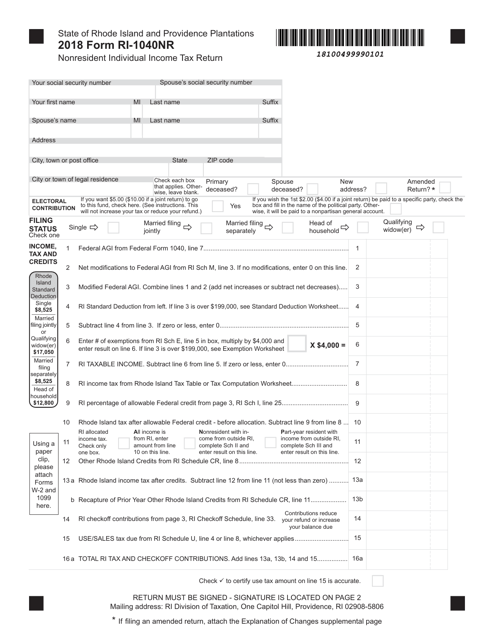

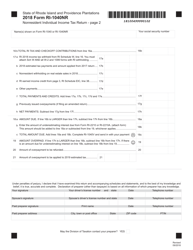

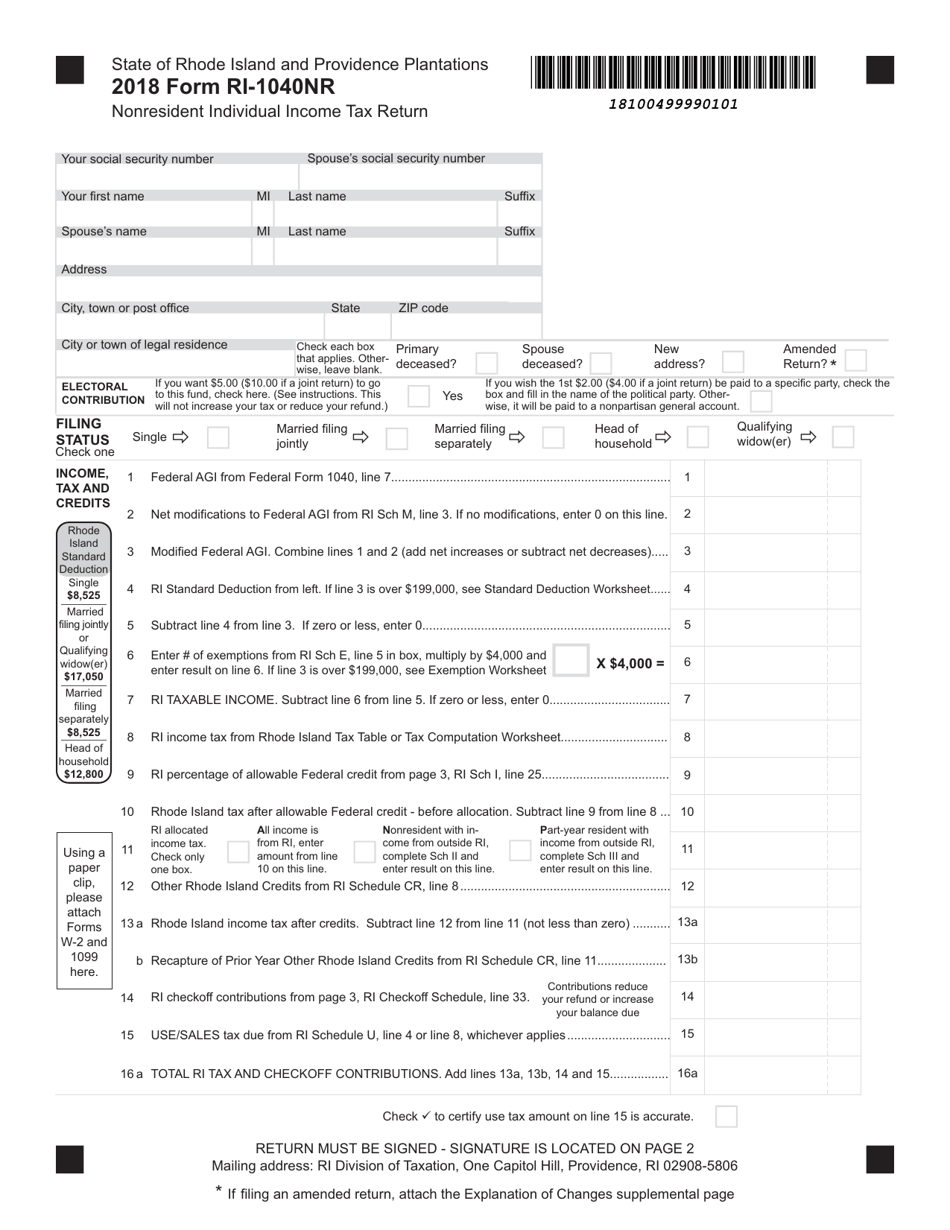

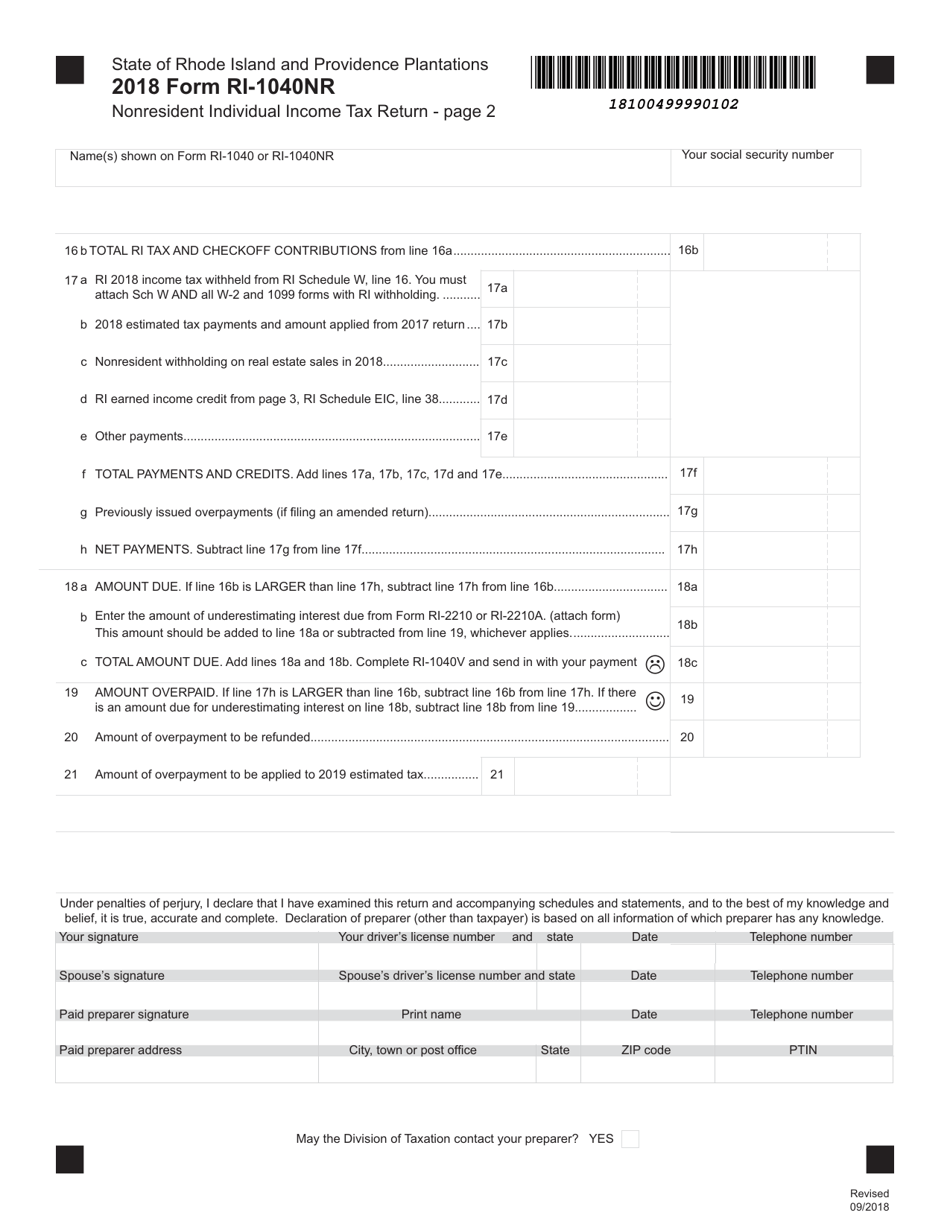

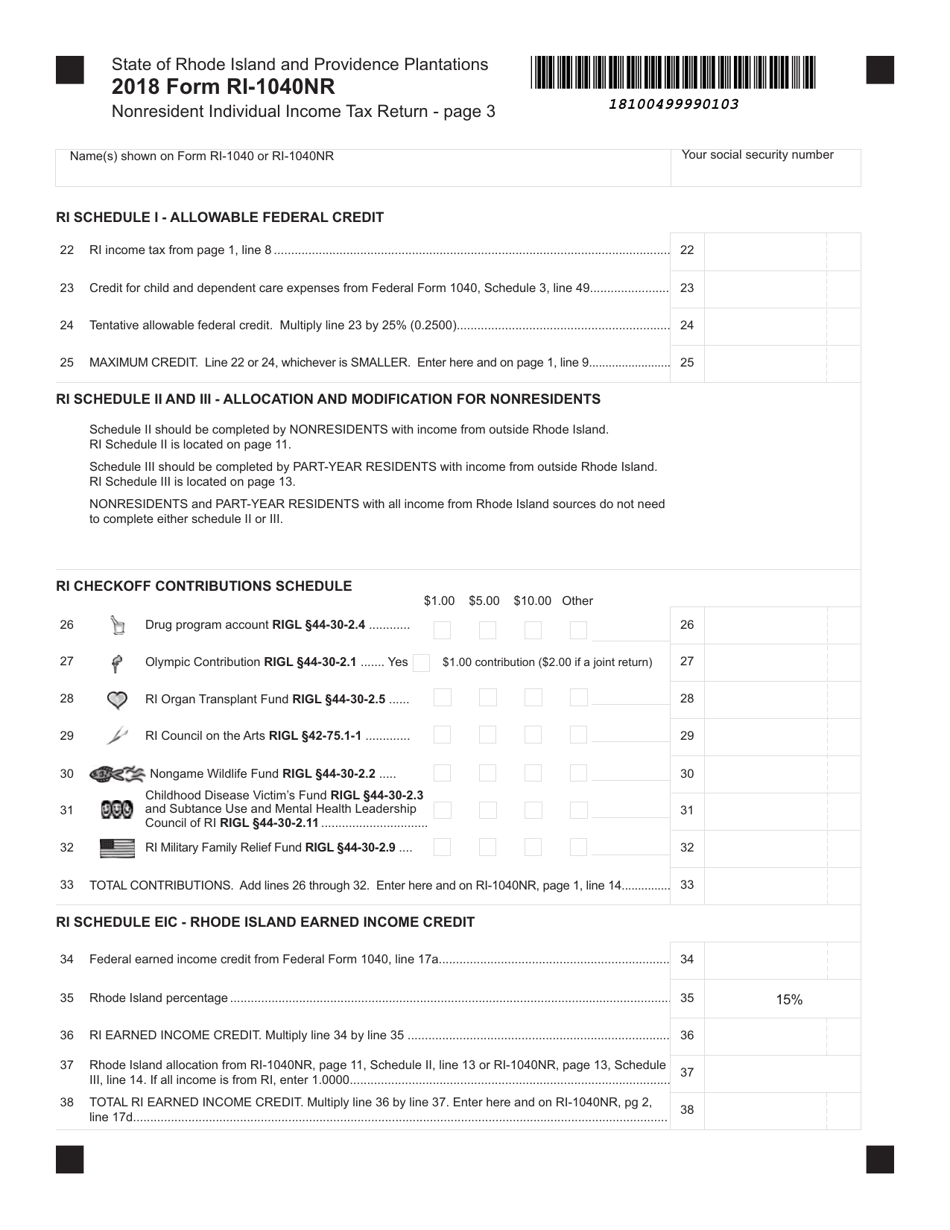

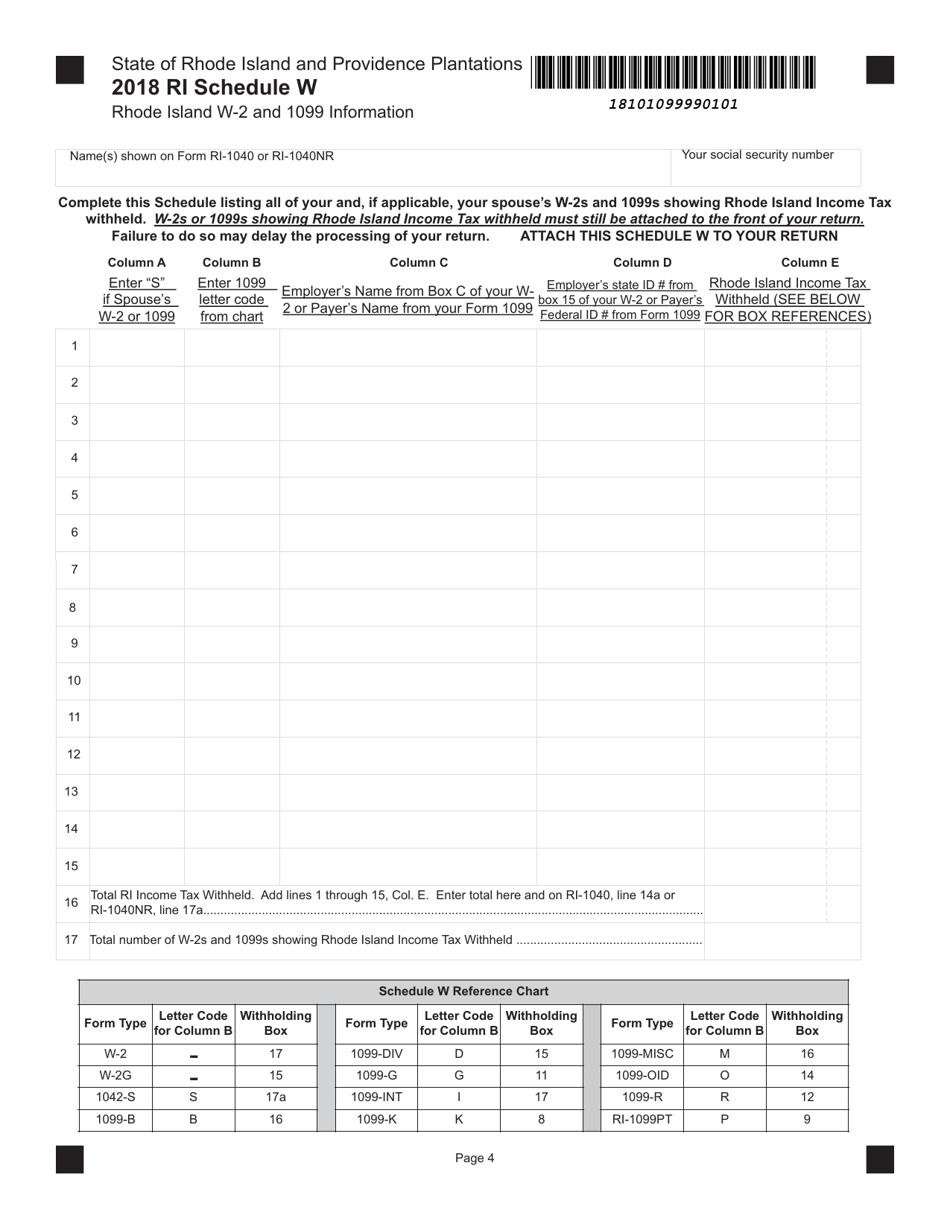

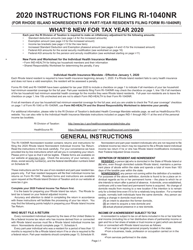

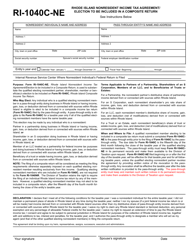

Form RI-1040NR Nonresident Individual Income Tax Return - Rhode Island

What Is Form RI-1040NR?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: Who files Form RI-1040NR?

A: Nonresident individuals who earned income in Rhode Island.

Q: What is Form RI-1040NR used for?

A: To report and pay taxes on income earned in Rhode Island as a nonresident.

Q: Do I need to file Form RI-1040NR if I didn't earn any income in Rhode Island?

A: No, if you didn't earn any income in Rhode Island as a nonresident, you don't need to file Form RI-1040NR.

Q: When is the deadline to file Form RI-1040NR?

A: The deadline to file Form RI-1040NR is the same as the federal tax deadline, typically April 15th.

Q: What if I need more time to file Form RI-1040NR?

A: You can request a filing extension using Form RI-4868, which will give you an additional 6 months to file.

Q: What are some common income sources that need to be reported on Form RI-1040NR?

A: Examples include wages or salaries earned in Rhode Island as a nonresident, rental income from properties in Rhode Island, and gambling winnings from Rhode Island casinos.

Q: Is Form RI-1040NR the only tax form I need to file as a nonresident in Rhode Island?

A: No, in addition to Form RI-1040NR, you may need to file other forms depending on your specific tax situation, such as Schedule B for interest and dividend income.

Q: Can I get help with filing Form RI-1040NR?

A: Yes, you can seek assistance from tax professionals, use tax preparation software, or consult the Rhode Island Division of Taxation for guidance on filing Form RI-1040NR.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040NR by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.