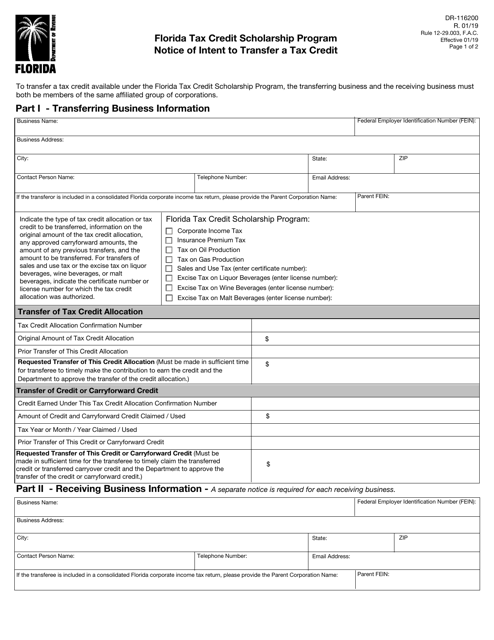

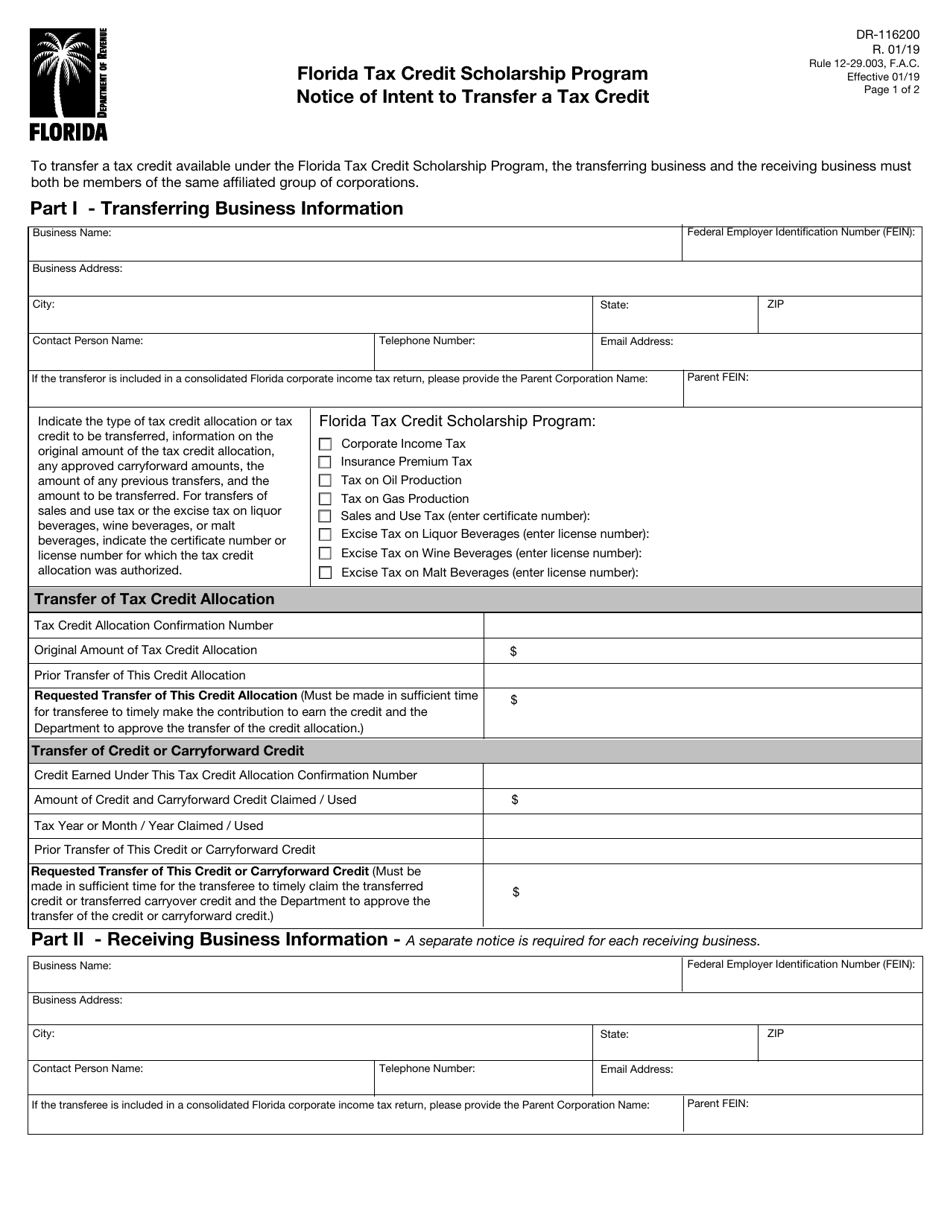

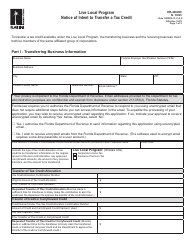

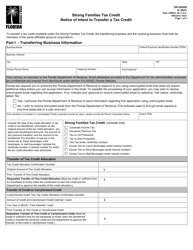

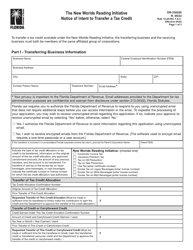

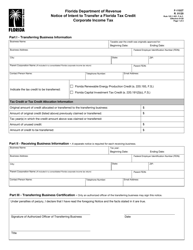

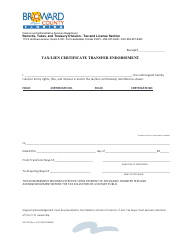

Form DR-116200 Florida Tax Credit Scholarship Program Notice of Intent to Transfer a Tax Credit - Florida

What Is Form DR-116200?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-116200?

A: Form DR-116200 is a notice of intent to transfer a tax credit for the Florida Tax Credit Scholarship Program.

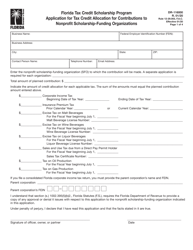

Q: What is the Florida Tax Credit Scholarship Program?

A: The Florida Tax Credit Scholarship Program is a scholarship program that provides financial assistance to eligible students attending eligible private schools in Florida.

Q: Who is eligible for the Florida Tax Credit Scholarship Program?

A: Eligible students are those from low-income families who meet certain criteria set by the program.

Q: What is the purpose of Form DR-116200?

A: The purpose of Form DR-116200 is to notify the state of Florida of the intent to transfer a tax credit for the Florida Tax Credit Scholarship Program.

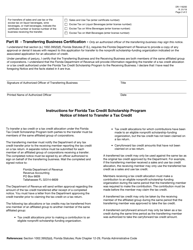

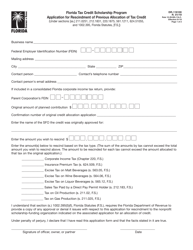

Q: How do I fill out Form DR-116200?

A: You must provide the necessary information, including your name, address, taxpayer identification number, and the amount of tax credit you intend to transfer.

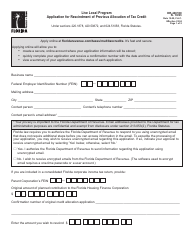

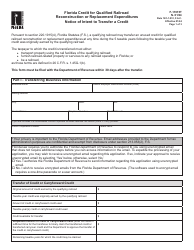

Q: Are there any deadlines for submitting Form DR-116200?

A: Yes, Form DR-116200 must be submitted by the specified deadline, which is usually specified by the program or the Florida Department of Revenue.

Q: Can I transfer my entire tax credit through Form DR-116200?

A: No, there are limitations on the amount of tax credit that can be transferred.

Q: Can I make changes to Form DR-116200 after submitting it?

A: Generally, once you have submitted Form DR-116200, you cannot make changes to it. However, it is always recommended to contact the Florida Department of Revenue for guidance.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-116200 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.