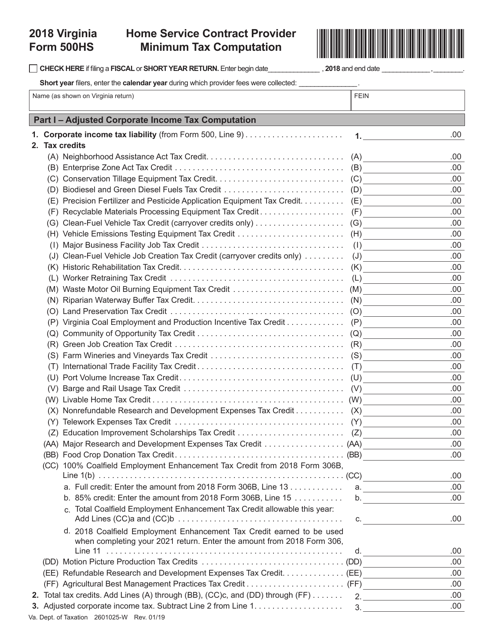

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 500HS

for the current year.

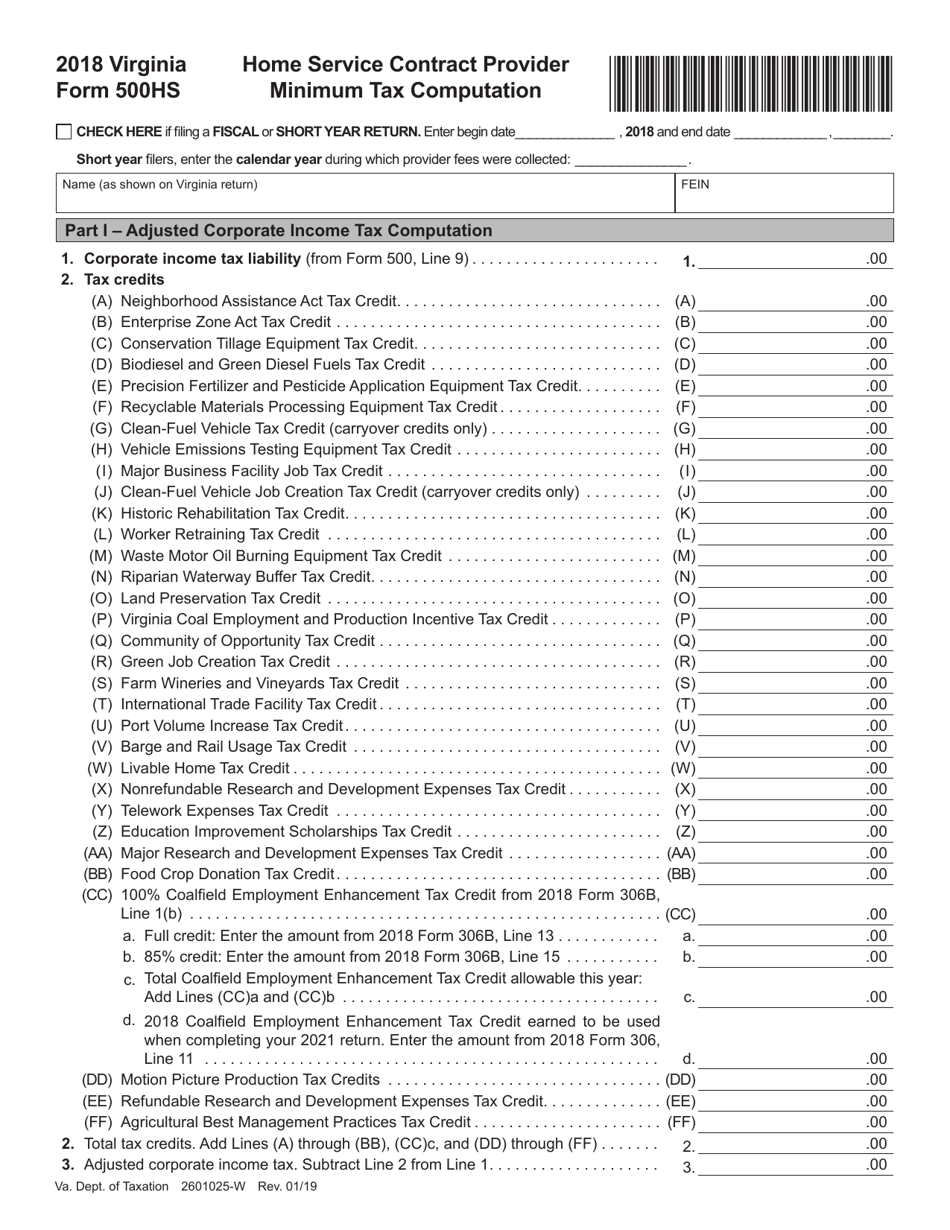

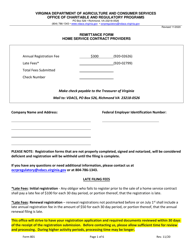

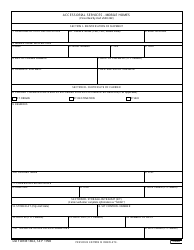

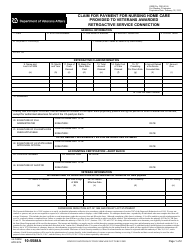

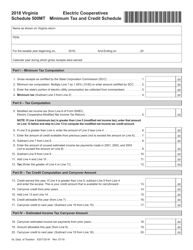

Form 500HS Home Service Contract Provider Minimum Tax Computation - Virginia

What Is Form 500HS?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

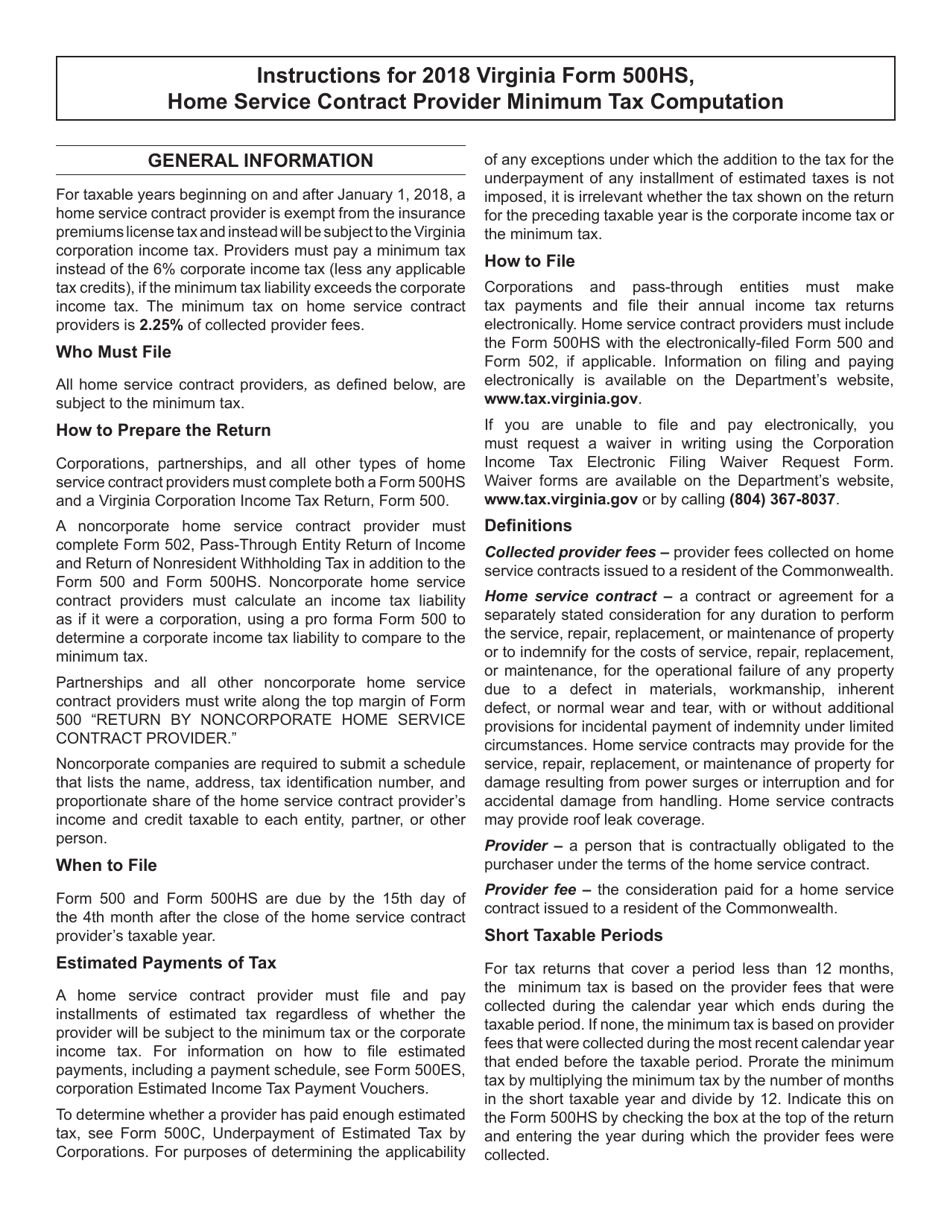

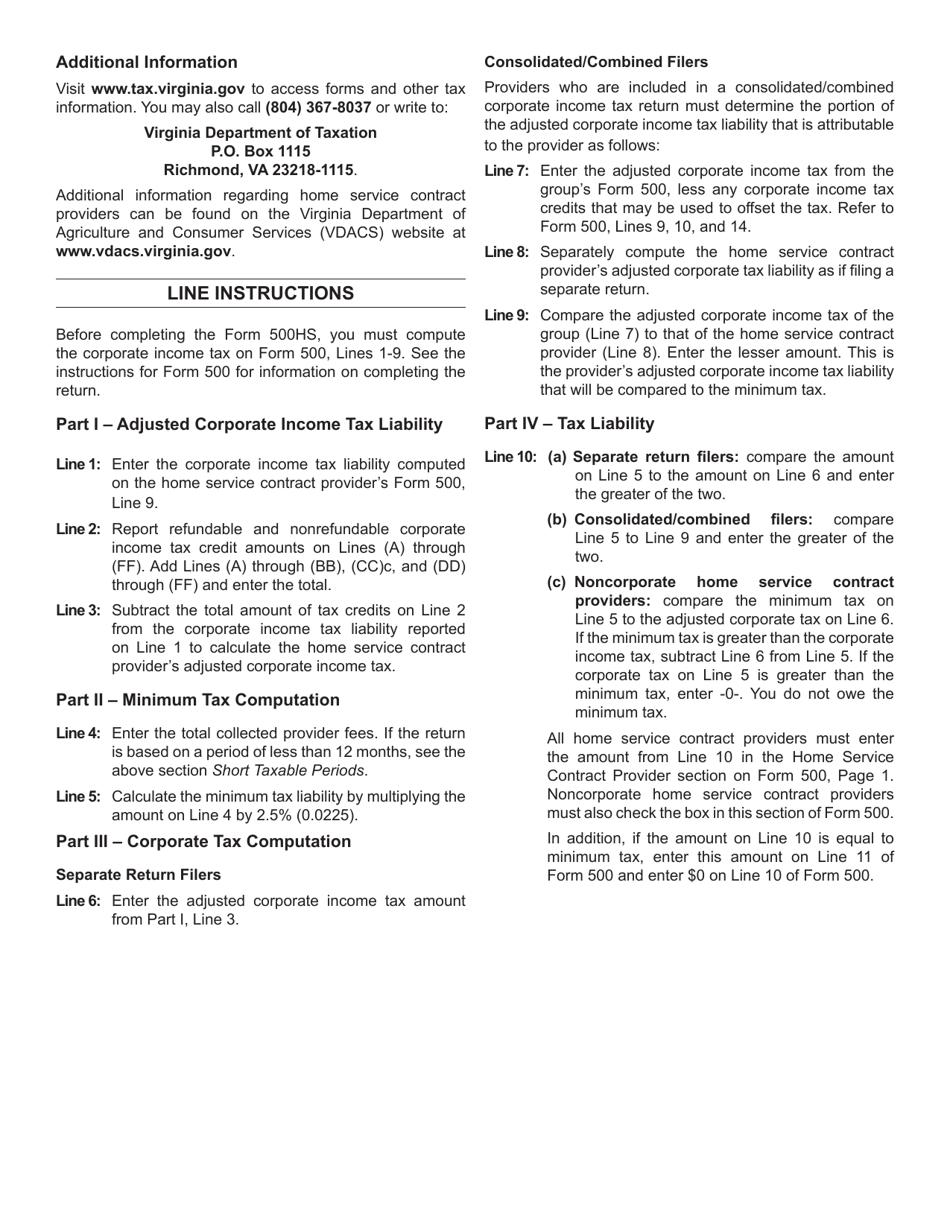

Q: What is Form 500HS?

A: Form 500HS is a tax form used by home service contract providers in Virginia.

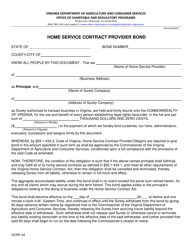

Q: What is a home service contract provider?

A: A home service contract provider is a company that sells contracts to provide repair, replacement, or maintenance services for household goods.

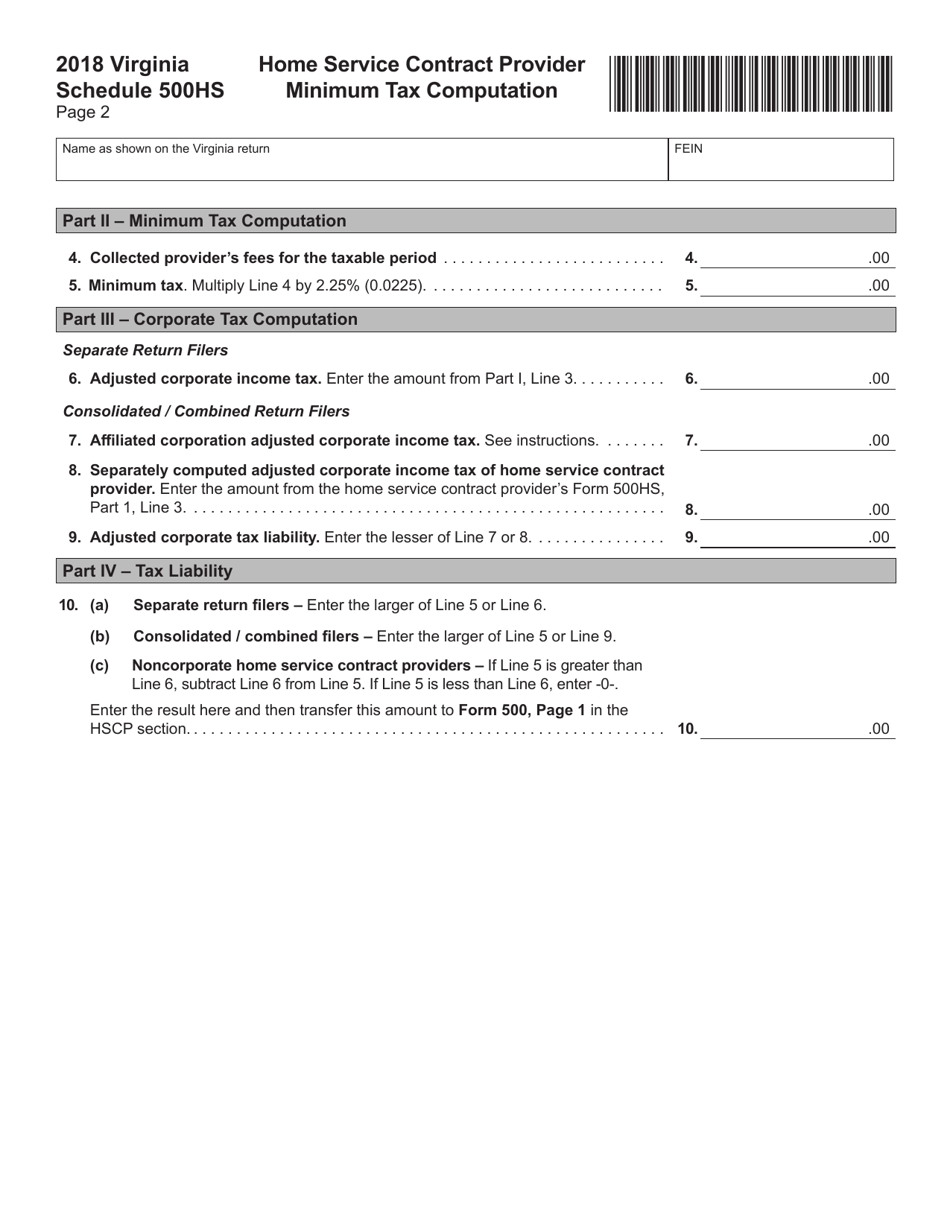

Q: What is the minimum tax computation?

A: The minimum tax computation is a calculation that determines the minimum amount of tax a home service contract provider must pay in Virginia.

Q: How is the minimum tax computed?

A: The minimum tax is computed based on the gross receipts from home service contracts sold in Virginia.

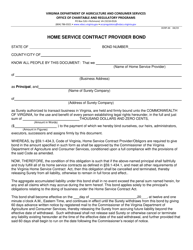

Q: Why is there a minimum tax for home service contract providers?

A: The minimum tax ensures that home service contract providers contribute to the tax revenue of the state, regardless of their income level.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 500HS by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.