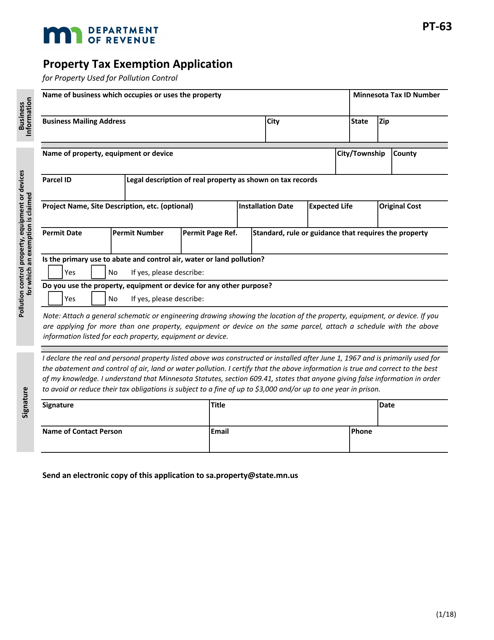

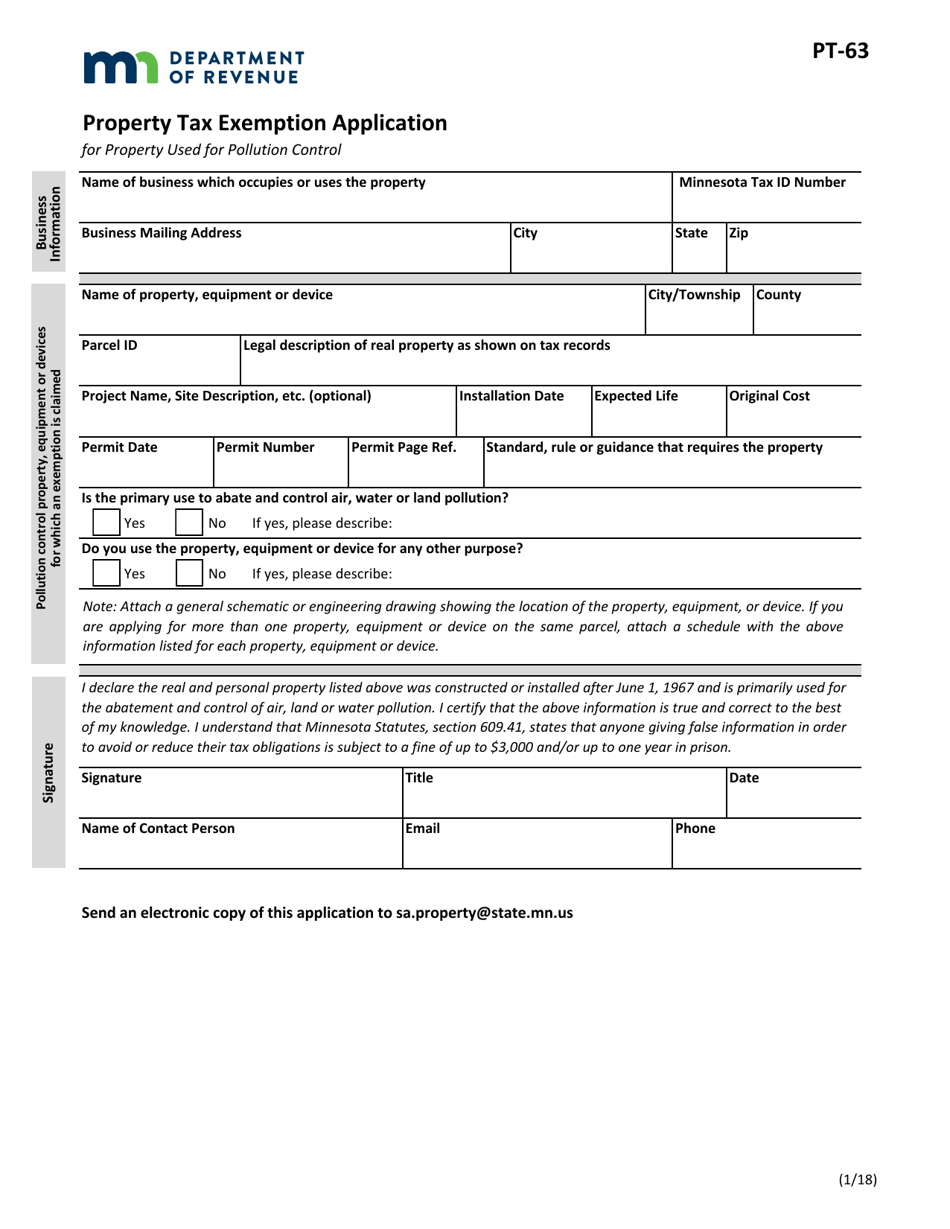

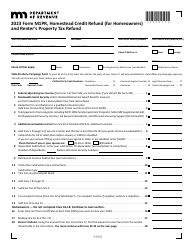

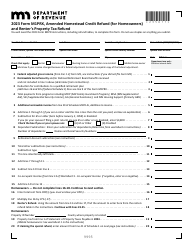

Form PT-63 Property Tax Exemption Application - Minnesota

What Is Form PT-63?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-63?

A: Form PT-63 is the Property Tax Exemption Application in Minnesota.

Q: What is the purpose of Form PT-63?

A: The purpose of Form PT-63 is to apply for property tax exemption in Minnesota.

Q: Who needs to fill out Form PT-63?

A: Property owners in Minnesota who wish to seek a property tax exemption need to fill out Form PT-63.

Q: What information is required on Form PT-63?

A: Form PT-63 requires information about the property owner, property type, and the reason for the exemption.

Q: Are there any fees associated with filing Form PT-63?

A: There are no fees associated with filing Form PT-63.

Q: When is the deadline to submit Form PT-63?

A: The deadline to submit Form PT-63 varies by county. Check with your local county office for the deadline.

Q: Can I apply for property tax exemption for multiple properties using Form PT-63?

A: Yes, you can apply for property tax exemption for multiple properties using Form PT-63.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT-63 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.