This version of the form is not currently in use and is provided for reference only. Download this version of

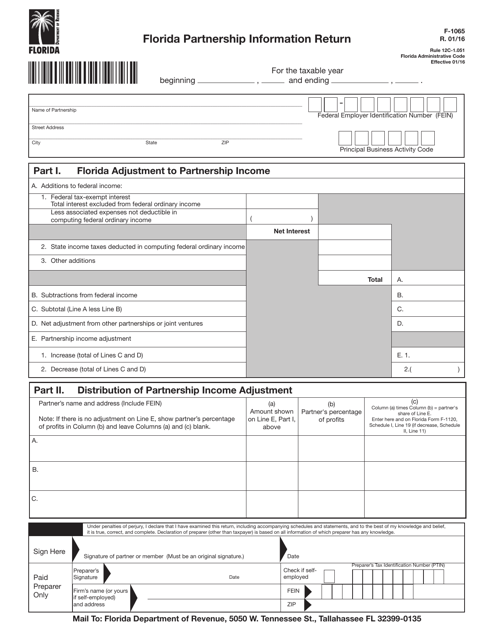

Form F-1065

for the current year.

Form F-1065 Florida Partnership Information Return - Florida

What Is Form F-1065?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

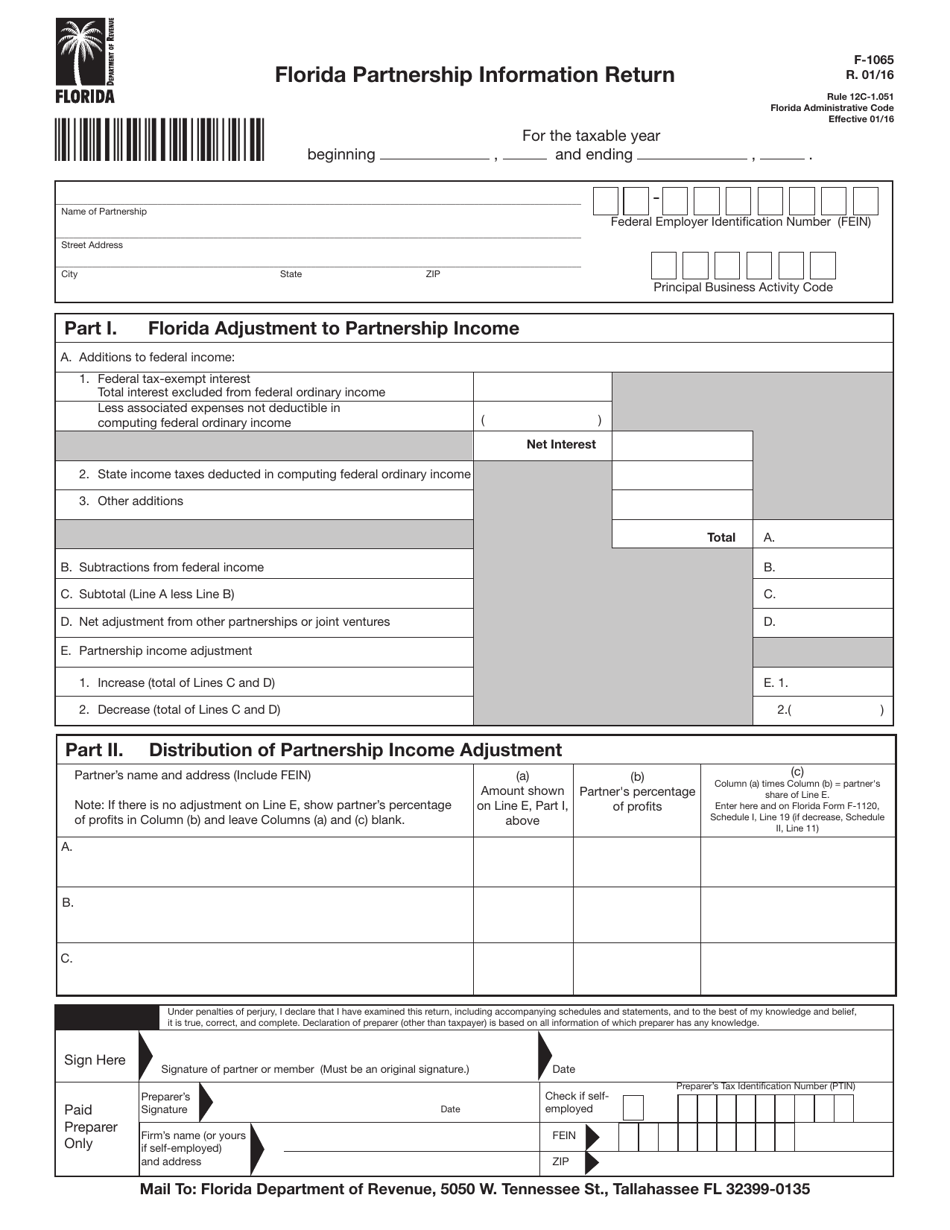

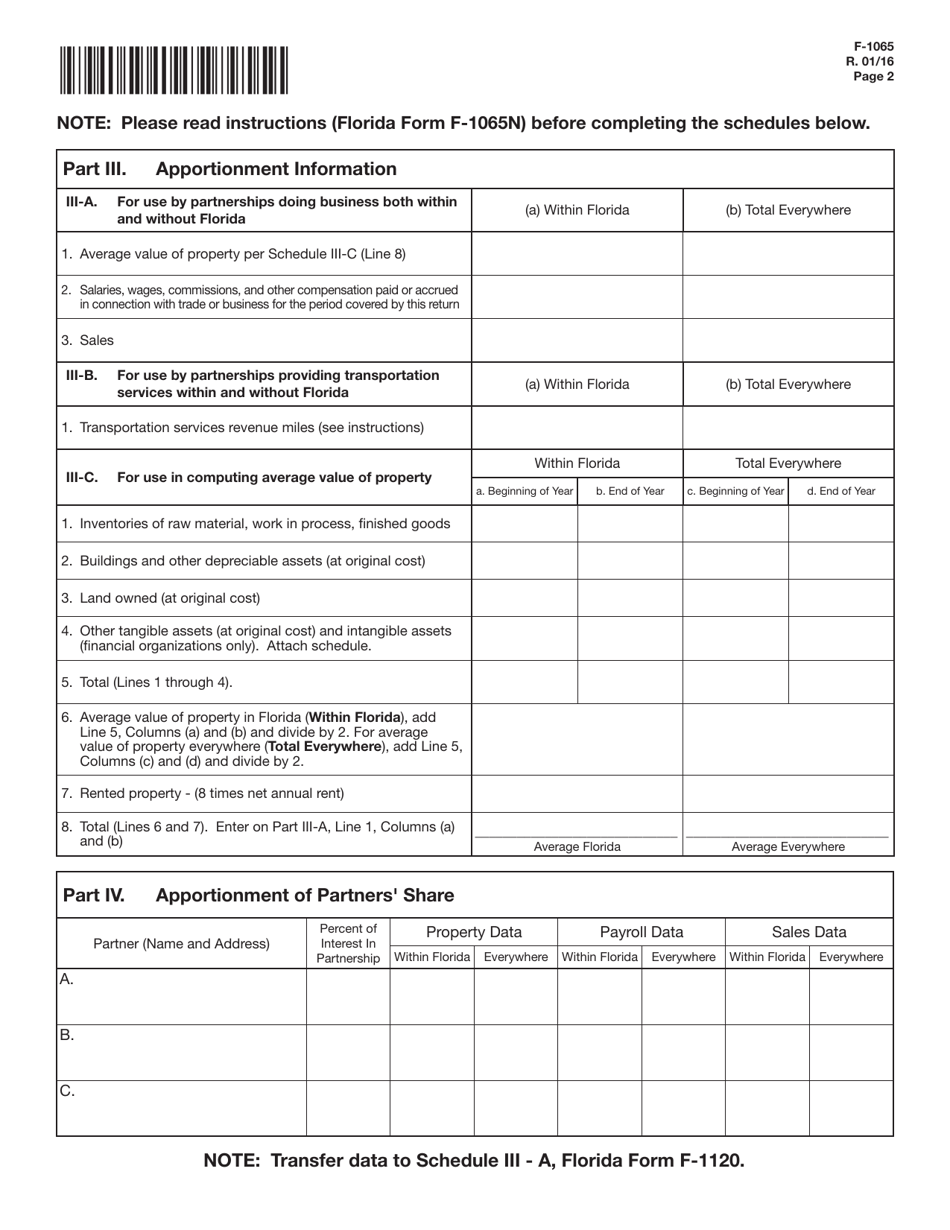

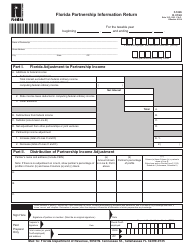

Q: What is Form F-1065?

A: Form F-1065 is the Florida Partnership Information Return.

Q: Who is required to file Form F-1065?

A: Partnerships doing business in Florida are required to file Form F-1065.

Q: What information is needed to complete Form F-1065?

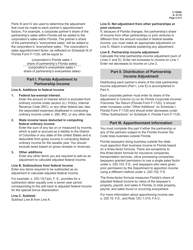

A: You will need the partnership's basic information, including its name, address, federal employer identification number (FEIN), and the names of all partners.

Q: When is the deadline to file Form F-1065?

A: Form F-1065 is due on or before the 15th day of the 4th month following the close of the partnership's taxable year.

Q: Can Form F-1065 be filed electronically?

A: Yes, you can file Form F-1065 electronically through the Florida Department of Revenue's e-file system.

Q: Are there any penalties for late filing of Form F-1065?

A: Yes, penalties may apply for late filing of Form F-1065. It is important to file the return on time to avoid penalties and interest.

Q: Do all partners have to submit a copy of Form F-1065 with their individual tax returns?

A: No, each partner does not have to submit a copy of Form F-1065 with their individual tax returns. However, they may need information from the form to accurately report their share of partnership income or loss.

Q: Is there a fee to file Form F-1065?

A: There is no fee to file Form F-1065 with the Florida Department of Revenue.

Q: Can I amend Form F-1065 if I made a mistake?

A: Yes, you can file an amended Form F-1065 to correct any errors or omissions. Use Form F-1065X to amend the original filing.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F-1065 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.