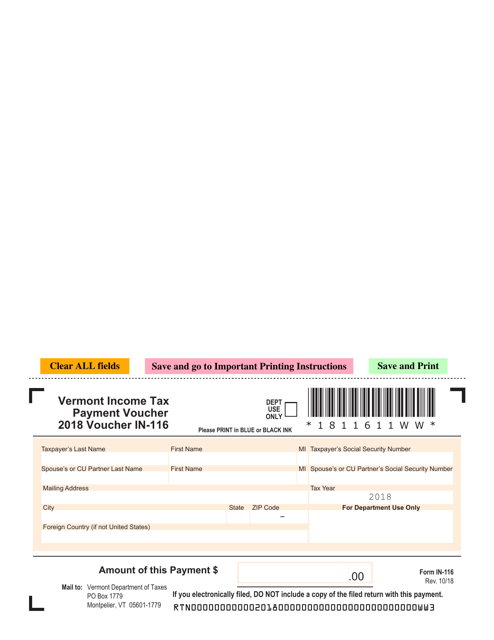

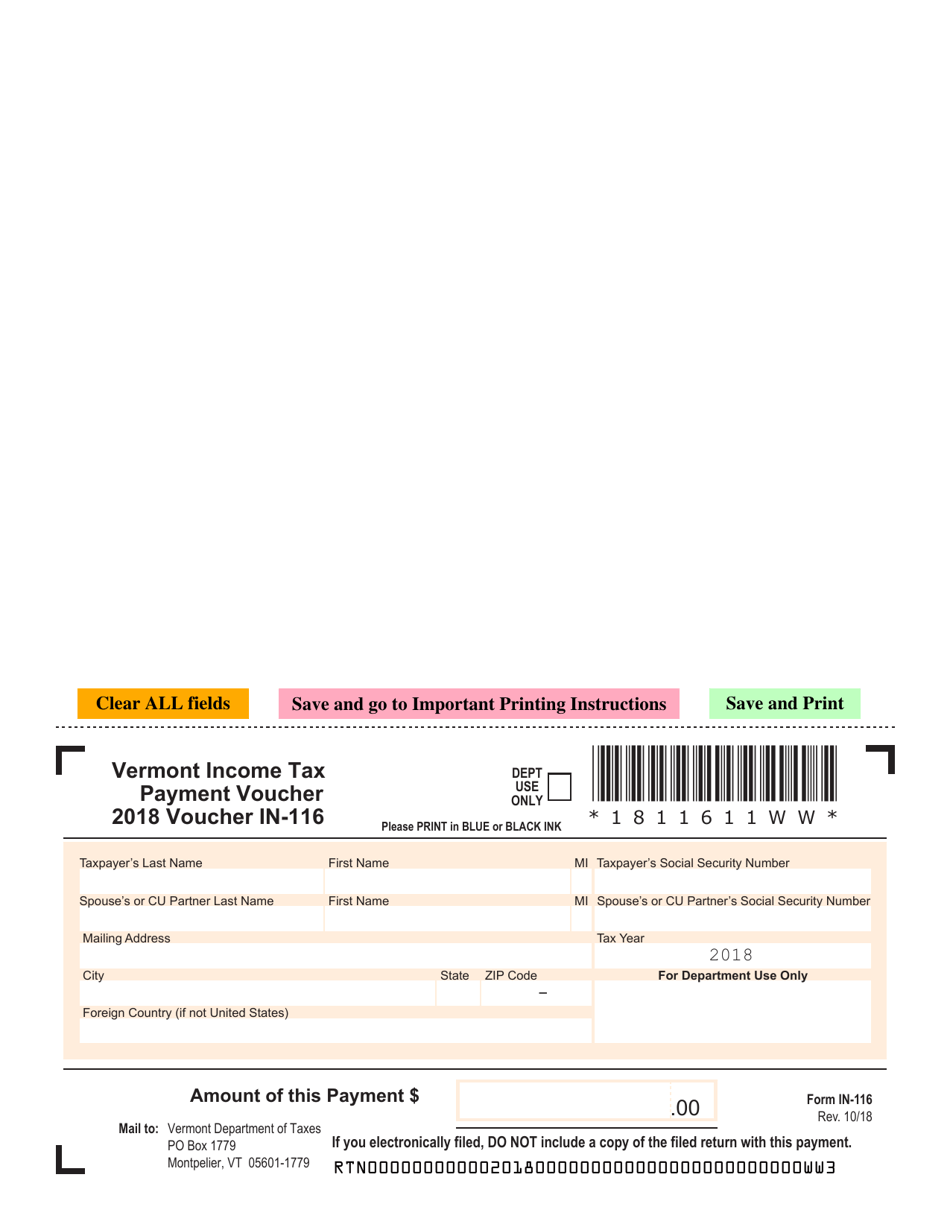

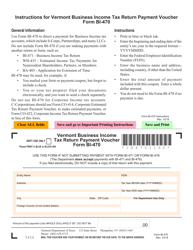

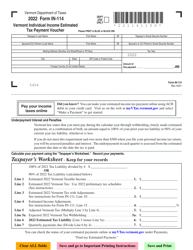

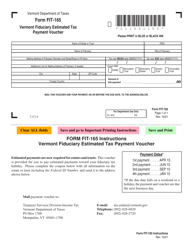

VT Form IN-116 Income Tax Payment Voucher - Vermont

What Is VT Form IN-116?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form IN-116?

A: VT Form IN-116 is an Income Tax Payment Voucher used in Vermont.

Q: What is the purpose of VT Form IN-116?

A: The purpose of VT Form IN-116 is to submit income tax payments to the state of Vermont.

Q: Who needs to use VT Form IN-116?

A: Anyone who owes income tax to the state of Vermont may need to use VT Form IN-116.

Q: When is VT Form IN-116 due?

A: VT Form IN-116 is typically due on or before the same date as your Vermont income tax return.

Q: What information do I need to fill out VT Form IN-116?

A: You will need to provide your name, address, SSN or ITIN, tax year, and the amount of payment.

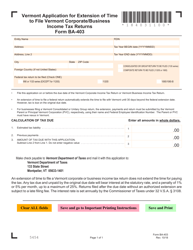

Q: Can I use VT Form IN-116 to request an extension?

A: No, VT Form IN-116 is only for making income tax payments, not for requesting an extension.

Q: What payment methods are accepted for VT Form IN-116?

A: You can pay using electronic funds withdrawal, credit card, or check/money order.

Q: Are there any penalties for late payment?

A: Yes, if you fail to pay the full amount of your income tax by the due date, you may be subject to penalties and interest.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form IN-116 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.