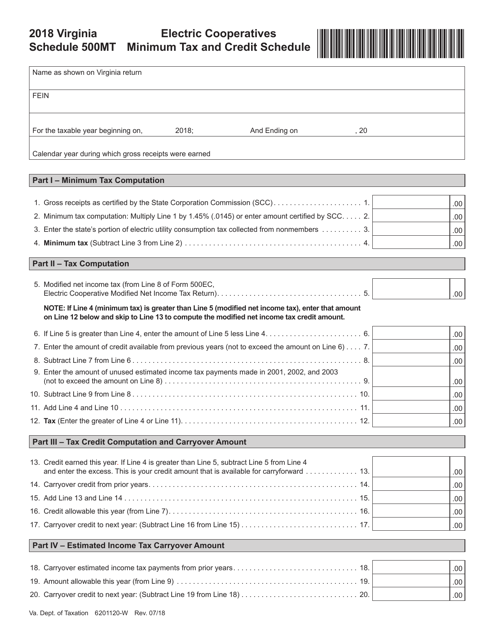

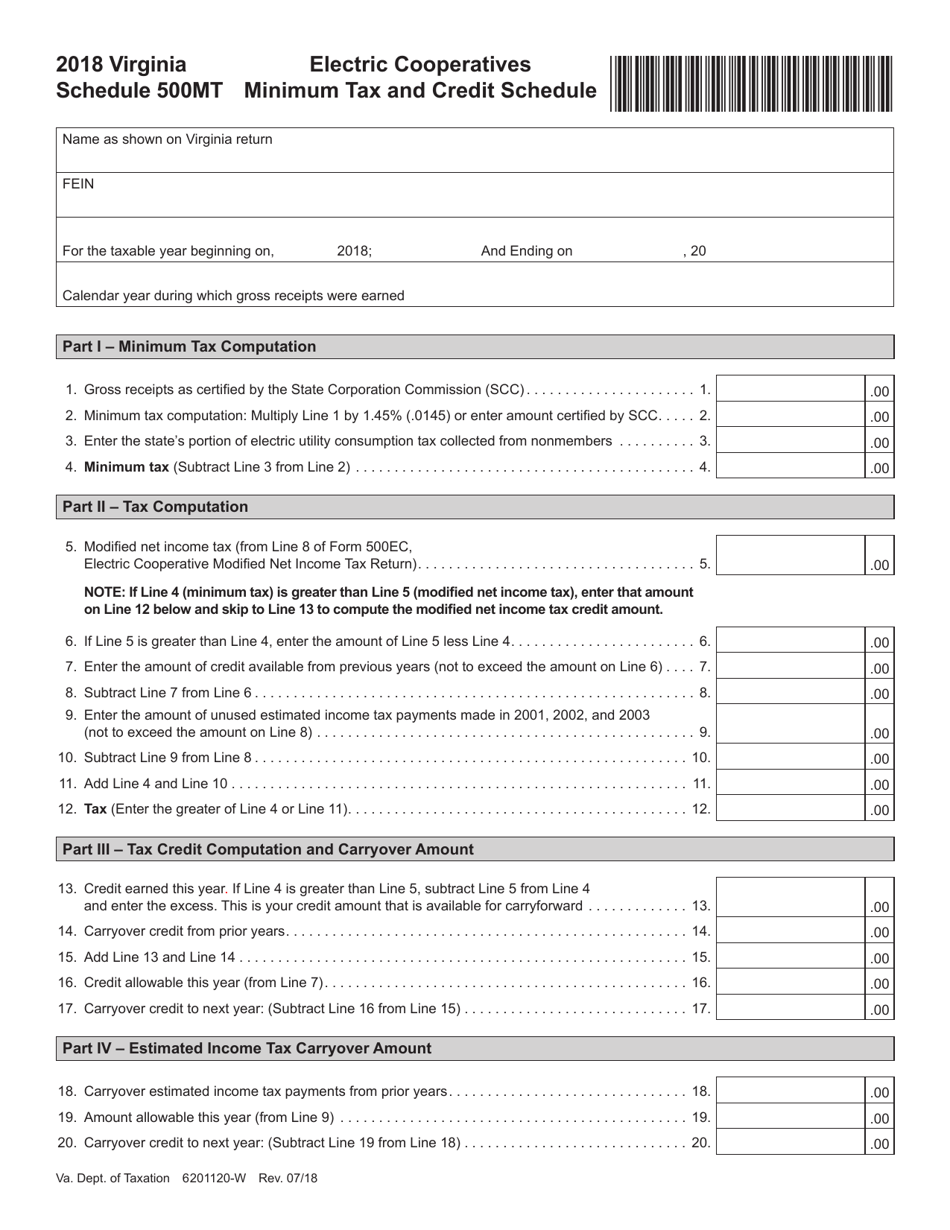

Form 6201120-W Schedule 500MT Electric Cooperatives Minimum Tax and Credit Schedule - Virginia

What Is Form 6201120-W Schedule 500MT?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 6201120-W Schedule 500MT?

A: Form 6201120-W Schedule 500MT is a tax form used by electric cooperatives in Virginia to calculate their minimum tax and credit.

Q: Who needs to file Form 6201120-W Schedule 500MT?

A: Electric cooperatives in Virginia need to file Form 6201120-W Schedule 500MT.

Q: What is the purpose of Form 6201120-W Schedule 500MT?

A: The purpose of Form 6201120-W Schedule 500MT is to determine the minimum tax and credit for electric cooperatives in Virginia.

Q: Are there any specific requirements for completing Form 6201120-W Schedule 500MT?

A: Yes, electric cooperatives need to provide specific financial information and follow the instructions provided on the form.

Q: When is the deadline for filing Form 6201120-W Schedule 500MT?

A: The deadline for filing Form 6201120-W Schedule 500MT is usually the same as the deadline for filing the Virginia corporation income tax return, which is typically May 1st.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 6201120-W Schedule 500MT by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.