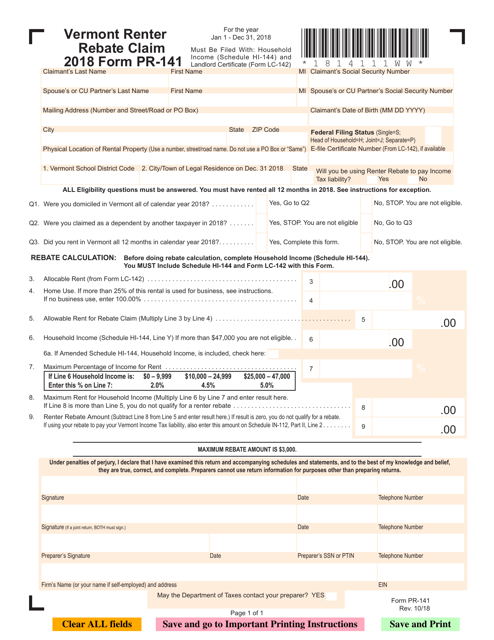

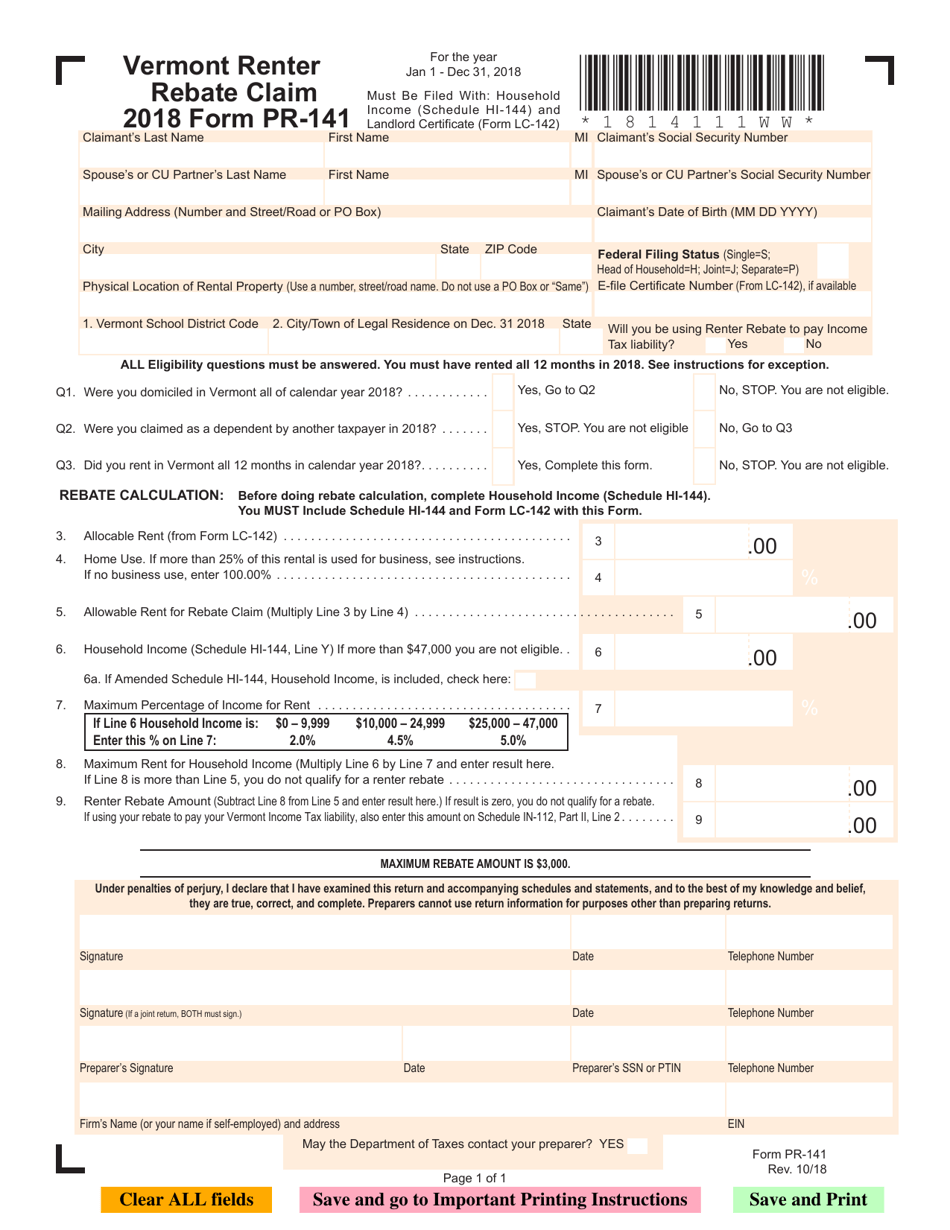

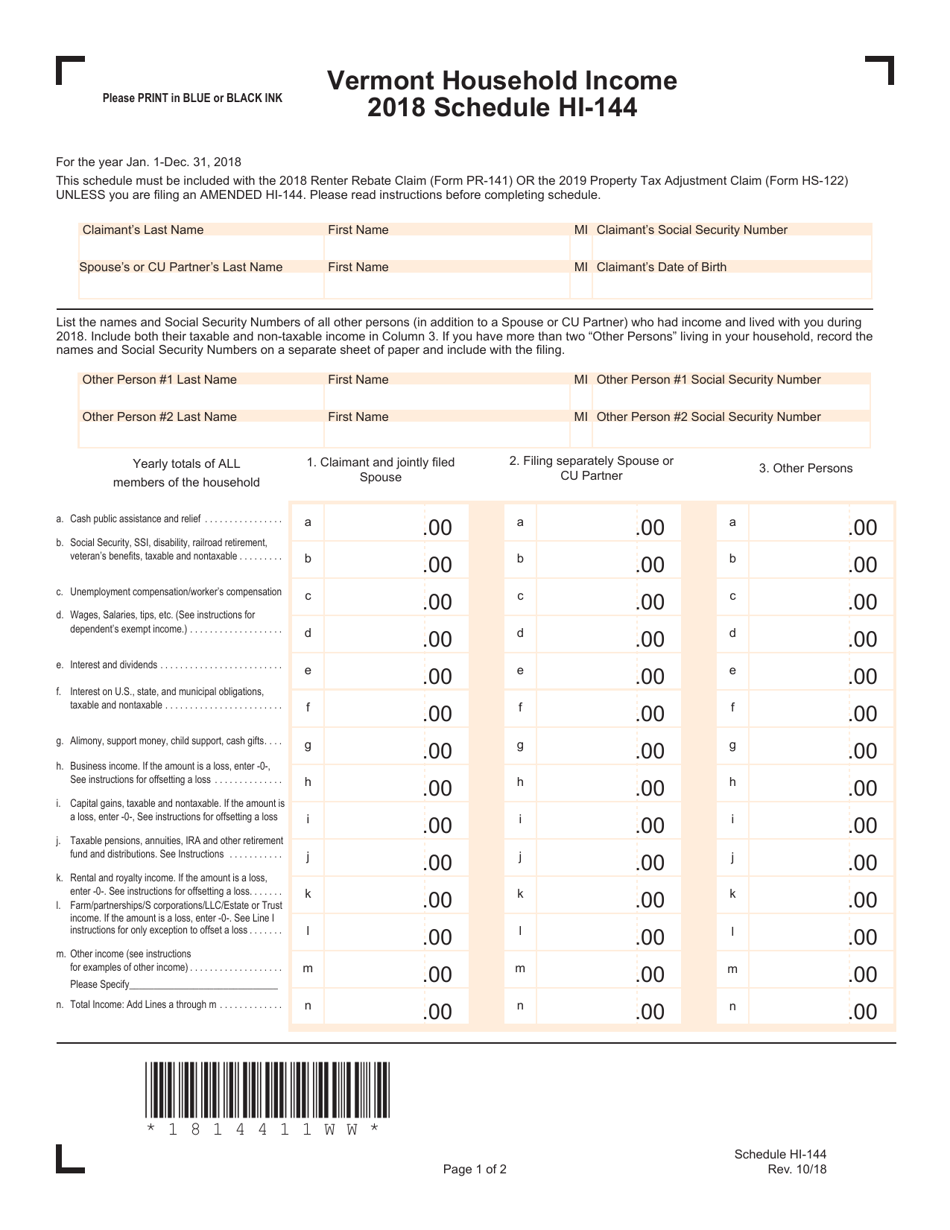

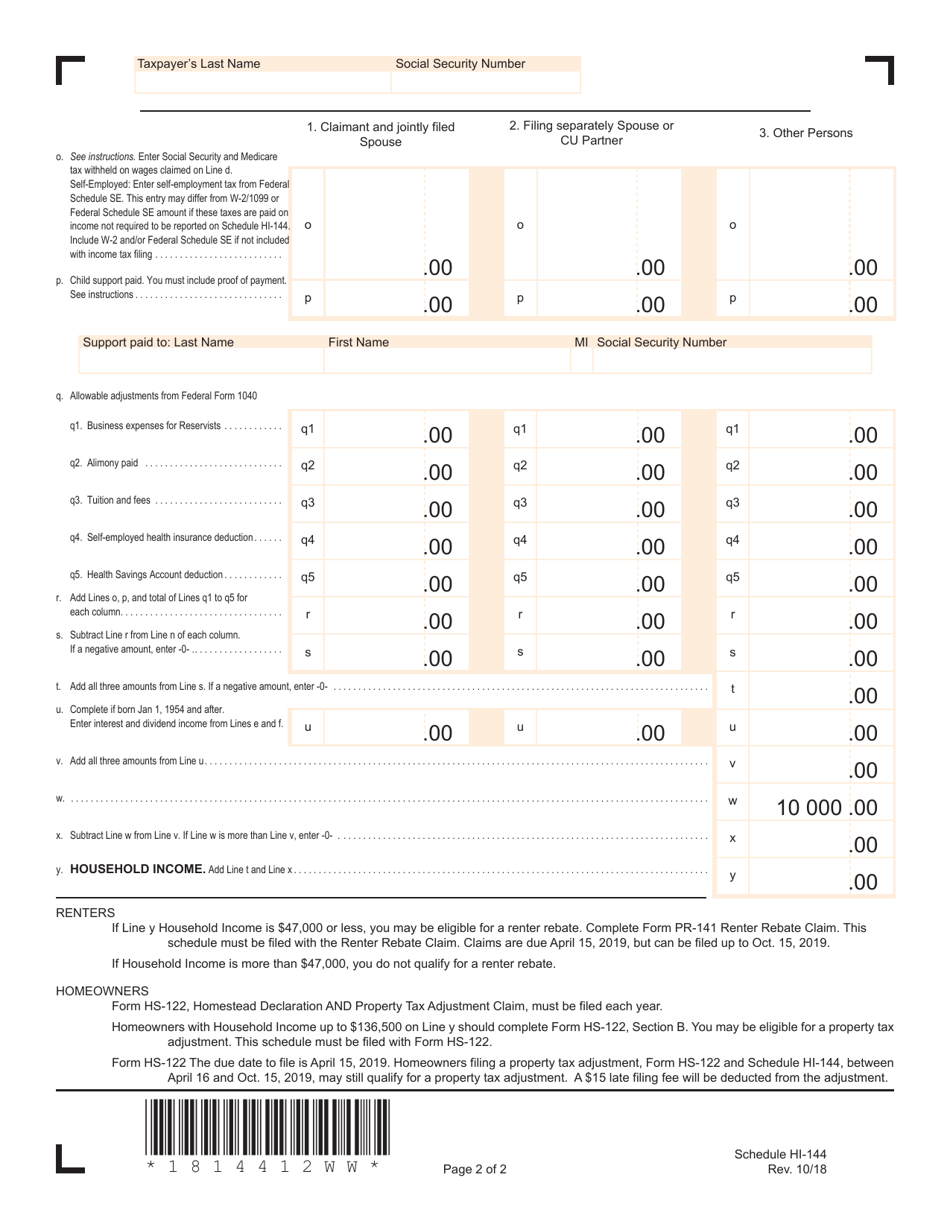

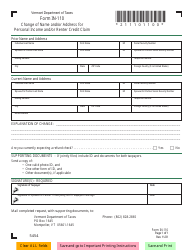

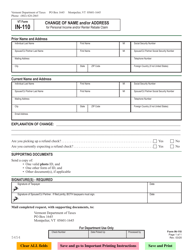

Form PR-141 Vermont Renter Rebate Claim - Vermont

What Is Form PR-141?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is PR-141?

A: PR-141 is the form used to file a Vermont Renter Rebate Claim.

Q: What is the Vermont Renter Rebate?

A: The Vermont Renter Rebate is a program that helps eligible individuals and families with the cost of renting their homes.

Q: Who is eligible for the Vermont Renter Rebate?

A: To be eligible for the Vermont Renter Rebate, you must meet certain income and residency requirements.

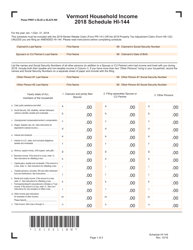

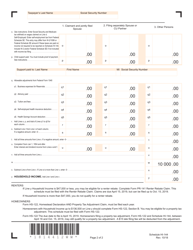

Q: What are the income requirements for the Vermont Renter Rebate?

A: The income requirements for the Vermont Renter Rebate vary depending on your marital status and number of dependents.

Q: How do I file a Vermont Renter Rebate Claim?

A: To file a Vermont Renter Rebate Claim, you need to complete and submit PR-141 form along with any required documentation.

Q: When is the deadline to file a Vermont Renter Rebate Claim?

A: The deadline to file a Vermont Renter Rebate Claim is typically April 15th of the following year.

Q: What documents do I need to include with my Vermont Renter Rebate Claim?

A: You will need to include copies of your renter statement or rent receipts, as well as any other required documentation such as proof of income.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PR-141 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.