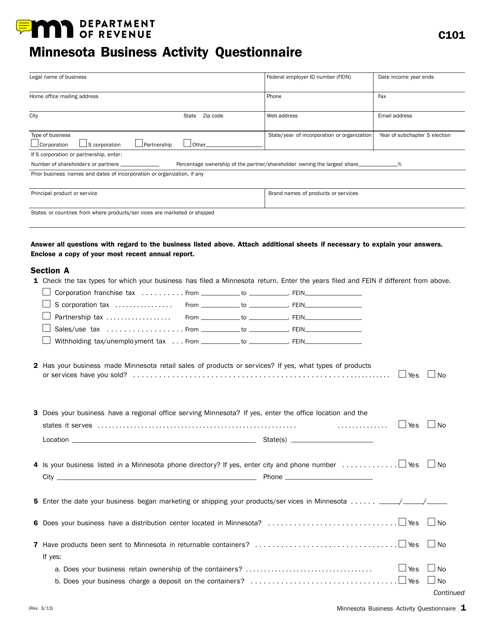

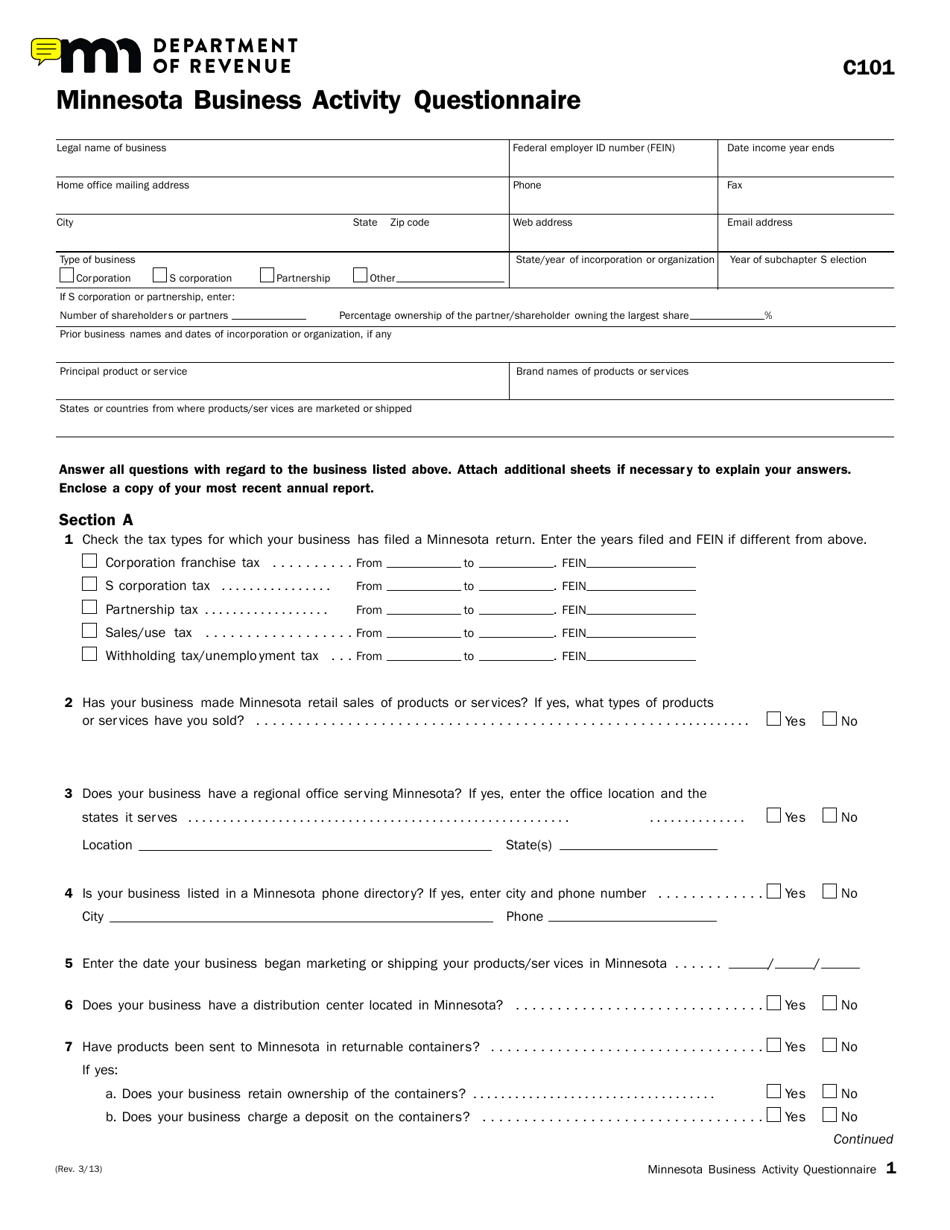

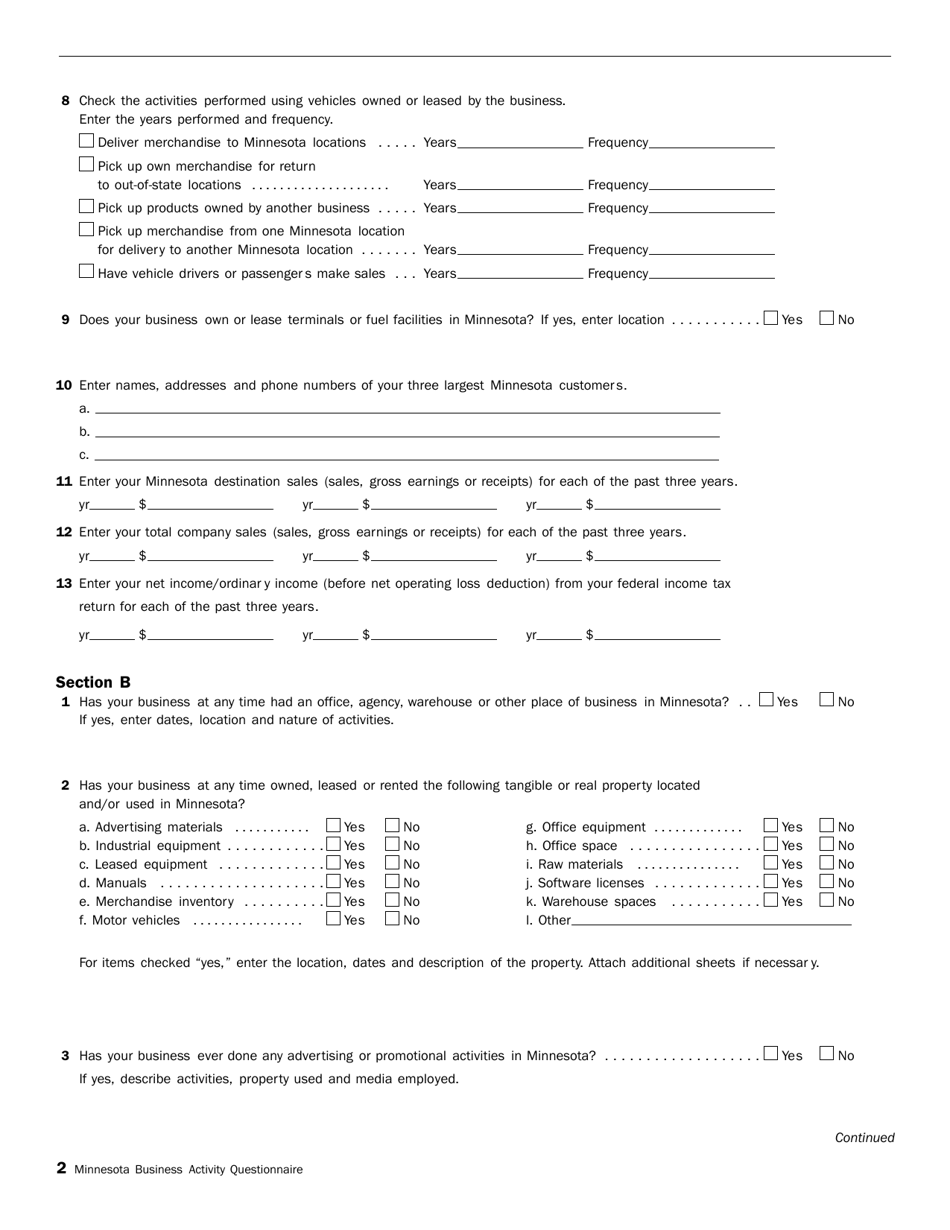

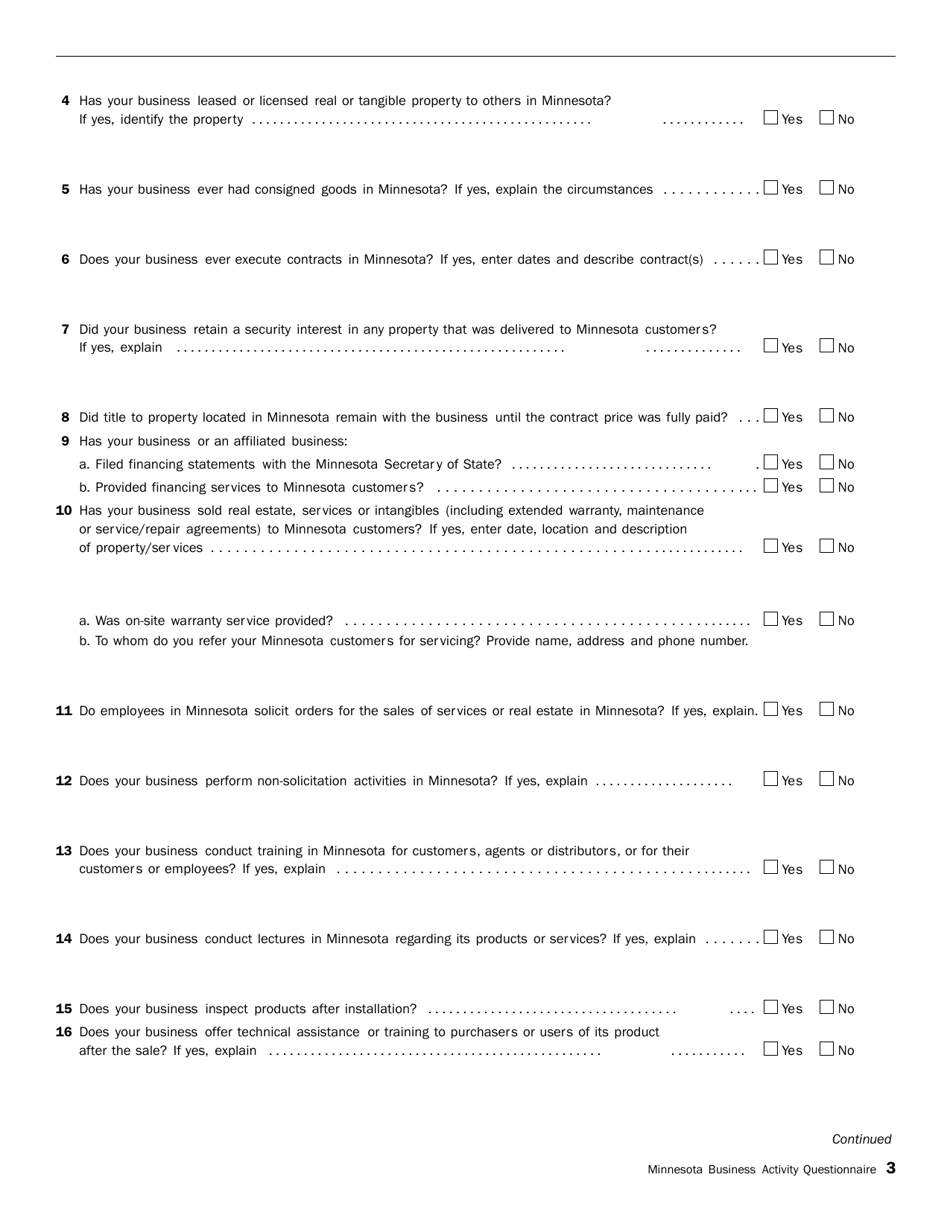

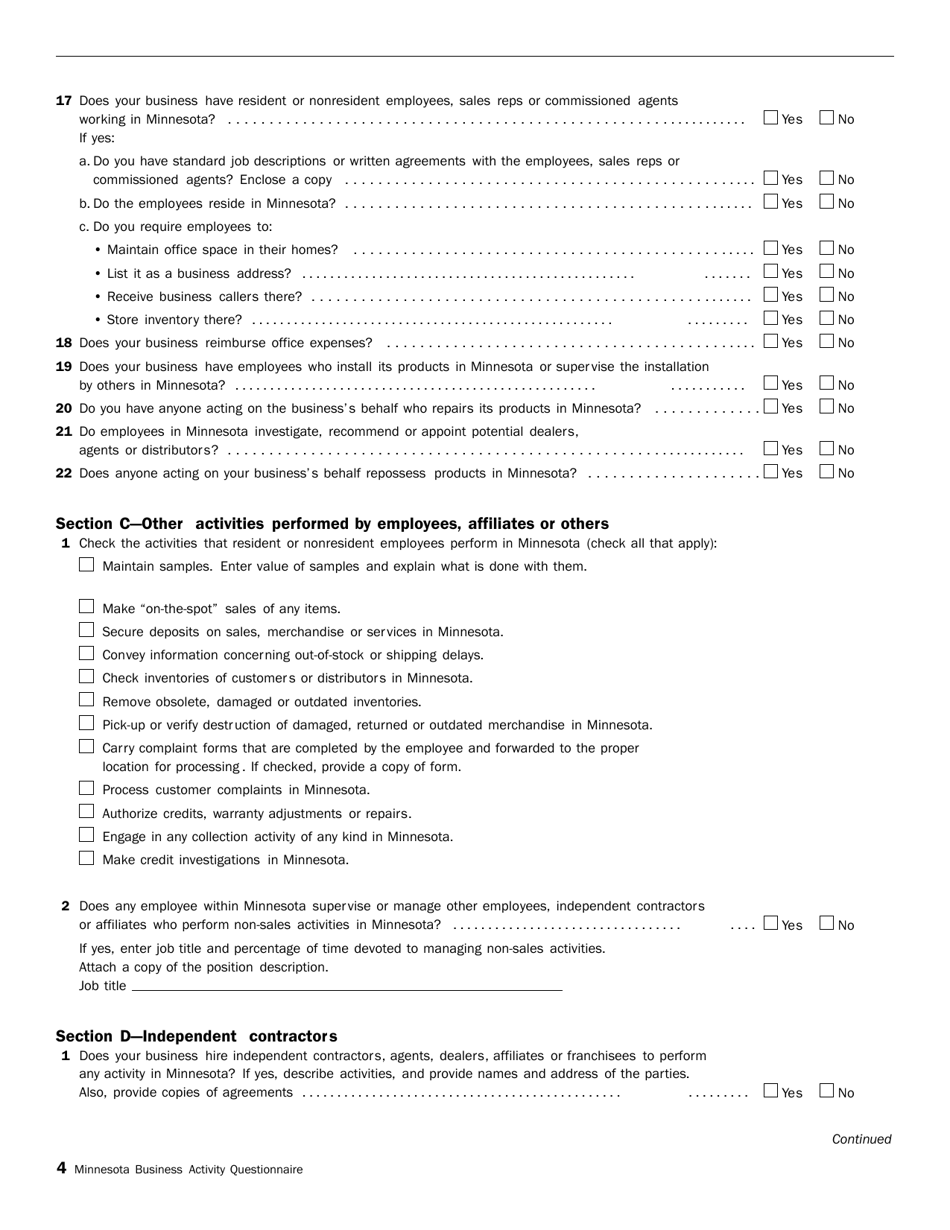

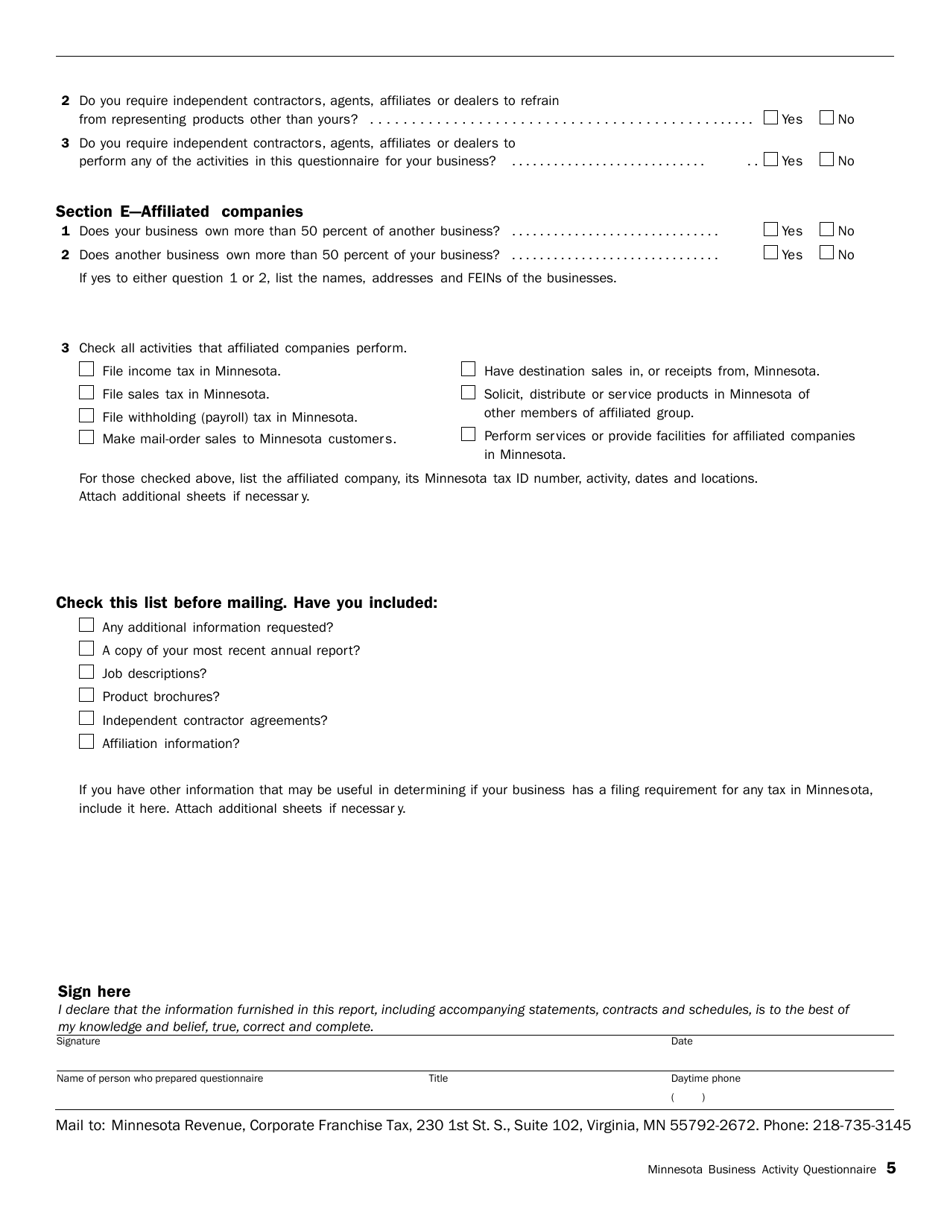

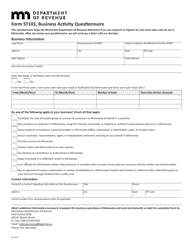

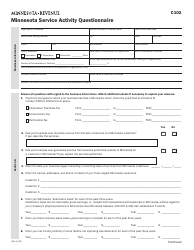

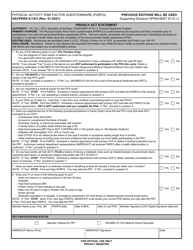

Form C101 Minnesota Business Activity Questionnaire - Minnesota

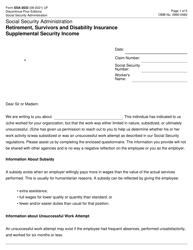

What Is Form C101?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C101?

A: Form C101 is the Minnesota Business Activity Questionnaire.

Q: Who needs to fill out Form C101?

A: Businesses operating in Minnesota need to fill out Form C101.

Q: What is the purpose of Form C101?

A: The purpose of Form C101 is to collect information about a business's activities in Minnesota for tax purposes.

Q: Do I need to file Form C101 every year?

A: Yes, businesses need to file Form C101 every year.

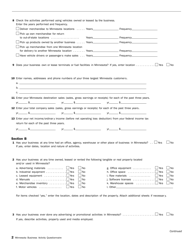

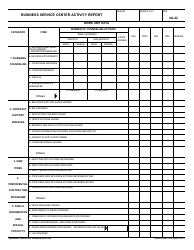

Q: What information do I need to provide on Form C101?

A: You need to provide information about your business's activities, such as revenue, expenses, and number of employees in Minnesota.

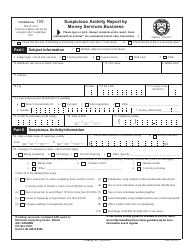

Q: Are there any penalties for not filing Form C101?

A: Yes, there are penalties for not filing Form C101, including late filing penalties and interest on unpaid taxes.

Q: When is the deadline for filing Form C101?

A: The deadline for filing Form C101 is determined by the Minnesota Department of Revenue and may vary each year.

Q: Can I get an extension to file Form C101?

A: Yes, you can request an extension to file Form C101, but you must do so before the original filing deadline.

Form Details:

- Released on March 1, 2013;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C101 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.