This version of the form is not currently in use and is provided for reference only. Download this version of

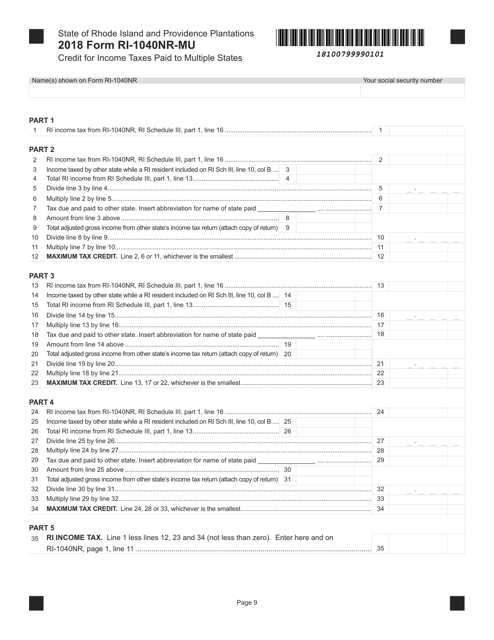

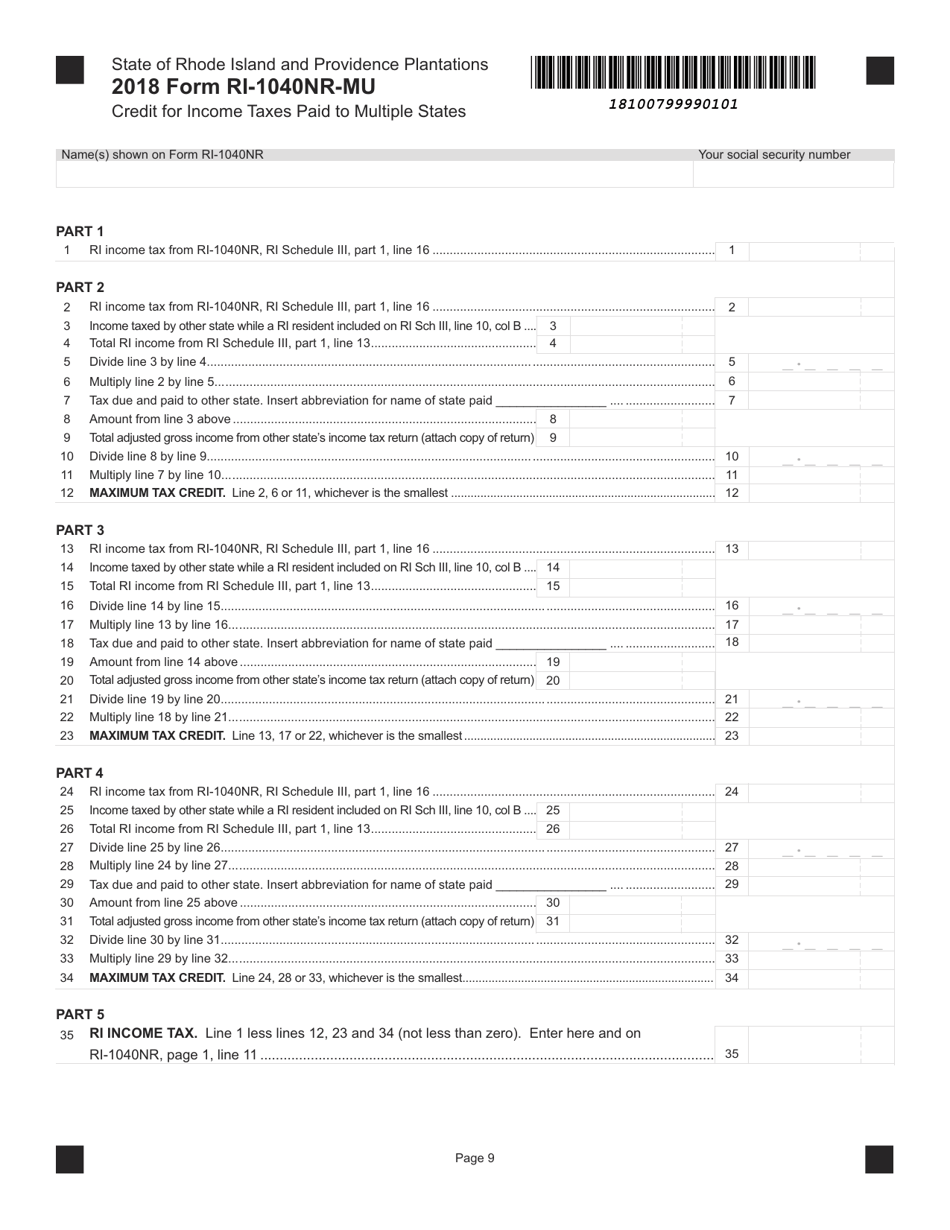

Form RI-1040NR-MU

for the current year.

Form RI-1040NR-MU Credit for Income Taxes Paid to Multiple States - Rhode Island

What Is Form RI-1040NR-MU?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1040NR-MU?

A: Form RI-1040NR-MU is a tax form used by non-residents of Rhode Island to claim a credit for income taxes paid to multiple states.

Q: Who can use Form RI-1040NR-MU?

A: Non-residents of Rhode Island who have paid income taxes to multiple states can use Form RI-1040NR-MU.

Q: What is the purpose of Form RI-1040NR-MU?

A: The purpose of Form RI-1040NR-MU is to allow non-residents of Rhode Island to claim a credit for income taxes paid to multiple states, reducing their overall tax liability.

Q: Is Form RI-1040NR-MU different from Form RI-1040NR?

A: Yes, Form RI-1040NR-MU is specifically used to claim a credit for income taxes paid to multiple states, while Form RI-1040NR is the general non-resident tax form for Rhode Island.

Q: Are there any filing deadlines for Form RI-1040NR-MU?

A: Yes, the filing deadline for Form RI-1040NR-MU is the same as the regular tax filing deadline for Rhode Island, which is typically April 15th.

Q: Can I e-file Form RI-1040NR-MU?

A: No, as of now, Rhode Island does not support e-filing for Form RI-1040NR-MU. You have to submit a paper copy by mail.

Q: Do I need to include supporting documentation with Form RI-1040NR-MU?

A: Yes, you should include copies of your tax returns filed with other states and any relevant supporting documents that prove your income and the taxes paid.

Q: Can I claim a credit for income taxes paid to any state on Form RI-1040NR-MU?

A: No, you can only claim a credit for income taxes paid to states that have a reciprocal agreement with Rhode Island. Only taxes paid to these specific states are eligible for the credit.

Q: What if I have income from a state that does not have a reciprocal agreement with Rhode Island?

A: If you have income from a state that does not have a reciprocal agreement with Rhode Island, you cannot claim a credit for the taxes paid to that state on Form RI-1040NR-MU. You may need to file a separate tax return and claim the credit on that state's form.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040NR-MU by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.