This version of the form is not currently in use and is provided for reference only. Download this version of

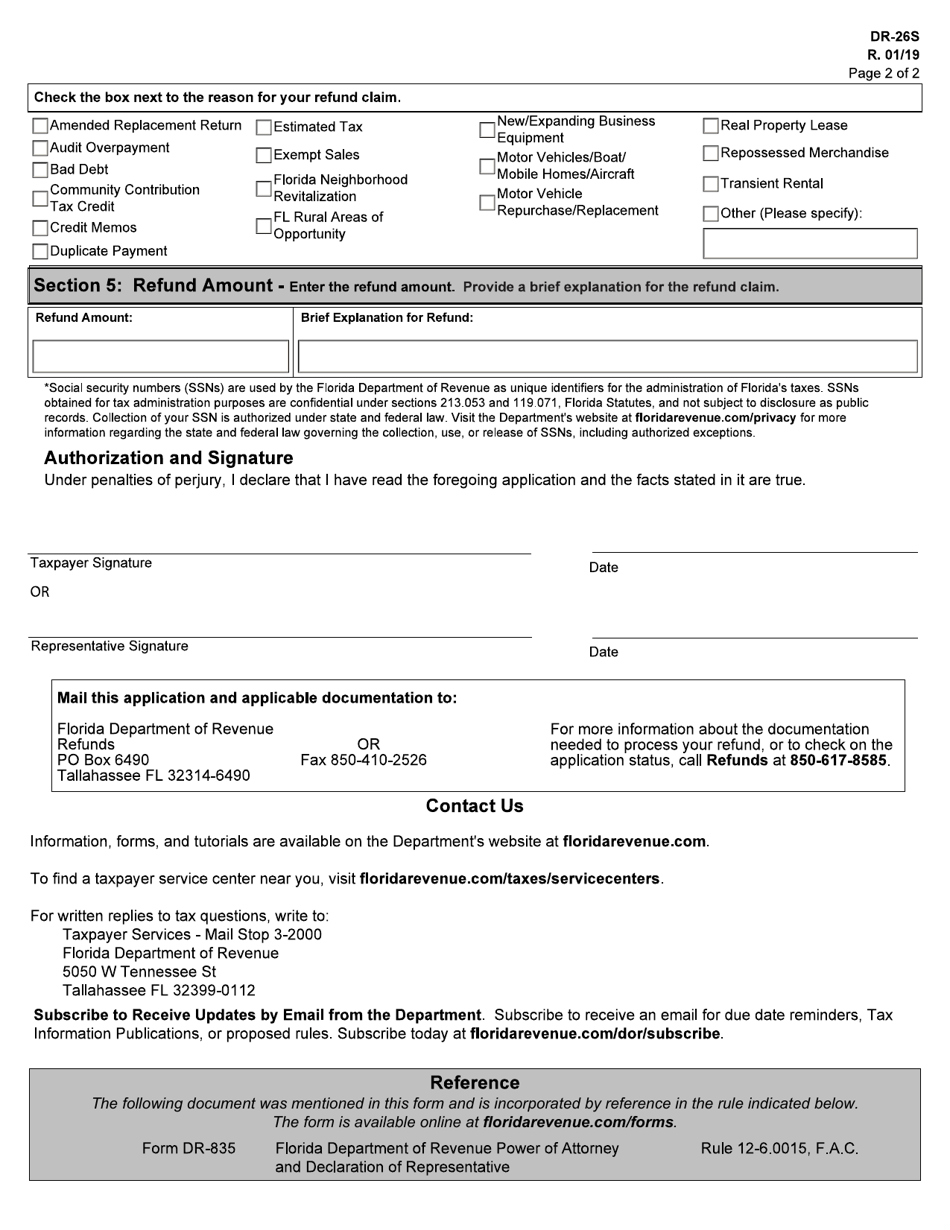

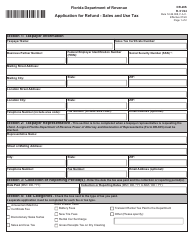

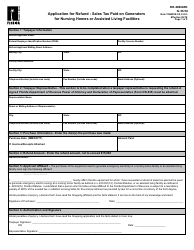

Form DR-26S

for the current year.

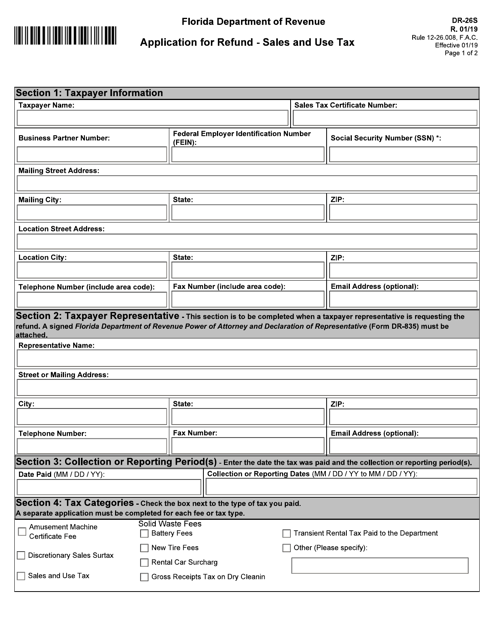

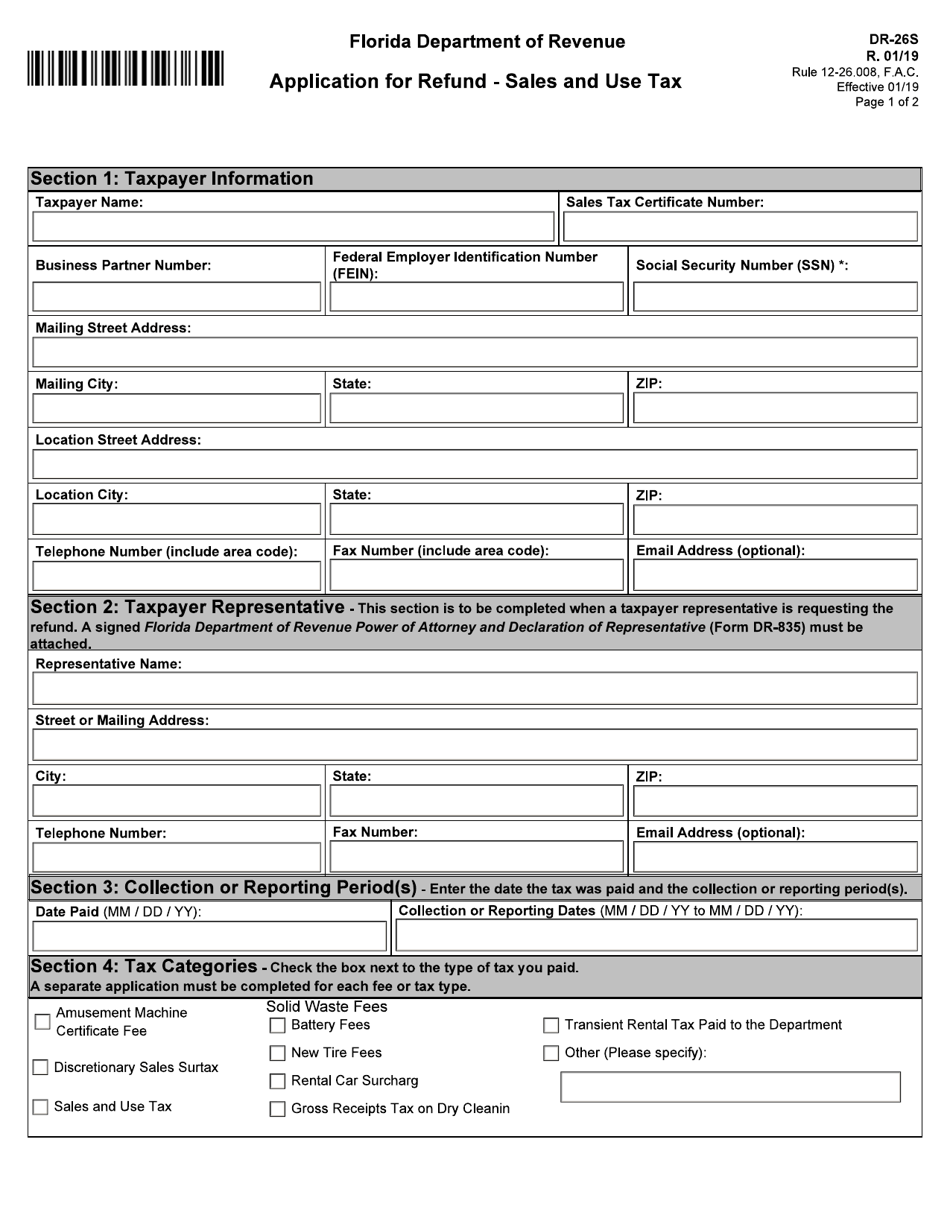

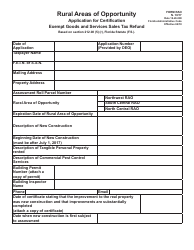

Form DR-26S Application for Refund - Sales and Use Tax - Florida

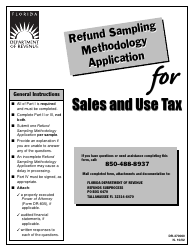

What Is Form DR-26S?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. Check the official instructions before completing and submitting the form.

FAQ

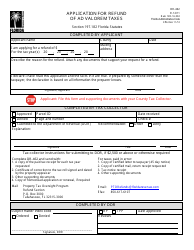

Q: What is Form DR-26S?

A: Form DR-26S is the Application for Refund - Sales and Use Tax in Florida.

Q: What is the purpose of Form DR-26S?

A: The purpose of Form DR-26S is to apply for a refund of sales and use tax paid in Florida.

Q: Who can use Form DR-26S?

A: Any individual or business that has paid sales and use tax in Florida and wishes to seek a refund can use Form DR-26S.

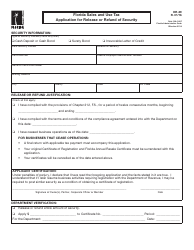

Q: What information do I need to provide on Form DR-26S?

A: You will need to provide your contact information, detailed description of the reason for the refund, and supporting documentation.

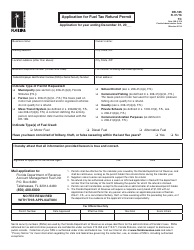

Q: Are there any deadlines for submitting Form DR-26S?

A: Yes, you must submit Form DR-26S within the applicable statute of limitations period, which is generally four years from the due date of the tax return.

Q: How long does it take to process a refund application filed on Form DR-26S?

A: The processing time for refund applications can vary, but the Department of Revenue aims to process complete and accurate applications within 90 days.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-26S by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.