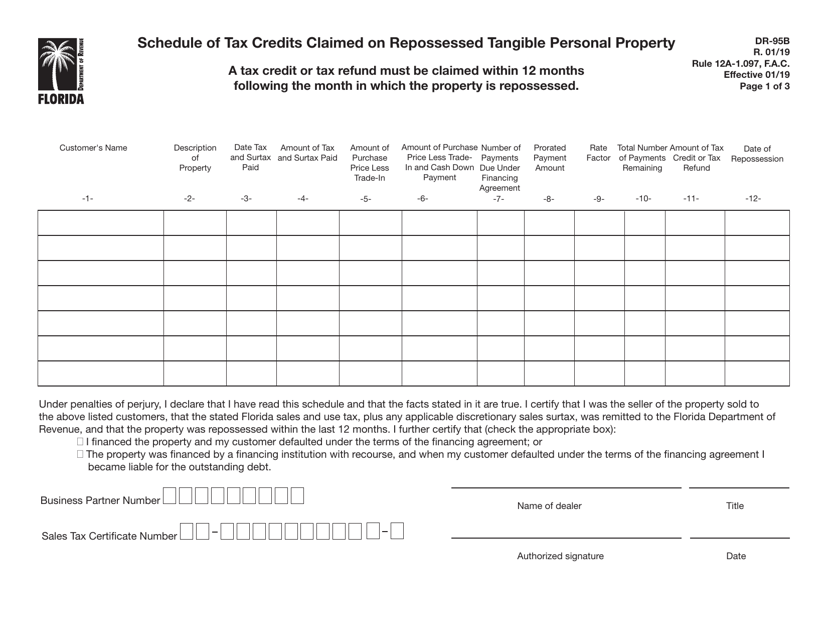

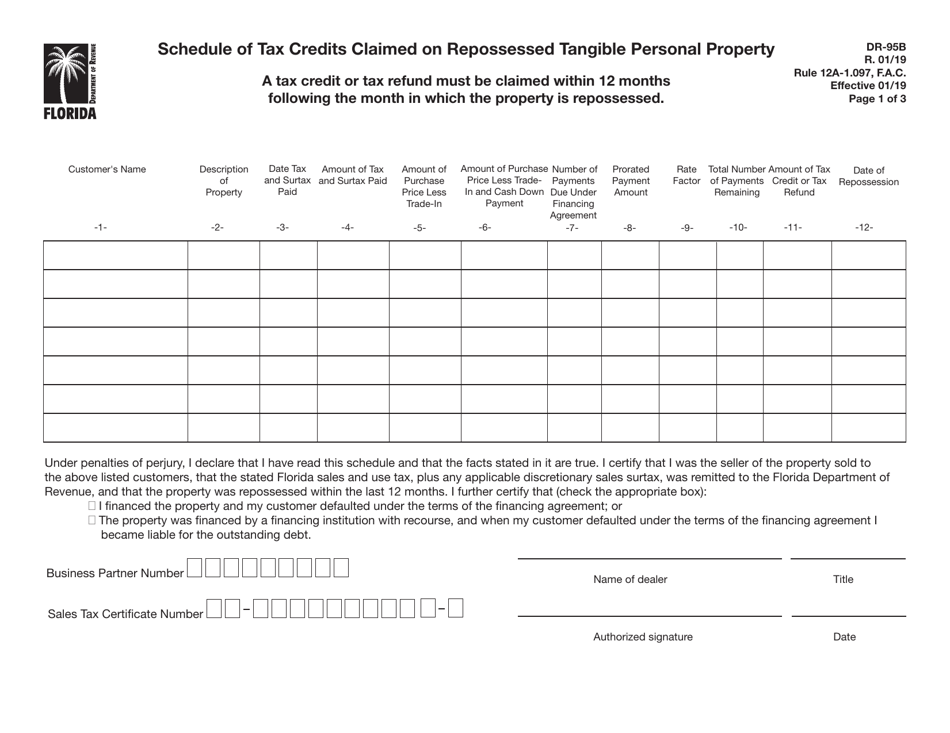

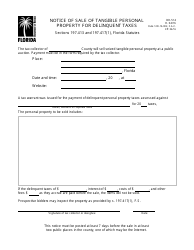

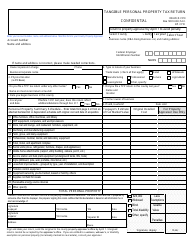

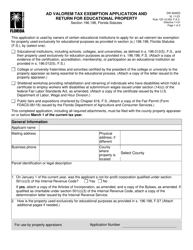

Form DR-95B Schedule of Tax Credits Claimed on Repossessed Tangible Personal Property - Florida

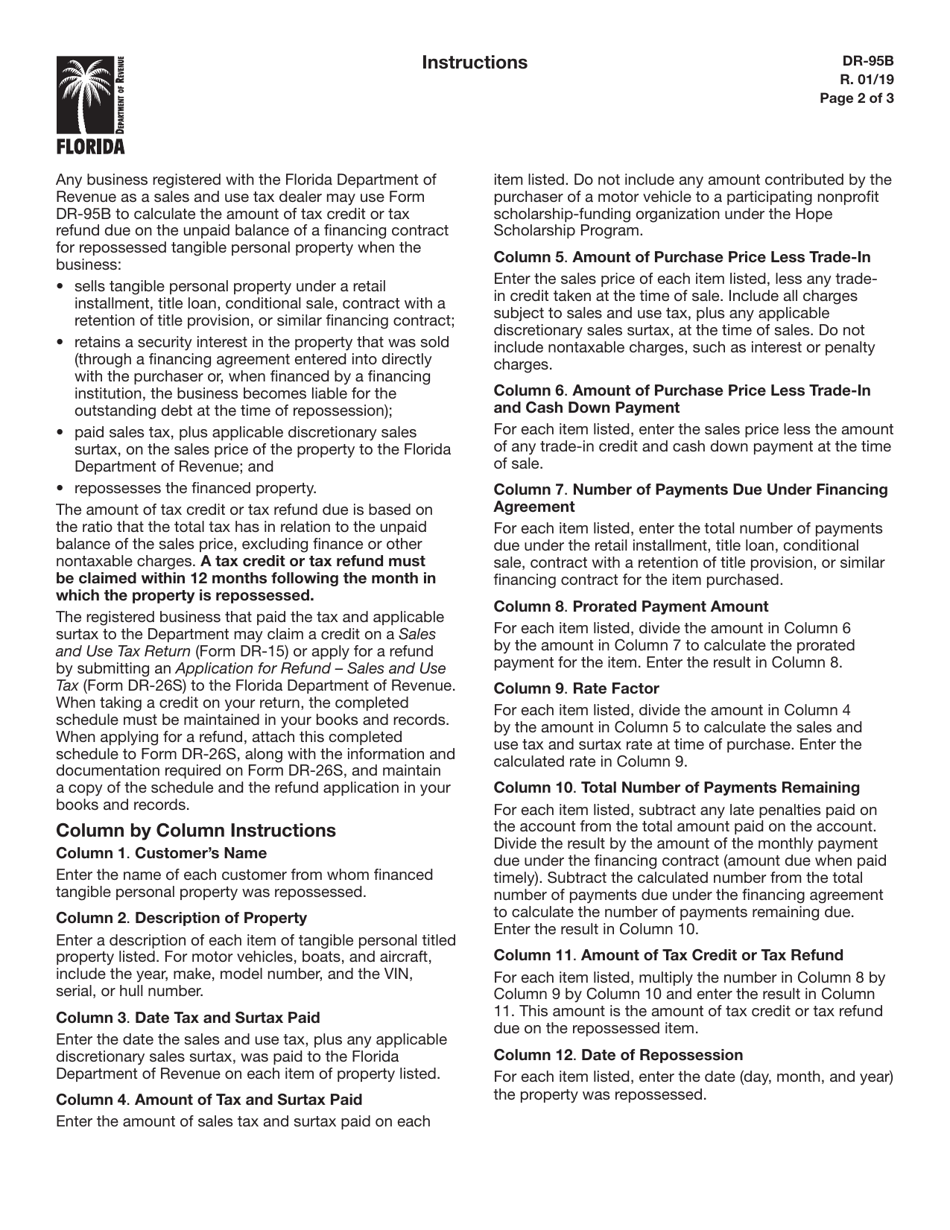

What Is Form DR-95B?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-95B?

A: Form DR-95B is a Schedule of Tax Credits Claimed on Repossessed Tangible Personal Property in Florida.

Q: What is the purpose of Form DR-95B?

A: The purpose of Form DR-95B is to report tax credits claimed on repossessed tangible personal property in Florida.

Q: Who needs to file Form DR-95B?

A: Those who have claimed tax credits on repossessed tangible personal property in Florida need to file Form DR-95B.

Q: When is Form DR-95B due?

A: Form DR-95B is due on or before April 1 each year.

Q: Can I e-file Form DR-95B?

A: No, Form DR-95B cannot be e-filed. It must be filed by mail.

Q: What should I do if I have questions about Form DR-95B?

A: If you have questions about Form DR-95B, you can contact the Florida Department of Revenue for assistance.

Q: Are there any penalties for not filing Form DR-95B?

A: Yes, there may be penalties for failure to file Form DR-95B or for filing it late.

Q: Can I claim tax credits on repossessed tangible personal property in other states?

A: The availability of tax credits on repossessed tangible personal property may vary by state. You should consult the relevant state's tax authority for more information.

Q: Are tax credits on repossessed tangible personal property refundable?

A: The refundability of tax credits on repossessed tangible personal property depends on the specific tax laws in each state. Consult the appropriate tax authority for guidance.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-95B by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.