This version of the form is not currently in use and is provided for reference only. Download this version of

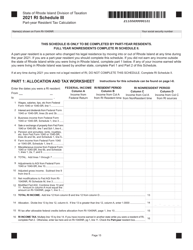

Schedule III

for the current year.

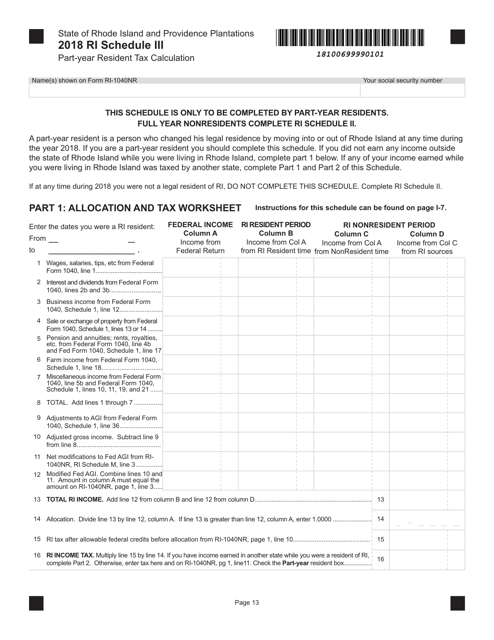

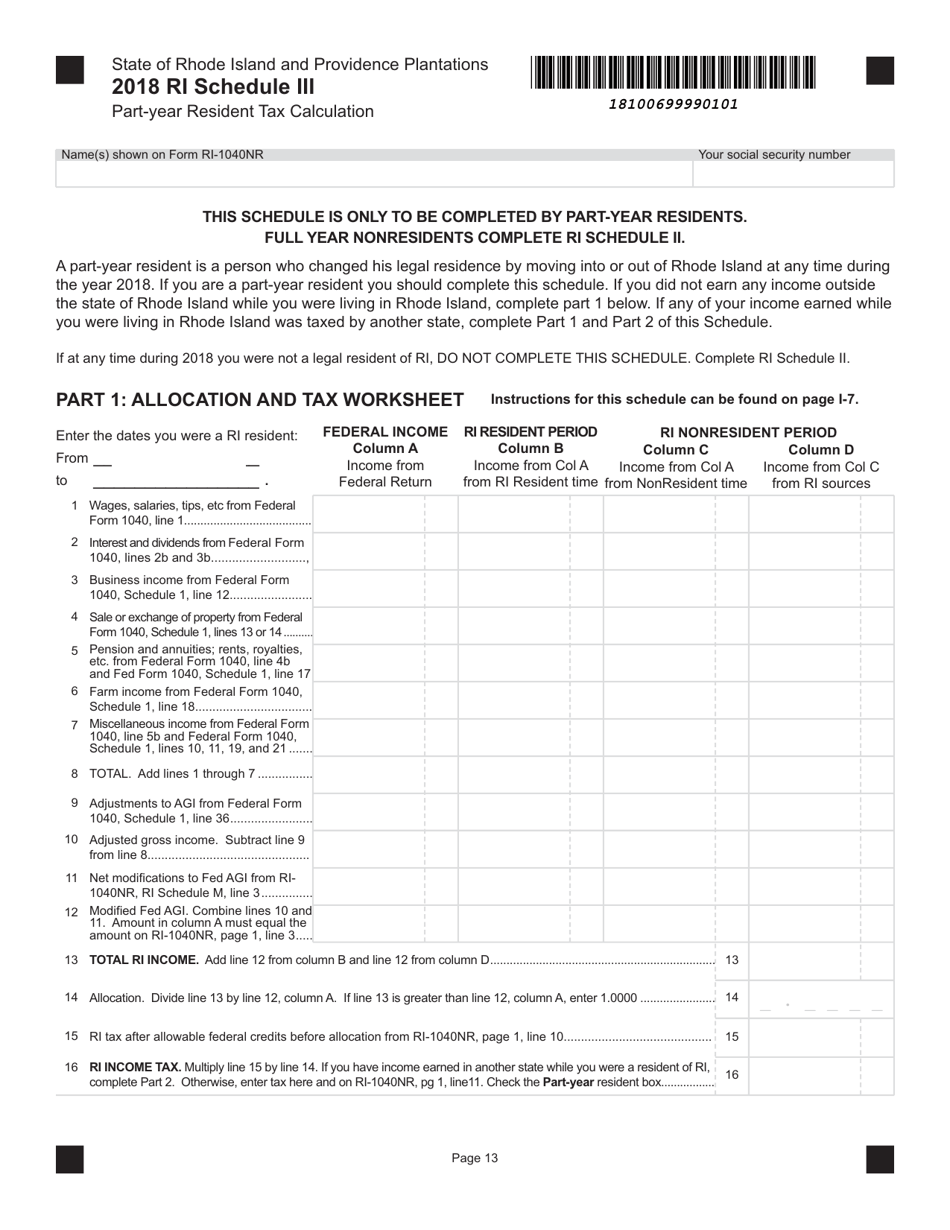

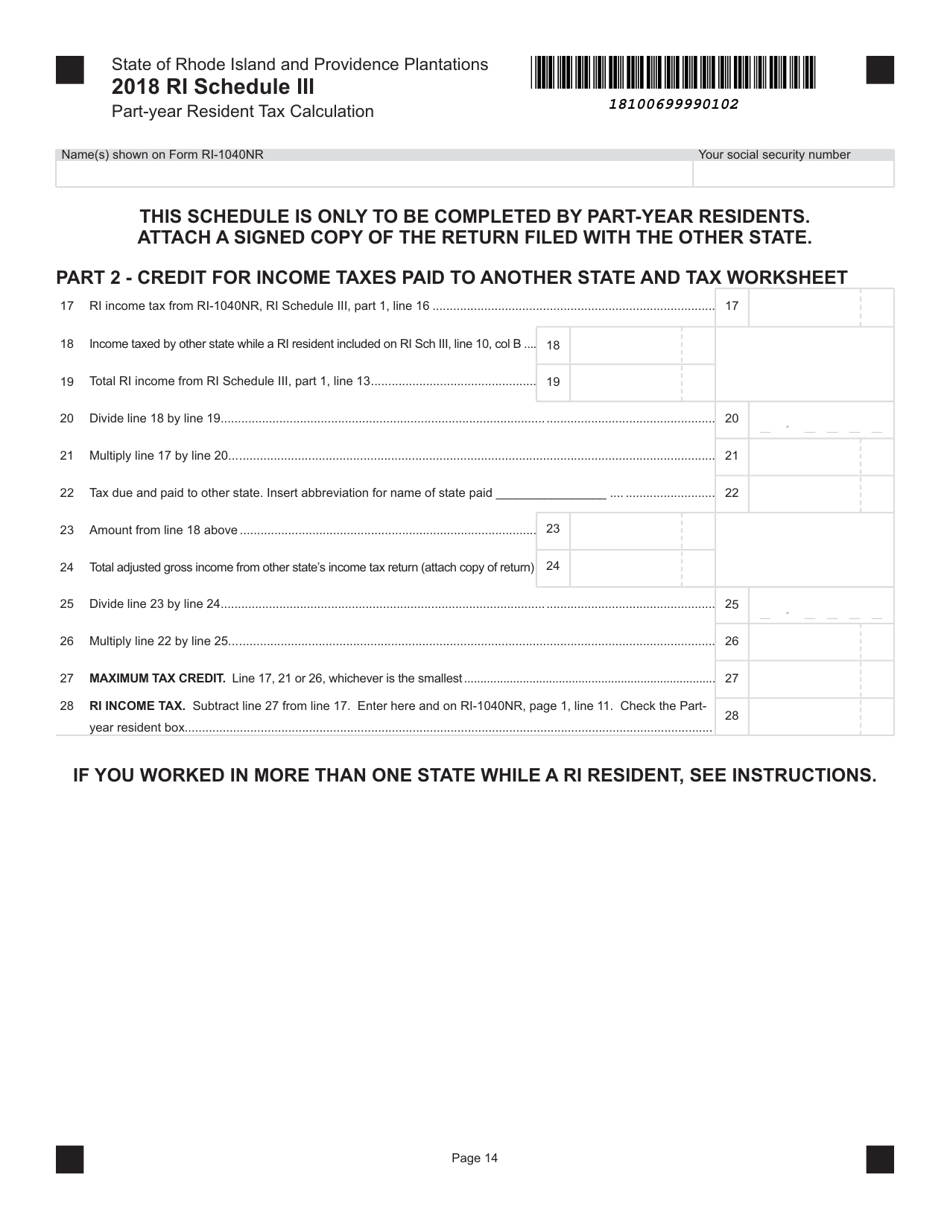

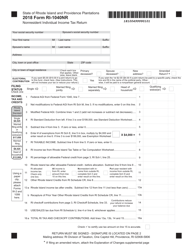

Schedule III Part-Year Resident Tax Calculation - Rhode Island

What Is Schedule III?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Part-Year Resident?

A: A Part-Year Resident is someone who lived in Rhode Island for only part of the year.

Q: How is Part-Year Resident Tax calculated?

A: Part-Year Resident Tax is calculated by determining the portion of income earned while living in Rhode Island and applying the applicable tax rates.

Q: What is the tax rate for Part-Year Residents in Rhode Island?

A: The tax rate for Part-Year Residents in Rhode Island is the same as the tax rate for full-year residents.

Q: Do Part-Year Residents need to file a Rhode Island tax return?

A: Yes, Part-Year Residents are required to file a Rhode Island tax return if they had any Rhode Island source income during the part-year period.

Q: How do I determine my Rhode Island source income as a Part-Year Resident?

A: Rhode Island source income for Part-Year Residents includes income from any work or services performed in Rhode Island, as well as income from Rhode Island property or businesses.

Q: Are there any deductions or credits available to Part-Year Residents in Rhode Island?

A: Yes, Part-Year Residents may be eligible for certain deductions and credits based on their specific circumstances. Consult the Rhode Island tax forms and instructions for more information.

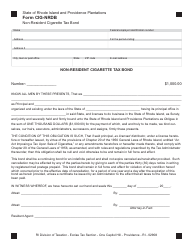

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule III by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.