This version of the form is not currently in use and is provided for reference only. Download this version of

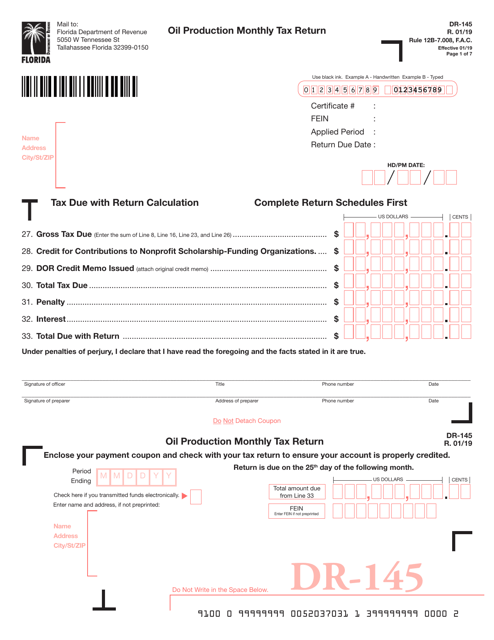

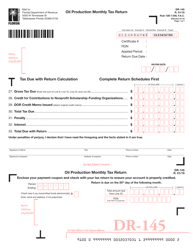

Form DR-145

for the current year.

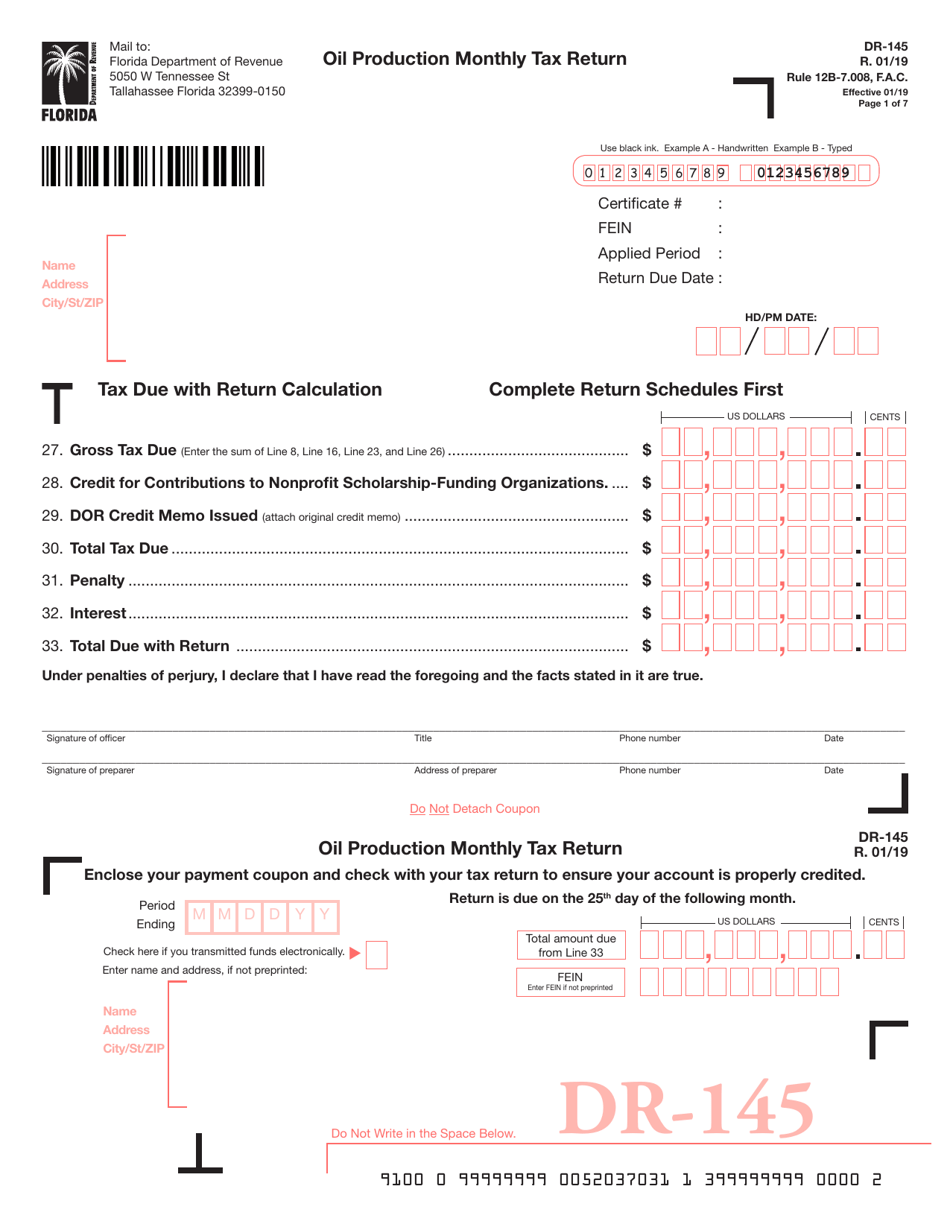

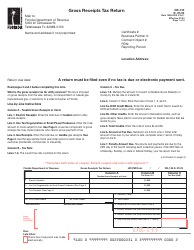

Form DR-145 Oil Production Monthly Tax Return - Florida

What Is Form DR-145?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-145?

A: Form DR-145 is the Oil ProductionMonthly Tax Return for the state of Florida.

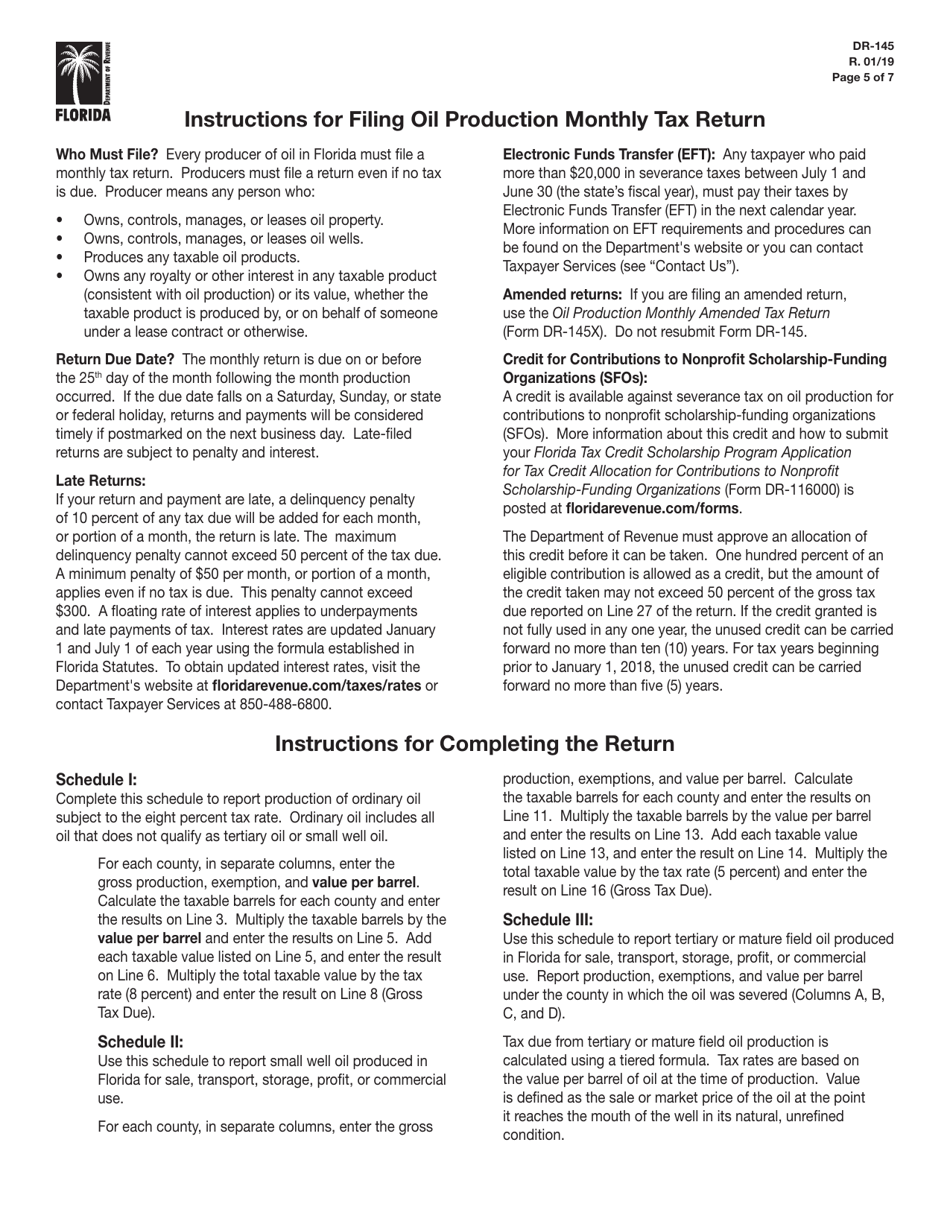

Q: Who needs to file Form DR-145?

A: Oil producers in Florida need to file Form DR-145.

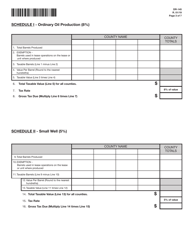

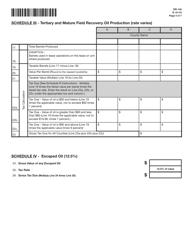

Q: What is the purpose of Form DR-145?

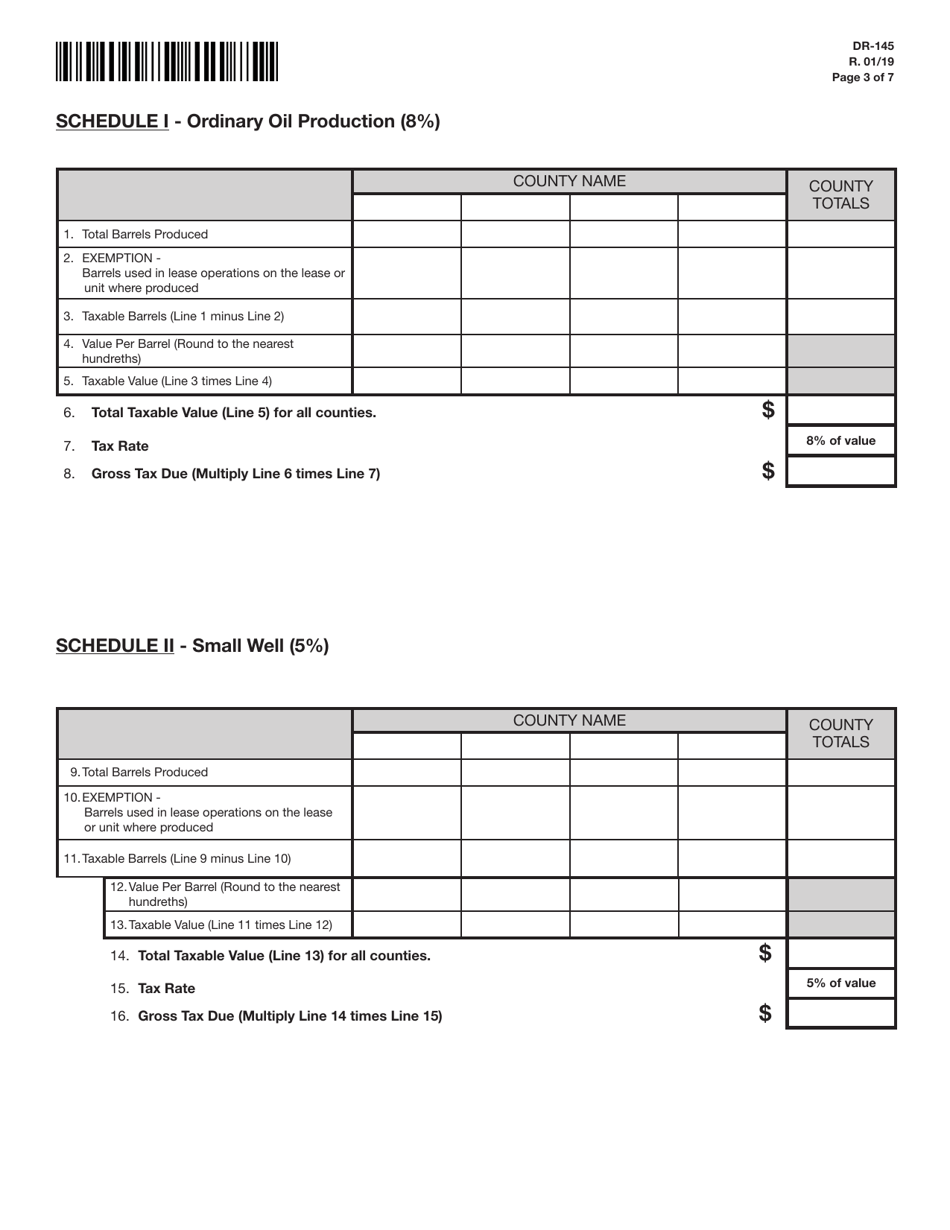

A: The purpose of Form DR-145 is to report oil production and calculate the corresponding tax liability.

Q: When is Form DR-145 due?

A: Form DR-145 is due on the 1st day of the month following the month in which the oil was produced.

Q: Are there any penalties for late filing of Form DR-145?

A: Yes, there are penalties for late filing of Form DR-145. It is important to submit the form on time to avoid penalties.

Q: How can I pay the tax due on Form DR-145?

A: You can pay the tax due on Form DR-145 by electronic funds transfer (EFT) or by check or money order.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-145 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.