This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR0526

for the current year.

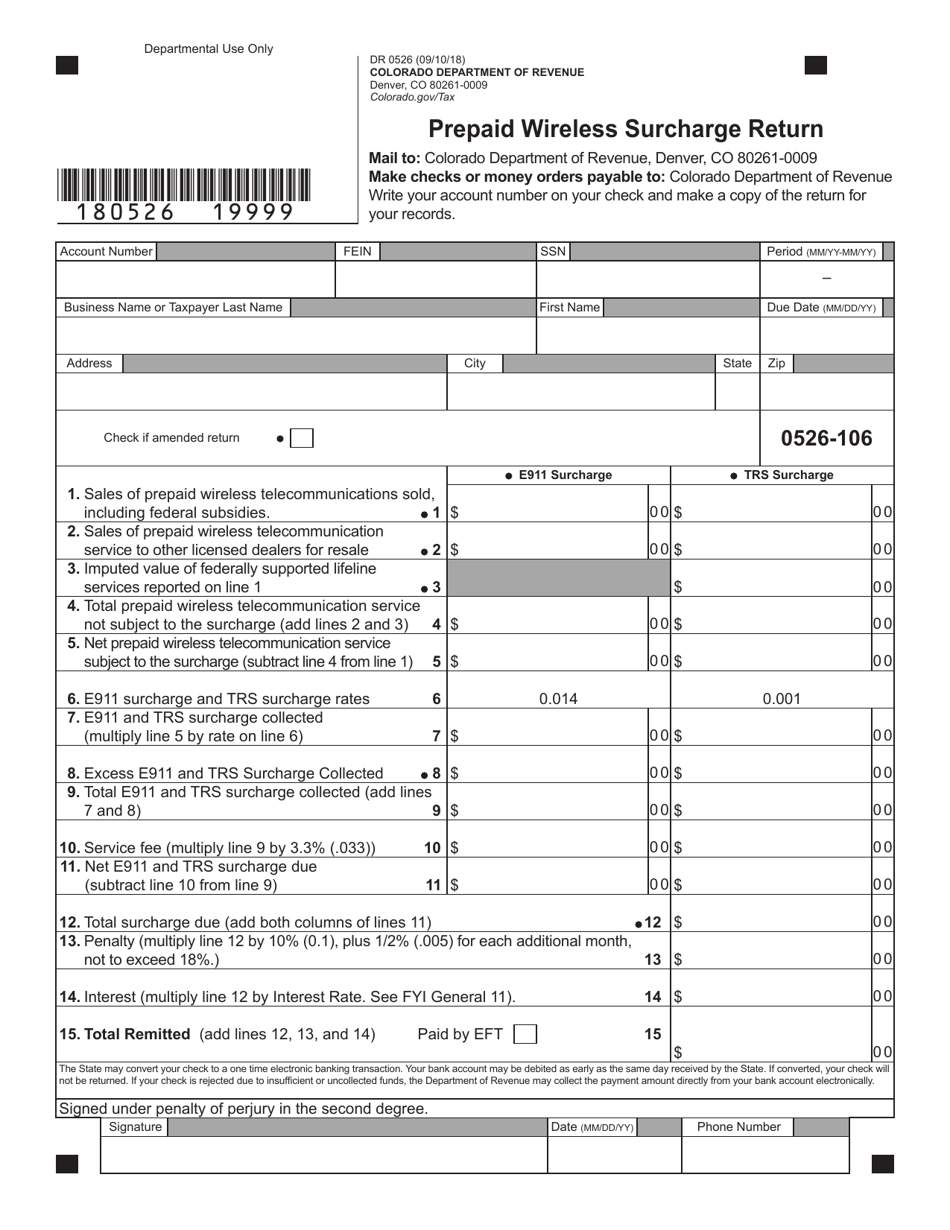

Form DR0526 Prepaid Wireless Surcharge Return - Colorado

What Is Form DR0526?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DR0526?

A: The Form DR0526 is the Prepaid Wireless Surcharge Return for the state of Colorado.

Q: What is the purpose of the Form DR0526?

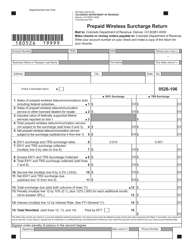

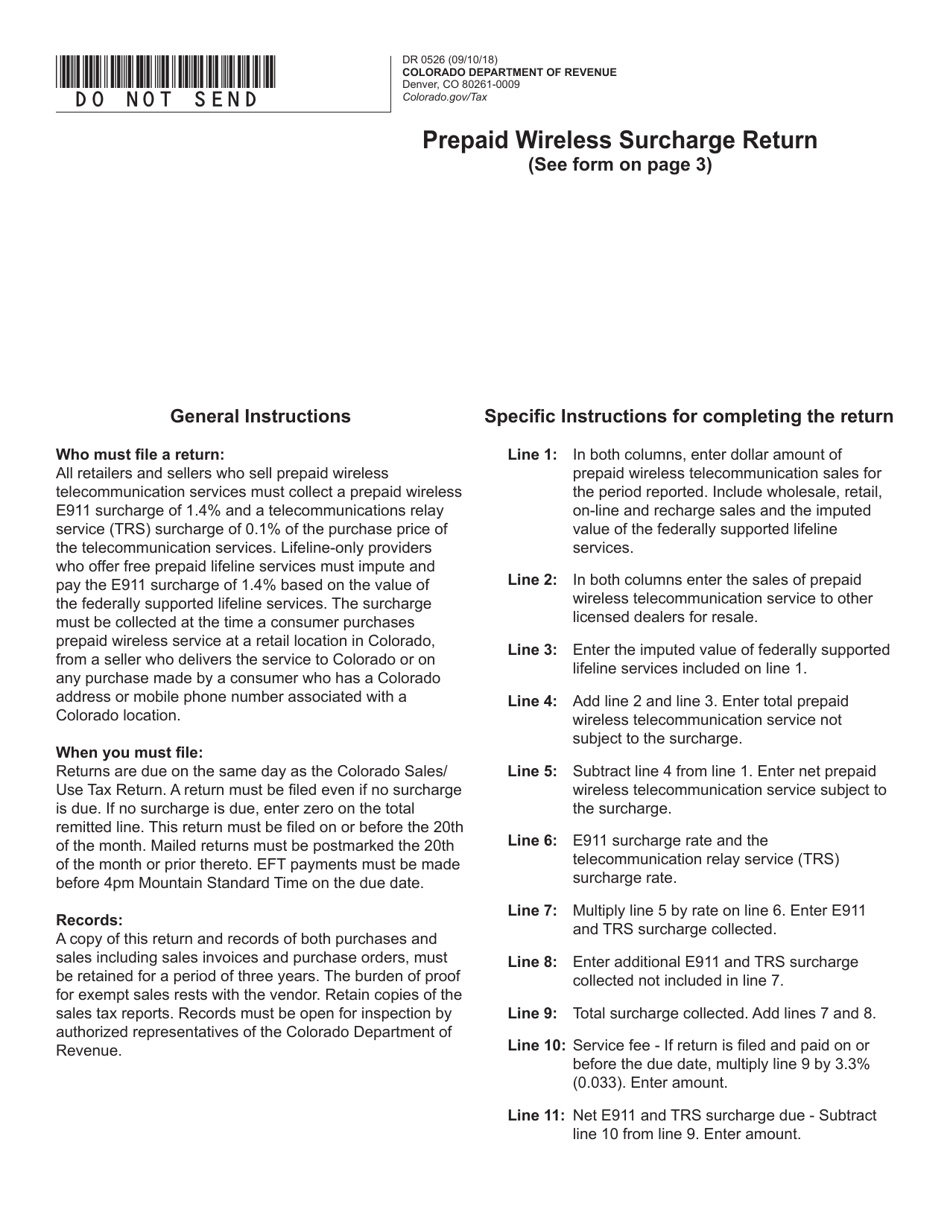

A: The Form DR0526 is used to report and remit prepaid wireless surchargetaxes collected by vendors in Colorado.

Q: Who needs to file the Form DR0526?

A: Vendors who collect prepaid wireless surcharge taxes in Colorado are required to file the Form DR0526.

Q: When is the Form DR0526 due?

A: The Form DR0526 is due on a quarterly basis and must be submitted by the last day of the month following the end of the quarter.

Q: What information is required on the Form DR0526?

A: The Form DR0526 requires vendors to provide their business information, details of prepaid wireless surcharge collections, and remittance information.

Q: Are there any penalties for late filing or non-filing?

A: Yes, there are penalties for late filing or non-filing of the Form DR0526, which can include fines and interest charges.

Q: Can I amend my Form DR0526 if there are errors or changes?

A: Yes, vendors can file an amended Form DR0526 to correct any errors or changes in the original filing.

Form Details:

- Released on September 10, 2018;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0526 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.