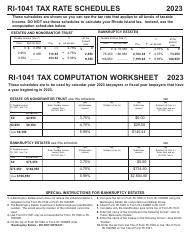

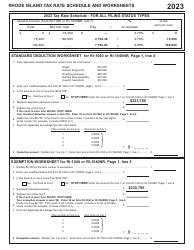

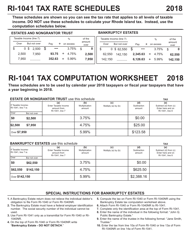

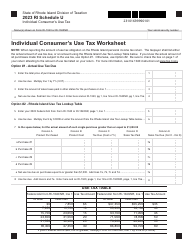

Tax Rate Schedule and Worksheets - Rhode Island

Tax Rate Schedule and Worksheets is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

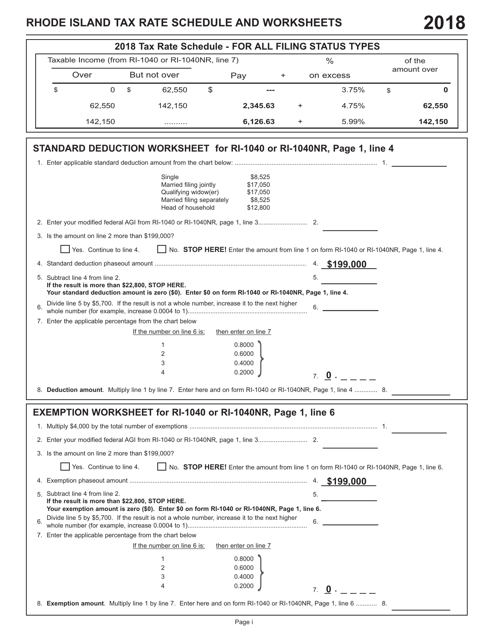

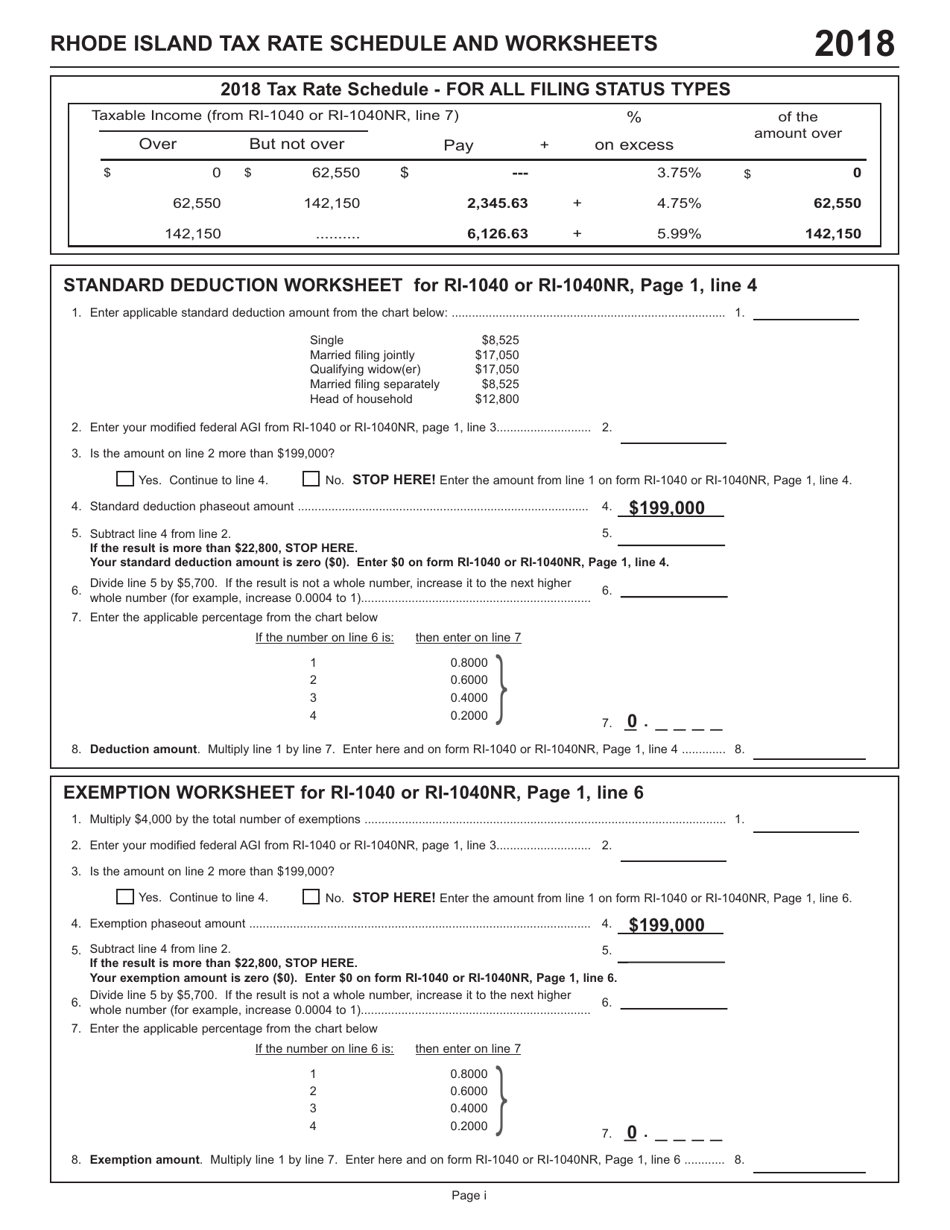

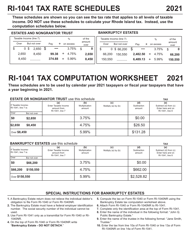

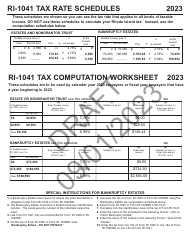

Q: What is the tax rate in Rhode Island?

A: The tax rate in Rhode Island varies depending on your income. It ranges from 3.75% to 5.99%.

Q: How do I calculate my Rhode Island tax?

A: To calculate your Rhode Island tax, you can use the tax rate schedule provided by the state. It takes into account your income and determines the applicable tax rate.

Q: Are there any deductions or credits available in Rhode Island?

A: Yes, there are various deductions and credits available in Rhode Island, such as the standard deduction and the Earned Income Tax Credit. You can consult the tax forms and instructions provided by the state for more information.

Q: Do I need to file a state tax return in Rhode Island?

A: If you are a resident of Rhode Island or have earned income in the state, you are generally required to file a state tax return.

Q: When is the deadline to file a state tax return in Rhode Island?

A: The deadline to file a state tax return in Rhode Island is typically April 15th, the same as the federal tax deadline.

Q: Can I e-file my state tax return in Rhode Island?

A: Yes, Rhode Island allows taxpayers to e-file their state tax returns. It is a convenient and secure way to file your taxes.

Q: Can I file my federal and state taxes together?

A: Yes, you can file your federal and Rhode Island state taxes together using tax software or by hiring a tax professional.

Q: What is the sales tax rate in Rhode Island?

A: The sales tax rate in Rhode Island is 7%. This applies to most goods and services, with some exceptions.

Q: What happens if I don't pay my Rhode Island taxes?

A: If you don't pay your Rhode Island taxes on time, you may face penalties and interest charges. It is important to fulfill your tax obligations to avoid these consequences.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.