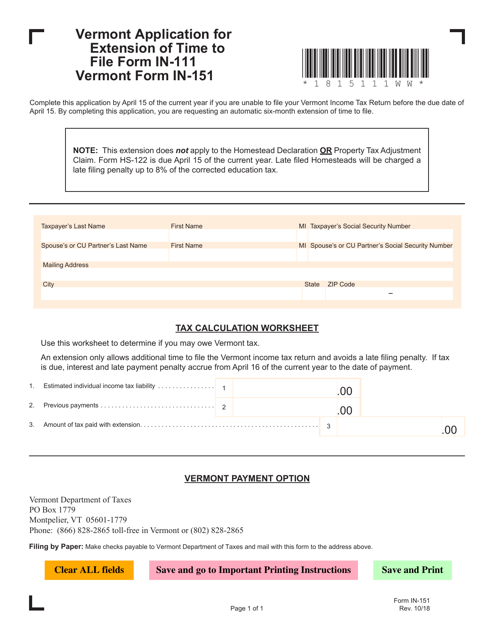

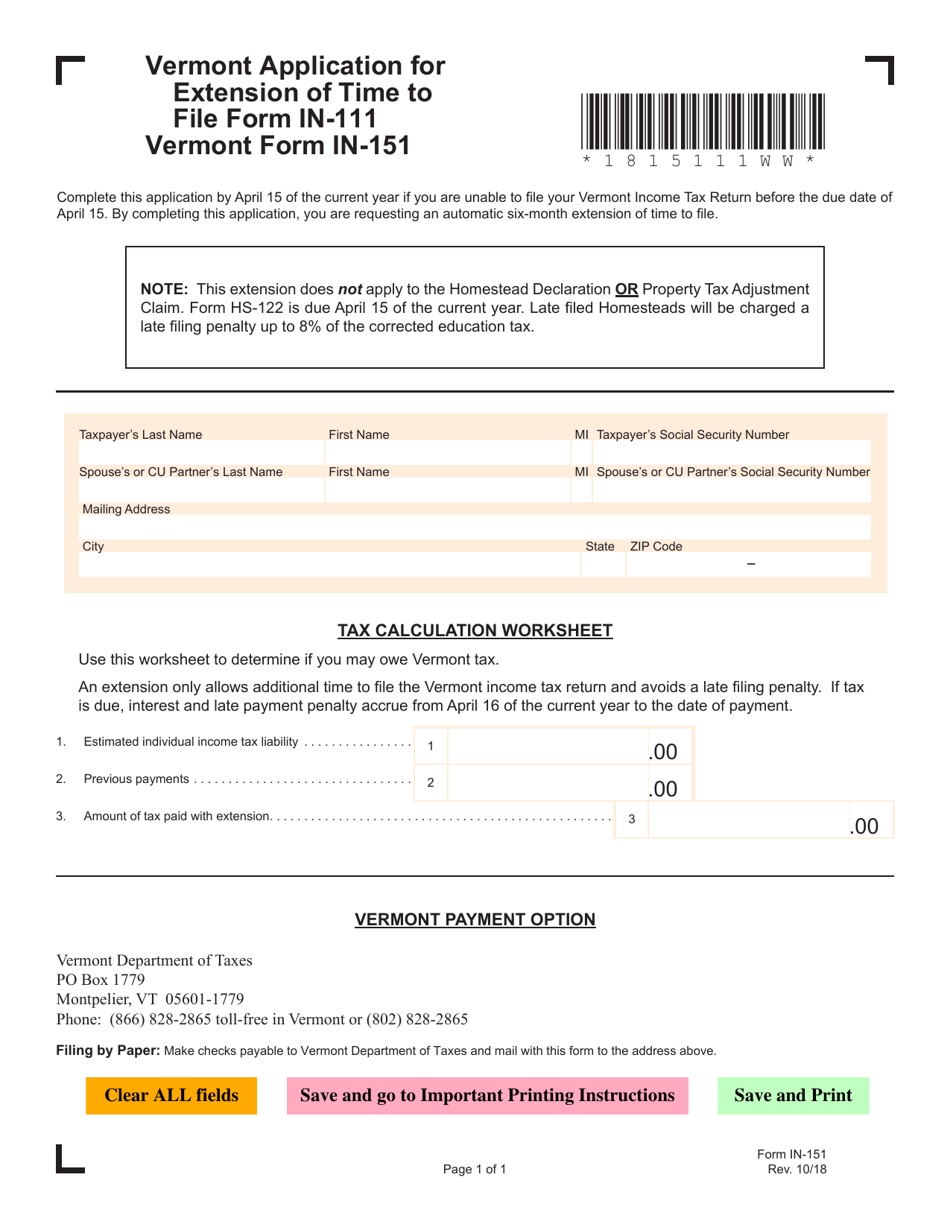

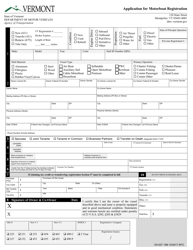

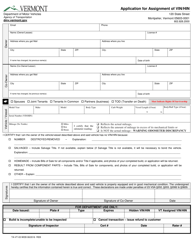

VT Form IN-151 Application for Extension of Time to File Form in-111 - Vermont

What Is VT Form IN-151?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

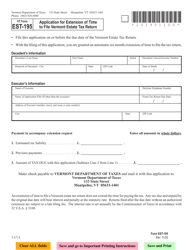

Q: What is the VT Form IN-151?

A: VT Form IN-151 is an Application for Extension of Time to File Form IN-111 in Vermont.

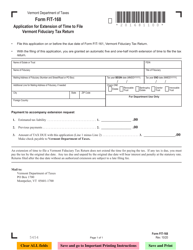

Q: What is Form IN-111?

A: Form IN-111 is the individual income tax return form for residents of Vermont.

Q: What is the purpose of Form IN-151?

A: The purpose of Form IN-151 is to request an extension of time to file Form IN-111.

Q: Who can use Form IN-151?

A: Any individual who needs additional time to file their Vermont income tax return can use Form IN-151.

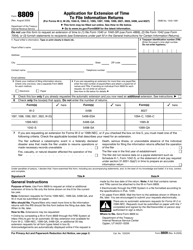

Q: How do I fill out Form IN-151?

A: You need to provide your personal information, estimate your tax liability, and explain the reason for needing an extension.

Q: When is Form IN-111 due?

A: Form IN-111 is generally due on April 15th, but the deadline may vary each year.

Q: How long of an extension does Form IN-151 provide?

A: Form IN-151 provides an automatic extension of 6 months to file Form IN-111.

Q: Is there a penalty for filing Form IN-151?

A: No, there is no penalty for filing Form IN-151, as long as you pay any taxes owed by the original due date.

Q: Can I e-file Form IN-151?

A: Yes, you can e-file Form IN-151 using approved tax software or through a tax professional.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form IN-151 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.