This version of the form is not currently in use and is provided for reference only. Download this version of

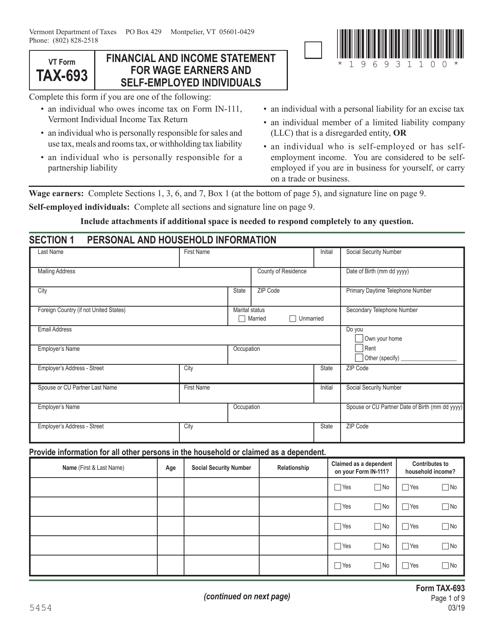

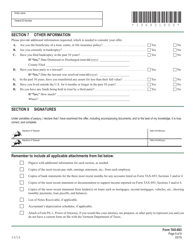

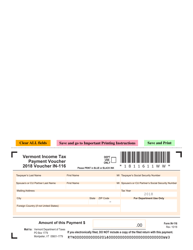

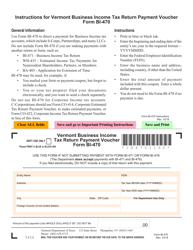

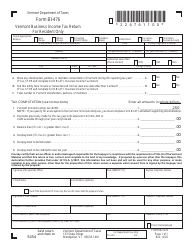

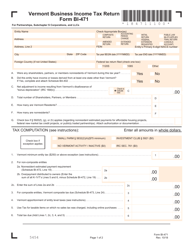

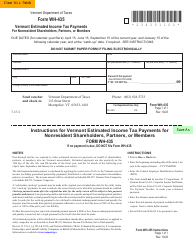

VT Form TAX-693

for the current year.

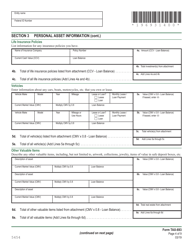

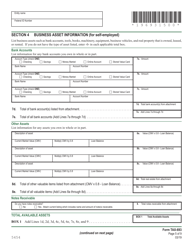

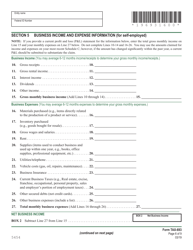

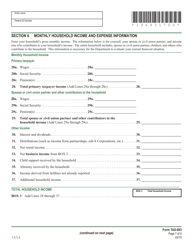

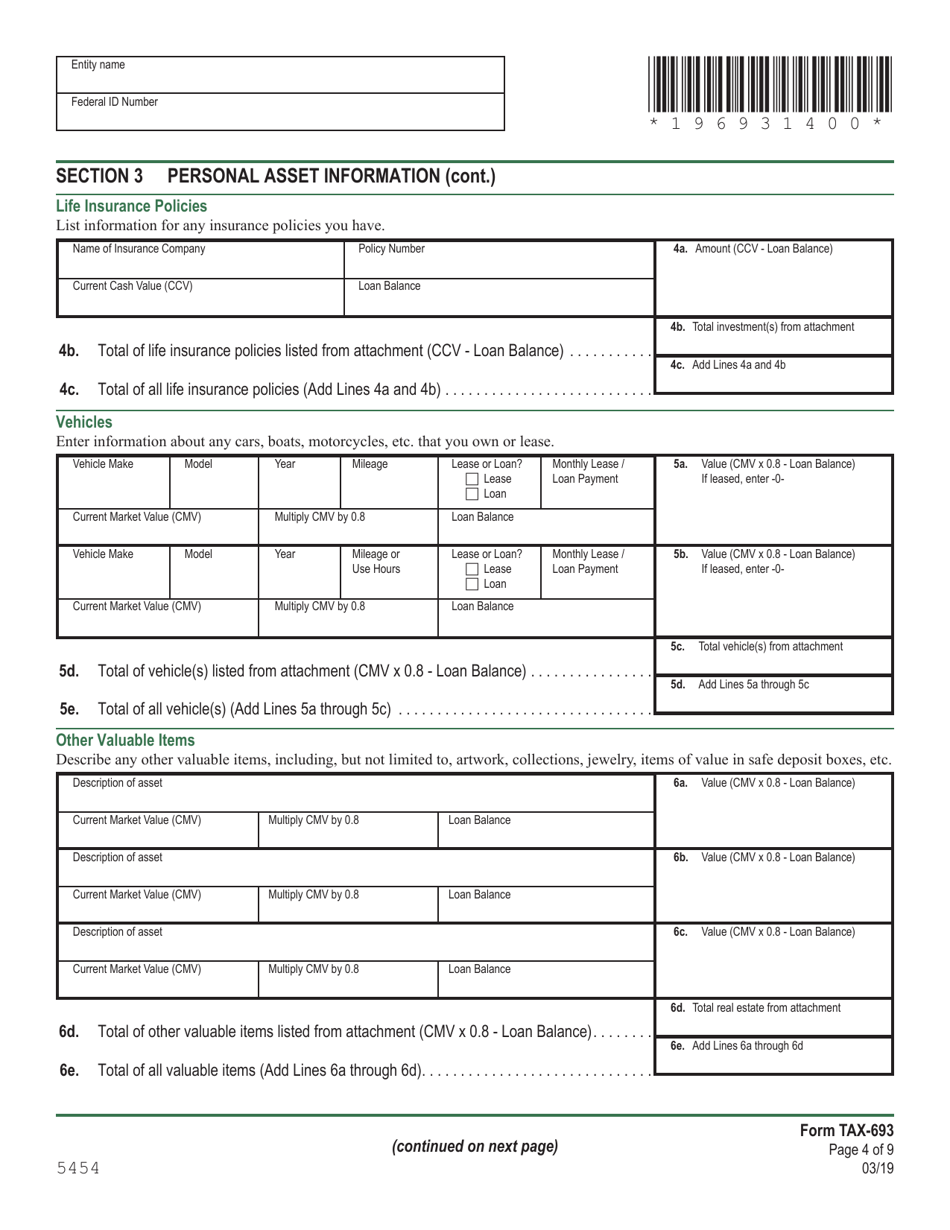

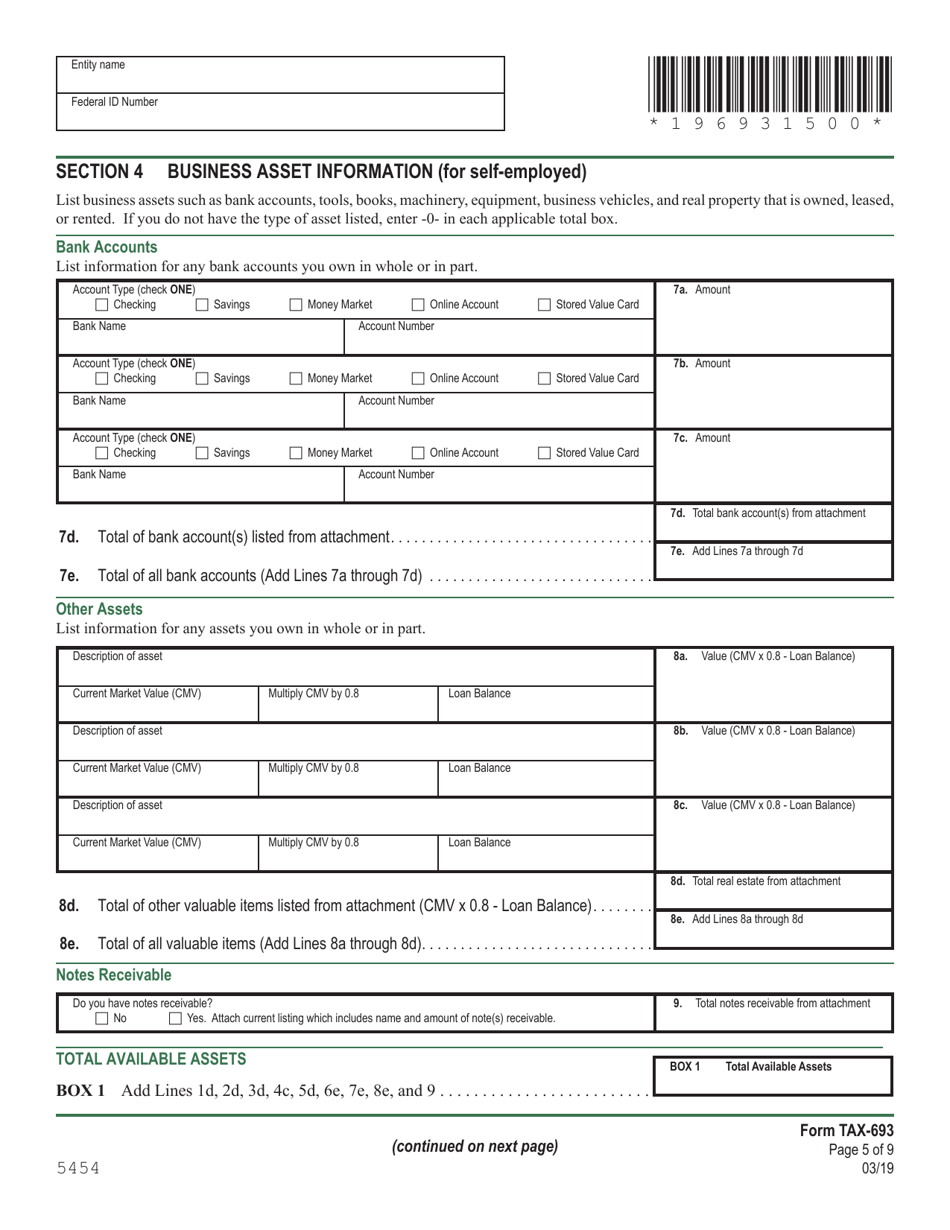

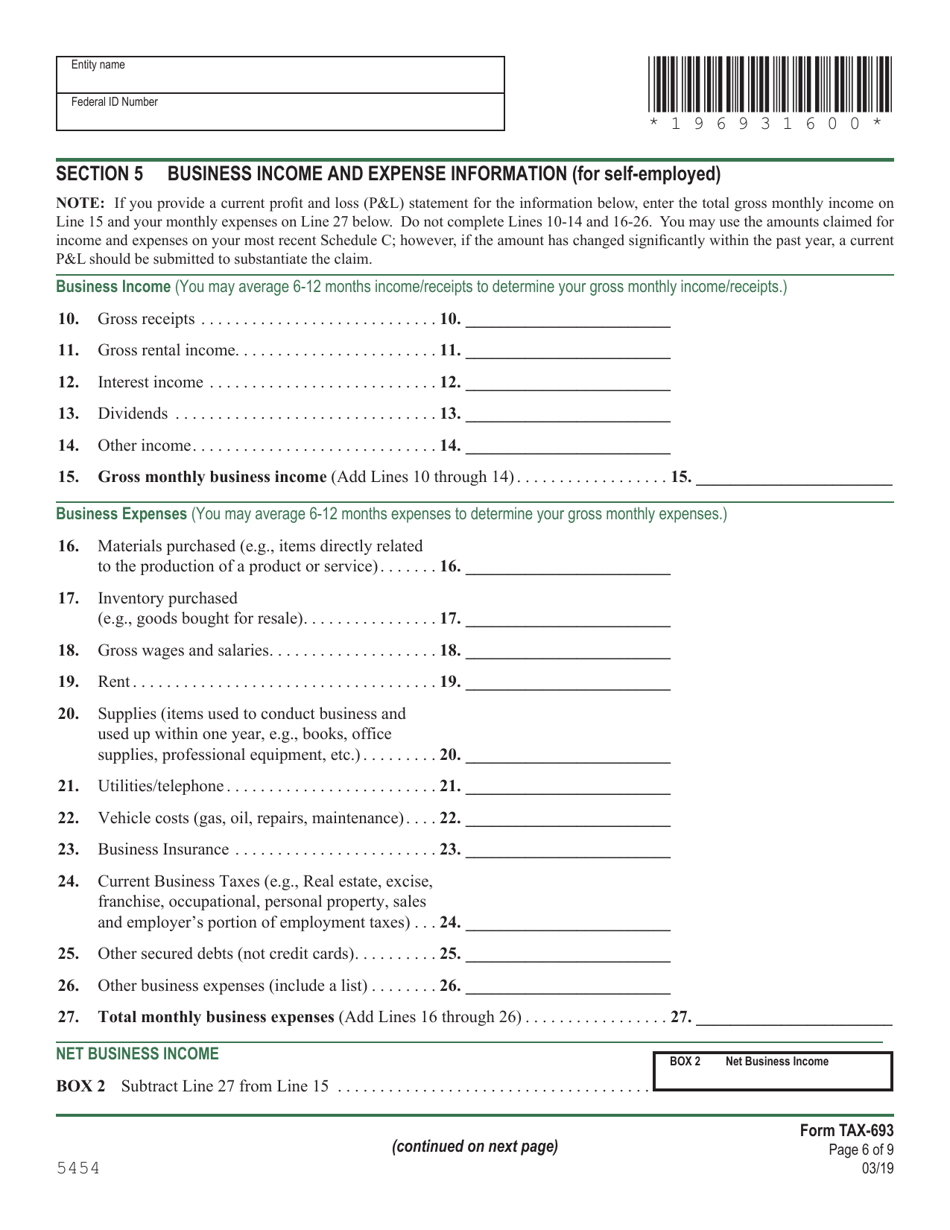

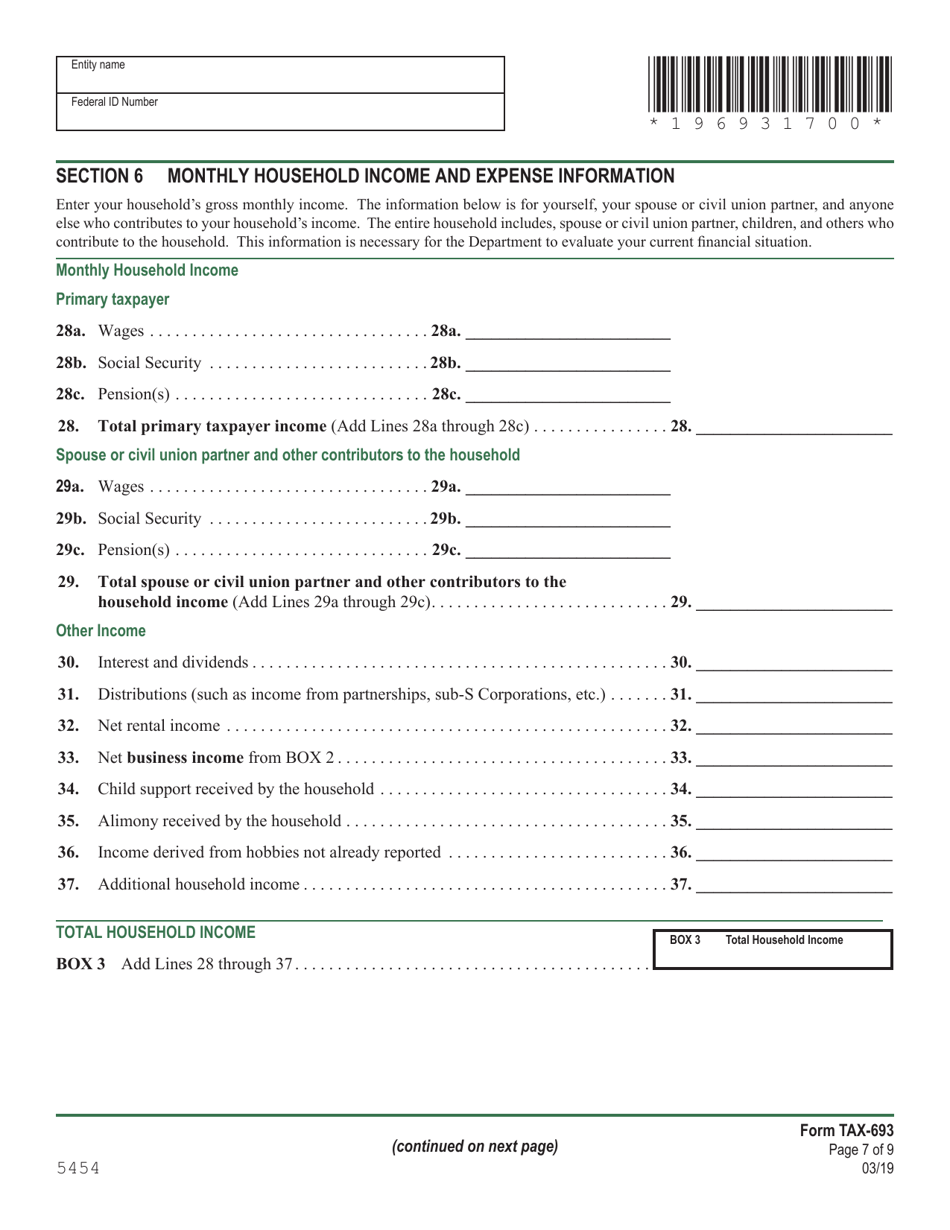

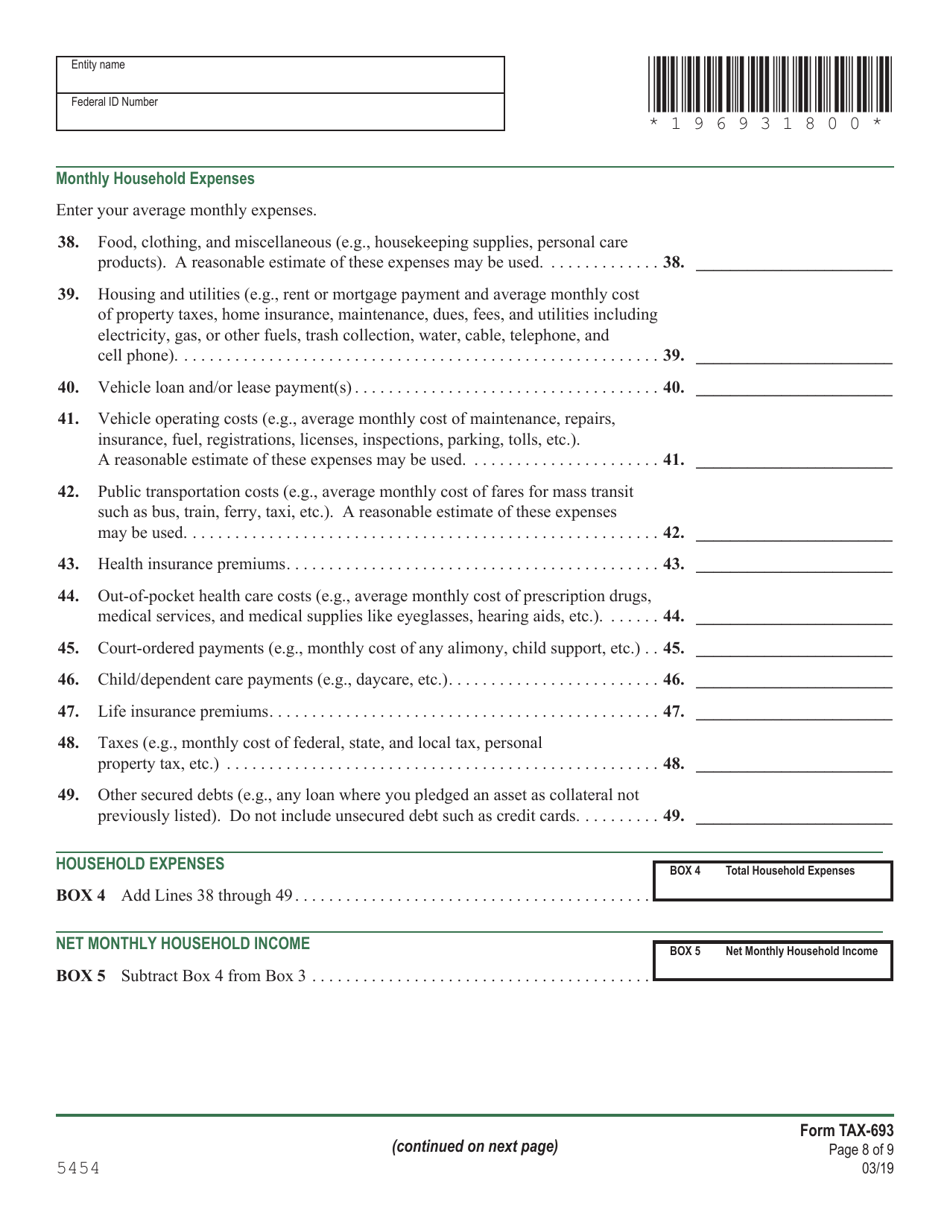

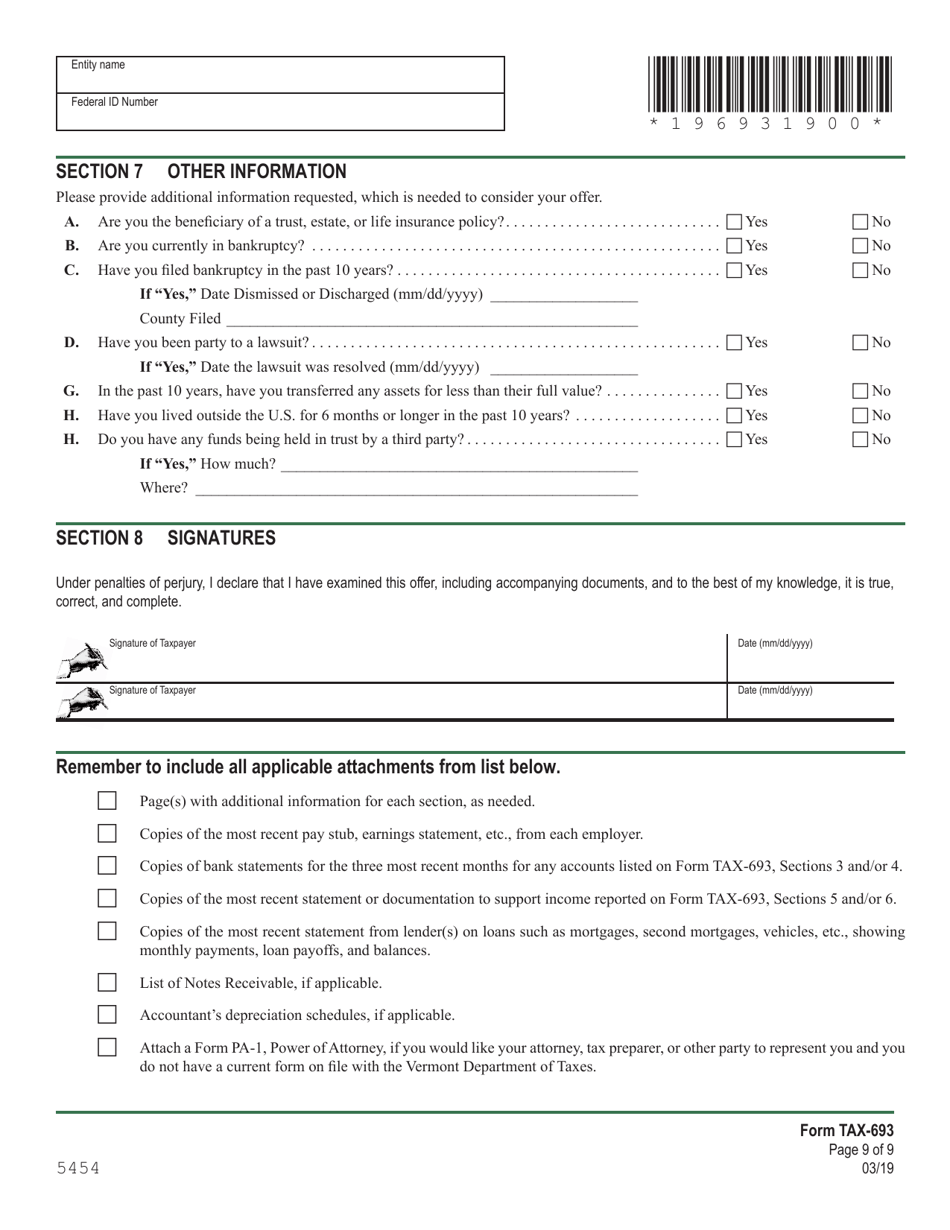

VT Form TAX-693 Financial and Income Statement for Wage Earners and Self-employed Individuals - Vermont

What Is VT Form TAX-693?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

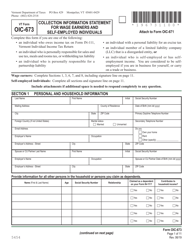

Q: What is Form TAX-693?

A: Form TAX-693 is the Financial and Income Statement for Wage Earners and Self-employed Individuals in Vermont.

Q: Who needs to file Form TAX-693?

A: Wage earners and self-employed individuals in Vermont may need to file Form TAX-693.

Q: What is the purpose of Form TAX-693?

A: The purpose of Form TAX-693 is to provide information on an individual's financial and income status.

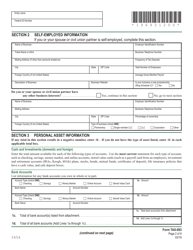

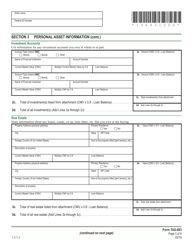

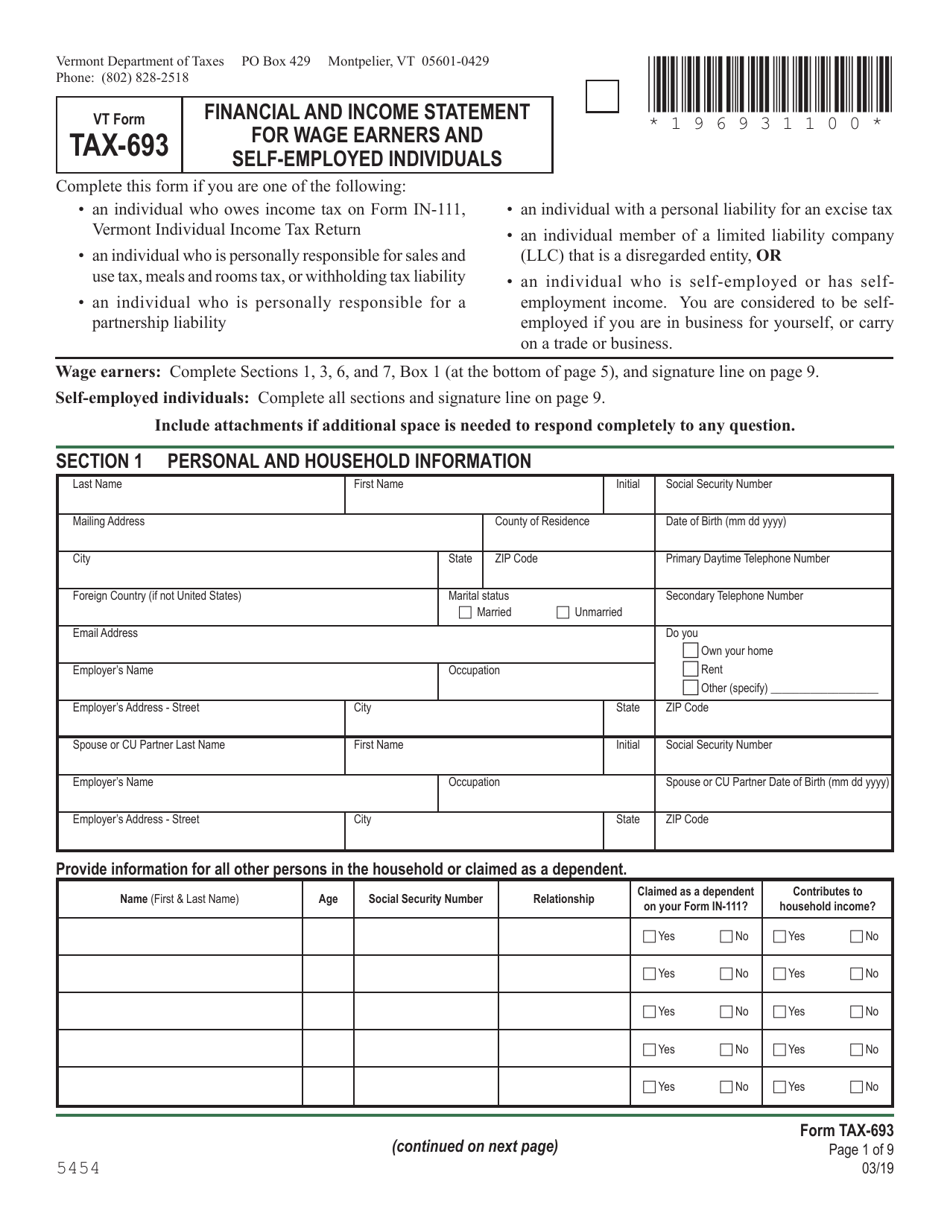

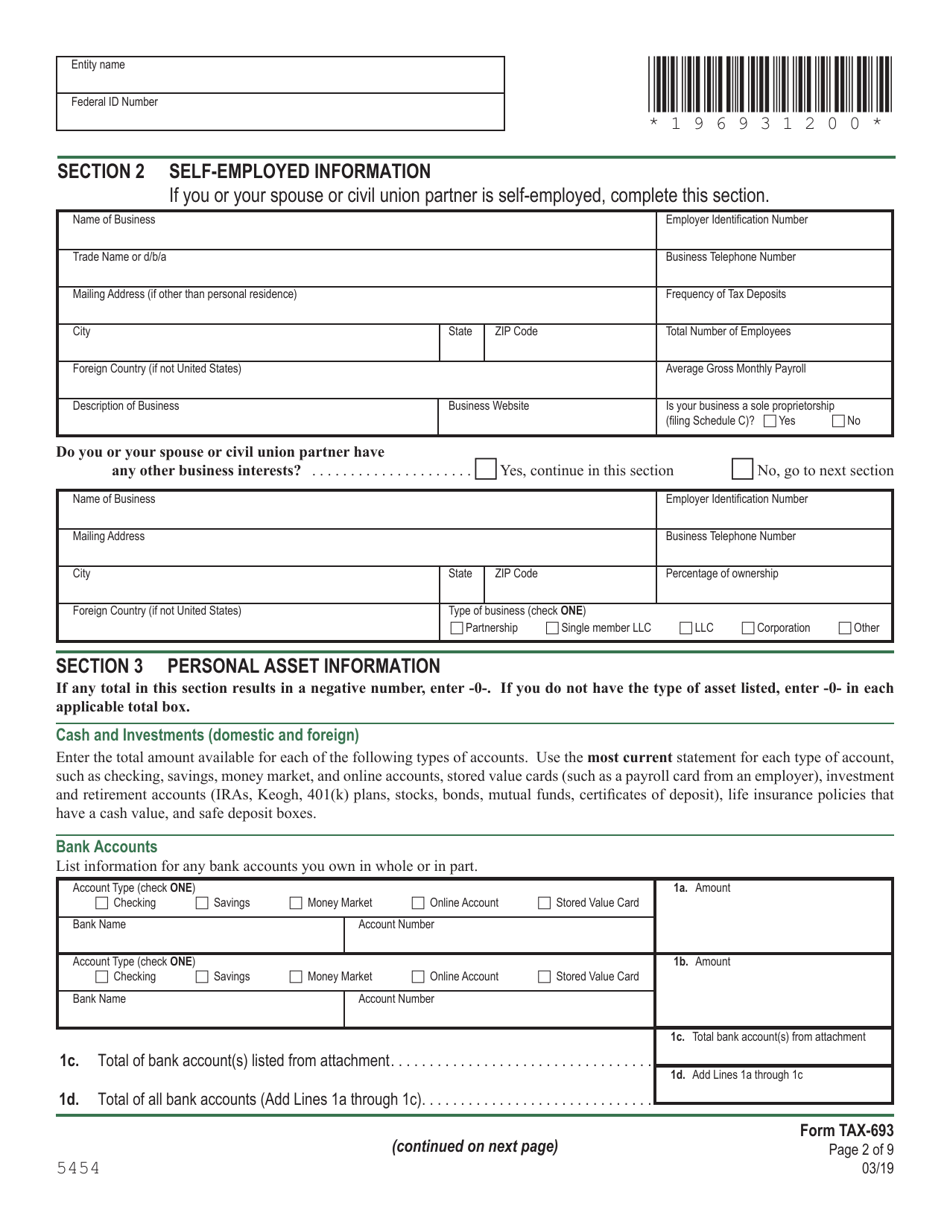

Q: What information is required on Form TAX-693?

A: Form TAX-693 requires information such as income, expenses, assets, and liabilities.

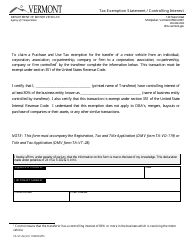

Q: Are there any penalties for not filing Form TAX-693?

A: Failure to file Form TAX-693 by the deadline may result in penalties and interest.

Q: Can I e-file Form TAX-693?

A: No, Form TAX-693 cannot be e-filed. It must be filed by mail or in person.

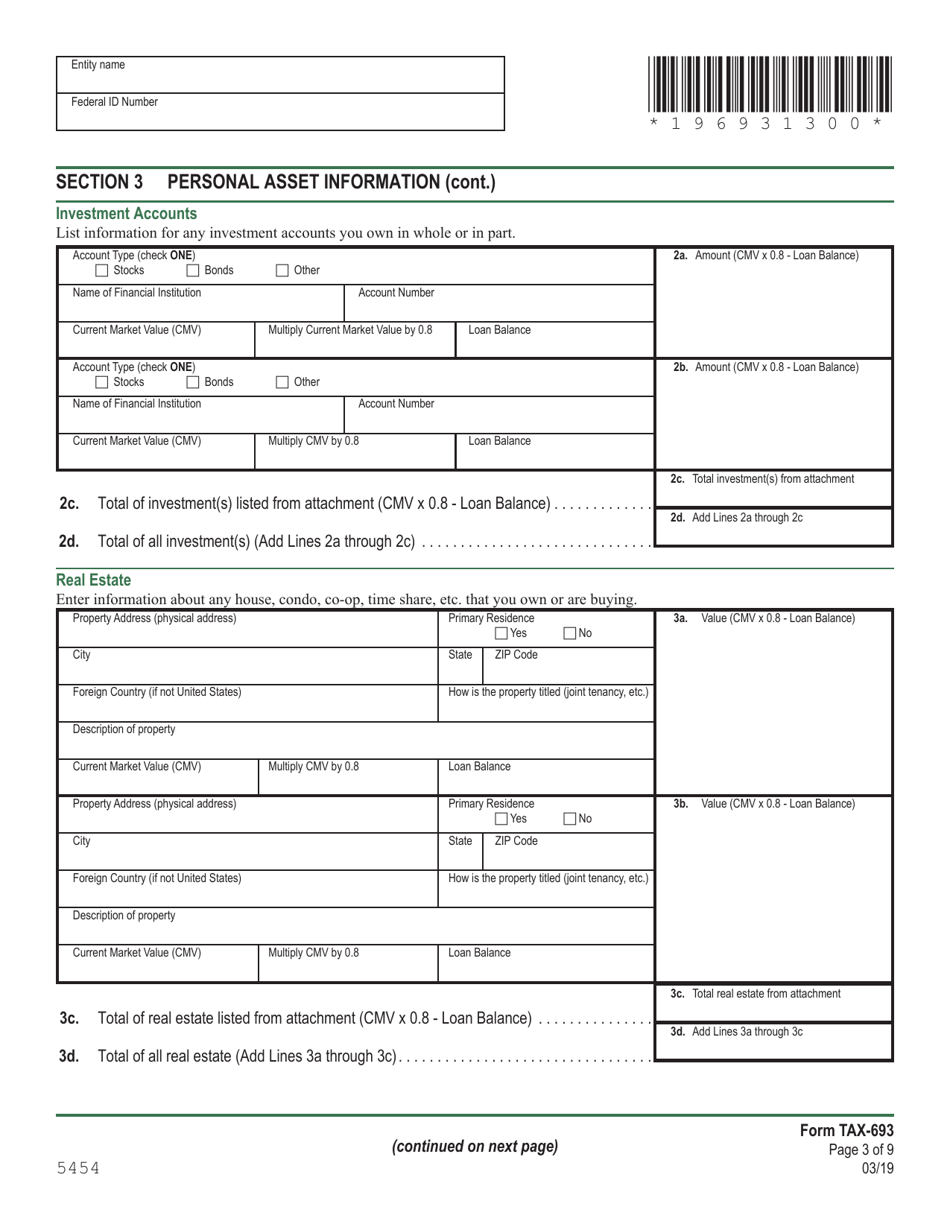

Q: Do I need to include supporting documents with Form TAX-693?

A: Yes, supporting documents such as bank statements, receipts, and other financial records may need to be included with Form TAX-693.

Q: Is Form TAX-693 only for Vermont residents?

A: Yes, Form TAX-693 is specifically for individuals who are residents of Vermont.

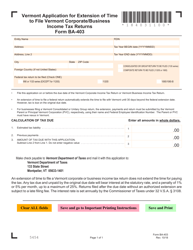

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form TAX-693 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.