This version of the form is not currently in use and is provided for reference only. Download this version of

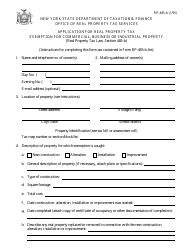

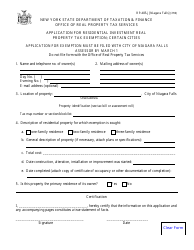

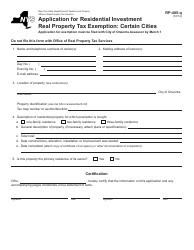

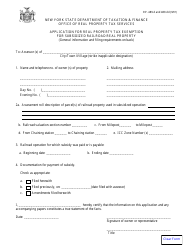

Form RP-5850

for the current year.

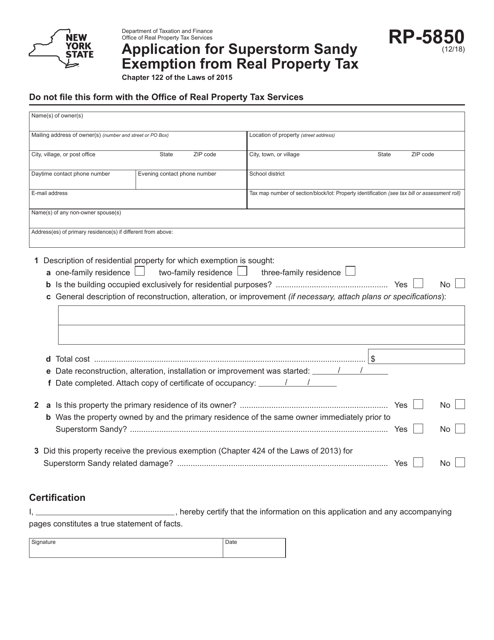

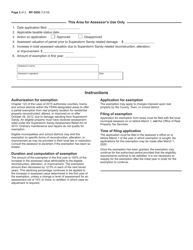

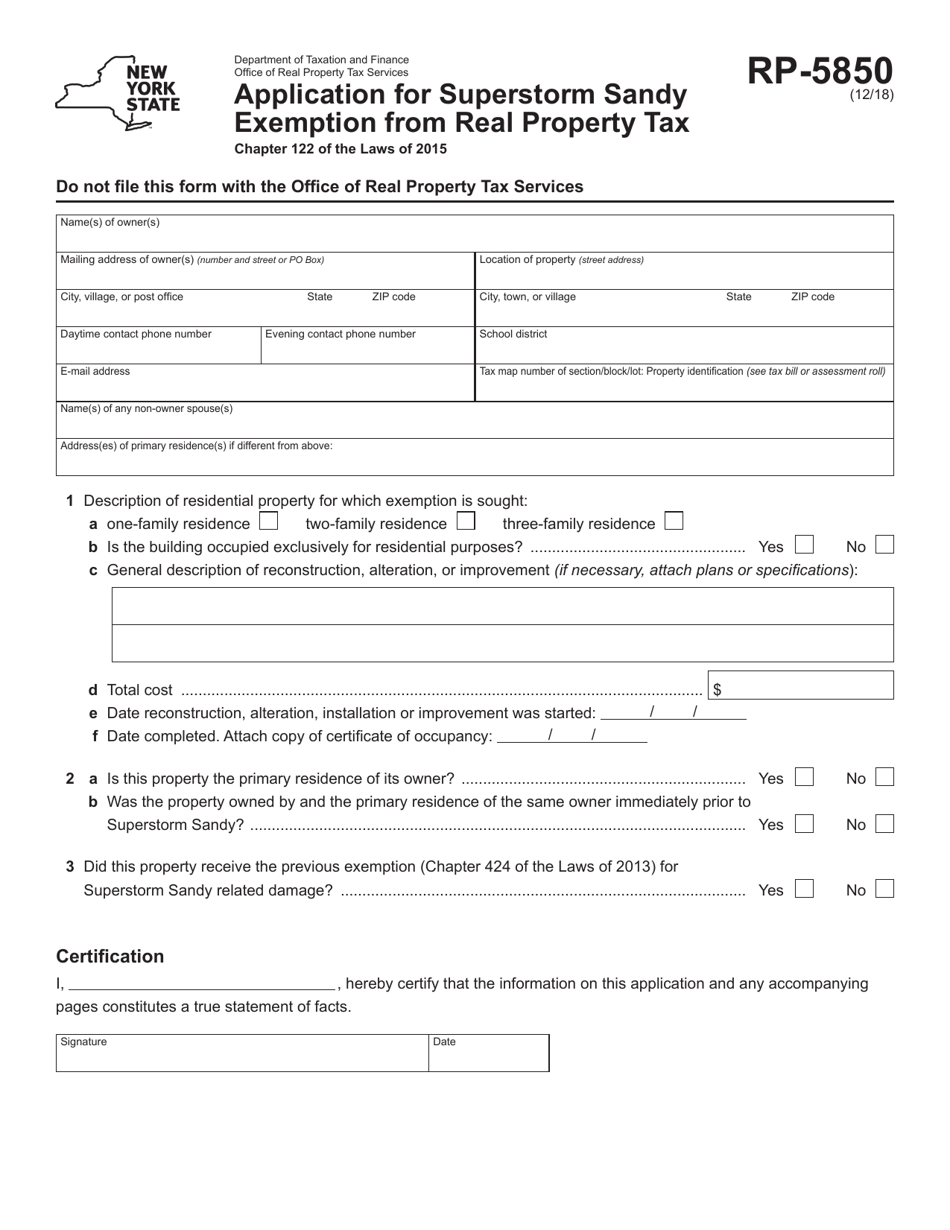

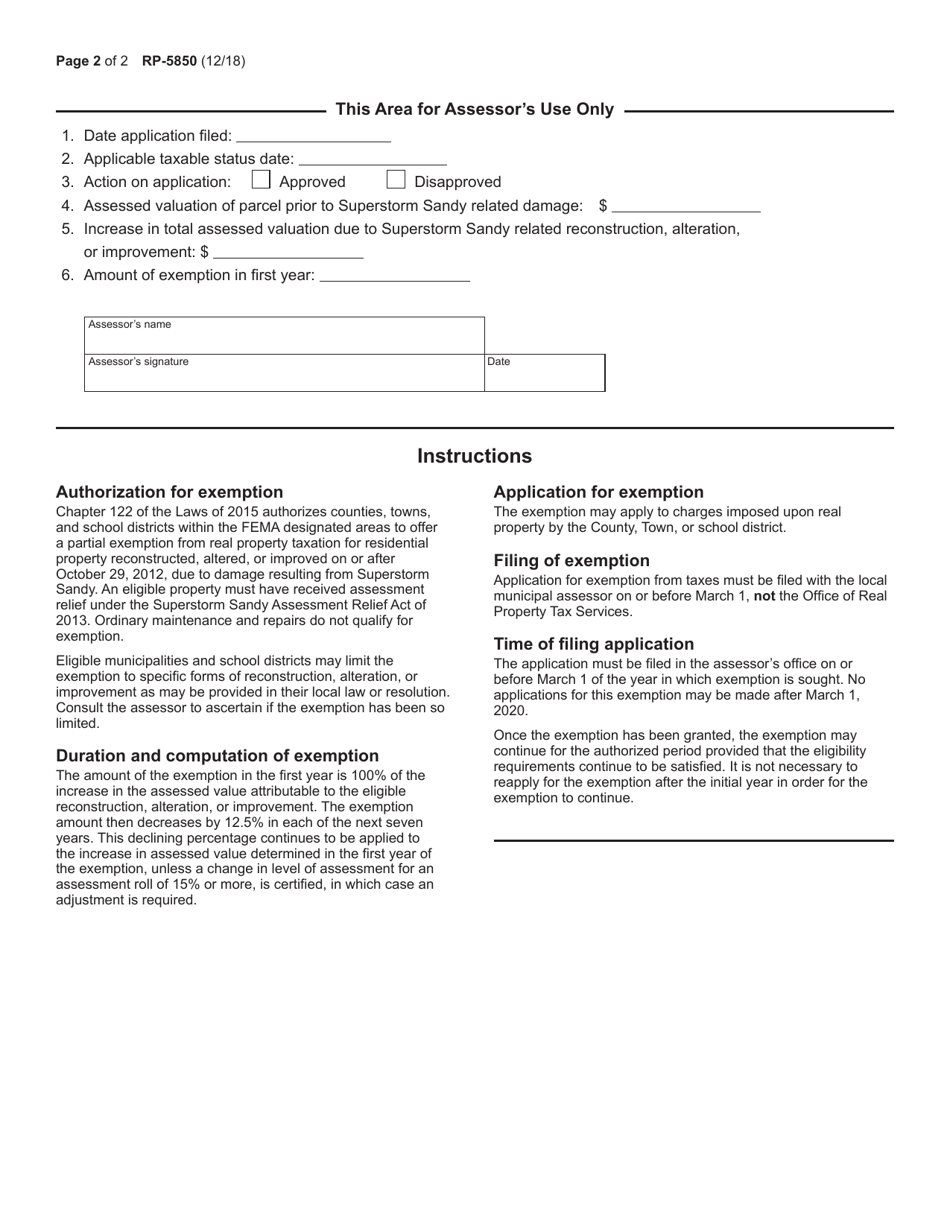

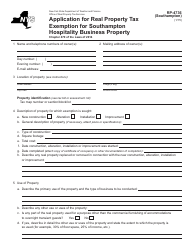

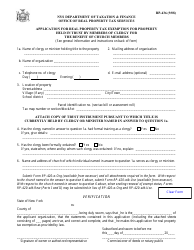

Form RP-5850 Application for Superstorm Sandy Exemption From Real Property Tax - New York

What Is Form RP-5850?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-5850?

A: Form RP-5850 is the Application for Superstorm Sandy Exemption From Real Property Tax in New York.

Q: What is the purpose of Form RP-5850?

A: The purpose of Form RP-5850 is to apply for an exemption from real property tax for properties affected by Superstorm Sandy.

Q: Who is eligible to apply for the Superstorm Sandy exemption?

A: Property owners whose properties were damaged or destroyed by Superstorm Sandy are eligible to apply.

Q: What information is required on the form?

A: The form requires information such as the property owner's name, contact information, property location, and details about the damage or destruction caused by Superstorm Sandy.

Q: Is there a deadline for submitting the form?

A: Yes, the deadline for submitting Form RP-5850 is generally within one year from the date on which the governor declared a state disaster emergency due to Superstorm Sandy.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-5850 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

![Document preview: Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)