This version of the form is not currently in use and is provided for reference only. Download this version of

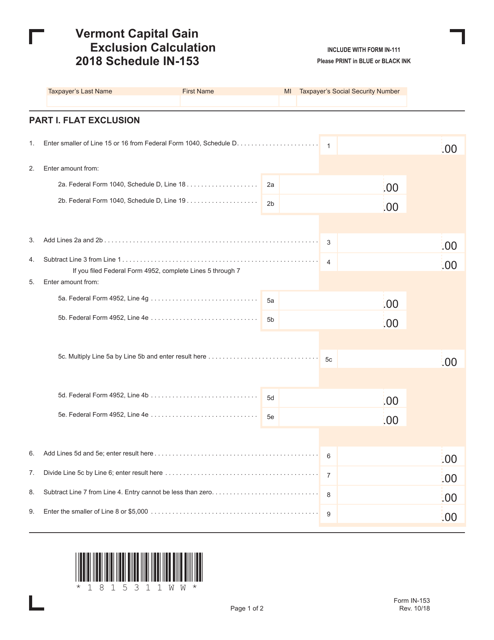

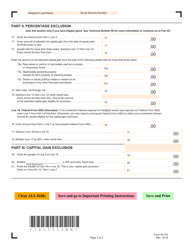

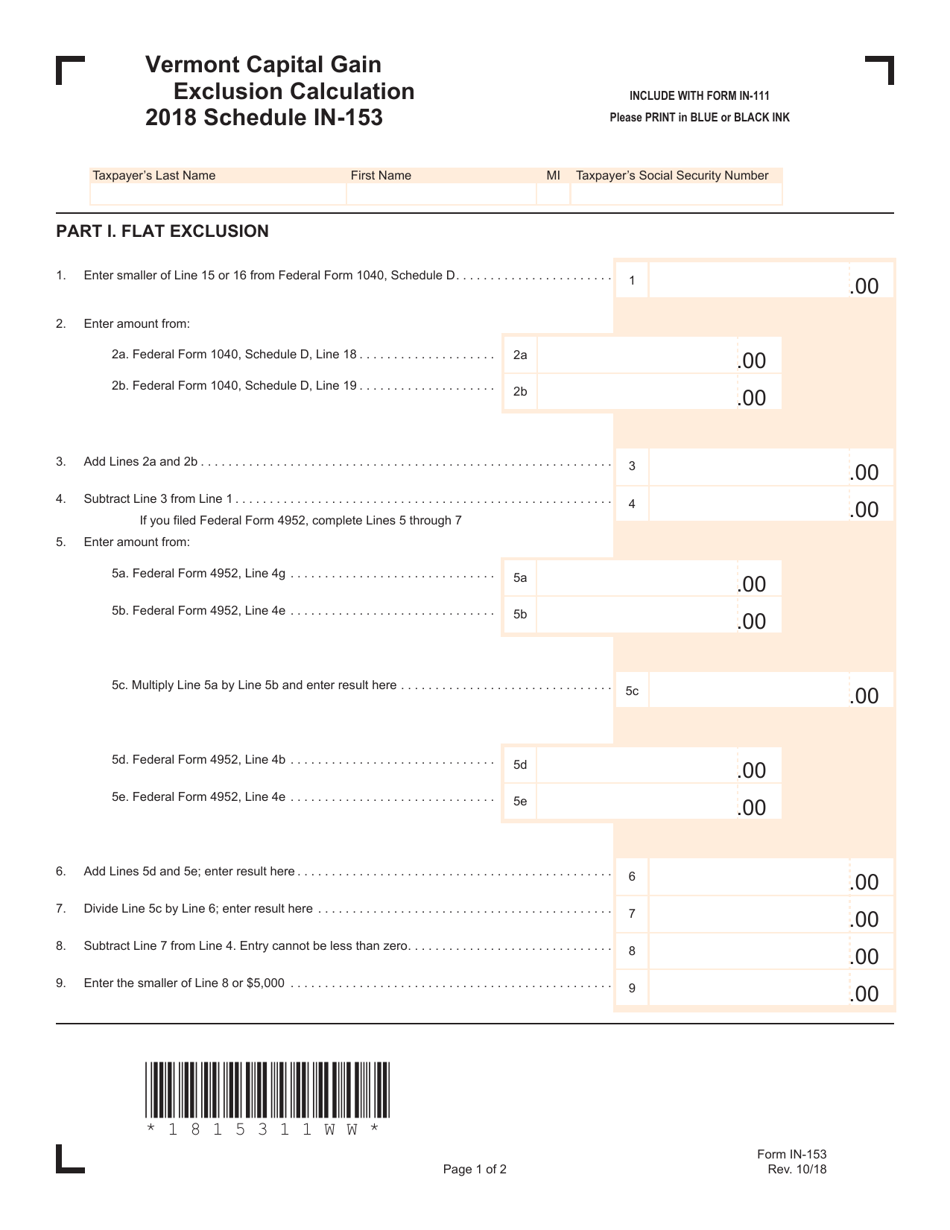

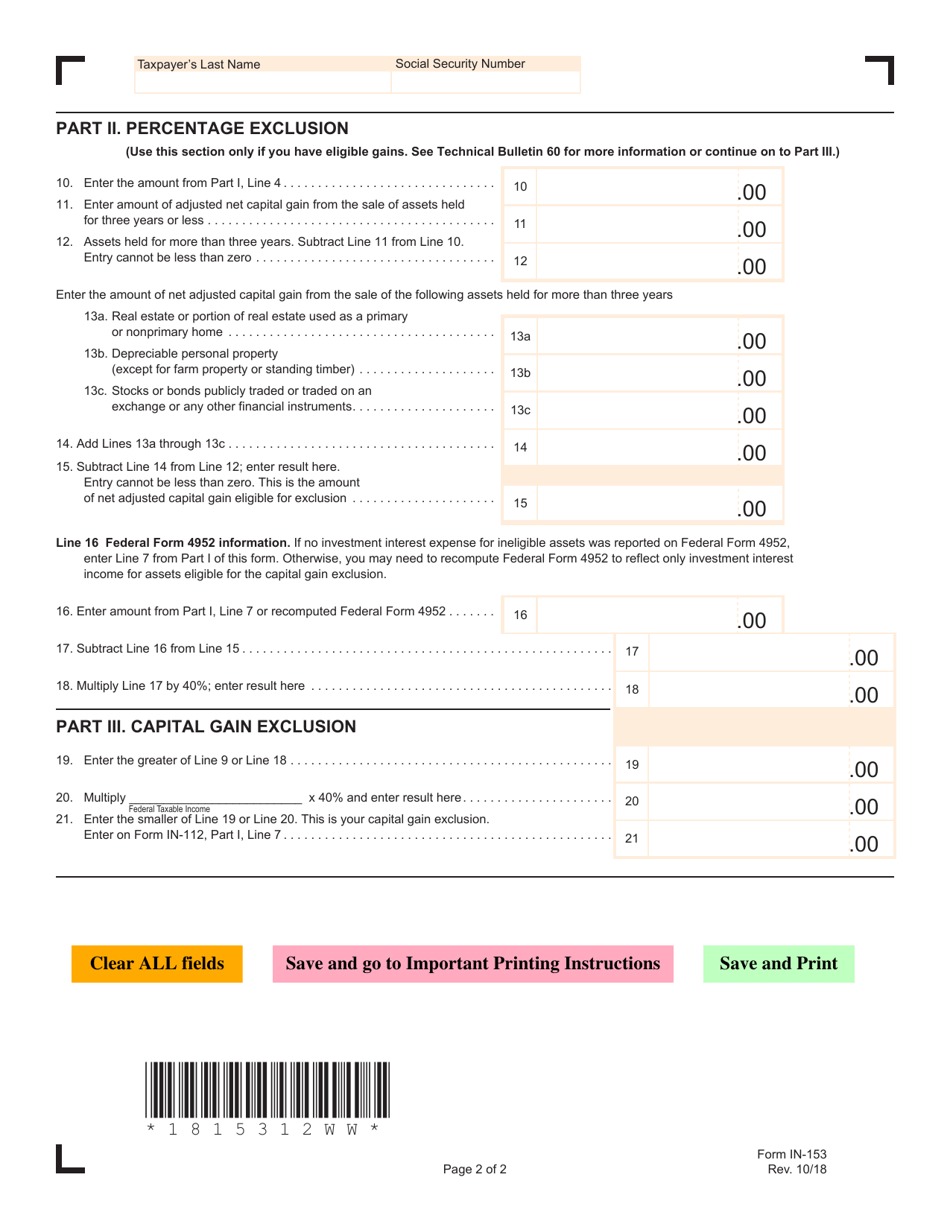

Schedule IN-153

for the current year.

Schedule IN-153 Capital Gain Exclusion Calculation - Vermont

What Is Schedule IN-153?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule IN-153?

A: Schedule IN-153 is a form used in Vermont to calculate the capital gain exclusion.

Q: What is a capital gain exclusion?

A: A capital gain exclusion is a tax benefit that allows individuals to exclude a portion of their capital gains from taxation.

Q: Who is eligible for the capital gain exclusion in Vermont?

A: In Vermont, individuals who meet certain criteria, such as owning and occupying a primary residence, may be eligible for the capital gain exclusion.

Q: How do I calculate the capital gain exclusion on Schedule IN-153?

A: To calculate the capital gain exclusion on Schedule IN-153, you will need to follow the instructions on the form, which will guide you through the necessary calculations.

Q: What should I do if I need help completing Schedule IN-153?

A: If you need assistance with completing Schedule IN-153 or have questions about the capital gain exclusion, it is recommended to consult a tax professional or contact the Vermont Department of Taxes for guidance.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule IN-153 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.