This version of the form is not currently in use and is provided for reference only. Download this version of

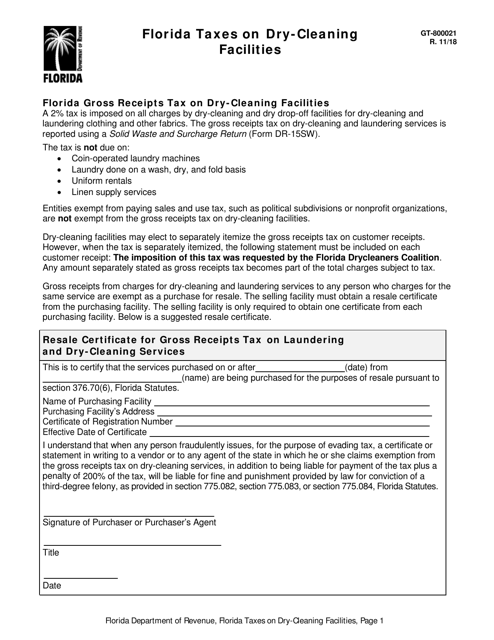

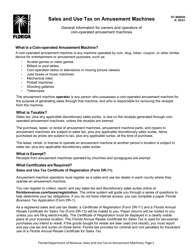

Form GT-800021

for the current year.

Form GT-800021 Florida Taxes on Dry-Cleaning Facilities - Florida

What Is Form GT-800021?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

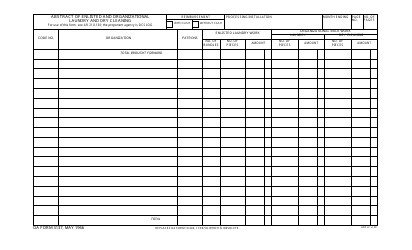

Q: What is Form GT-800021?

A: Form GT-800021 is a tax form used in the state of Florida for reporting taxes on dry-cleaning facilities.

Q: Who needs to file Form GT-800021?

A: Owners and operators of dry-cleaning facilities in Florida need to file Form GT-800021.

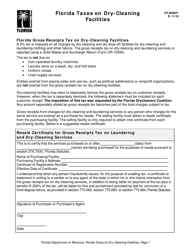

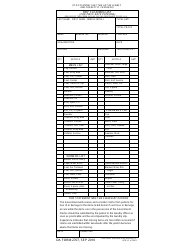

Q: What taxes are reported on Form GT-800021?

A: Form GT-800021 is used to report taxes on dry-cleaning chemicals and solvents.

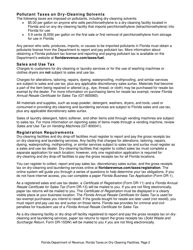

Q: When is Form GT-800021 due?

A: Form GT-800021 is due on a quarterly basis, with the due dates being January 1, April 1, July 1, and October 1.

Q: Are there any penalties for not filing Form GT-800021?

A: Yes, there are penalties for not filing Form GT-800021, including monetary fines and potential legal consequences.

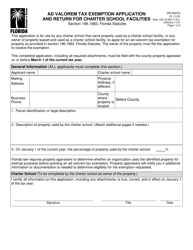

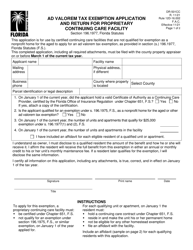

Q: Are there any exemptions or deductions available on Form GT-800021?

A: Yes, there are certain exemptions and deductions available on Form GT-800021. Consult the instructions for more information.

Q: How do I contact the Florida Department of Revenue for questions about Form GT-800021?

A: You can contact the Florida Department of Revenue at [phone number] for any questions or concerns regarding Form GT-800021.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GT-800021 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.