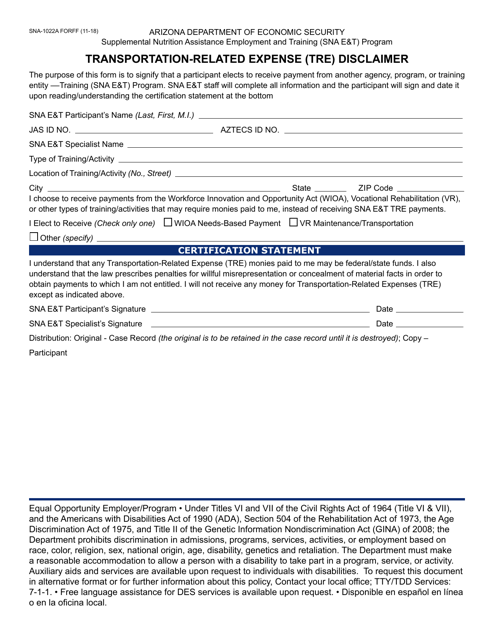

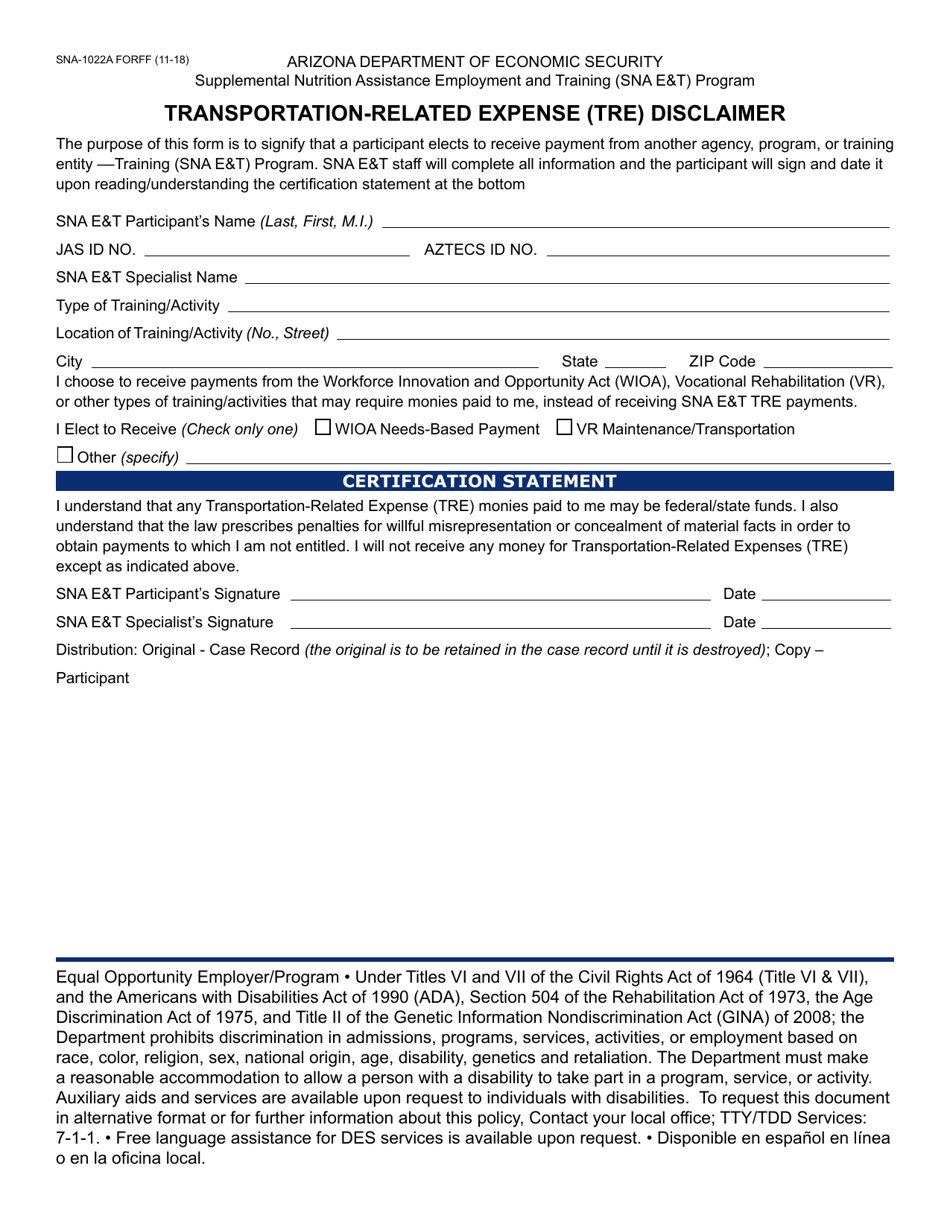

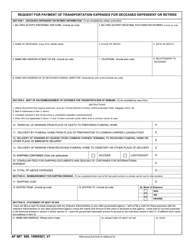

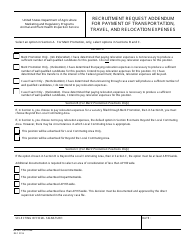

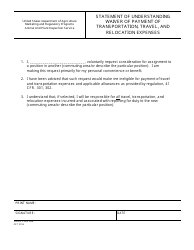

Form SNA-1022A Transportation-Related Expense (Tre) Disclaimer - Arizona

What Is Form SNA-1022A?

This is a legal form that was released by the Arizona Department of Economic Security - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SNA-1022A?

A: Form SNA-1022A is a transportation-related expense disclaimer form.

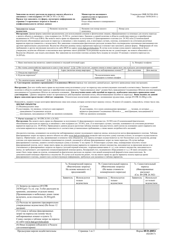

Q: What is a transportation-related expense?

A: A transportation-related expense refers to any costs related to transportation such as fuel, tolls, parking fees, and vehicle maintenance.

Q: Who needs to fill out Form SNA-1022A?

A: Anyone who has transportation-related expenses and is claiming them as a deduction for tax purposes in Arizona needs to fill out this form.

Q: What is the purpose of Form SNA-1022A?

A: The purpose of this form is to provide a disclaimer and declaration of transportation-related expenses for tax purposes.

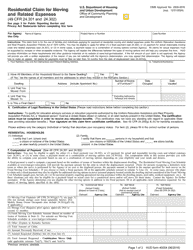

Q: Is Form SNA-1022A specific to Arizona?

A: Yes, Form SNA-1022A is specifically for transportation-related expenses claimed as deductions for tax purposes in Arizona.

Q: What should I do with Form SNA-1022A once I fill it out?

A: Once you fill out the form, you should keep a copy for your records and submit the original form along with your tax return.

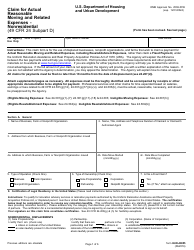

Q: Are there any limitations or restrictions to claiming transportation-related expenses?

A: Yes, there may be limitations or restrictions on claiming transportation-related expenses as deductions, so it's important to consult with a tax professional or review the guidelines provided by the Arizona Department of Revenue.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Arizona Department of Economic Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SNA-1022A by clicking the link below or browse more documents and templates provided by the Arizona Department of Economic Security.