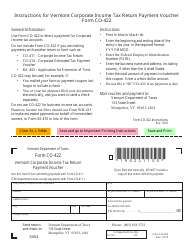

This version of the form is not currently in use and is provided for reference only. Download this version of

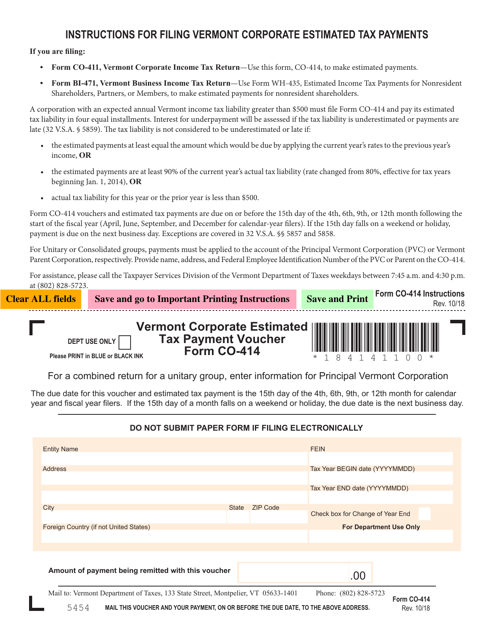

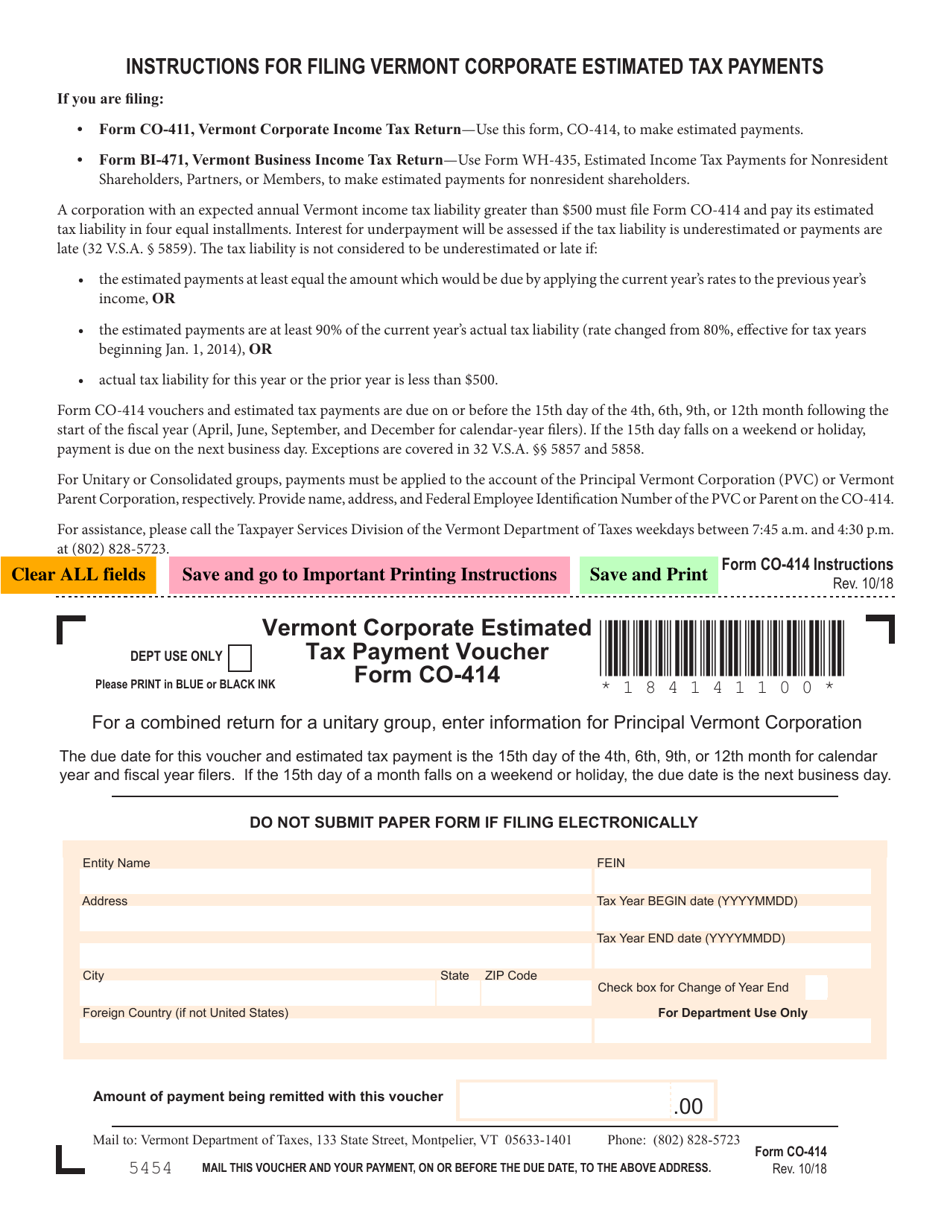

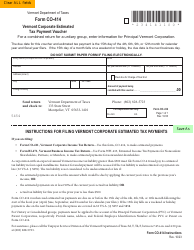

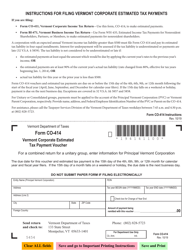

VT Form CO-414

for the current year.

VT Form CO-414 Corporate Estimated Tax Payment Voucher - Vermont

What Is VT Form CO-414?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form CO-414?

A: The VT Form CO-414 is the Corporate Estimated Tax Payment Voucher for Vermont.

Q: What is the purpose of the VT Form CO-414?

A: The purpose of the VT Form CO-414 is to make estimated tax payments for corporations in Vermont.

Q: Who needs to file the VT Form CO-414?

A: Corporations in Vermont that are required to make estimated tax payments need to file the VT Form CO-414.

Q: When is the due date for the VT Form CO-414?

A: The due date for the VT Form CO-414 is based on the federal estimated tax due dates.

Q: How do I fill out the VT Form CO-414?

A: To fill out the VT Form CO-414, you will need to provide your tax year, federal employer identification number (FEIN), and calculate your estimated tax liability.

Q: What are the consequences of not filing the VT Form CO-414?

A: Not filing the VT Form CO-414 or making the required estimated tax payments can result in penalties and interest charges.

Q: Are there any exemptions or credits available for the VT Form CO-414?

A: Yes, there may be exemptions and credits available that can reduce your estimated tax liability. You should refer to the instructions for the VT Form CO-414 for more information.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form CO-414 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.