This version of the form is not currently in use and is provided for reference only. Download this version of

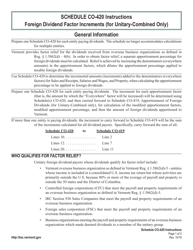

Instructions for Schedule CO-420

for the current year.

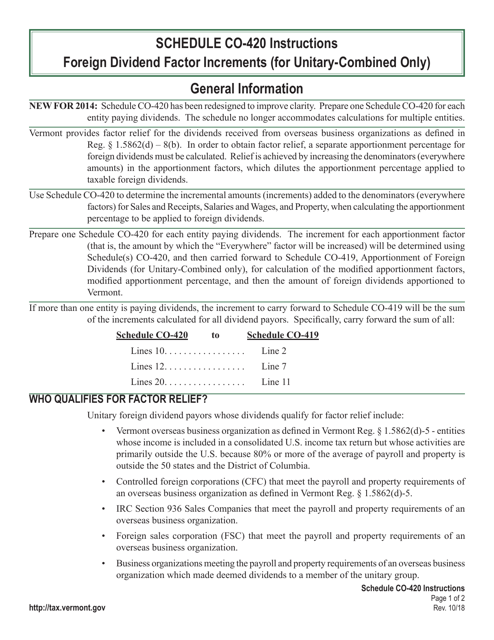

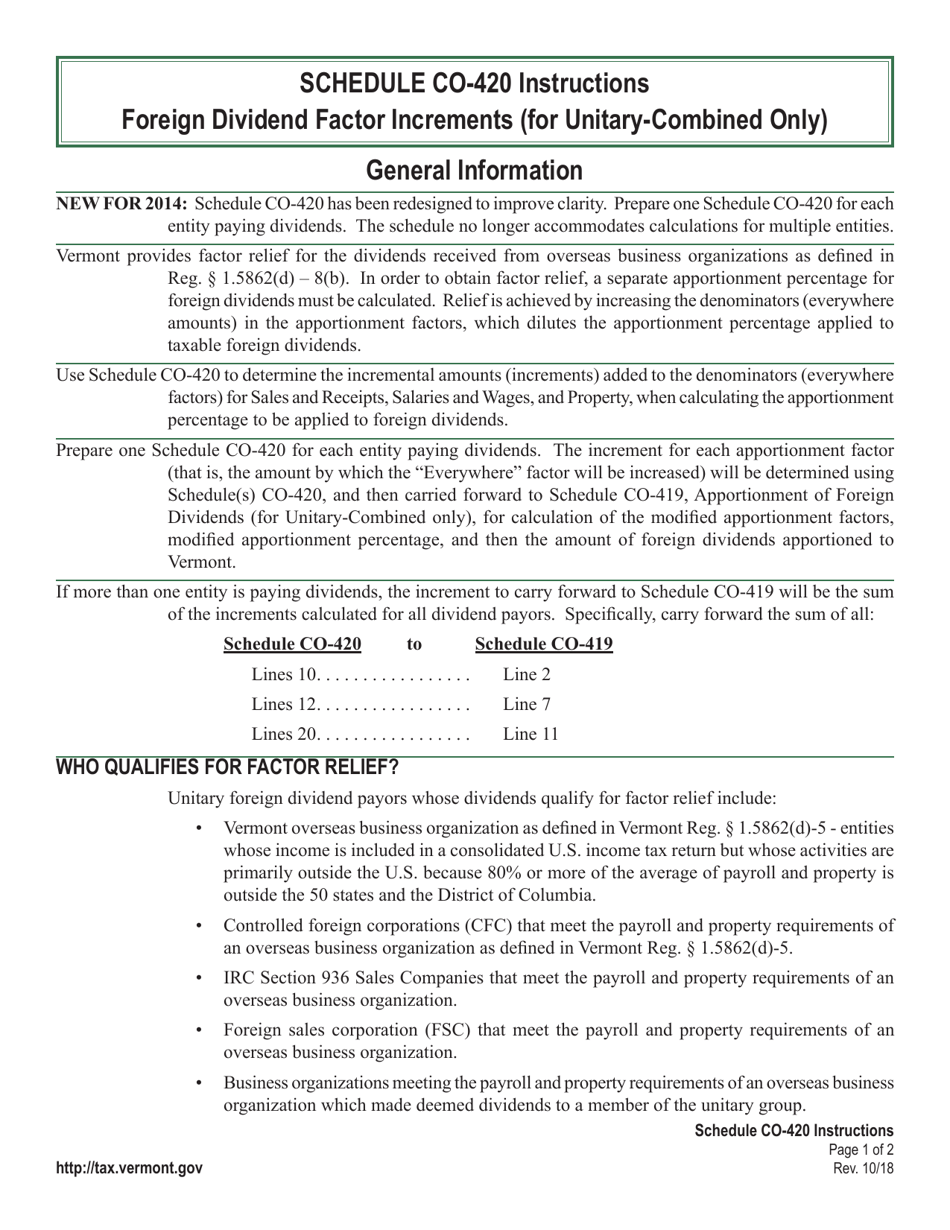

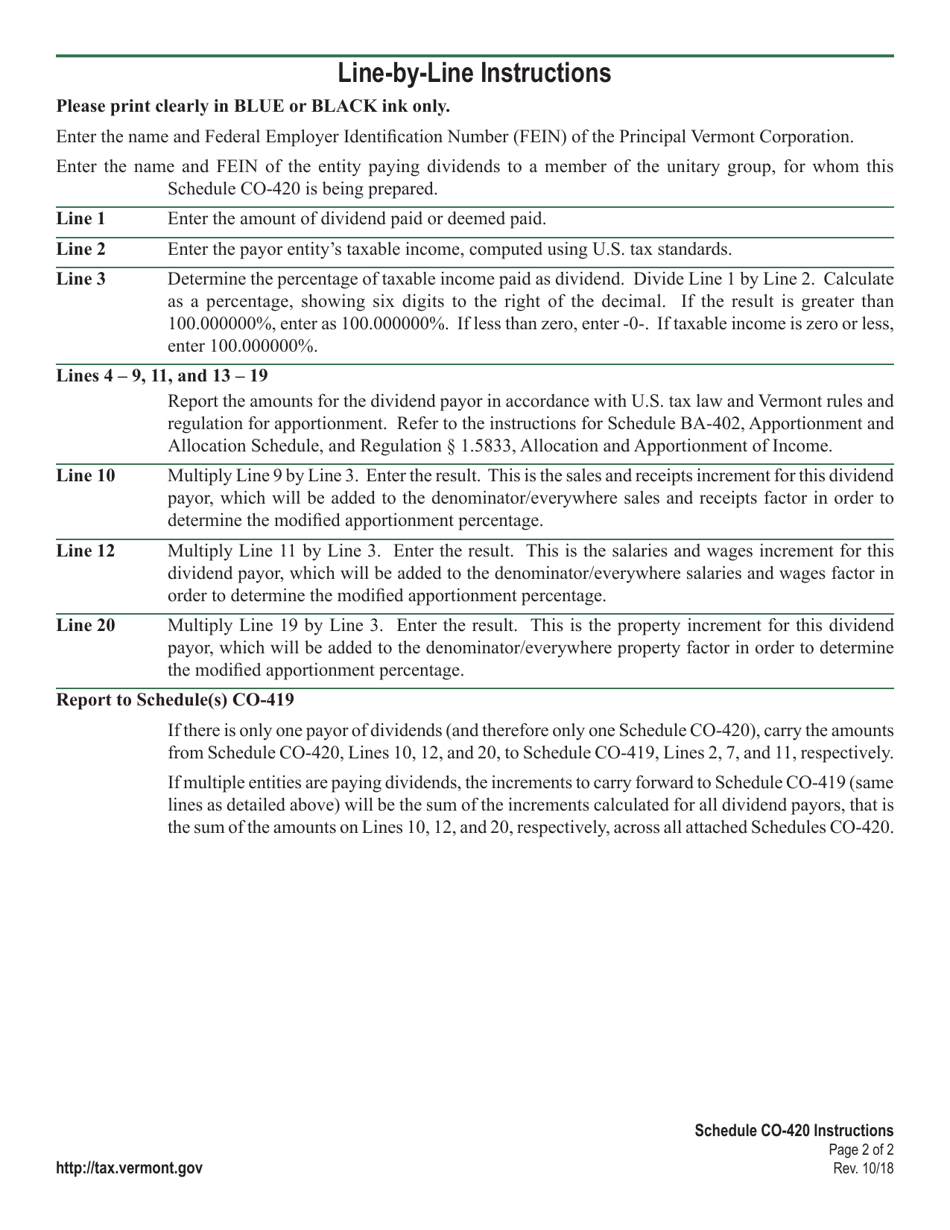

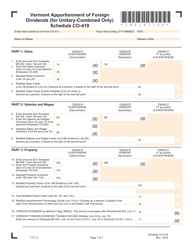

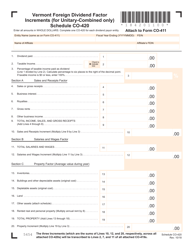

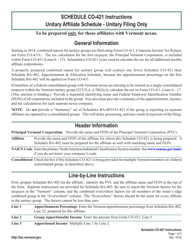

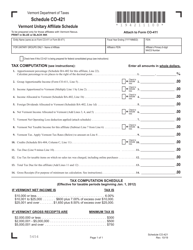

Instructions for Schedule CO-420 Foreign Dividend Factor Increments (For Unitary-Combined Only) - Vermont

This document contains official instructions for Schedule CO-420 , Foreign Dividend Factor Increments (For Unitary-Combined Only) - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule CO-420?

A: Schedule CO-420 is a form used in Vermont for reporting foreign dividend factor increments for unitary-combined filings.

Q: Who needs to file Schedule CO-420?

A: This form is required to be filed by taxpayers who are submitting unitary-combined filings in Vermont.

Q: What does Schedule CO-420 report?

A: This form is used to report the foreign dividend factor increments.

Q: What are foreign dividend factor increments?

A: Foreign dividend factor increments are adjustments made to the dividend factor for income apportionment purposes in a unitary-combined filing.

Q: What is a unitary-combined filing?

A: A unitary-combined filing is when multiple corporations that are part of the same group are treated as a single entity for tax purposes.

Q: When is Schedule CO-420 due?

A: The due date for Schedule CO-420 corresponds with the due date of the unitary-combined filing in Vermont.

Q: Are there any penalties for not filing Schedule CO-420?

A: Yes, failure to file Schedule CO-420 can result in penalties and interest being assessed by the Vermont Department of Taxes.

Q: Are there any specific instructions for completing Schedule CO-420?

A: Yes, you should refer to the instructions provided with the form for guidance on completing Schedule CO-420.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.