This version of the form is not currently in use and is provided for reference only. Download this version of

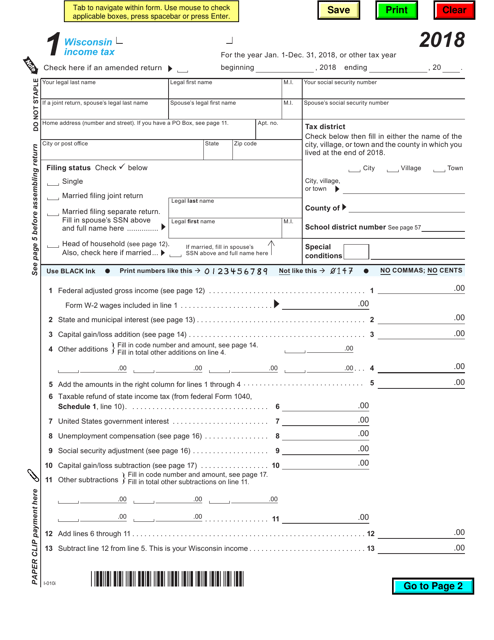

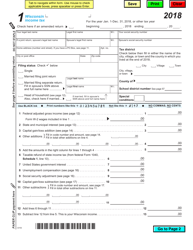

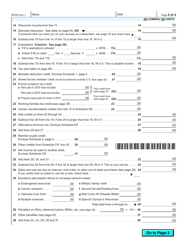

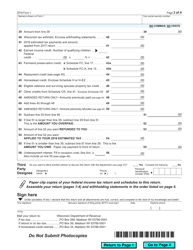

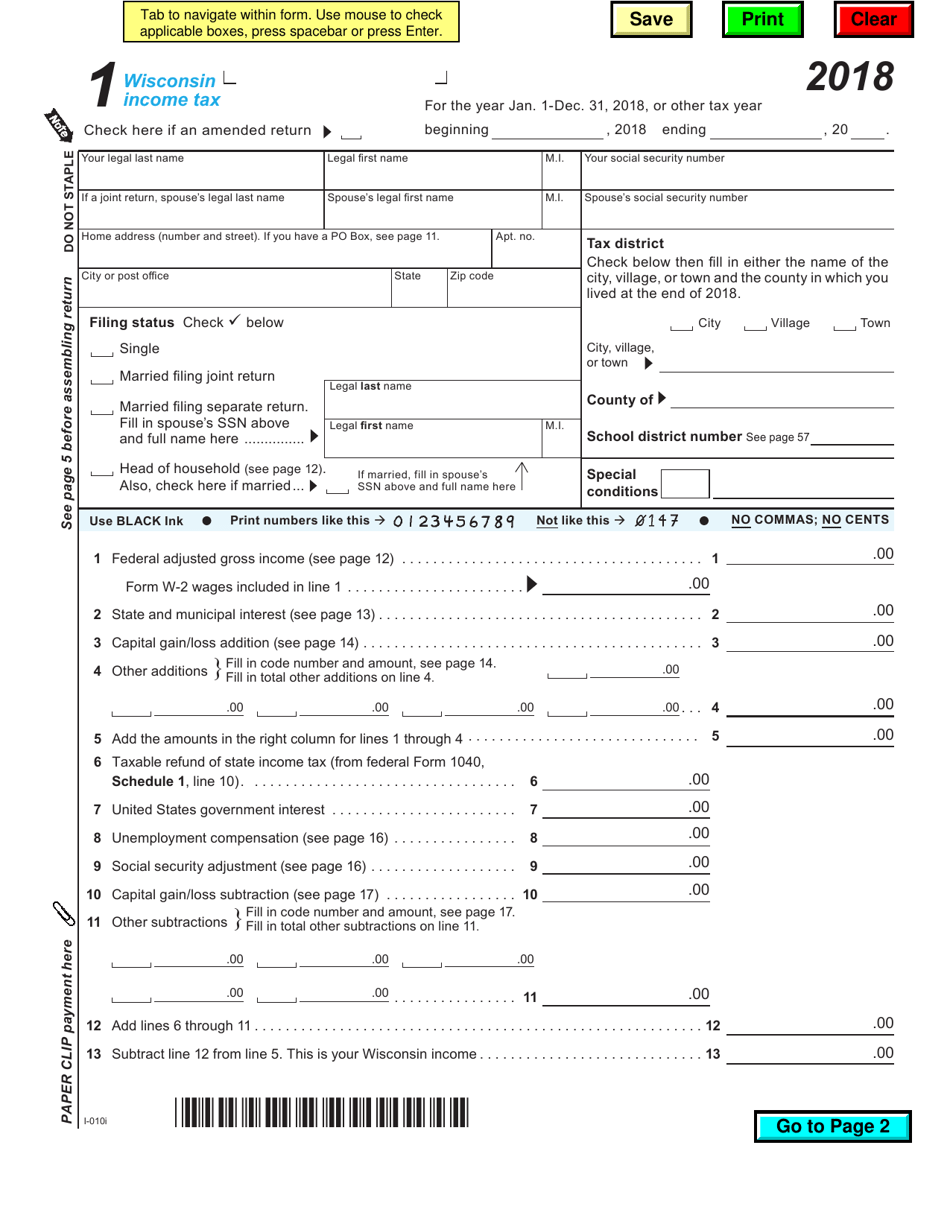

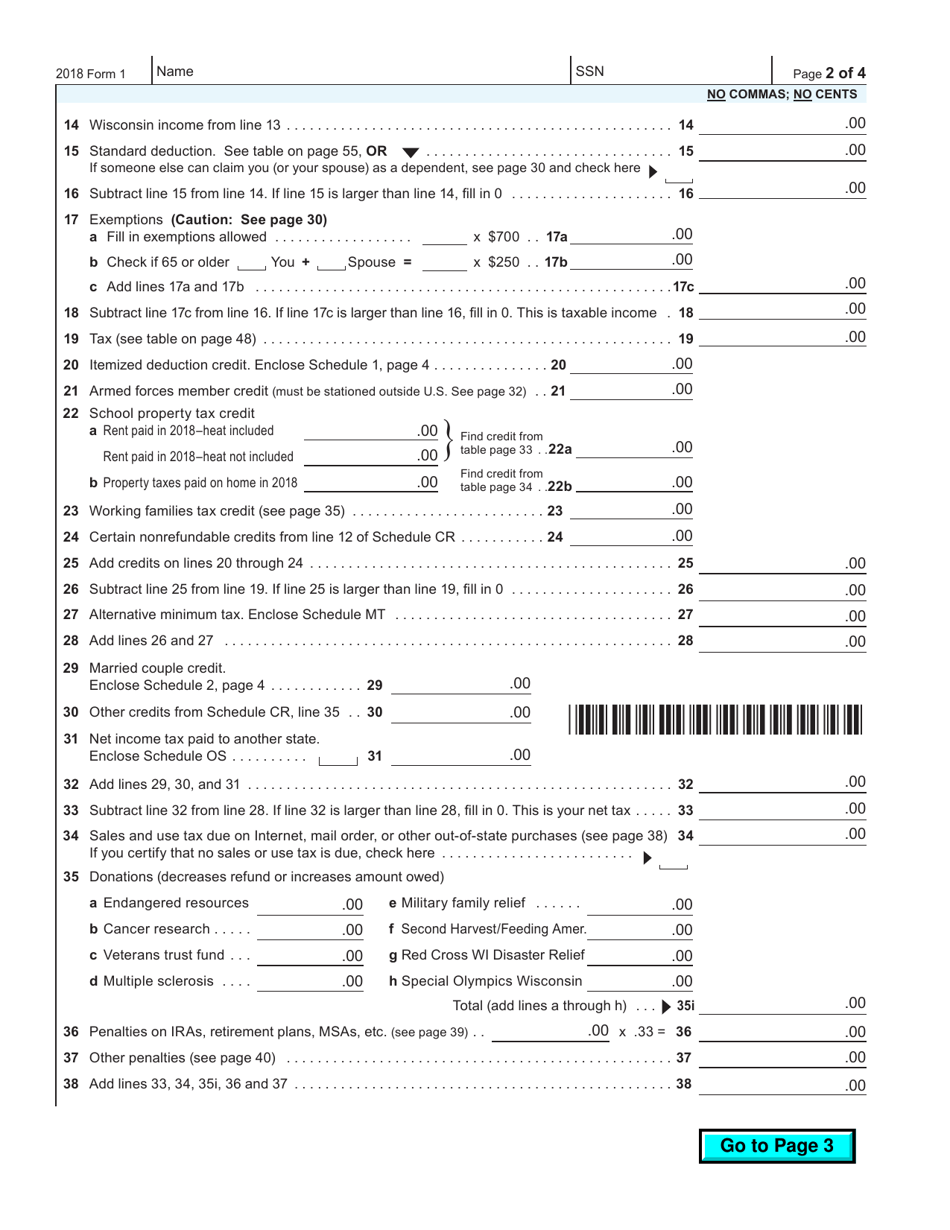

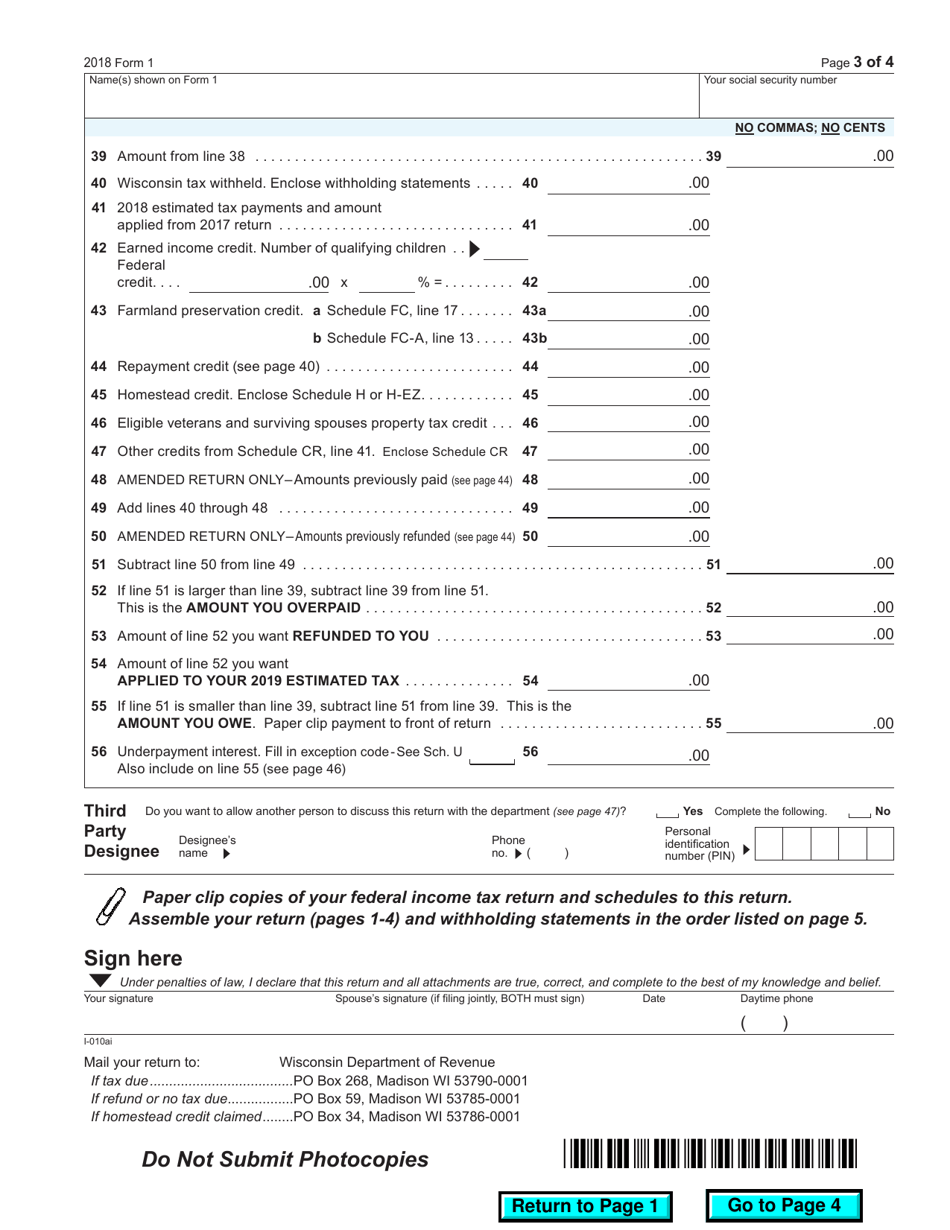

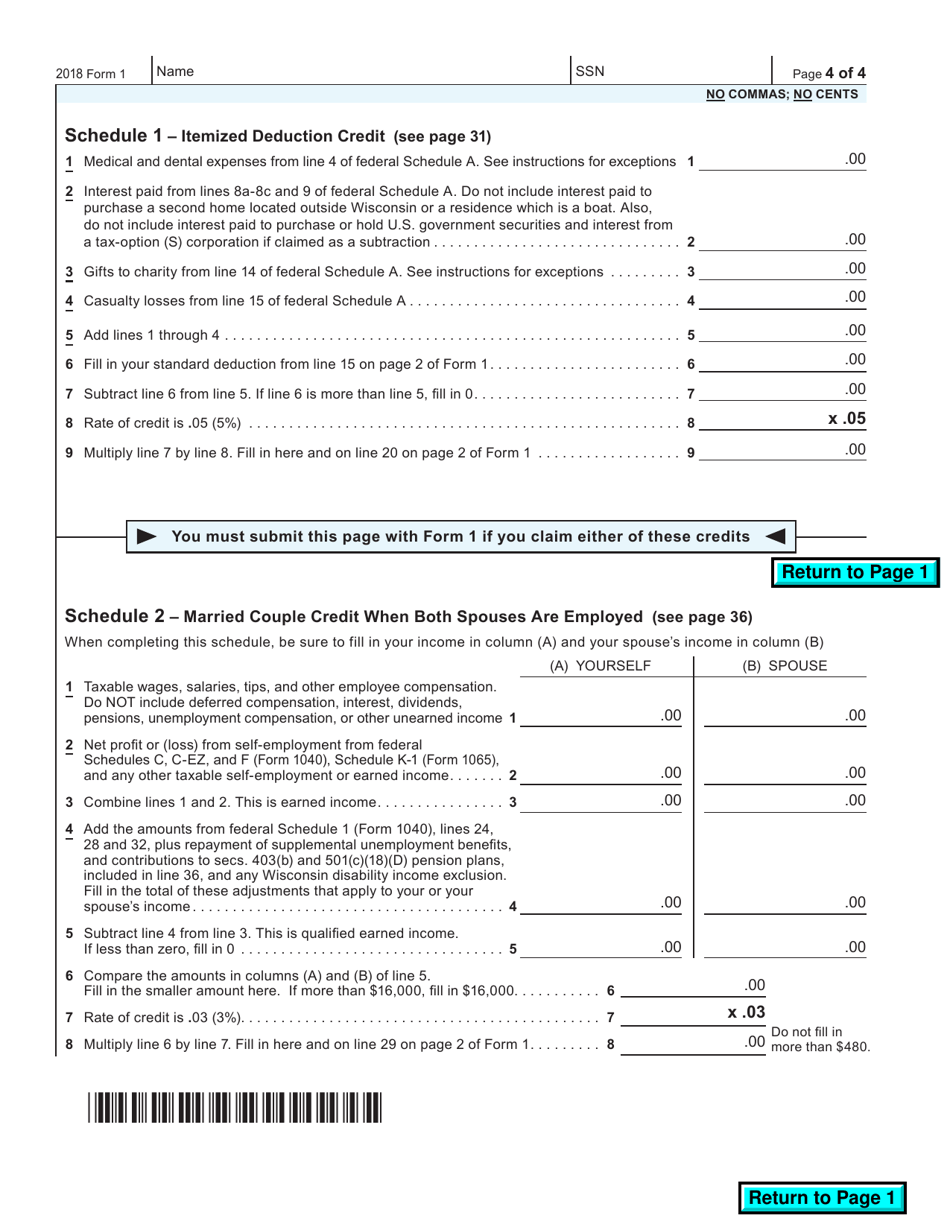

Form 1

for the current year.

Form 1 Wisconsin Income Tax - Wisconsin

What Is Form 1?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1?

A: Form 1 is the Wisconsin Income Tax form.

Q: Who needs to file Form 1?

A: Any resident of Wisconsin who has income from various sources needs to file Form 1.

Q: What is the purpose of Form 1?

A: The purpose of Form 1 is to report your income and calculate your state income tax liability.

Q: Do I need to include a copy of my federal tax return with Form 1?

A: No, you do not need to include a copy of your federal tax return with Form 1.

Q: When is the deadline to file Form 1?

A: The deadline to file Form 1 is April 15th, or the next business day if April 15th falls on a weekend or holiday.

Q: Are there any extensions available for filing Form 1?

A: Yes, you can request an extension to file Form 1, but you must still pay any tax owed by the original due date to avoid penalties and interest.

Q: What if I make a mistake on Form 1?

A: If you make a mistake on Form 1, you can file an amended return using Form 1X.

Q: Can I e-file Form 1?

A: Yes, you can e-file Form 1 using approved tax software or through a professional tax preparer.

Q: Is there a fee to e-file Form 1?

A: There may be a fee to e-file Form 1, depending on the tax software or tax preparer you use.

Form Details:

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.