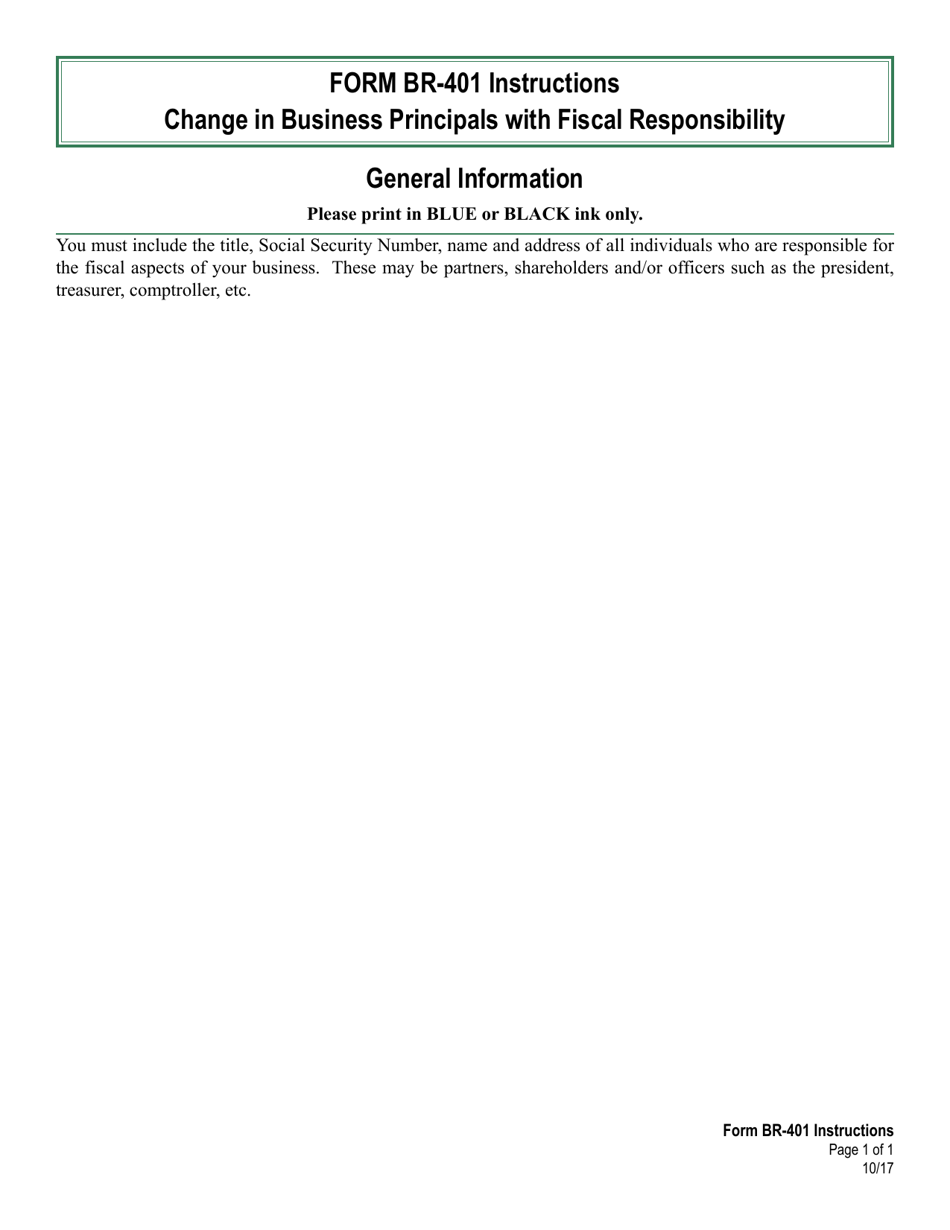

VT Form BR-401 Change in Business Principals With Fiscal Responsibility - Vermont

What Is VT Form BR-401?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form BR-401?

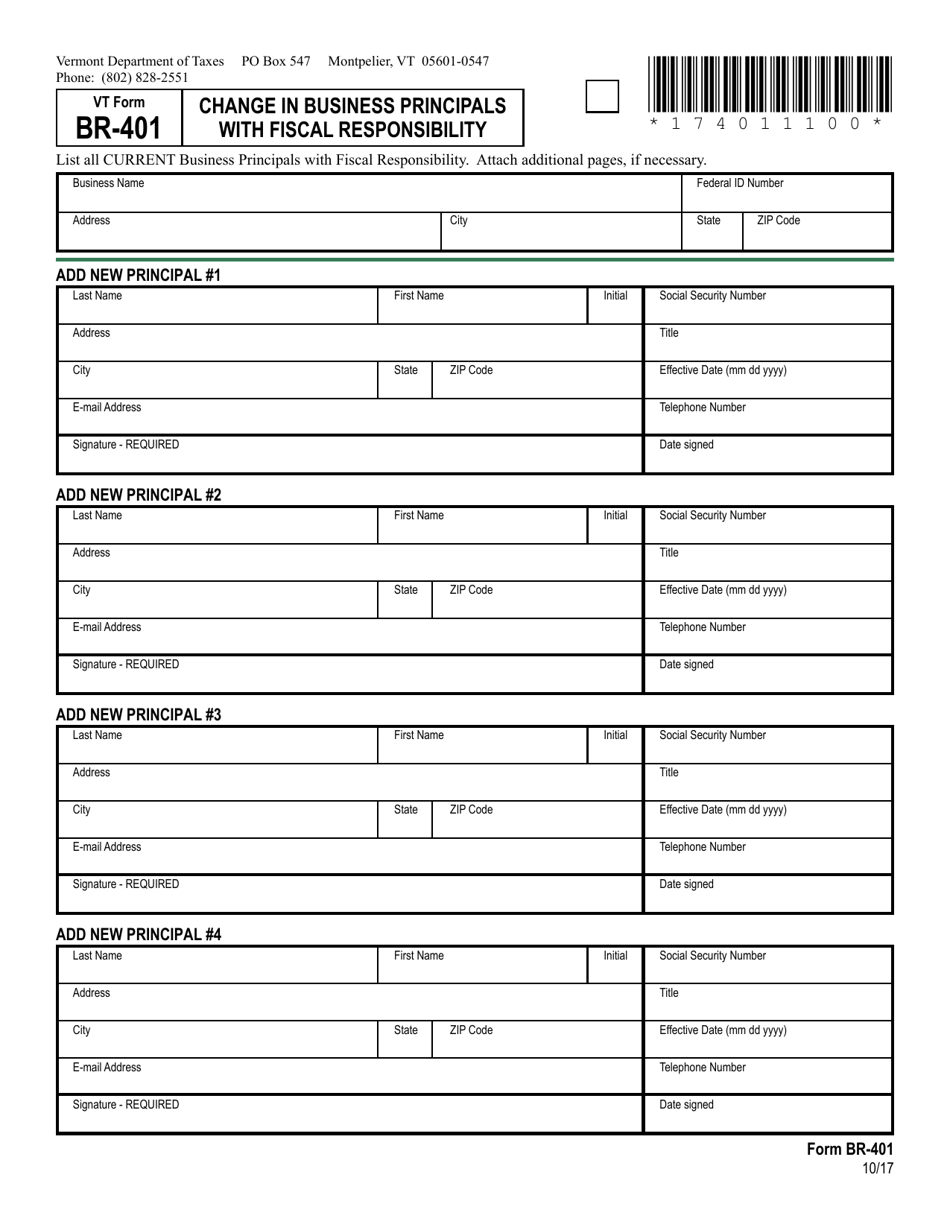

A: The VT Form BR-401 is a form used for reporting changes in business principals with fiscal responsibility in Vermont.

Q: What is considered a change in business principals with fiscal responsibility?

A: A change in business principals with fiscal responsibility refers to any changes in the individuals who are responsible for the financial management of a business in Vermont.

Q: When should the VT Form BR-401 be filed?

A: The VT Form BR-401 should be filed within 30 days of the change in business principals with fiscal responsibility.

Q: Are there any fees associated with filing the VT Form BR-401?

A: No, there are no fees associated with filing the VT Form BR-401.

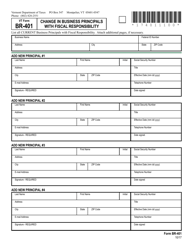

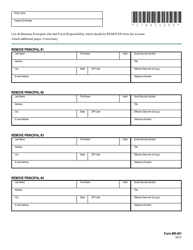

Q: What information is required on the VT Form BR-401?

A: The VT Form BR-401 requires information about the business, the previous and new principals with fiscal responsibility, and the effective date of the change.

Q: What happens if I fail to file the VT Form BR-401?

A: Failure to file the VT Form BR-401 may result in penalties or fines imposed by the Vermont Department of Taxes.

Q: Is the VT Form BR-401 required for all types of businesses in Vermont?

A: Yes, the VT Form BR-401 is required for all types of businesses in Vermont that experience a change in business principals with fiscal responsibility.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form BR-401 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.