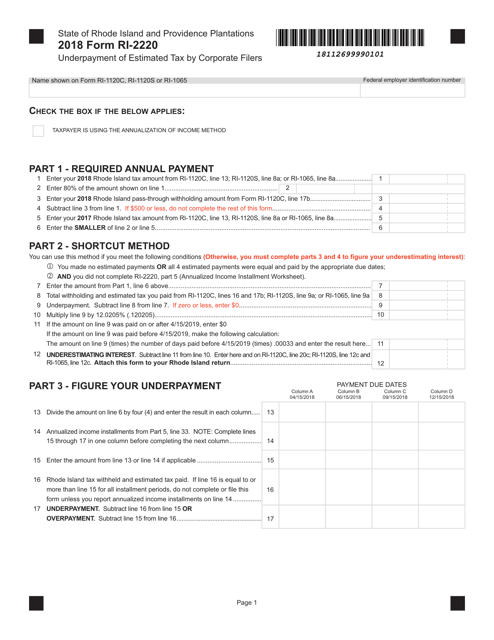

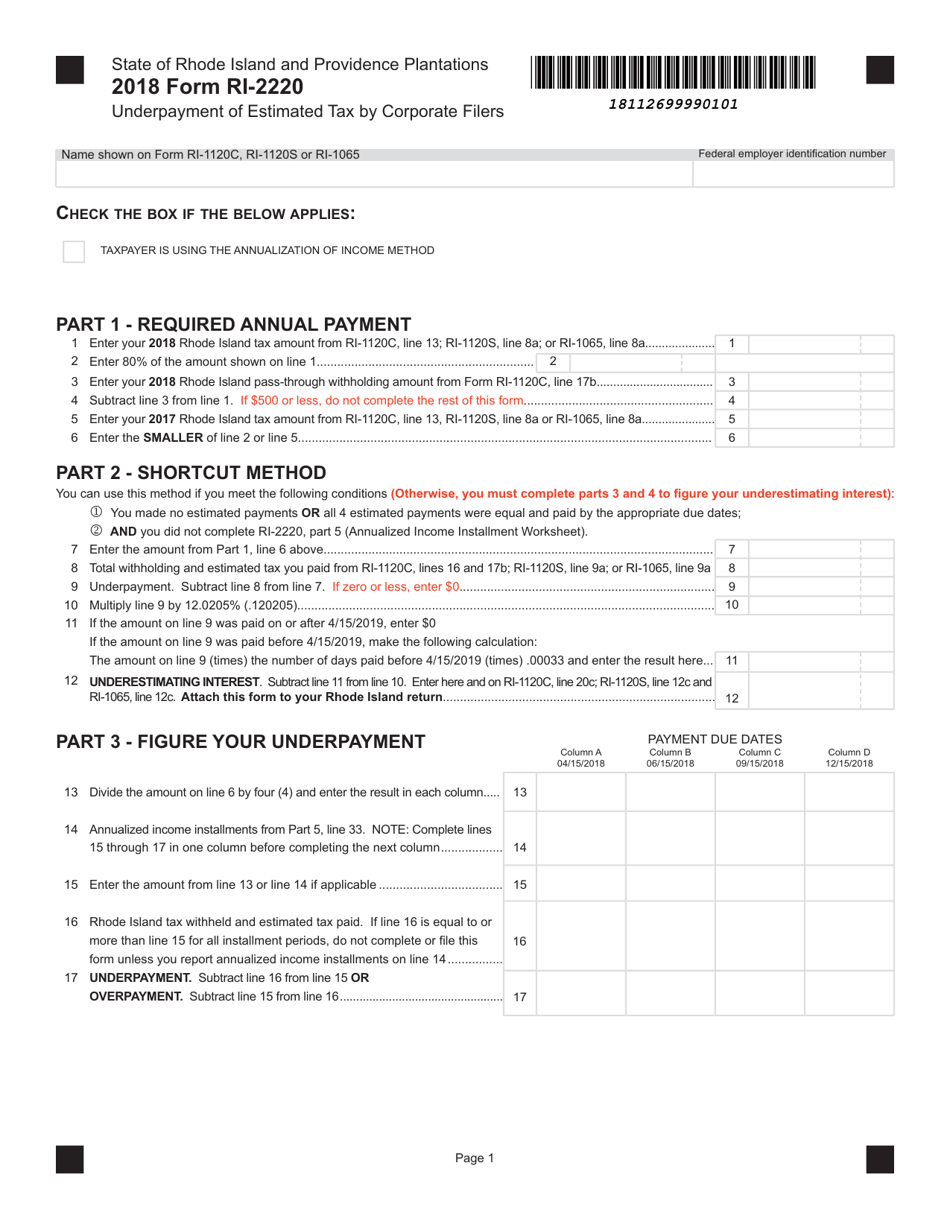

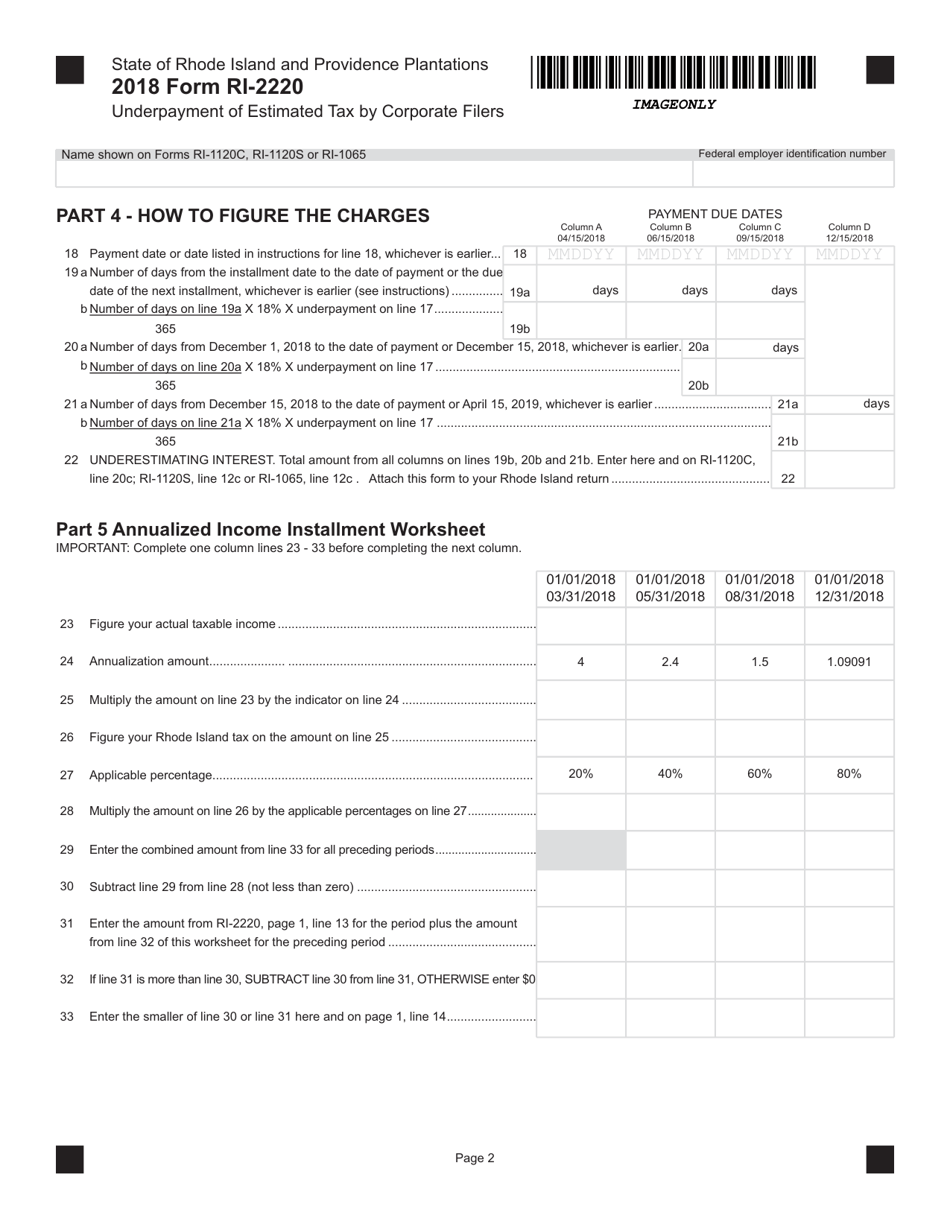

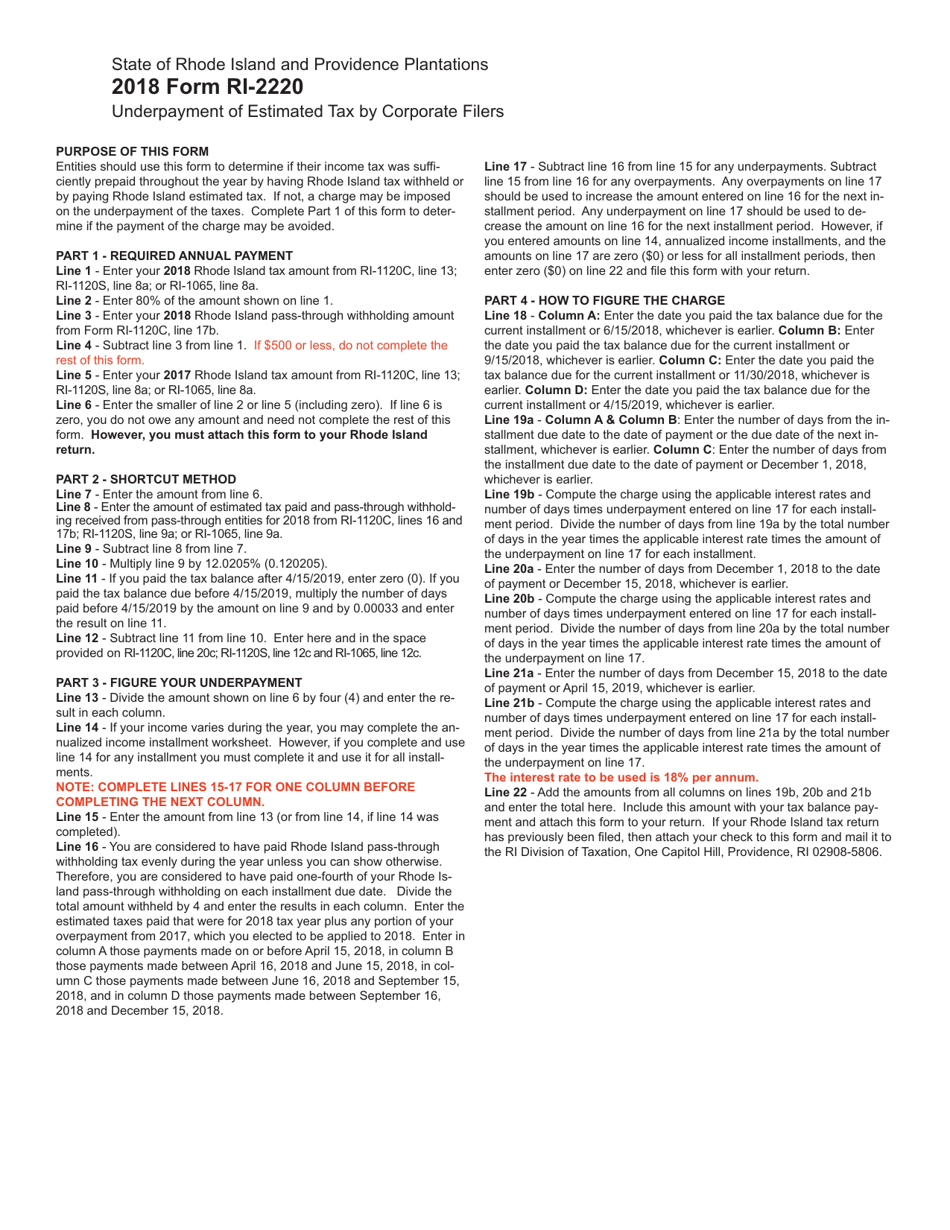

Form RI-2220 Underpayment of Estimated Tax by Corporate Filers - Rhode Island

What Is Form RI-2220?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-2220?

A: Form RI-2220 is a form used by corporate filers in Rhode Island to calculate any underpayment of estimated tax.

Q: Who needs to file Form RI-2220?

A: Corporate filers in Rhode Island who have underpaid their estimated tax may need to file Form RI-2220.

Q: When is Form RI-2220 due?

A: Form RI-2220 is generally due on the same date as the corporate income tax return, which is April 15th for most filers.

Q: What is the purpose of Form RI-2220?

A: The purpose of Form RI-2220 is to calculate any underpayment of estimated tax and determine whether any penalties or interest apply.

Q: What should I do if I have underpaid my estimated tax?

A: If you have underpaid your estimated tax, you should complete and file Form RI-2220 to calculate any penalties or interest owed.

Q: Are there any penalties or interest for underpayment of estimated tax?

A: Yes, there may be penalties and interest for underpayment of estimated tax. Form RI-2220 helps determine if these apply.

Q: Can I amend my Form RI-2220 if I made an error?

A: Yes, you can amend your Form RI-2220 if you made an error. Follow the instructions on the form to make the necessary corrections.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-2220 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.