This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule M

for the current year.

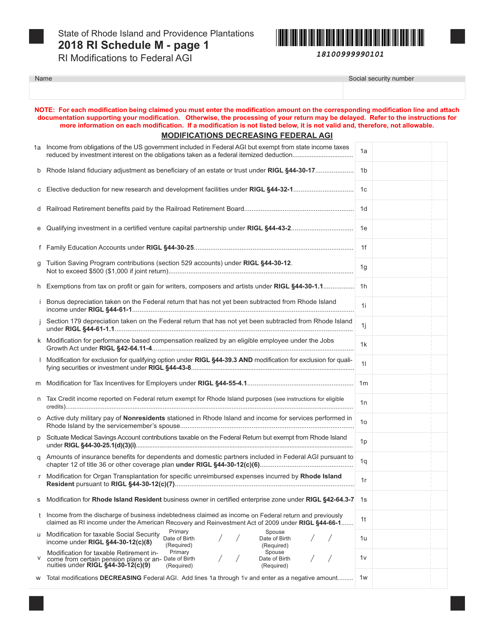

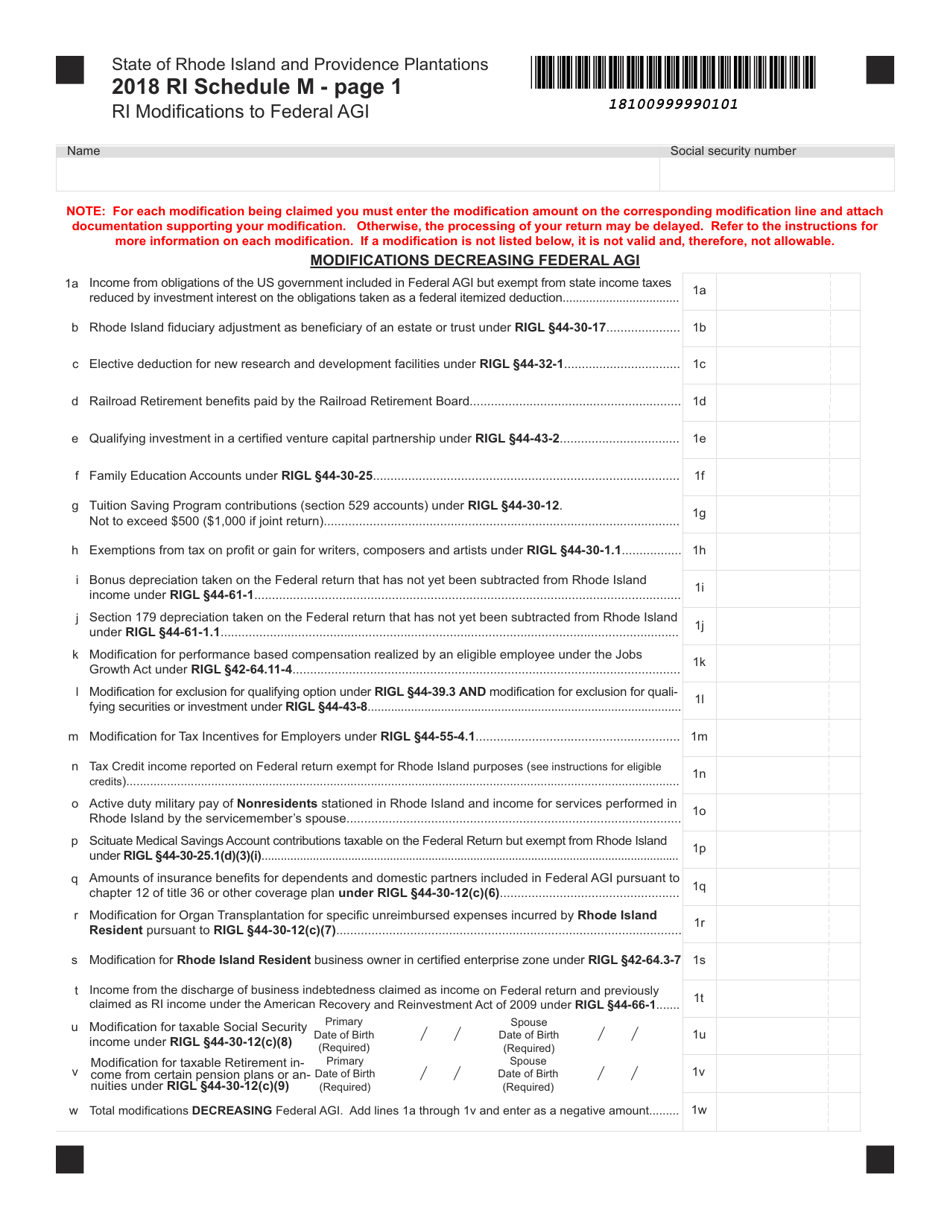

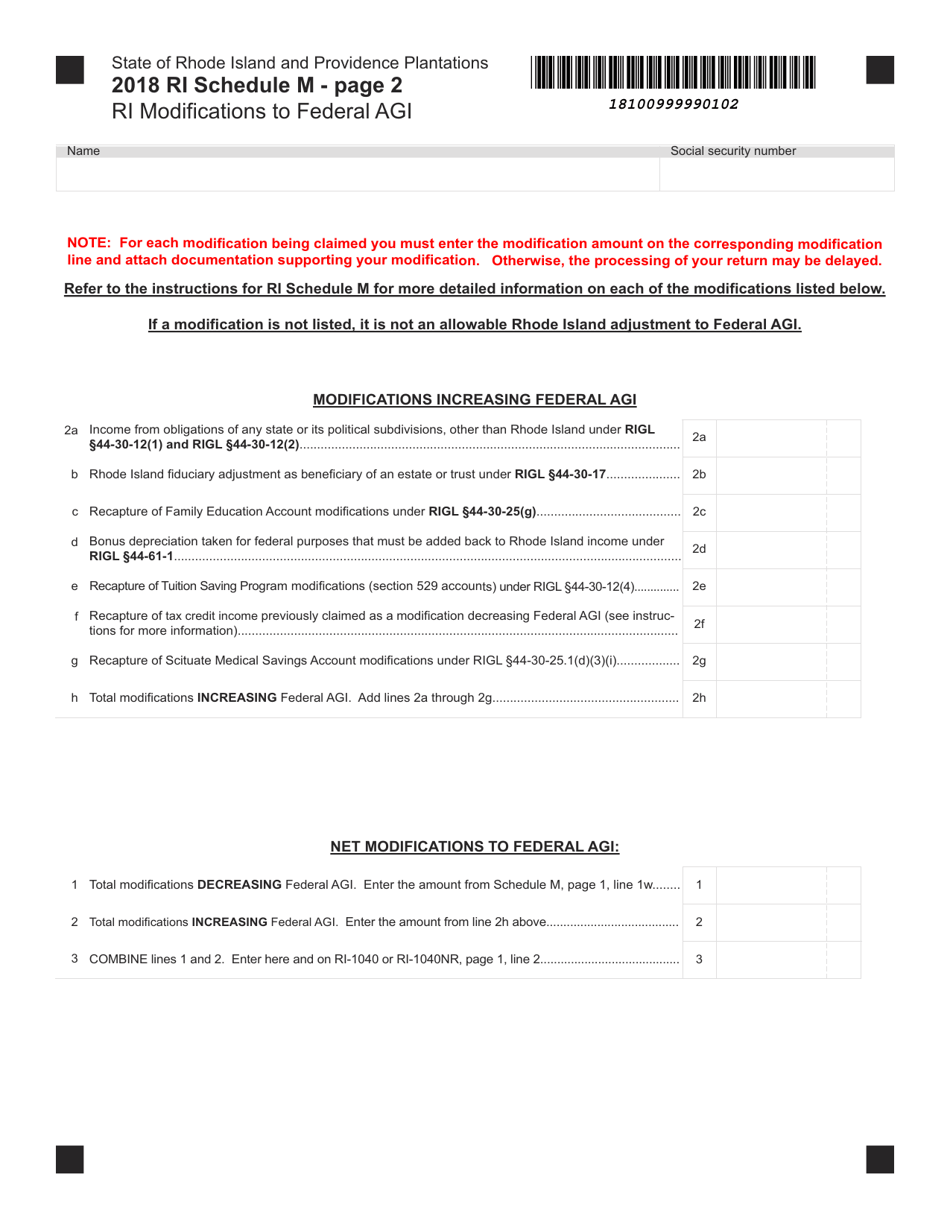

Schedule M Ri Modifications to Federal Agi - Rhode Island

What Is Schedule M?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule M RI?

A: Schedule M RI is a form used in Rhode Island to make modifications to your federal adjusted gross income (AGI) for state tax purposes.

Q: Why do I need to complete Schedule M RI?

A: You need to complete Schedule M RI to accurately calculate your Rhode Island state income tax liability.

Q: What kinds of modifications can I make on Schedule M RI?

A: On Schedule M RI, you can make modifications to your federal AGI for various types of income, deductions, and adjustments specific to Rhode Island.

Q: Is Schedule M RI the same as Schedule M on the federal tax return?

A: No, Schedule M RI is specific to Rhode Island and is used to make modifications for state tax purposes. It is separate from the federal Schedule M.

Q: Do I need to file Schedule M RI if I don't have any modifications to make?

A: If you don't have any modifications to make, you don't need to file Schedule M RI. You can simply enter your federal AGI on your Rhode Island state tax return.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule M by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.