This version of the form is not currently in use and is provided for reference only. Download this version of

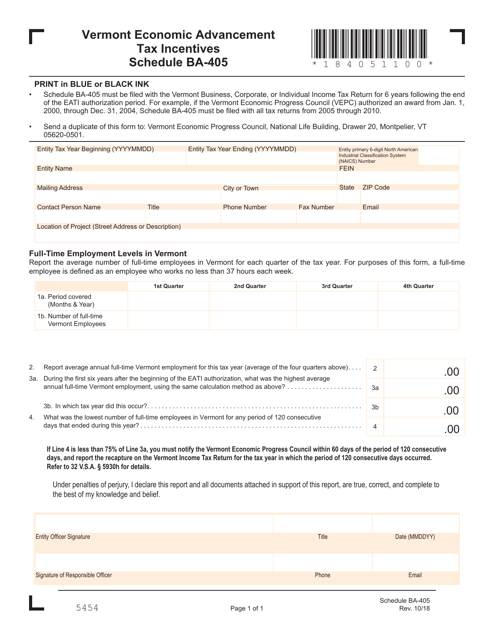

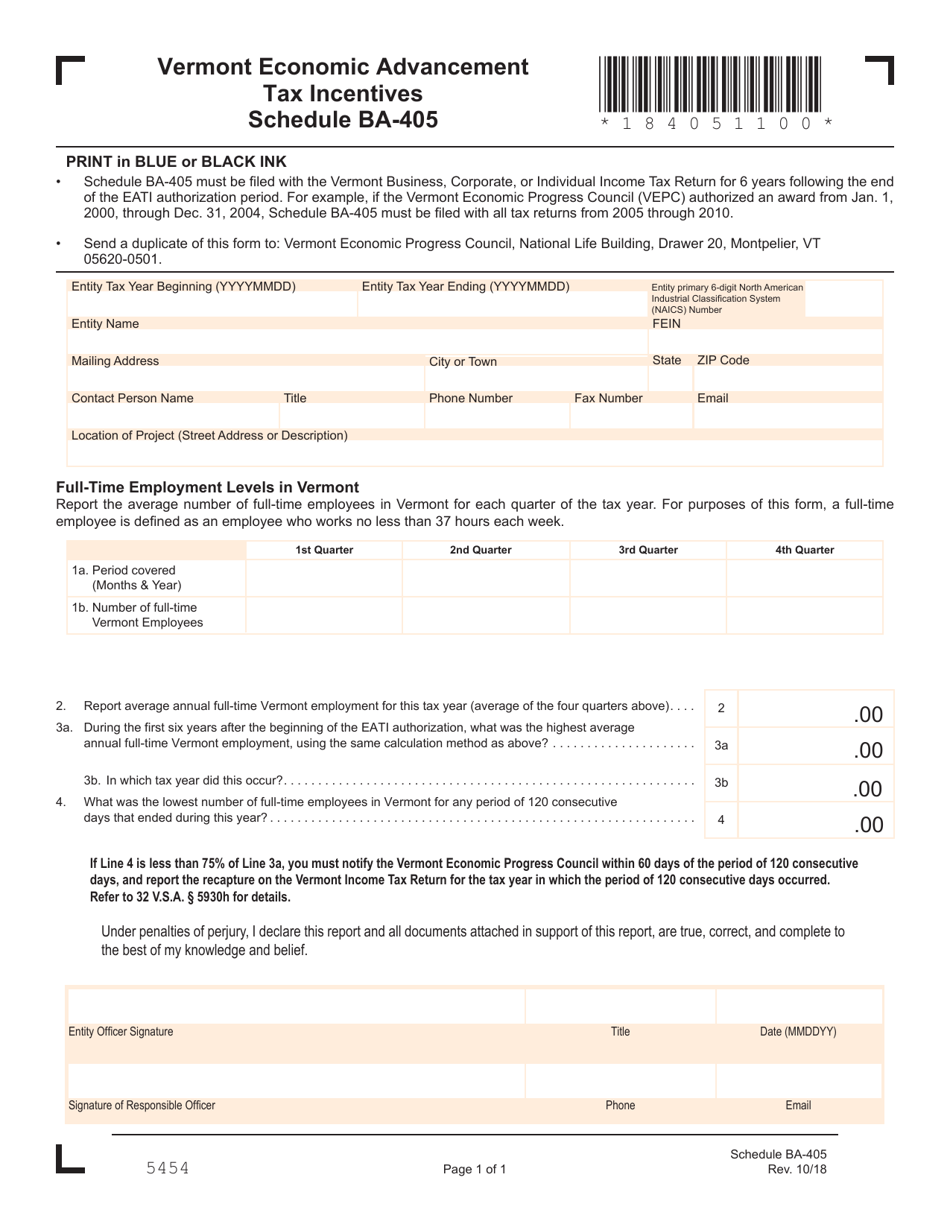

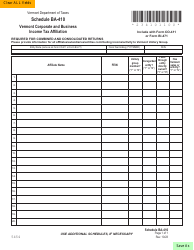

Schedule BA-405

for the current year.

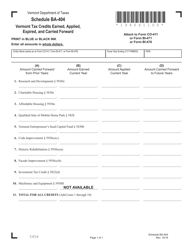

Schedule BA-405 Economic Advancement Tax Incentives - Vermont

What Is Schedule BA-405?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule BA-405?

A: Schedule BA-405 is a tax schedule used in Vermont for reporting economic advancement tax incentives.

Q: What are economic advancement tax incentives?

A: Economic advancement tax incentives are tax benefits provided by the state of Vermont to encourage economic growth and development.

Q: What types of tax incentives are reported on Schedule BA-405?

A: Schedule BA-405 is used to report various tax incentives available in Vermont, such as tax credits for job creation, research and development, and capital investments.

Q: Who is required to file Schedule BA-405?

A: Businesses or individuals who have claimed economic advancement tax incentives in Vermont are required to file Schedule BA-405.

Q: Is there a deadline for filing Schedule BA-405?

A: Yes, the deadline for filing Schedule BA-405 is typically the same as the deadline for filing your Vermont tax return, which is usually April 15th.

Q: Are there any penalties for not filing Schedule BA-405?

A: Yes, failure to file Schedule BA-405 or providing false information can result in penalties and interest charges by the Vermont Department of Taxes.

Q: Can I claim economic advancement tax incentives if I am an individual taxpayer?

A: Yes, certain tax incentives reported on Schedule BA-405, such as the research and developmenttax credit, can be claimed by individual taxpayers as well as businesses.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule BA-405 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.