This version of the form is not currently in use and is provided for reference only. Download this version of

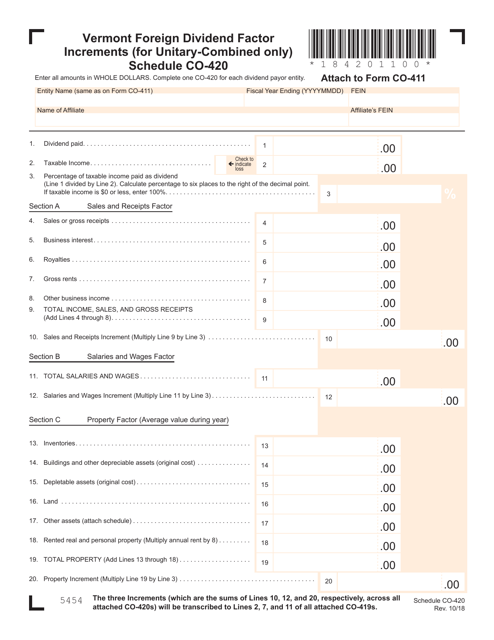

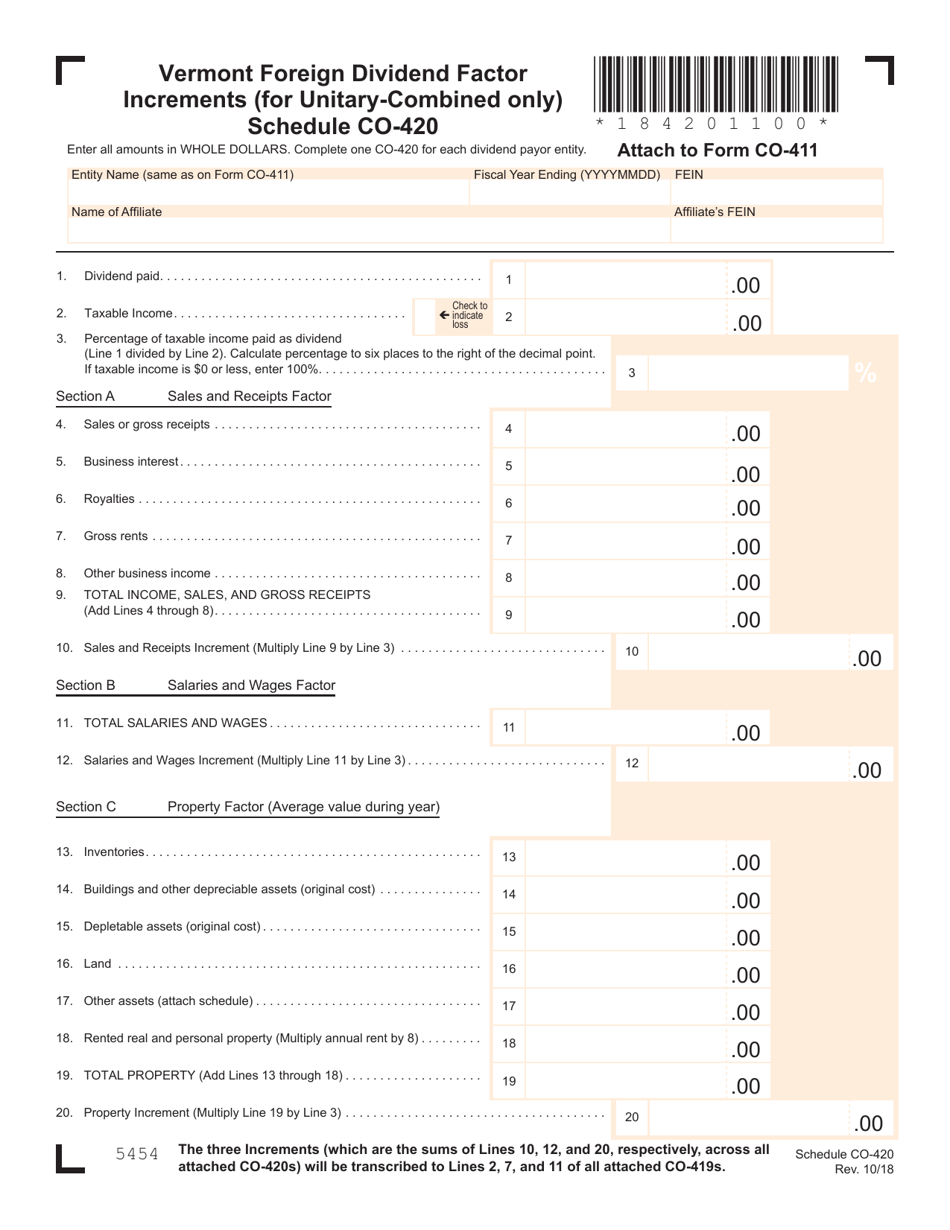

Schedule CO-420

for the current year.

Schedule CO-420 Foreign Dividend Factor Increments (For Unitary-Combined Only) - Vermont

What Is Schedule CO-420?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule CO-420?

A: Schedule CO-420 is a form used for reporting foreign dividend factor increments for unitary-combined taxpayers in Vermont.

Q: Who needs to file Schedule CO-420?

A: Unitary-combined taxpayers in Vermont who have foreign dividend factor increments need to file Schedule CO-420.

Q: What are foreign dividend factor increments?

A: Foreign dividend factor increments refer to the increase in the dividend factor due to foreign-source dividends received by the unitary group.

Q: Is Schedule CO-420 only for foreign dividends?

A: Yes, Schedule CO-420 is specifically for reporting foreign dividend factor increments.

Q: Is Schedule CO-420 required for all taxpayers in Vermont?

A: No, Schedule CO-420 is only required for unitary-combined taxpayers who have foreign dividend factor increments.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CO-420 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.