This version of the form is not currently in use and is provided for reference only. Download this version of

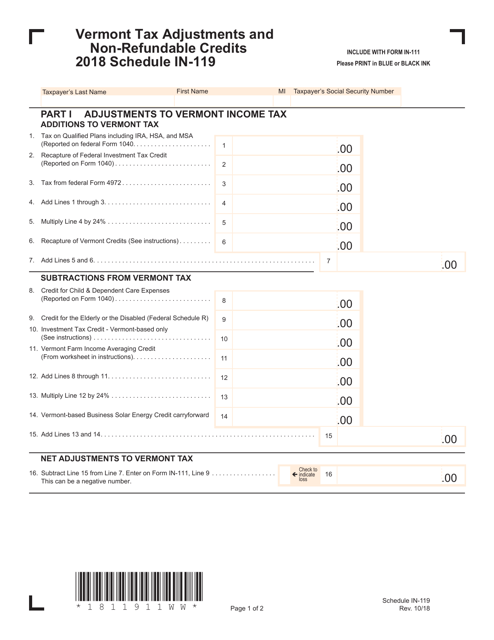

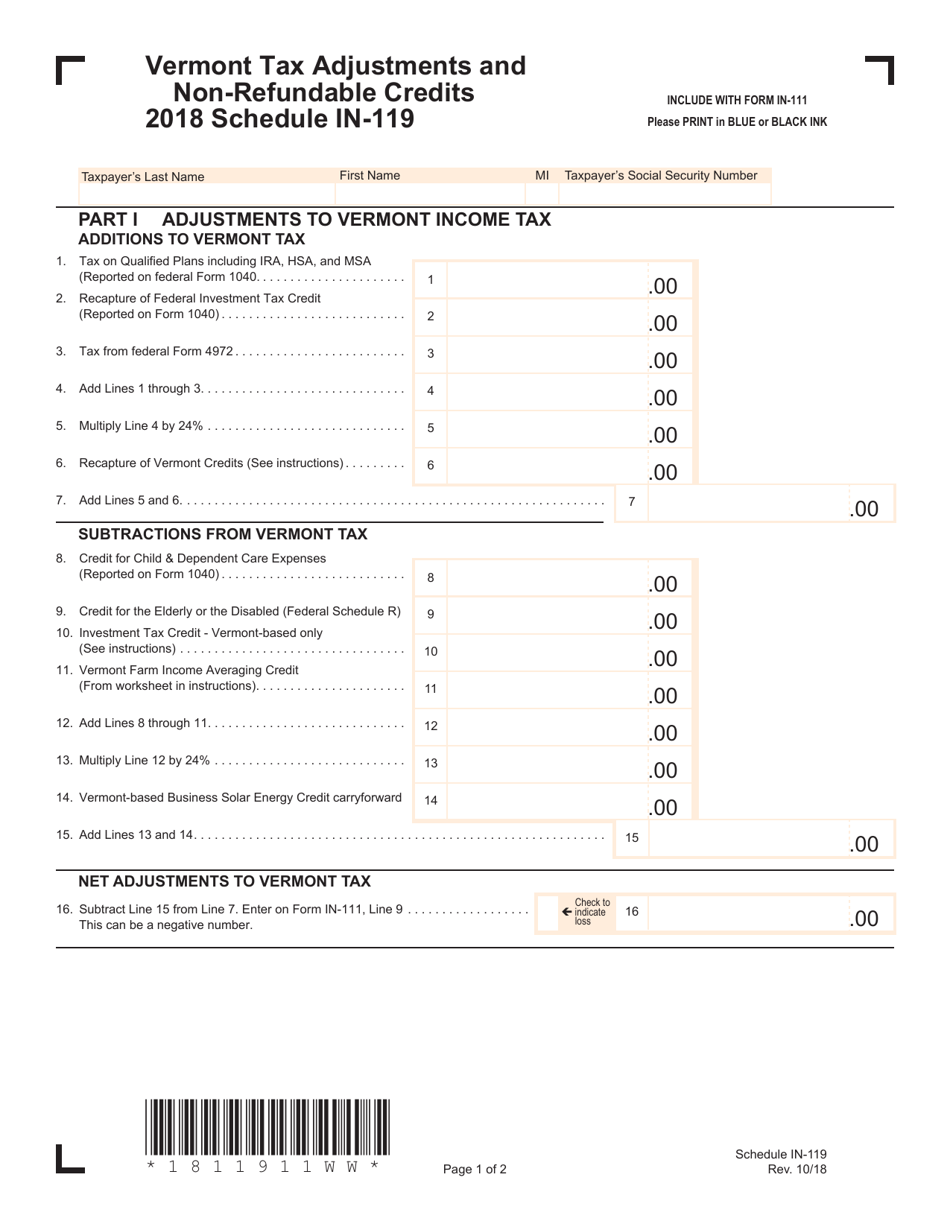

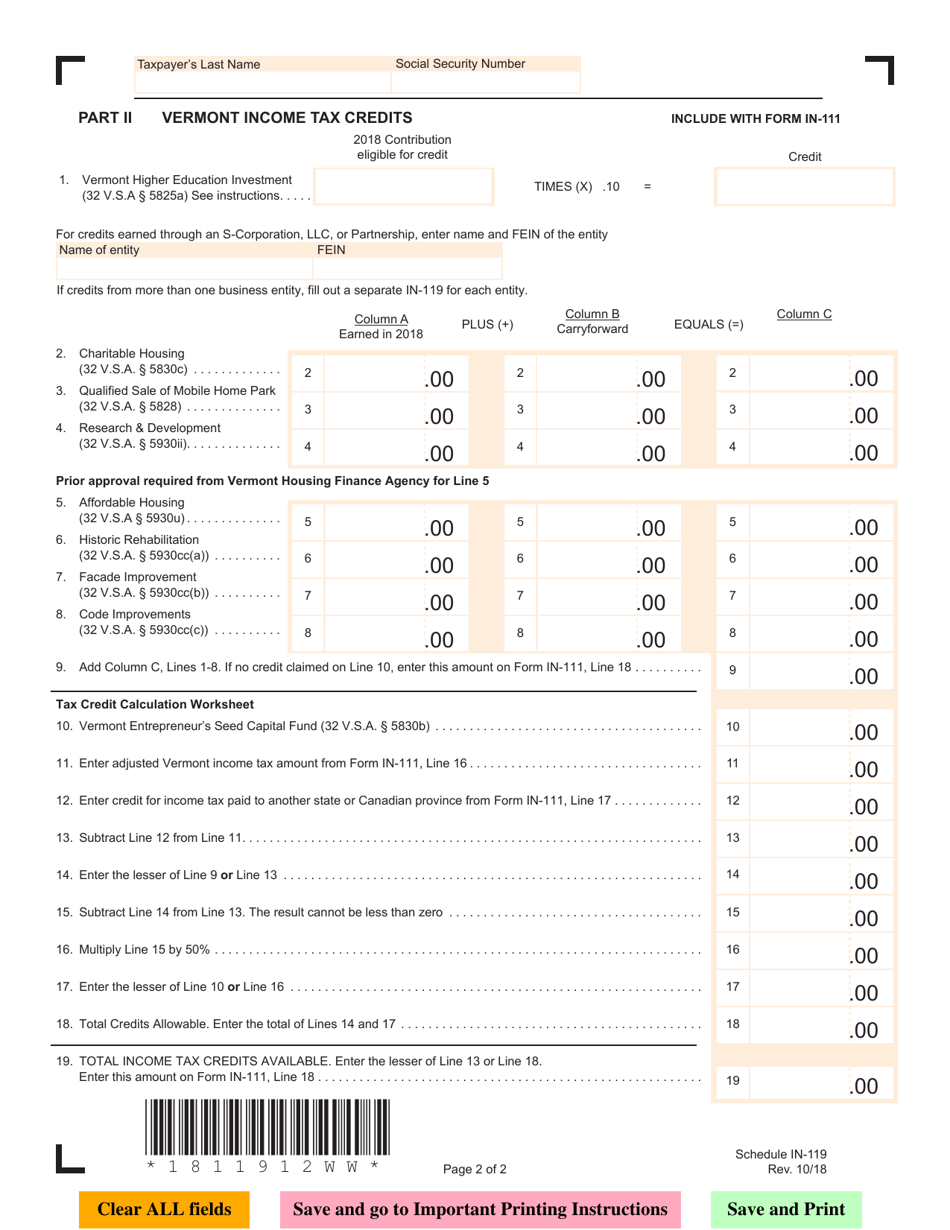

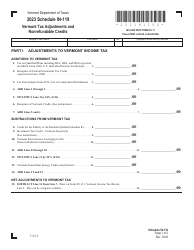

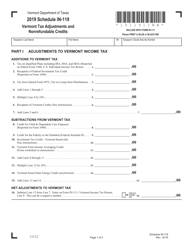

Schedule IN-119

for the current year.

Schedule IN-119 Vermont Tax Adjustments and Non-refundable Credits - Vermont

What Is Schedule IN-119?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule IN-119?

A: Schedule IN-119 is a tax form used in Vermont to report tax adjustments and non-refundable credits.

Q: Who needs to file Schedule IN-119?

A: Residents of Vermont who have tax adjustments and non-refundable credits need to file Schedule IN-119.

Q: What are tax adjustments?

A: Tax adjustments are changes made to your taxable income or tax liability, such as deductions or additions.

Q: What are non-refundable credits?

A: Non-refundable credits are tax credits that can be used to reduce your tax liability, but cannot be refunded if they exceed your tax liability.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule IN-119 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.