This version of the form is not currently in use and is provided for reference only. Download this version of

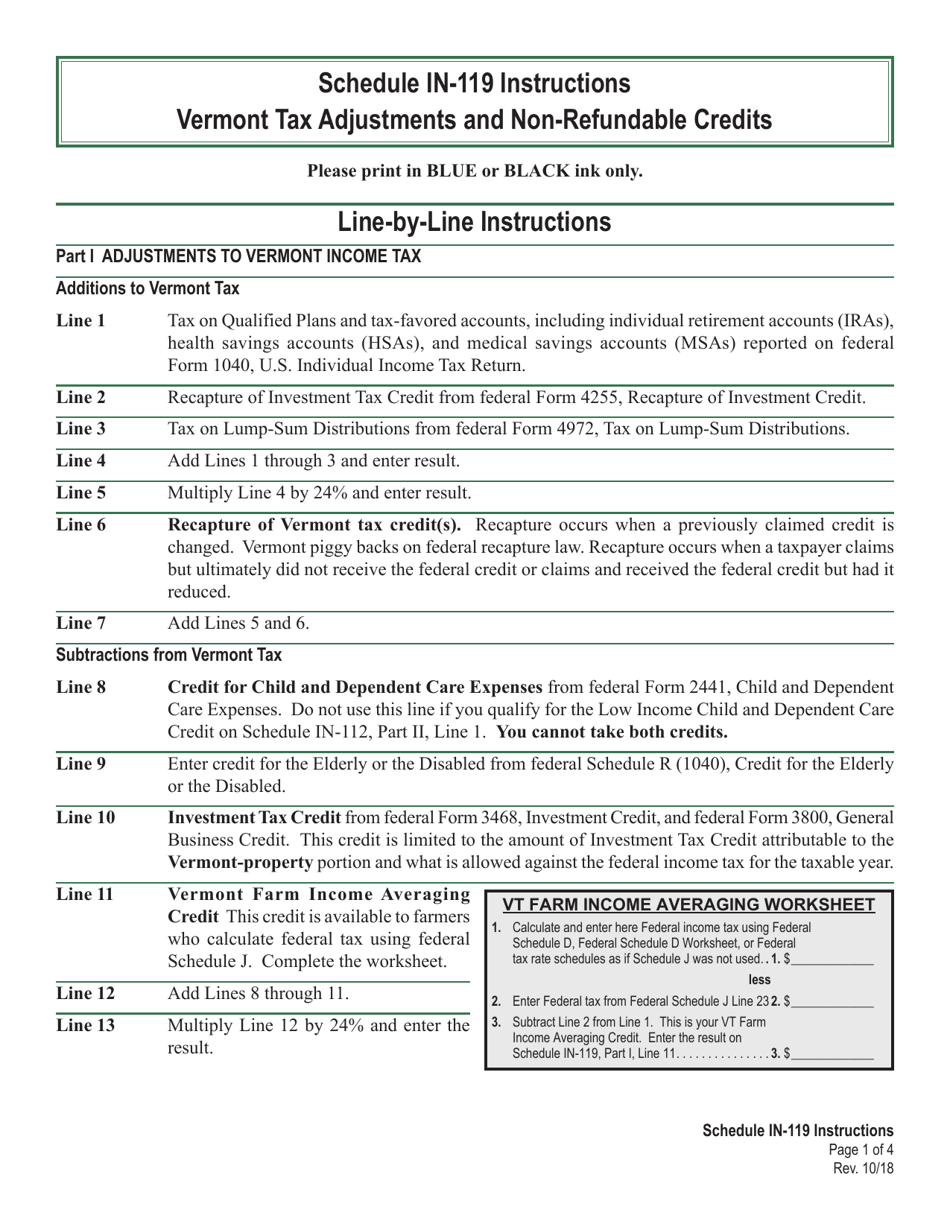

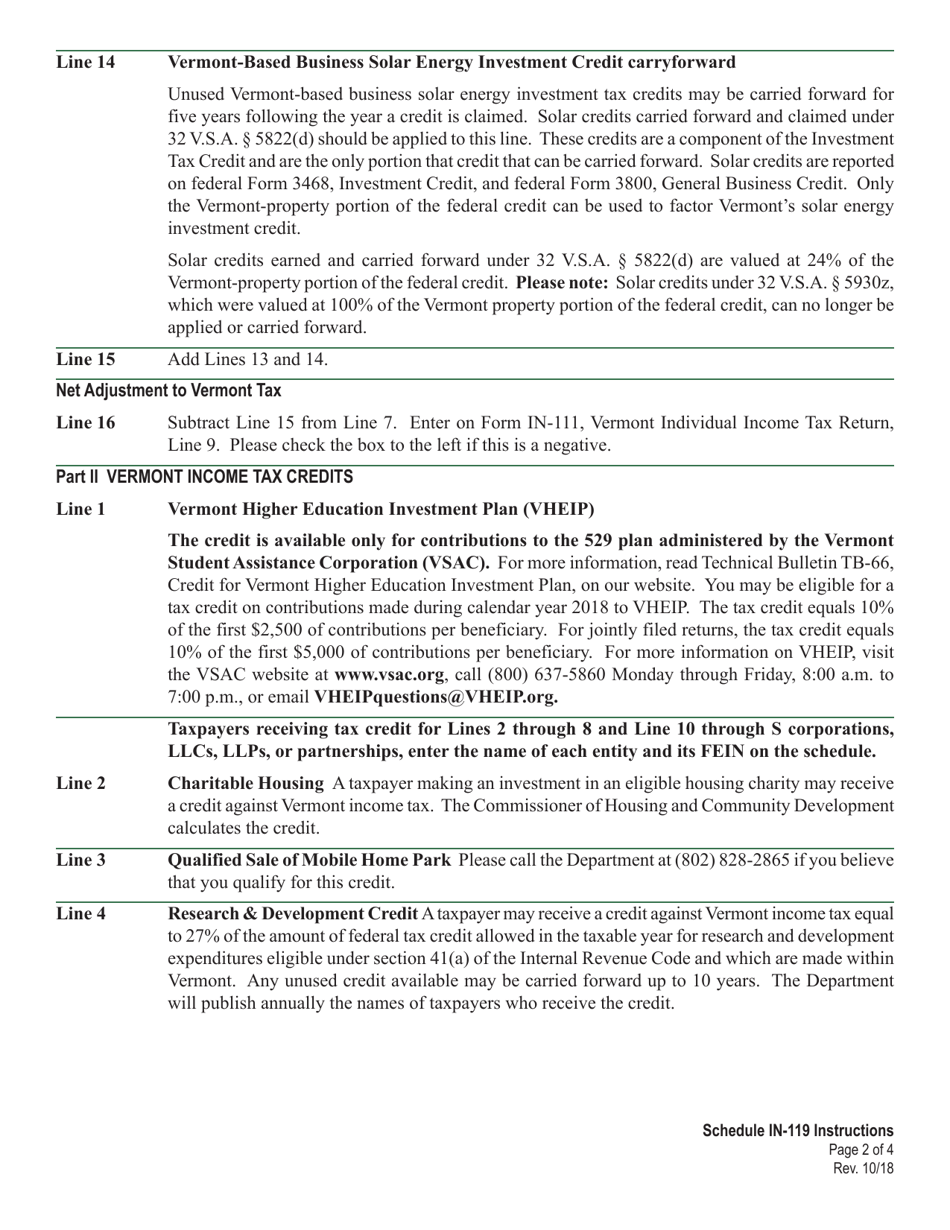

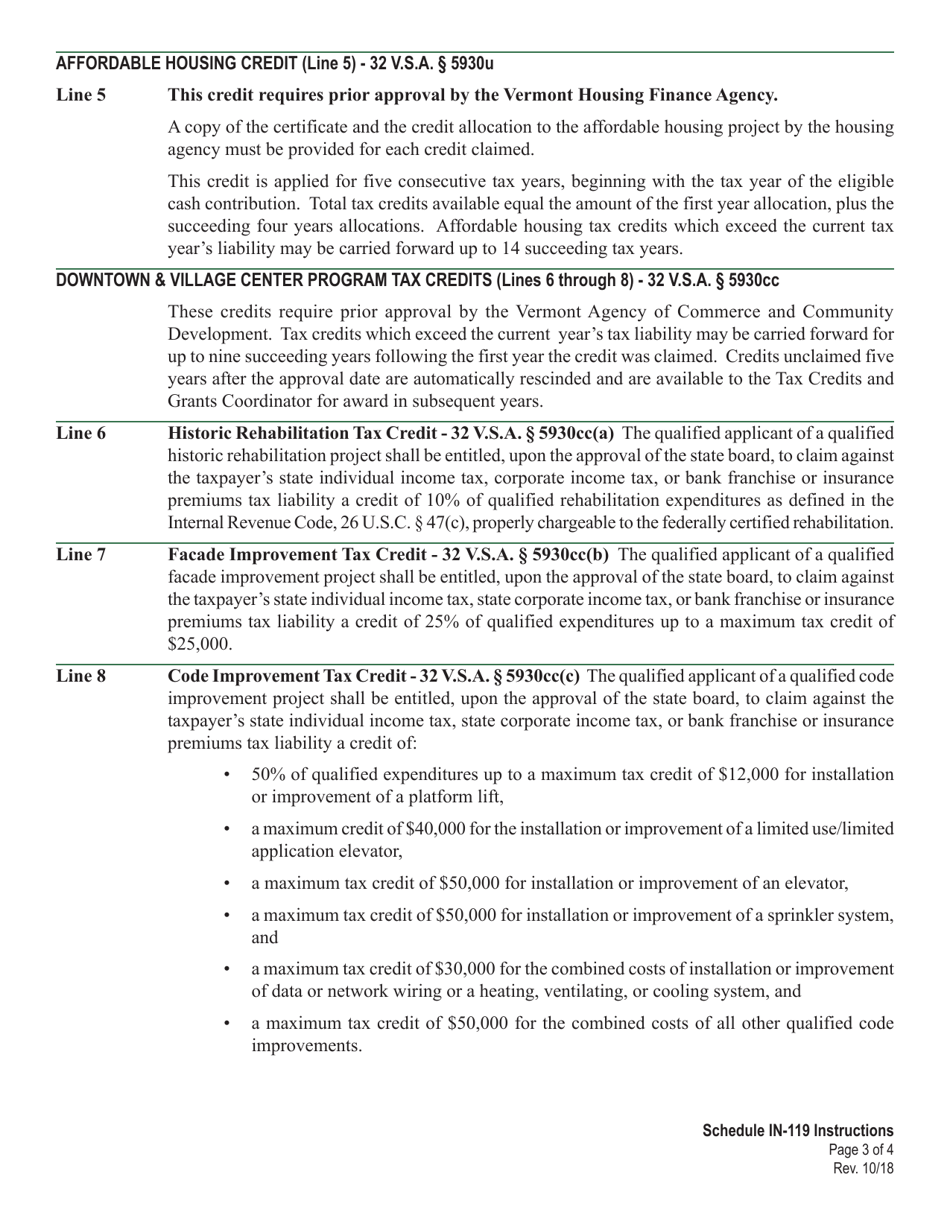

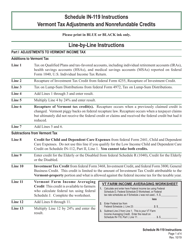

Instructions for Schedule IN-119

for the current year.

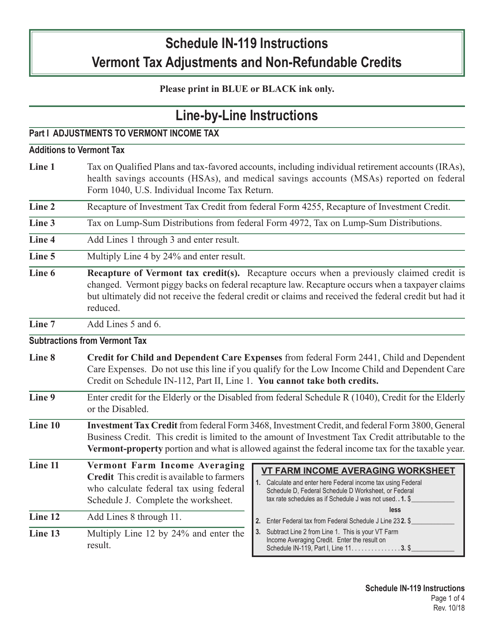

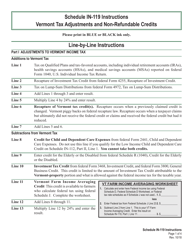

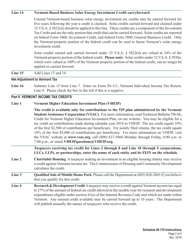

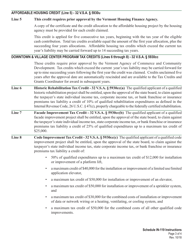

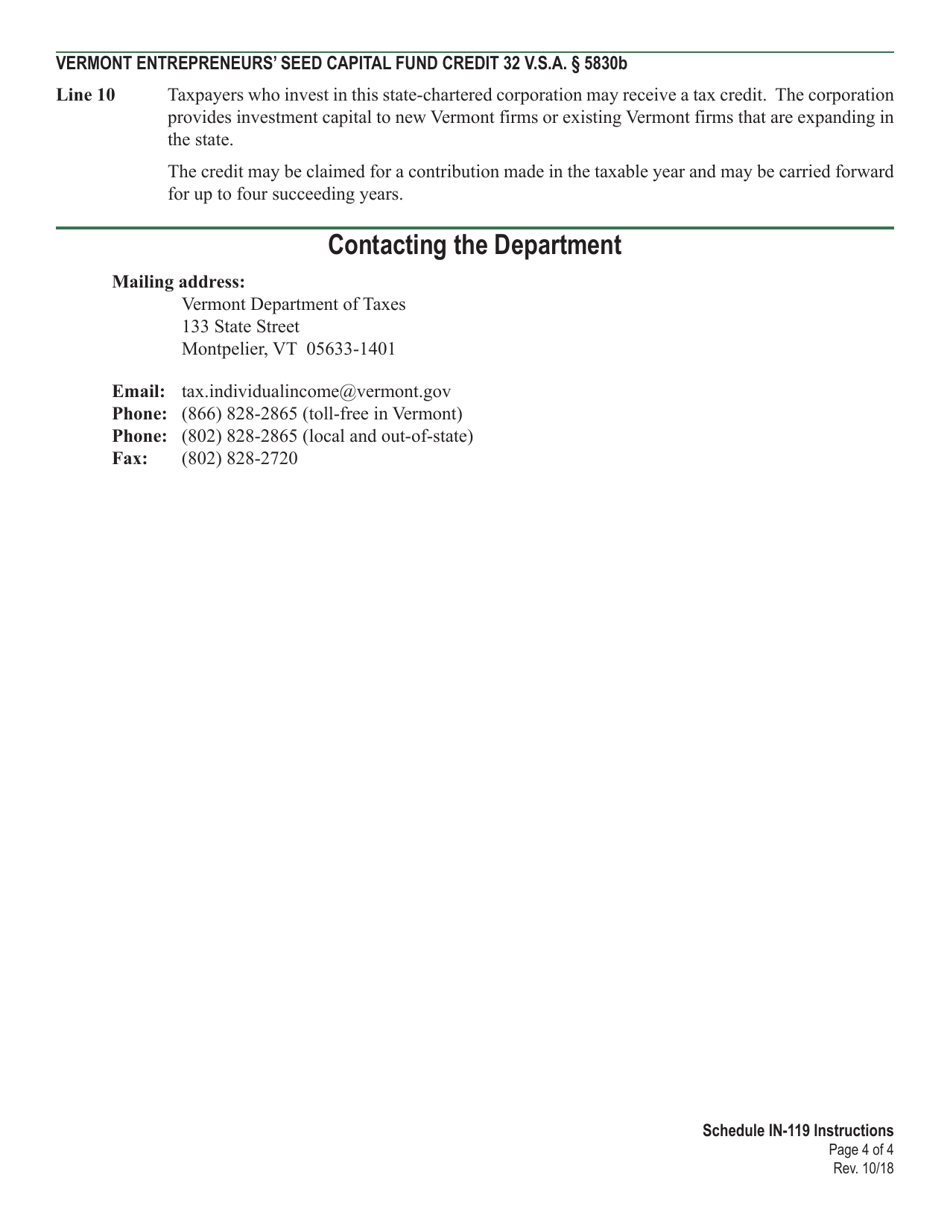

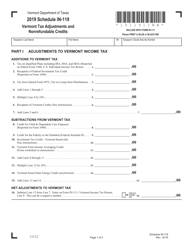

Instructions for Schedule IN-119 Vermont Tax Adjustments and Non-refundable Credits - Vermont

This document contains official instructions for Schedule IN-119 , Vermont Tax Adjustments and Non-refundable Credits - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule IN-119?

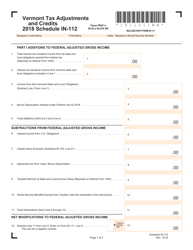

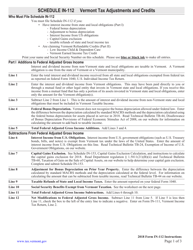

A: Schedule IN-119 is a form used in Vermont to report tax adjustments and non-refundable credits.

Q: When do I need to fill out Schedule IN-119?

A: You need to fill out Schedule IN-119 if you have any tax adjustments or non-refundable credits to report on your Vermont tax return.

Q: What types of tax adjustments can be reported on Schedule IN-119?

A: Some examples of tax adjustments that can be reported on Schedule IN-119 include adjustments for federal taxable income, Vermont modification, and prior year adjustments.

Q: What are non-refundable credits?

A: Non-refundable credits are credits that can reduce your tax liability but cannot result in a tax refund. They can include credits for child and dependent care expenses, education expenses, and home weatherization expenses, among others.

Q: How do I fill out Schedule IN-119?

A: To fill out Schedule IN-119, you will need to enter the appropriate amounts for each tax adjustment or non-refundable credit you are reporting. The instructions on the form will guide you through the process.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.