This version of the form is not currently in use and is provided for reference only. Download this version of

VT Form IN-114

for the current year.

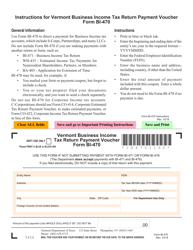

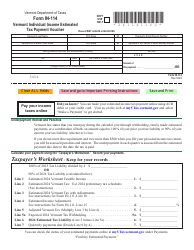

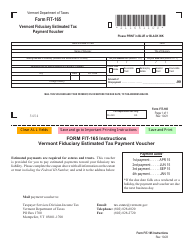

VT Form IN-114 Individual Income Estimated Tax Payment Voucher - Vermont

What Is VT Form IN-114?

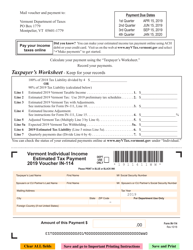

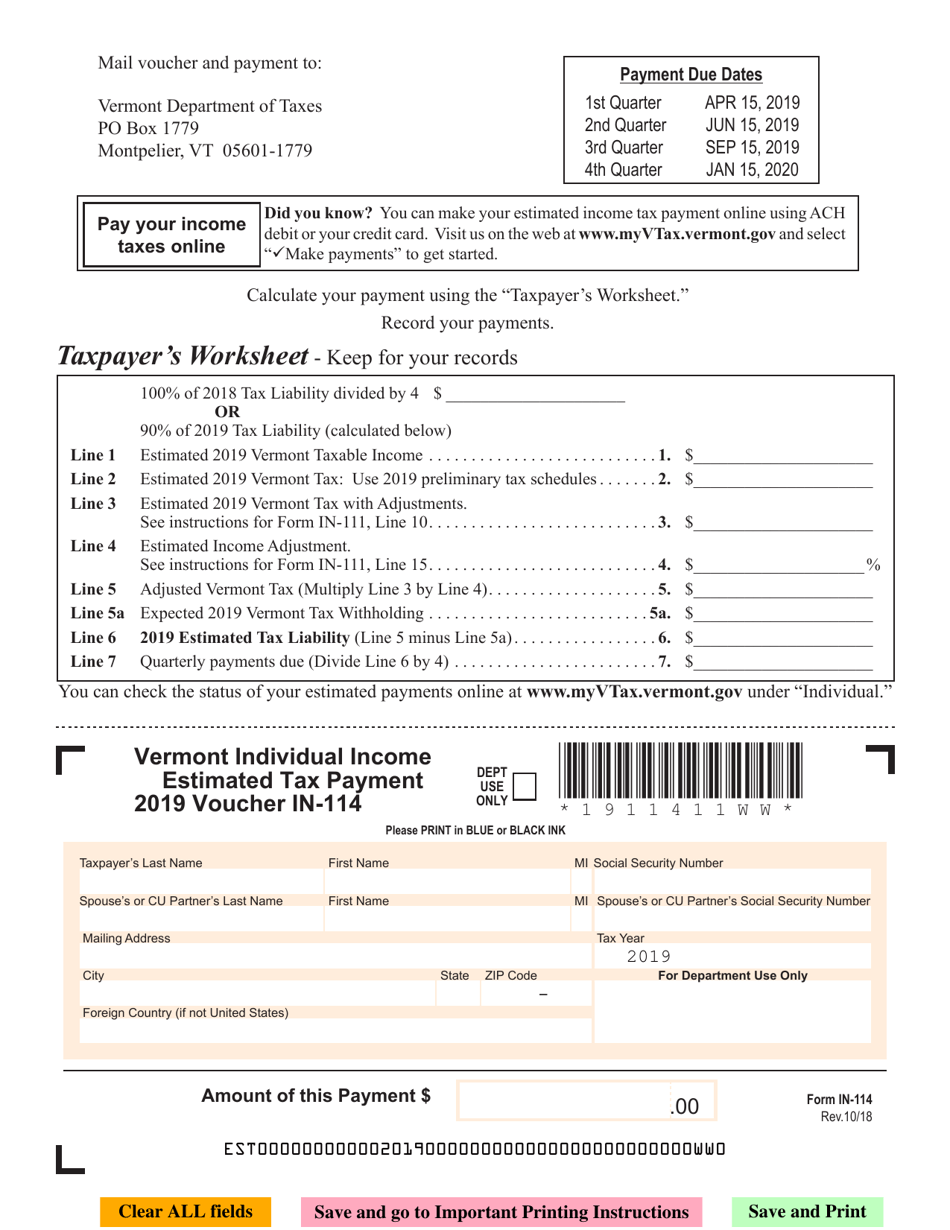

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form IN-114?

A: The VT Form IN-114 is the Individual Income Estimated Tax Payment Voucher for Vermont.

Q: What is the purpose of the VT Form IN-114?

A: The purpose of the VT Form IN-114 is to make estimated tax payments for individual income in Vermont.

Q: Who needs to use the VT Form IN-114?

A: Any individual who has income in Vermont and expects to owe taxes on that income may need to use the VT Form IN-114 to make estimated tax payments.

Q: What information is required on the VT Form IN-114?

A: The VT Form IN-114 requires information such as taxpayer information, income estimates, and payment details.

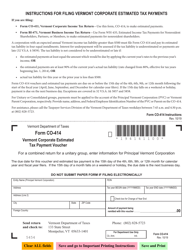

Q: When is the deadline to submit the VT Form IN-114?

A: The deadline to submit the VT Form IN-114 for each estimated tax payment is typically April 15, June 15, September 15, and January 15 of the following year, unless adjusted for weekends or holidays.

Q: Is the VT Form IN-114 the only form required for Vermont income tax?

A: No, the VT Form IN-114 is specifically for making estimated tax payments. You may also need to file other forms such as the VT Form IN-111 for your annual income tax return in Vermont.

Q: What happens if I don't make estimated tax payments using the VT Form IN-114?

A: If you have income in Vermont and do not make estimated tax payments, you may be subject to penalties and interest on the amount of taxes owed.

Q: Are there different versions of the VT Form IN-114 for different tax years?

A: Yes, the VT Form IN-114 may vary from year to year. Make sure to use the correct version for the tax year you are making estimated tax payments for.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form IN-114 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.