This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule TAX-692

for the current year.

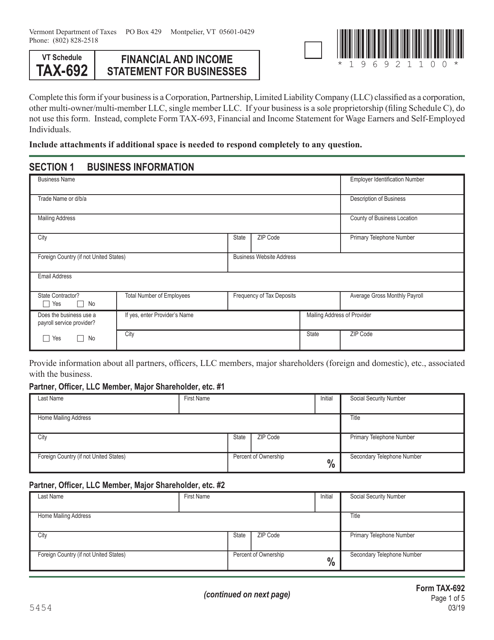

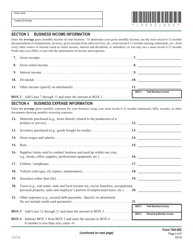

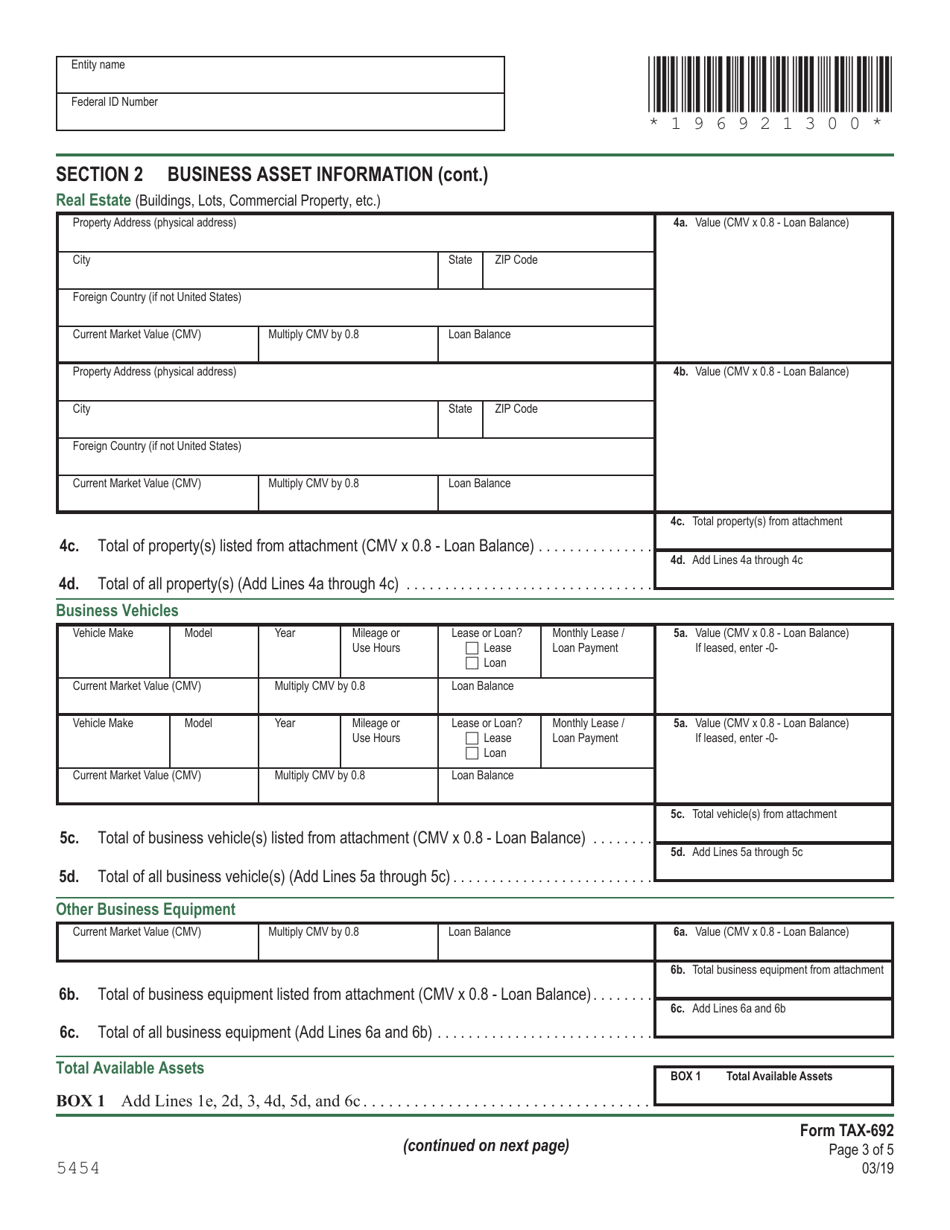

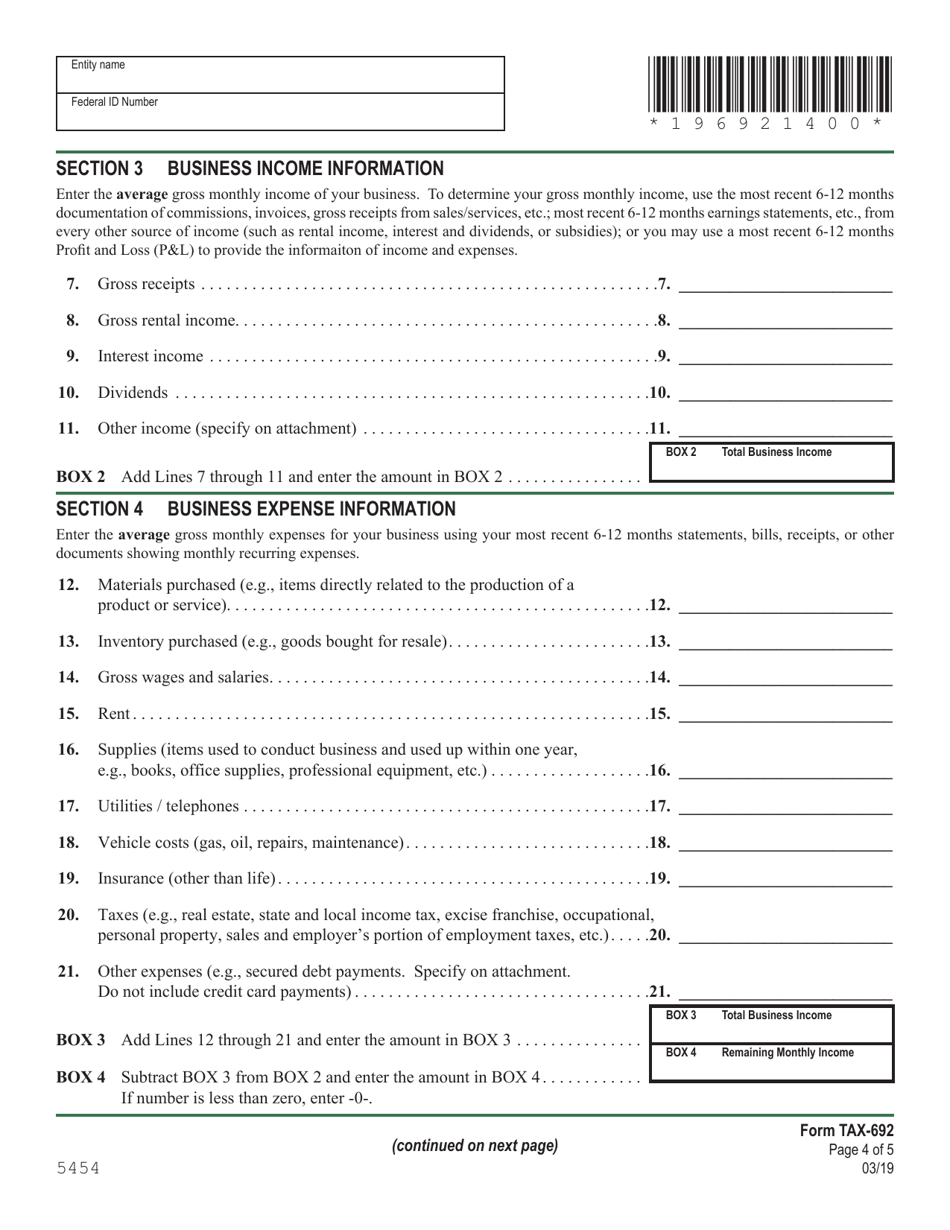

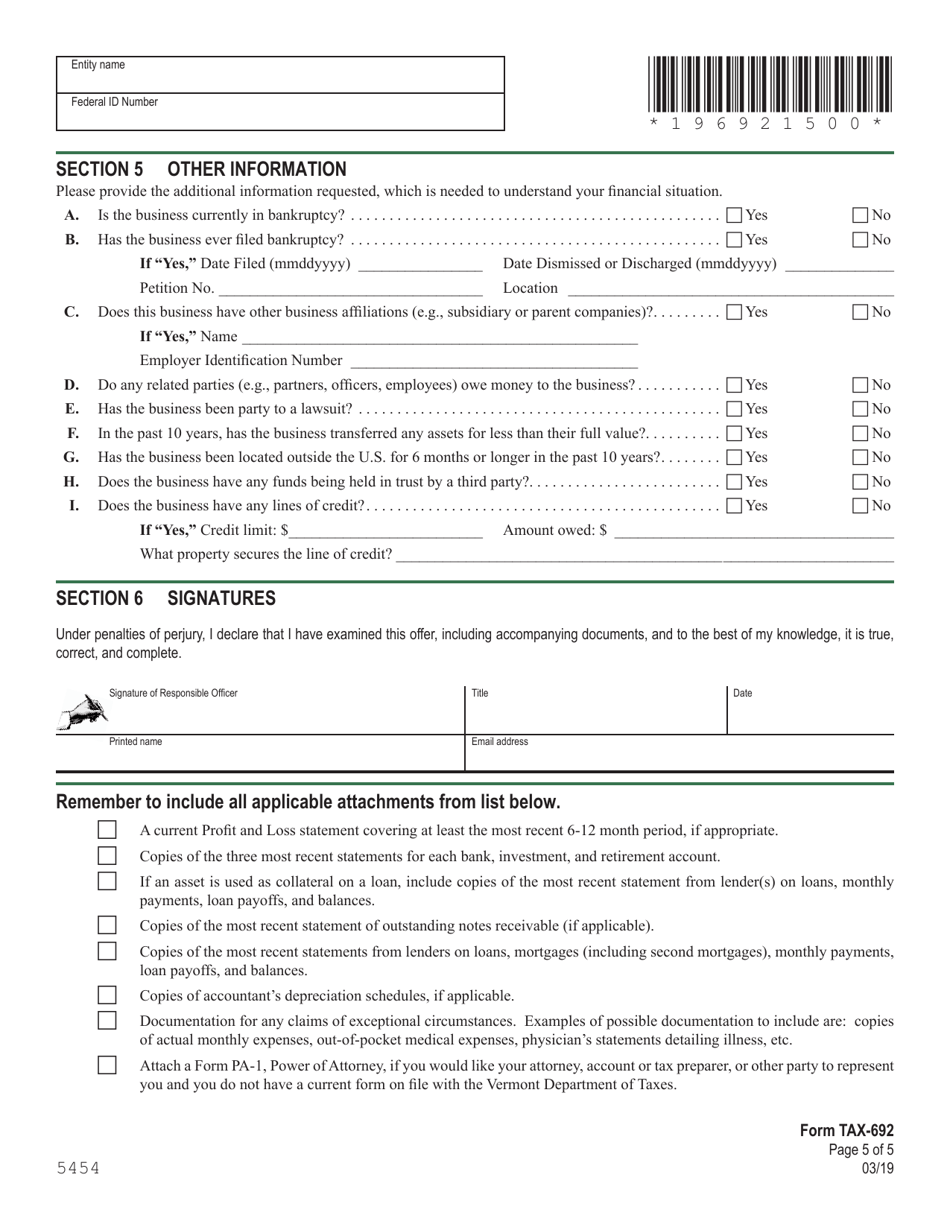

Schedule TAX-692 Financial and Income Statement for Businesses - Vermont

What Is Schedule TAX-692?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TAX-692?

A: TAX-692 is a financial and income statement form for businesses in Vermont.

Q: When is the deadline to file TAX-692?

A: The deadline to file TAX-692 varies and depends on the tax year. It is generally due on the same date as the business's federal tax return.

Q: Who needs to file TAX-692?

A: Businesses operating in Vermont that meet certain criteria, such as having a certain amount of gross receipts, are required to file TAX-692.

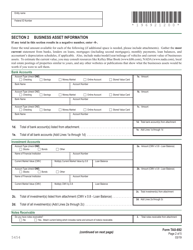

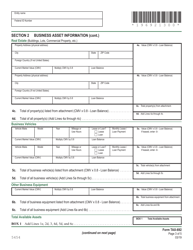

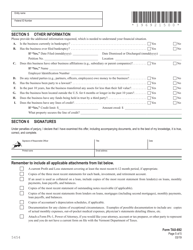

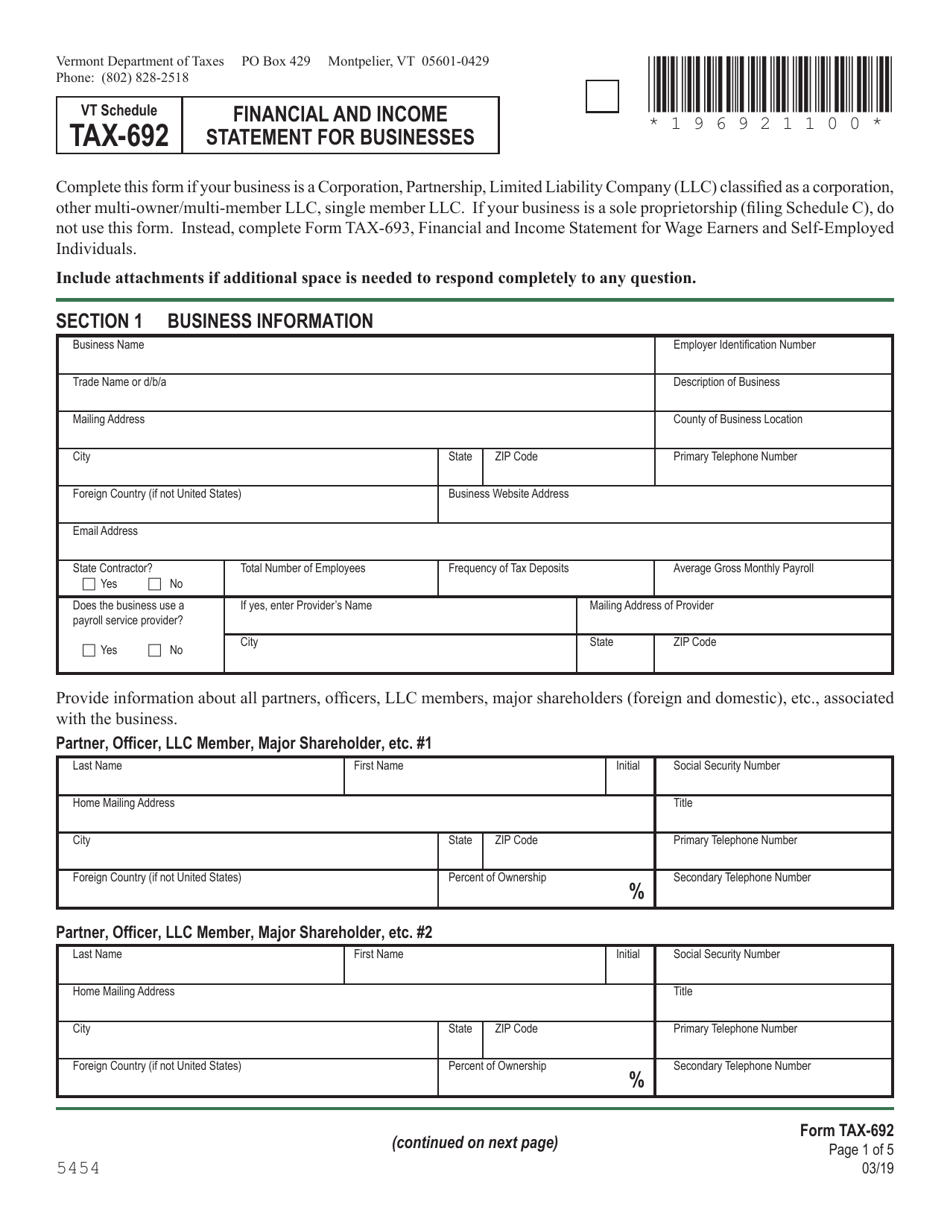

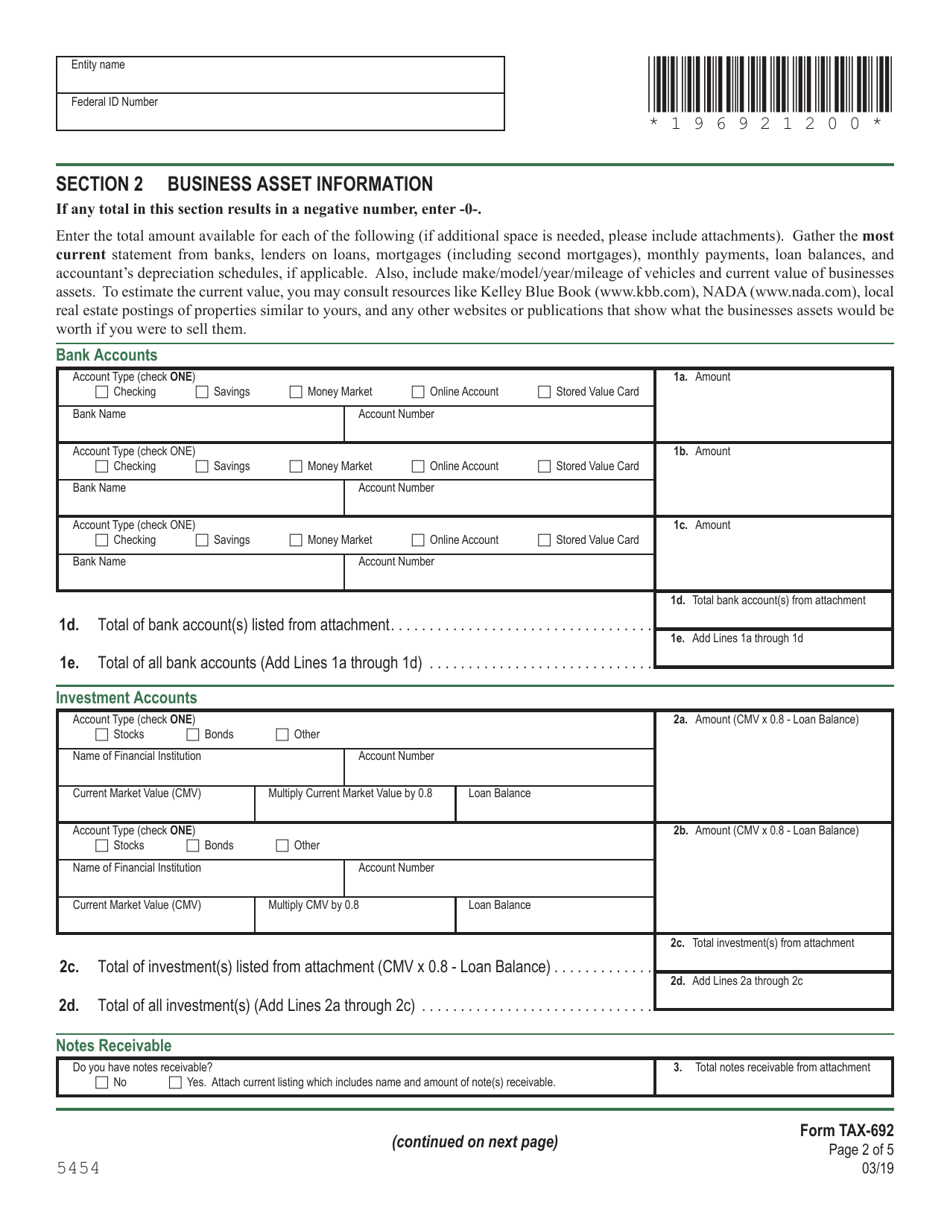

Q: What information is required on the TAX-692 form?

A: The TAX-692 form requires businesses to provide detailed financial and income statement information, including revenue, expenses, and deductions.

Q: Are there any penalties for not filing TAX-692?

A: Yes, failing to file TAX-692 or filing it late can result in penalties and interest charges.

Q: Are there any exemptions from filing TAX-692?

A: Certain types of businesses, such as sole proprietorships with no employees, may be exempt from filing TAX-692. It is best to consult the Vermont Department of Taxes for specific exemptions.

Q: What if I have questions or need assistance with filing TAX-692?

A: If you have questions or need assistance with filing TAX-692, you can contact the Vermont Department of Taxes directly or seek guidance from a tax professional.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule TAX-692 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.