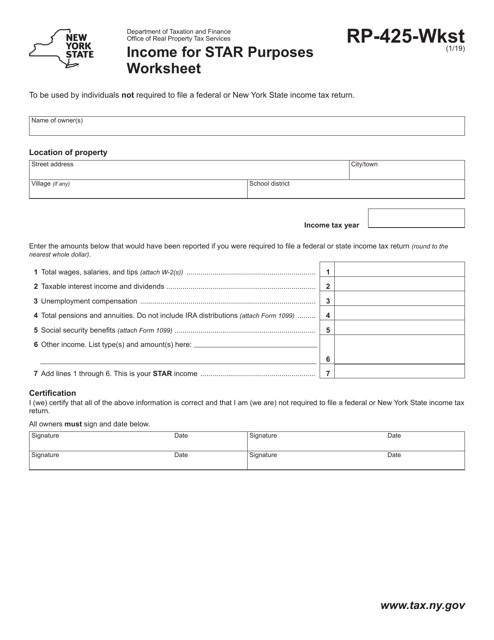

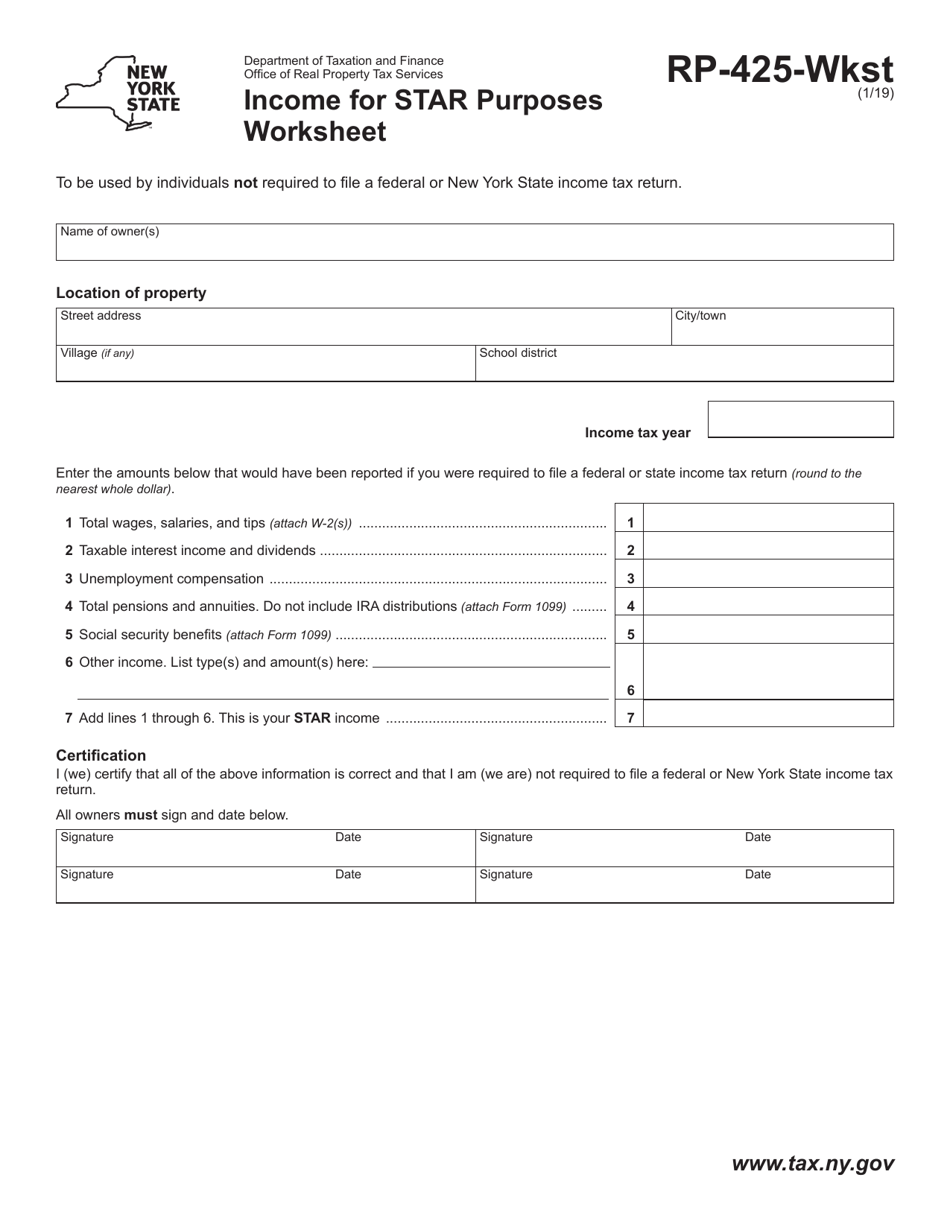

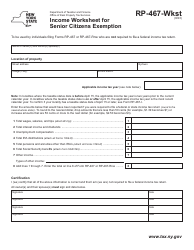

Form RP-425-WKST Income for Star Purposes Worksheet - New York

What Is Form RP-425-WKST?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RP-425-WKST?

A: The Form RP-425-WKST is a worksheet used for calculating income for star (School Tax Relief) purposes in New York.

Q: What is star (School Tax Relief)?

A: STAR (School Tax Relief) is a program in New York that provides property tax relief to eligible homeowners.

Q: Who needs to fill out Form RP-425-WKST?

A: Homeowners in New York who are applying for the STAR program may need to fill out Form RP-425-WKST.

Q: What information is required on Form RP-425-WKST?

A: Form RP-425-WKST requires information about the homeowner's income, including wages, interest, dividends, and retirement distributions.

Q: Is Form RP-425-WKST only for residents of New York?

A: Yes, Form RP-425-WKST is specifically for residents of New York who are applying for the STAR program.

Q: What is the deadline for submitting Form RP-425-WKST?

A: The deadline for submitting Form RP-425-WKST varies each year. It is important to check the instructions or contact the appropriate tax authority for the current year's deadline.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-425-WKST by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.