This version of the form is not currently in use and is provided for reference only. Download this version of

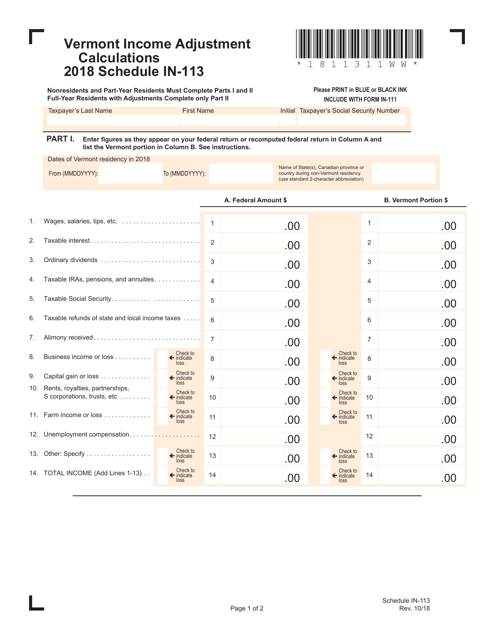

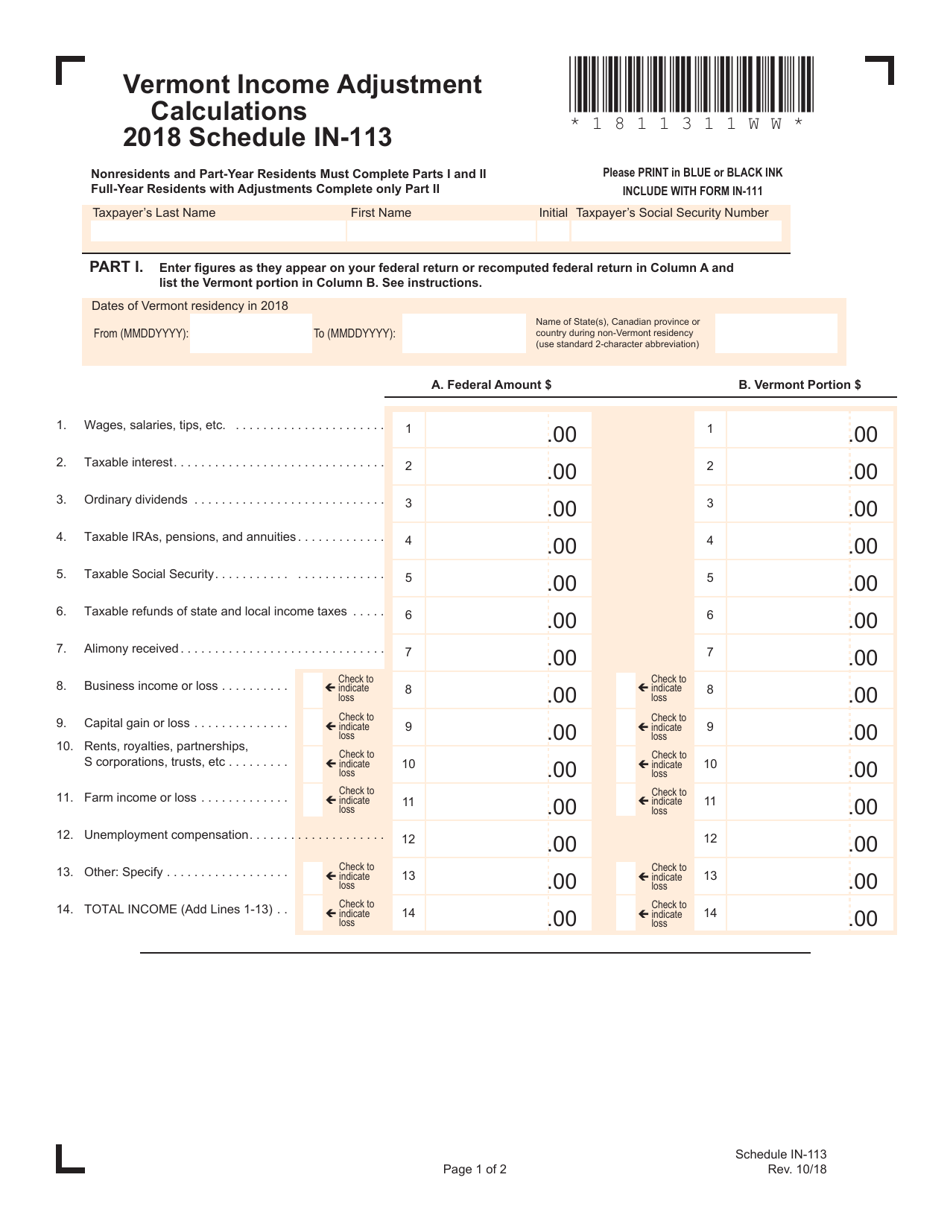

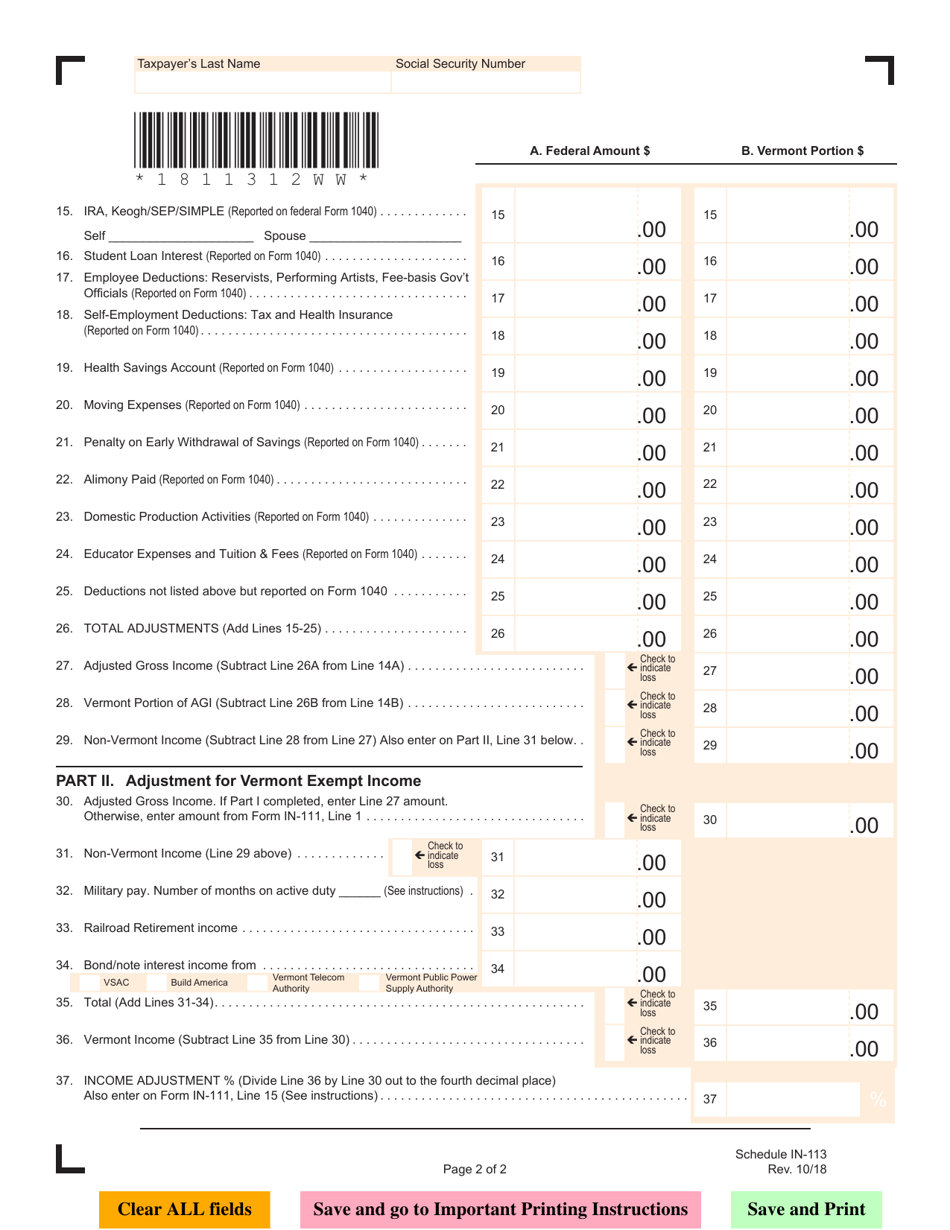

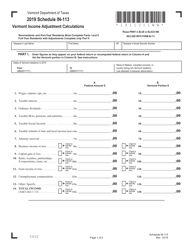

Schedule IN-113

for the current year.

Schedule IN-113 Income Adjustment Calculations - Vermont

What Is Schedule IN-113?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule IN-113?

A: Schedule IN-113 is a form used for income adjustment calculations in Vermont.

Q: What is an income adjustment?

A: An income adjustment is an alteration made to a taxpayer's income to account for specific factors.

Q: Who needs to file Schedule IN-113?

A: Individuals who have specific income adjustments in Vermont may need to file Schedule IN-113.

Q: What types of income adjustments should be reported on Schedule IN-113?

A: Income adjustments such as certain deductions, exemptions, or credits should be reported on Schedule IN-113.

Q: Do I need to file Schedule IN-113 with my federal tax return?

A: No, Schedule IN-113 is specific to Vermont and should be filed separately from your federal tax return.

Q: Is there a penalty for not filing Schedule IN-113?

A: There may be penalties for failing to file Schedule IN-113 or filing it incorrectly, depending on the circumstances.

Q: Do I need to include supporting documents with Schedule IN-113?

A: You may need to attach supporting documents, such as receipts or other proof of income adjustments, with your Schedule IN-113.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule IN-113 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.