This version of the form is not currently in use and is provided for reference only. Download this version of

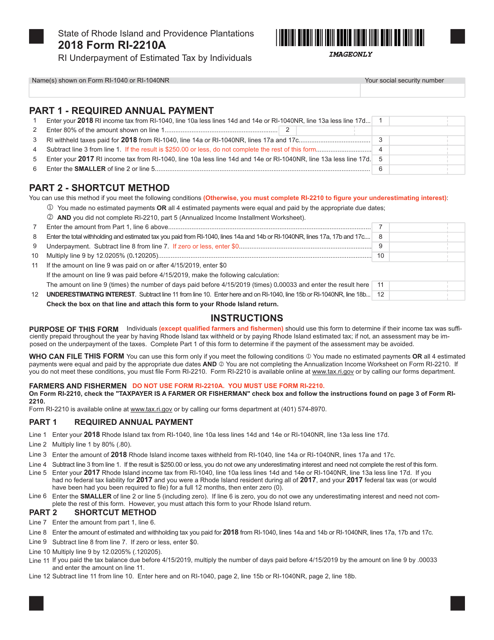

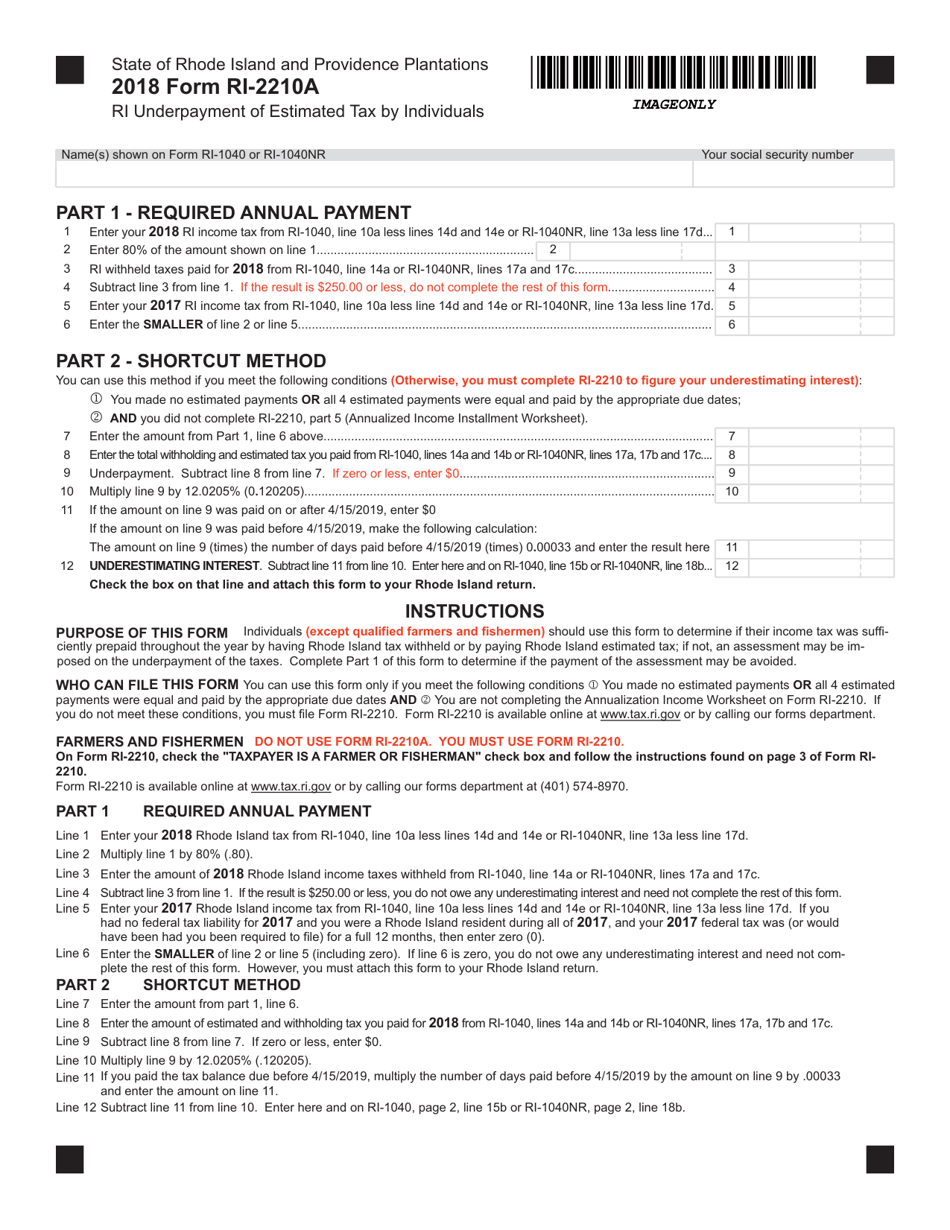

Form RI-2210A

for the current year.

Form RI-2210A Underpayment of Estimated Tax by Individuals - Rhode Island

What Is Form RI-2210A?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RI-2210A?

A: Form RI-2210A is used by individuals in Rhode Island to calculate and report any underpayment of estimated tax.

Q: Who needs to file form RI-2210A?

A: Rhode Island residents who have underpaid their estimated tax during the tax year need to file form RI-2210A.

Q: When is form RI-2210A due?

A: Form RI-2210A is due on the same date as the individual income tax return, which is typically April 15th.

Q: How do I fill out form RI-2210A?

A: You will need to gather your income and deduction information and use it to complete the form according to the instructions provided by the Rhode Island Division of Taxation.

Q: What happens if I don't file form RI-2210A?

A: If you have underpaid your estimated tax and do not file form RI-2210A, you may be subject to penalties and interest on the amount owed.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-2210A by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.