This version of the form is not currently in use and is provided for reference only. Download this version of

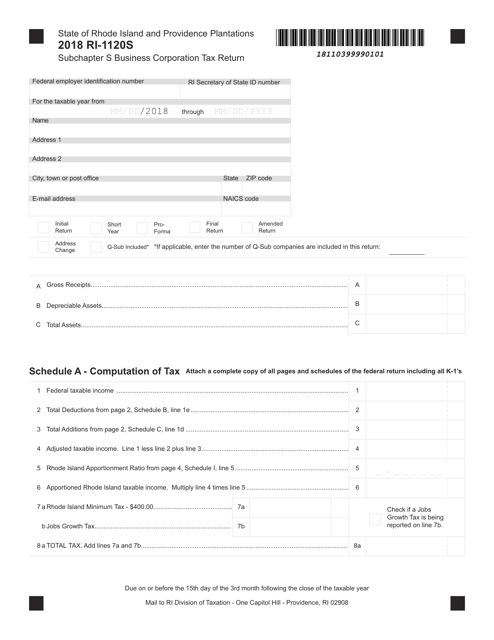

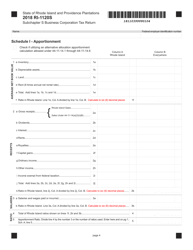

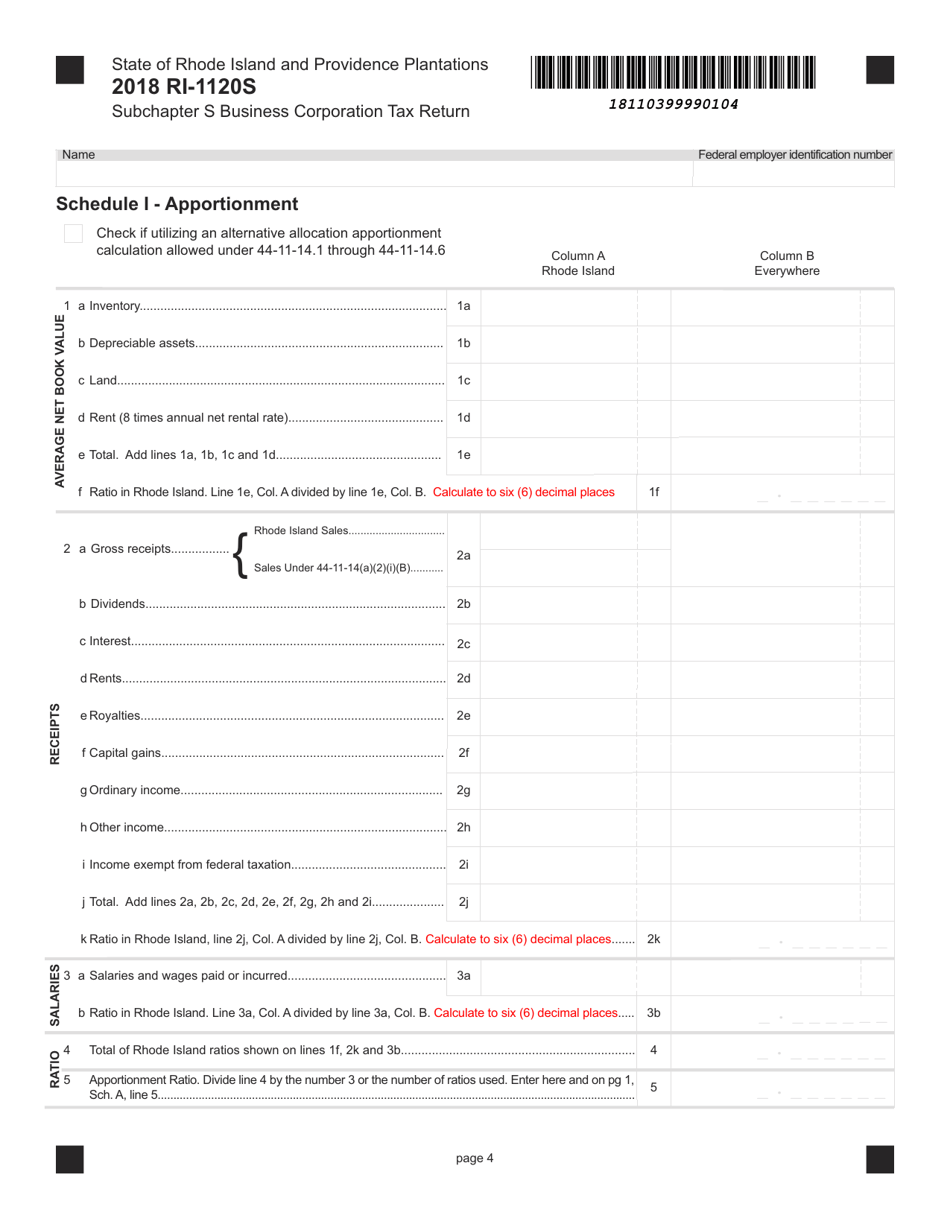

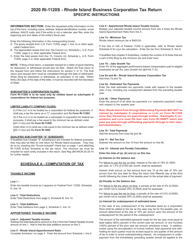

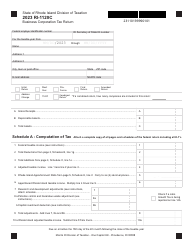

Form RI-1120S

for the current year.

Form RI-1120S Subchapter S Business Corporation Tax Return - Rhode Island

What Is Form RI-1120S?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1120S?

A: Form RI-1120S is the Subchapter S Business Corporation Tax Return for businesses in Rhode Island.

Q: Who needs to file Form RI-1120S?

A: Subchapter S corporations doing business in Rhode Island need to file Form RI-1120S.

Q: What is the purpose of Form RI-1120S?

A: The purpose of Form RI-1120S is to report the income, deductions, and tax liability of Subchapter S corporations in Rhode Island.

Q: When is the deadline to file Form RI-1120S?

A: Form RI-1120S must be filed by the 15th day of the 4th month following the end of the tax year.

Q: Can Form RI-1120S be filed electronically?

A: Yes, Form RI-1120S can be filed electronically.

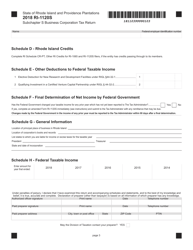

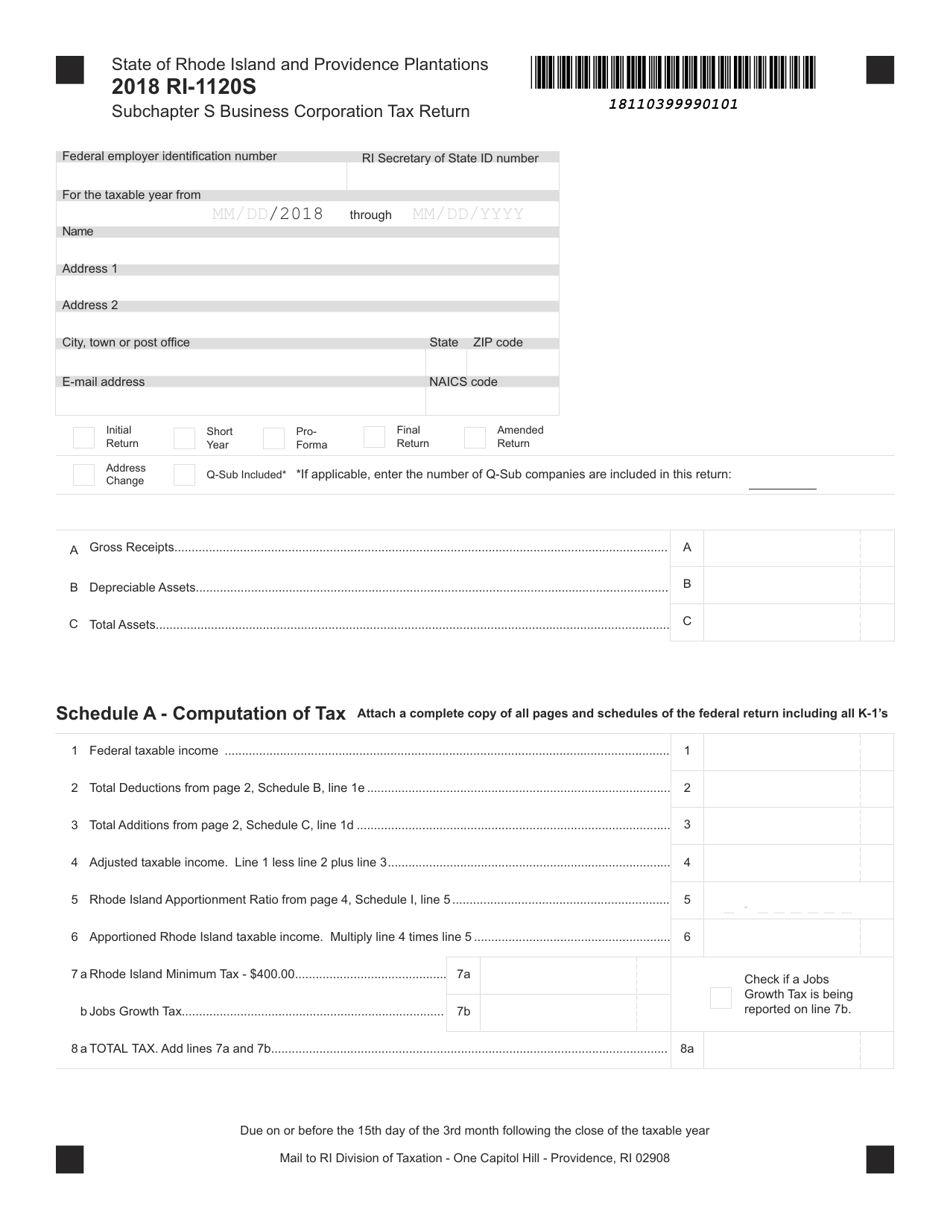

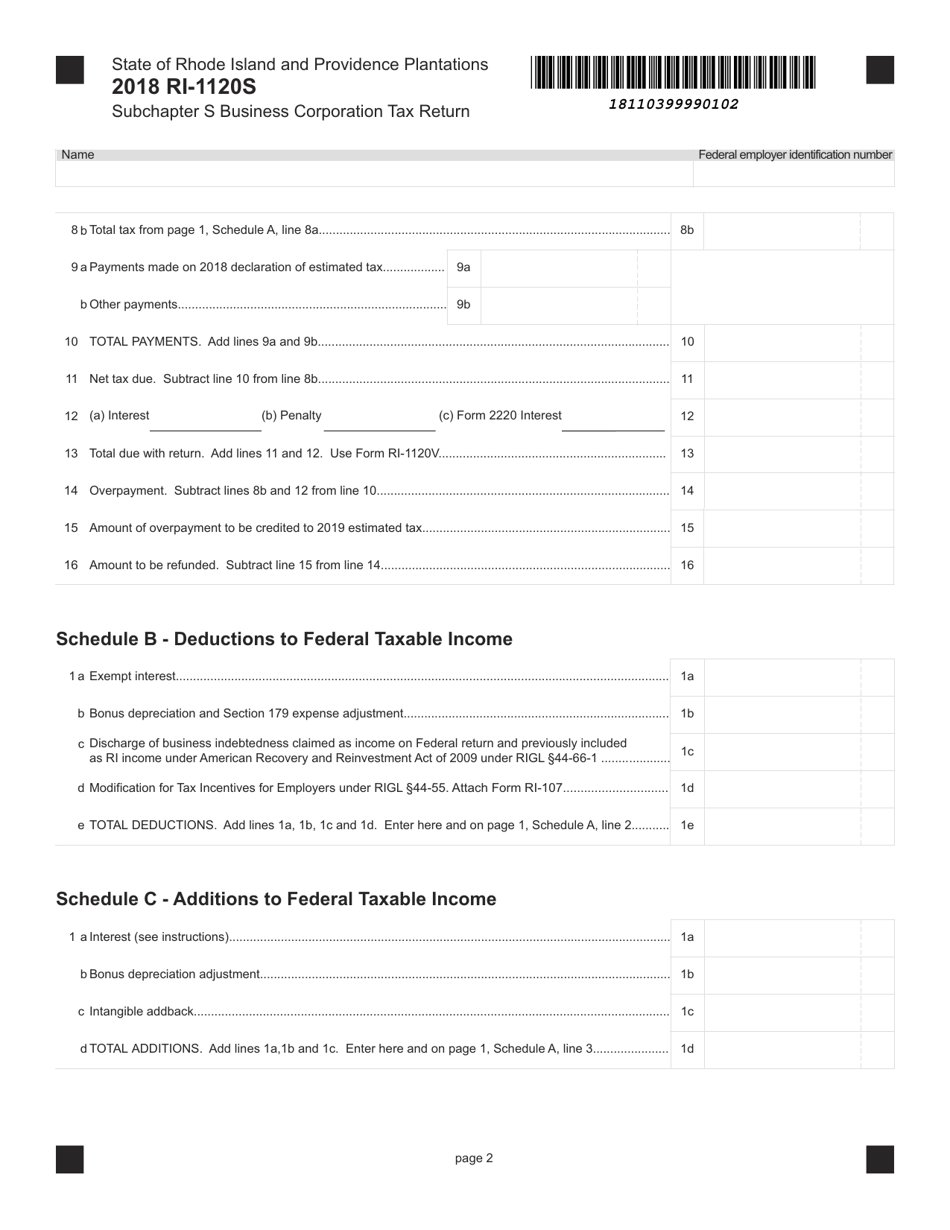

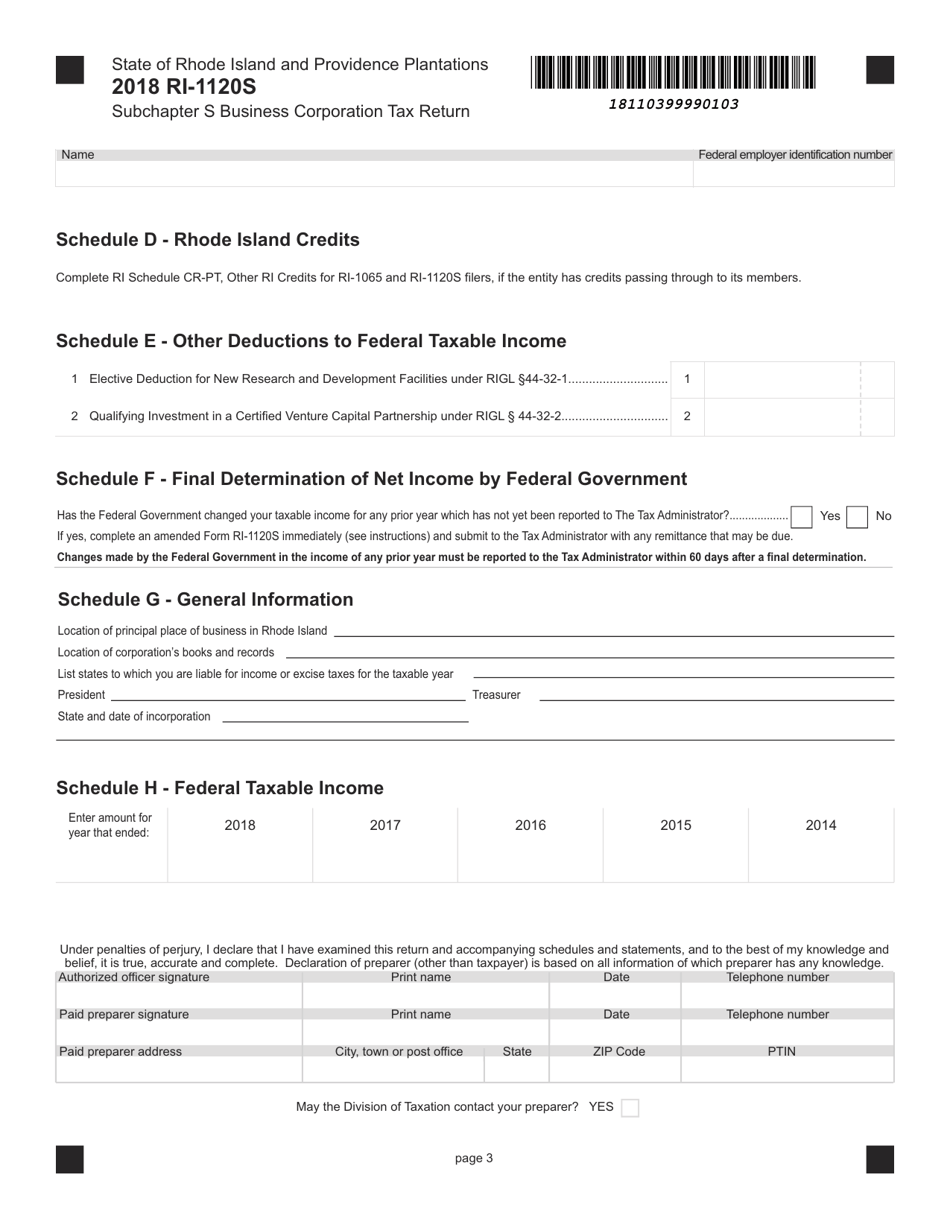

Q: Are there any additional forms or schedules that need to be filed with Form RI-1120S?

A: Depending on the specific circumstances of the Subchapter S corporation, additional forms and schedules may need to be filed with Form RI-1120S.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120S by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.