This version of the form is not currently in use and is provided for reference only. Download this version of

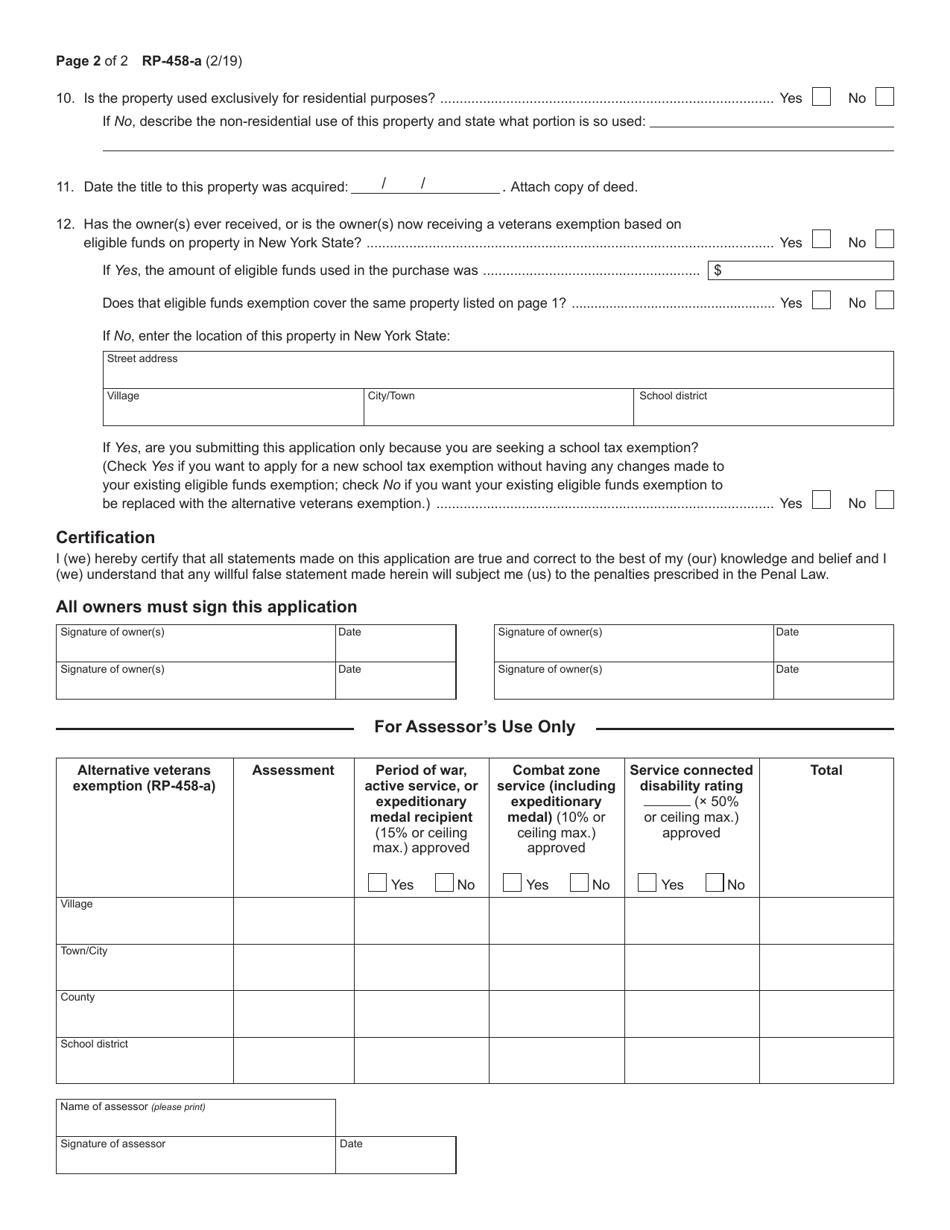

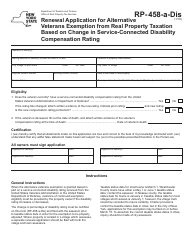

Form RP-458-A

for the current year.

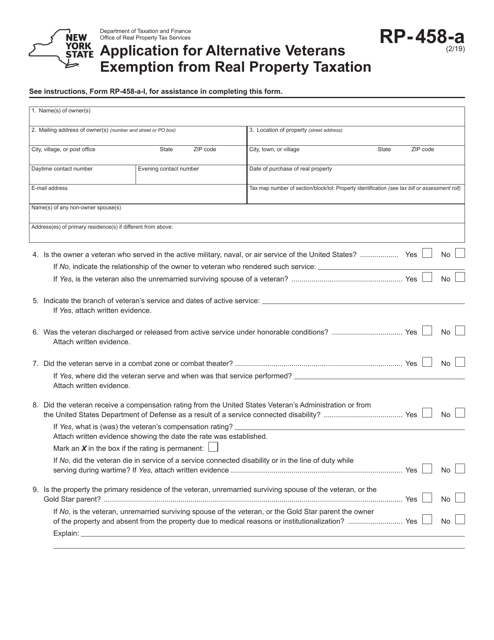

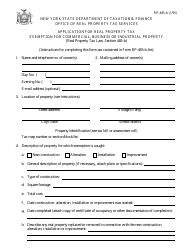

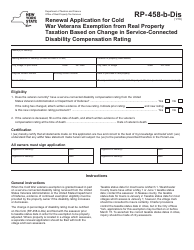

Form RP-458-A Application for Alternative Veterans Exemption From Real Property Taxation - New York

What Is Form RP-458-A?

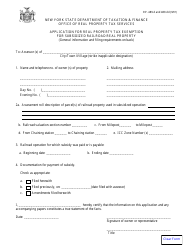

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RP-458-A?

A: Form RP-458-A is an application for the Alternative Veterans Exemption from Real Property Taxation in New York.

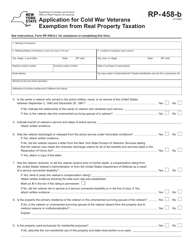

Q: Who is eligible to apply for the Alternative Veterans Exemption?

A: Veterans who meet certain criteria are eligible to apply for the Alternative Veterans Exemption.

Q: What is the Alternative Veterans Exemption?

A: The Alternative Veterans Exemption is a property tax exemption available to eligible veterans in New York.

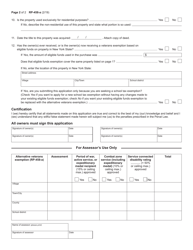

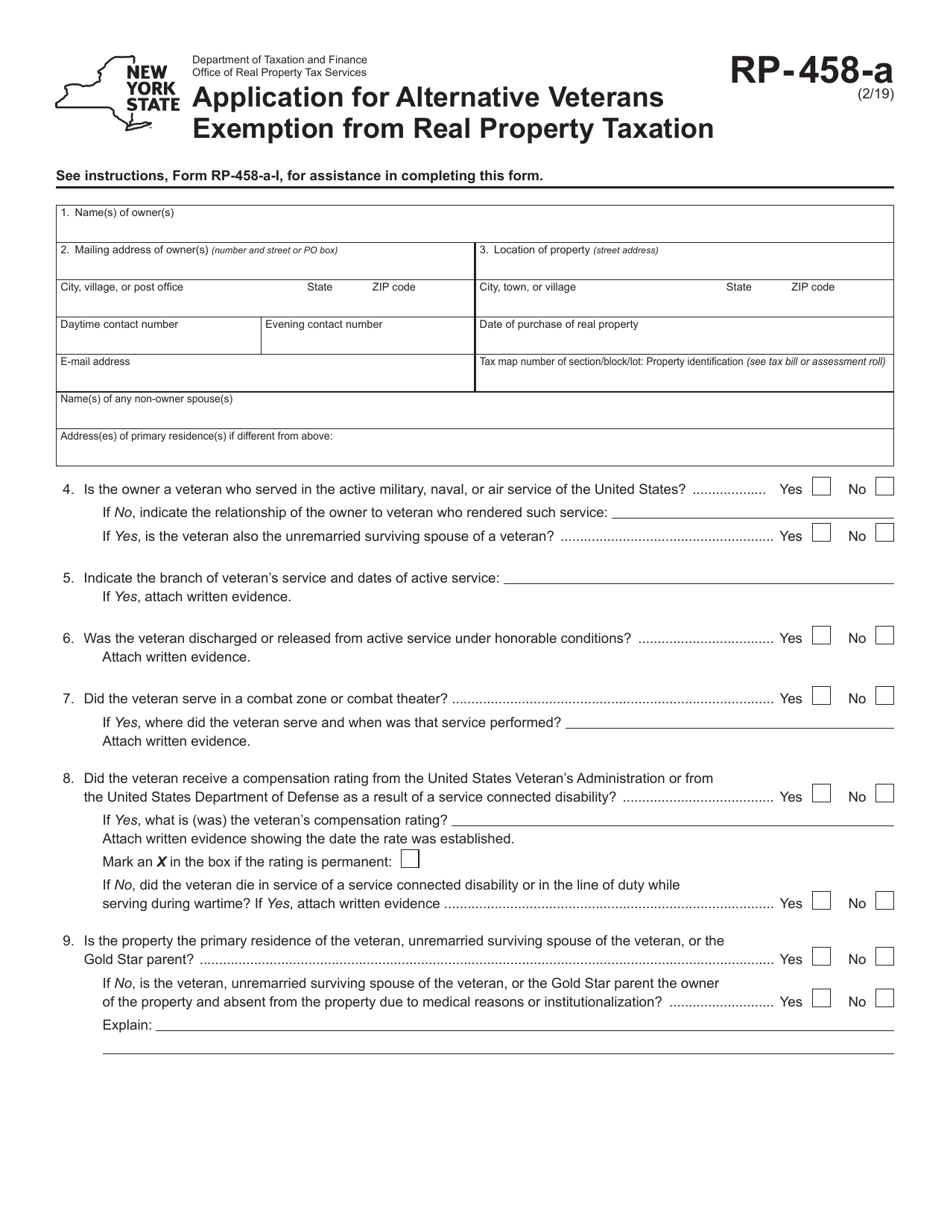

Q: What information is required on Form RP-458-A?

A: Form RP-458-A requires information about the veteran's military service and proof of eligibility.

Q: When is the deadline to file Form RP-458-A?

A: The deadline to file Form RP-458-A varies depending on your local municipality. Contact your assessor's office for the specific deadline.

Q: What are the benefits of the Alternative Veterans Exemption?

A: The Alternative Veterans Exemption can provide property tax savings for eligible veterans based on their level of service-connected disability or wartime service.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-458-A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.