This version of the form is not currently in use and is provided for reference only. Download this version of

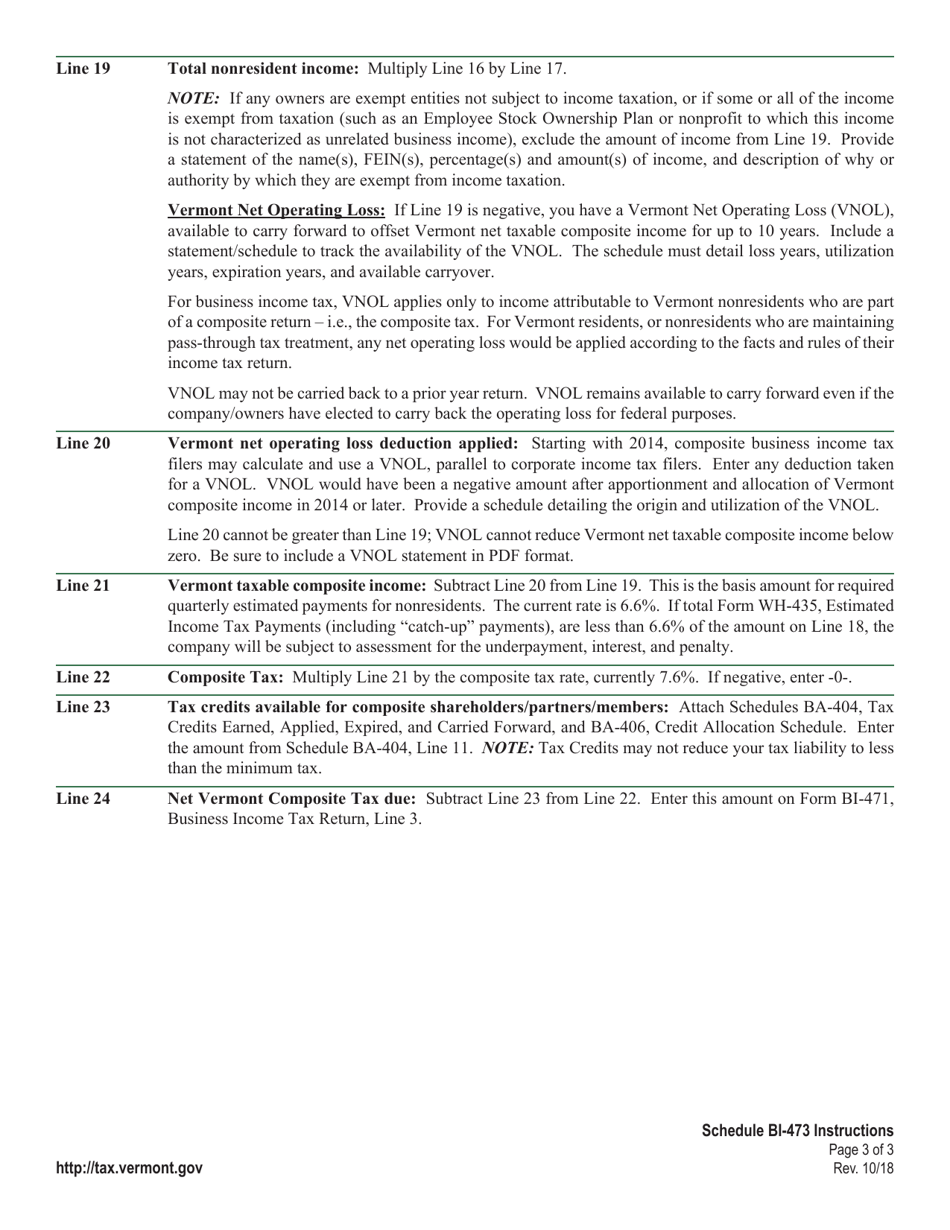

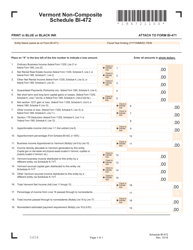

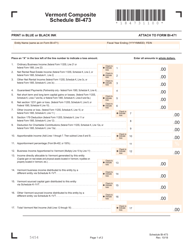

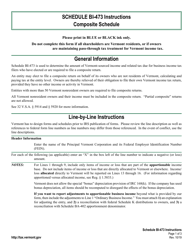

Instructions for Schedule BI-473

for the current year.

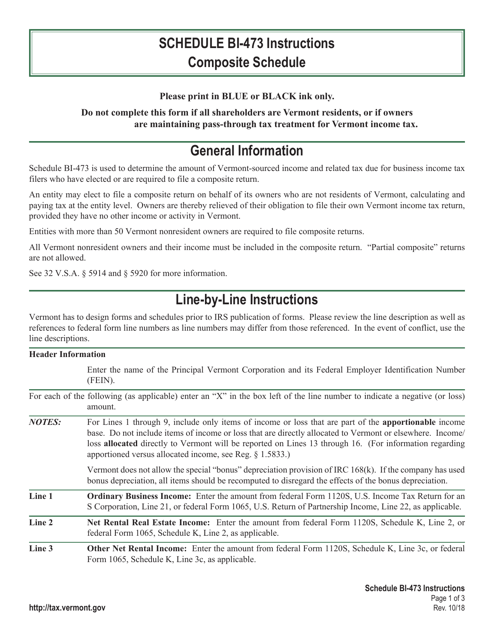

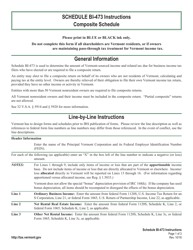

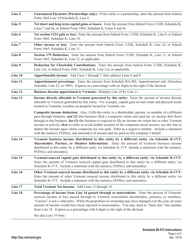

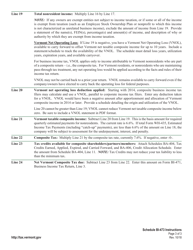

Instructions for Schedule BI-473 Composite Schedule - Vermont

This document contains official instructions for Schedule BI-473 , Composite Schedule - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule BI-473 Composite Schedule?

A: Schedule BI-473 Composite Schedule is a form used in Vermont to report the value of all personal property owned by a business and located within the state.

Q: Who needs to fill out Schedule BI-473?

A: Businesses in Vermont that own personal property that is taxable must fill out Schedule BI-473.

Q: What is considered taxable personal property?

A: Taxable personal property includes items such as equipment, machinery, furniture, and fixtures that are used for business purposes.

Q: When is the deadline to submit Schedule BI-473?

A: The deadline to submit Schedule BI-473 is typically April 18th, unless an extension has been granted.

Q: Are there any penalties for late submission of Schedule BI-473?

A: Yes, there are penalties for late submission of Schedule BI-473, including interest charges on any taxes owed.

Q: What should I do if I have questions or need assistance with Schedule BI-473?

A: If you have questions or need assistance with Schedule BI-473, you can contact the Vermont Department of Taxes for guidance.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.