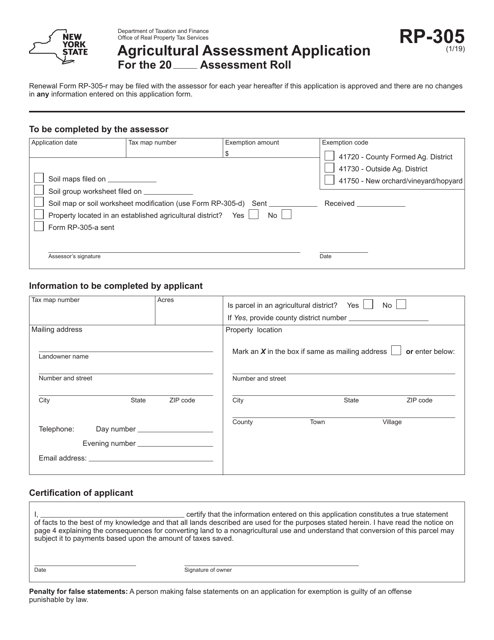

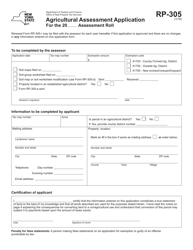

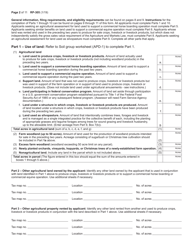

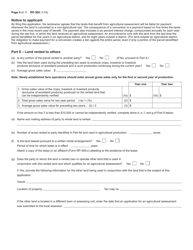

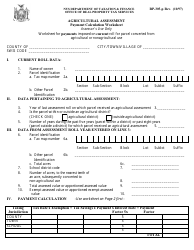

Form RP-305 Agricultural Assessment Application - New York

What Is Form RP-305?

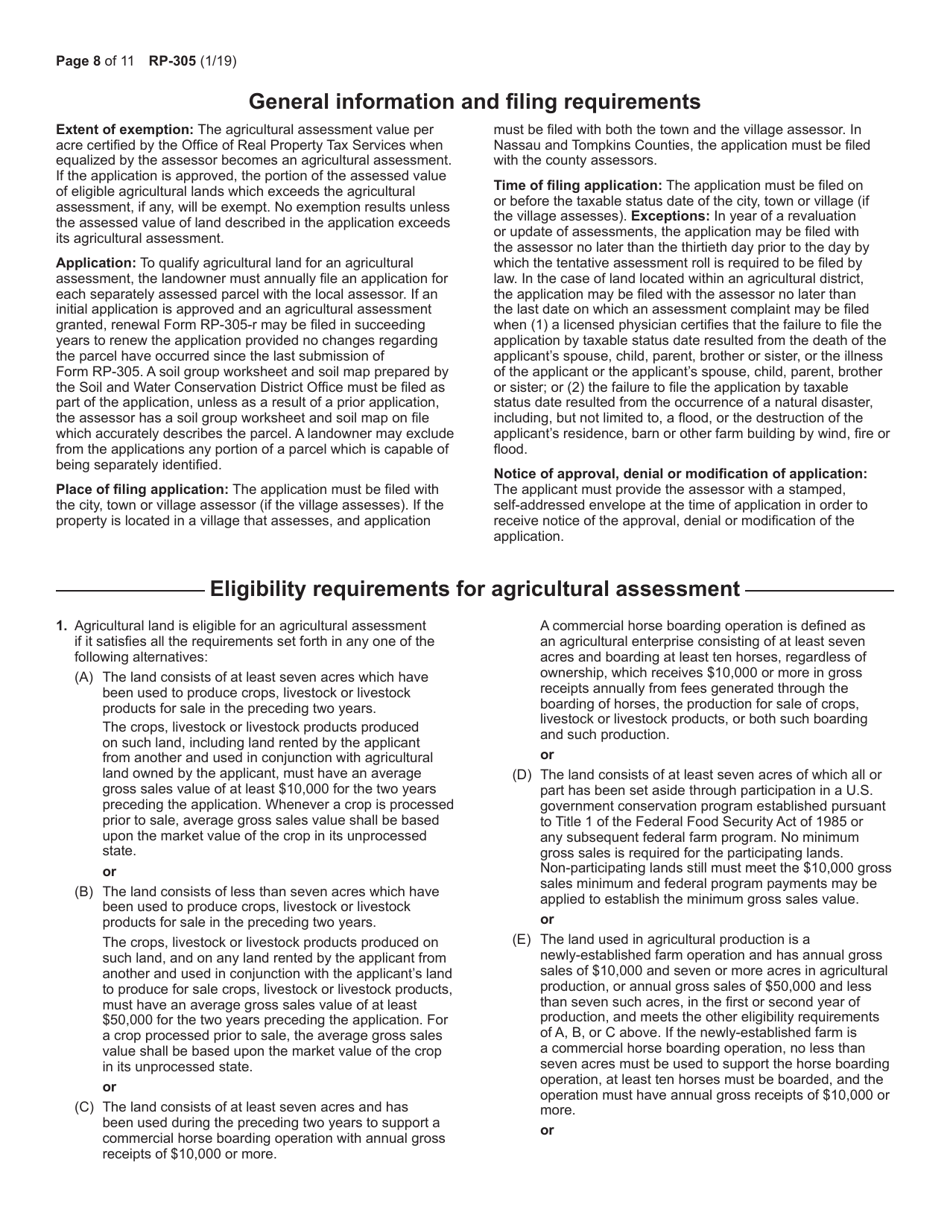

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-305?

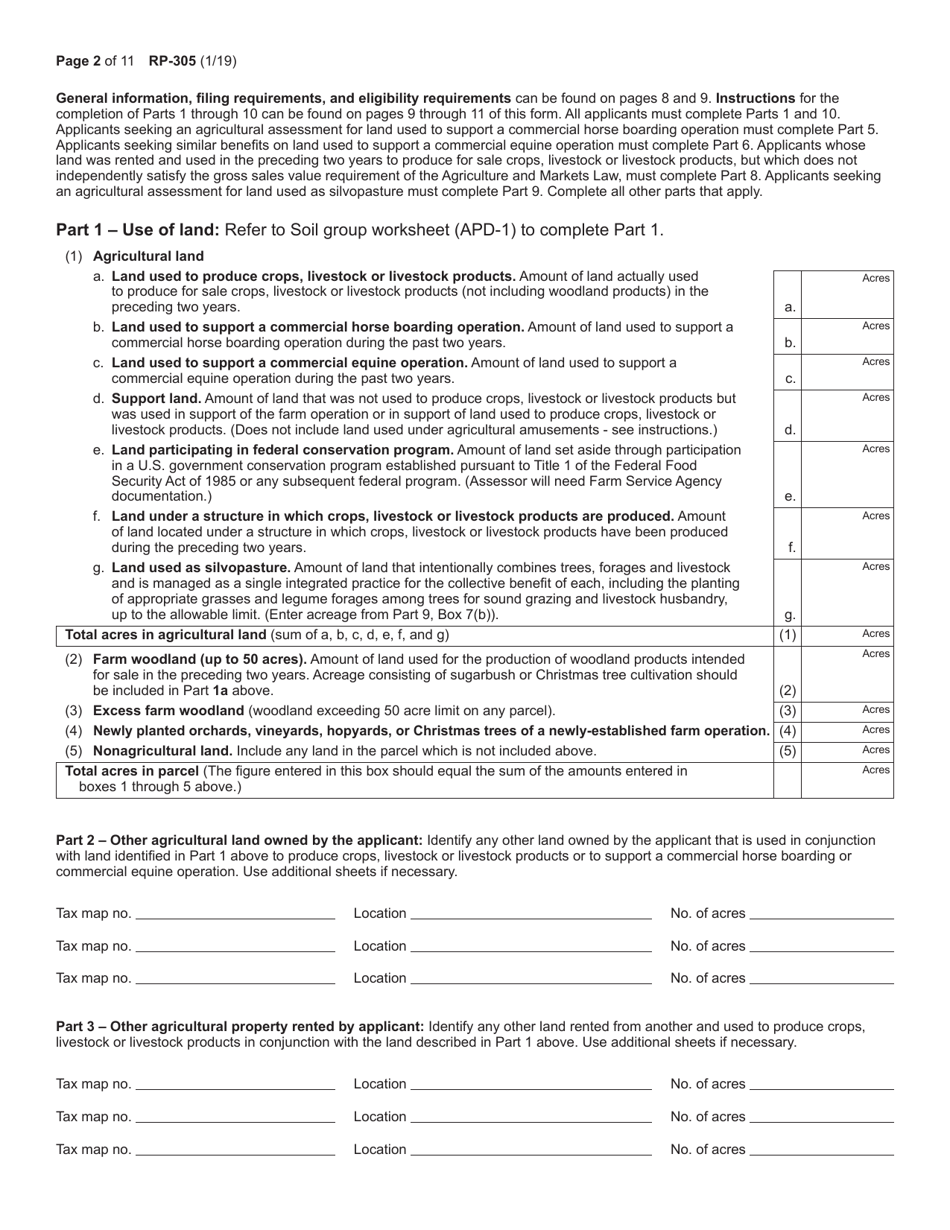

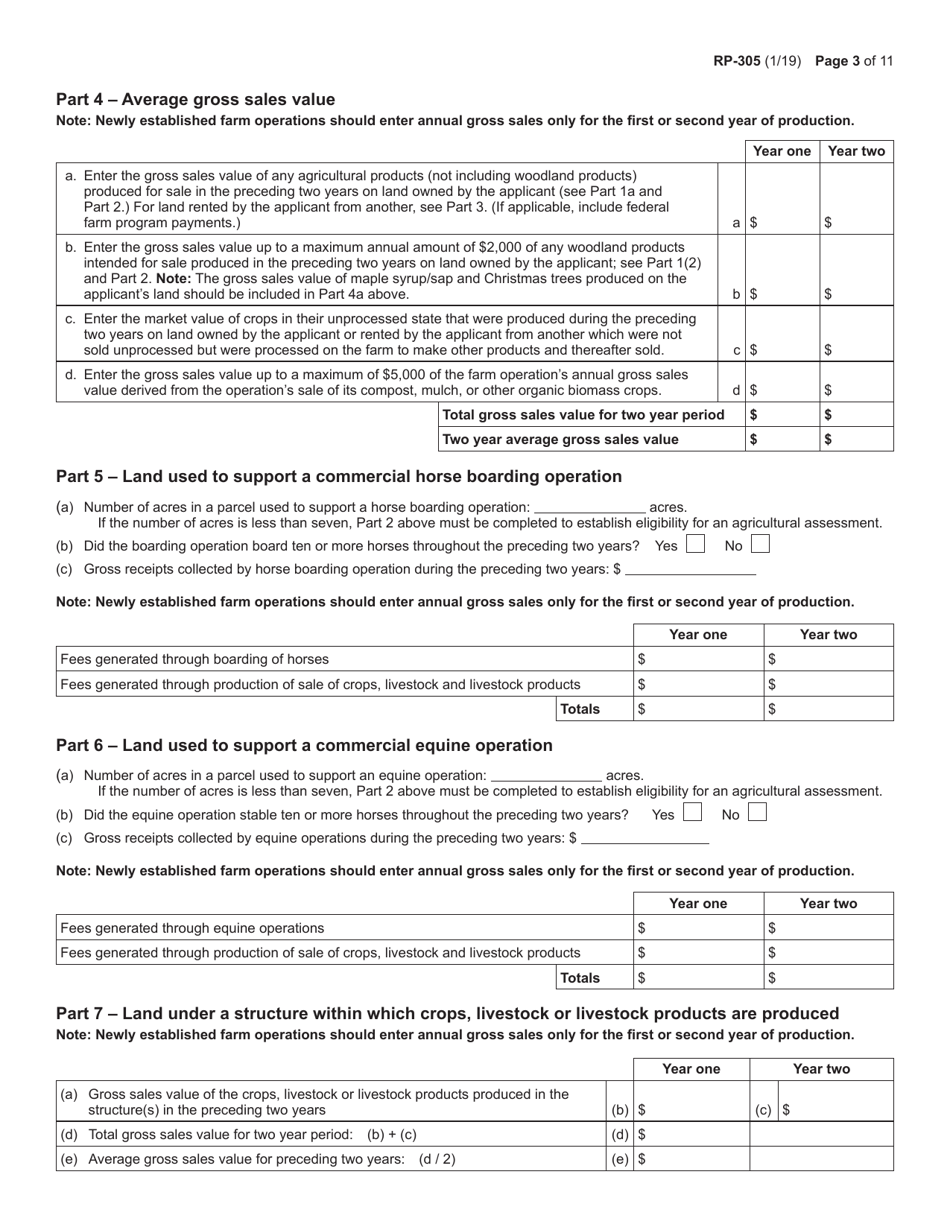

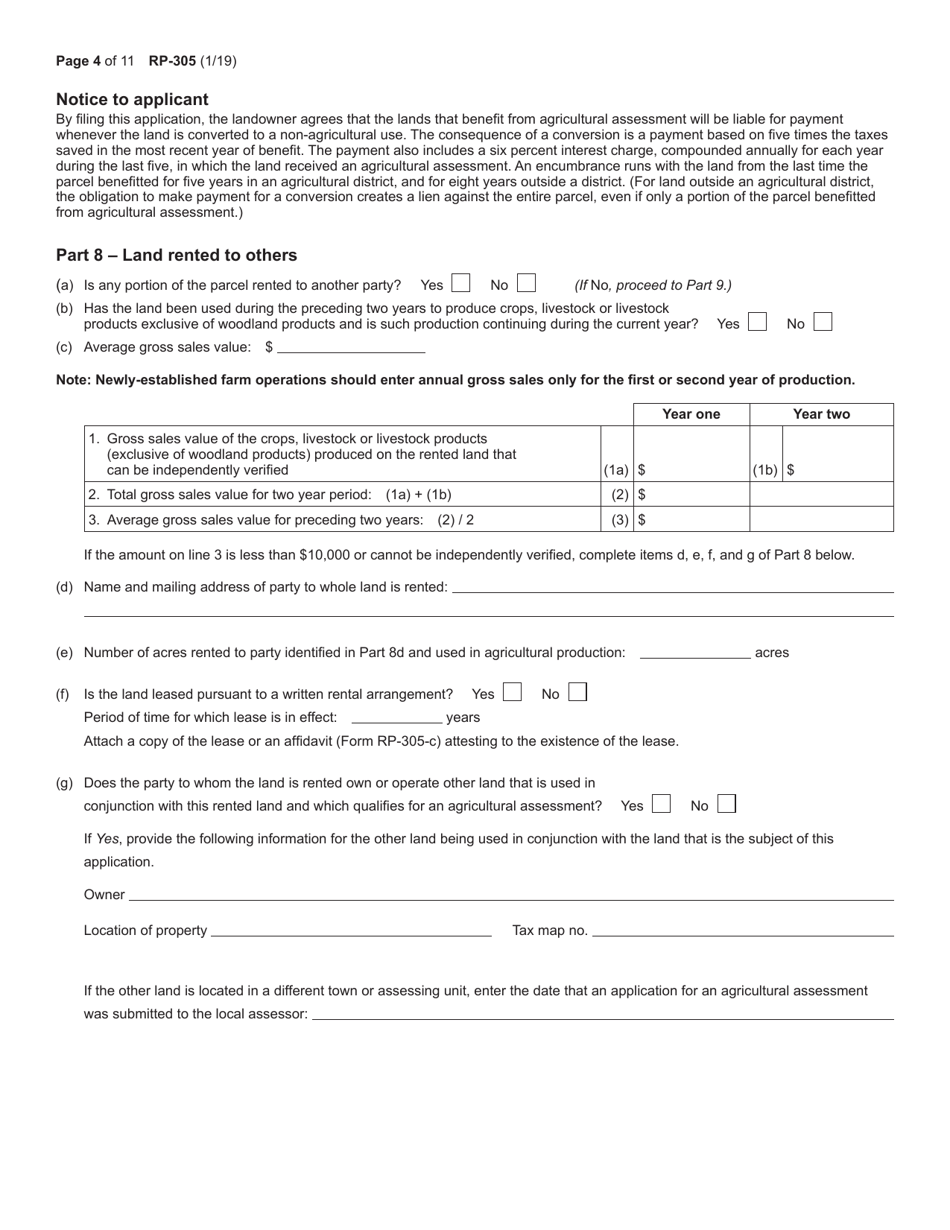

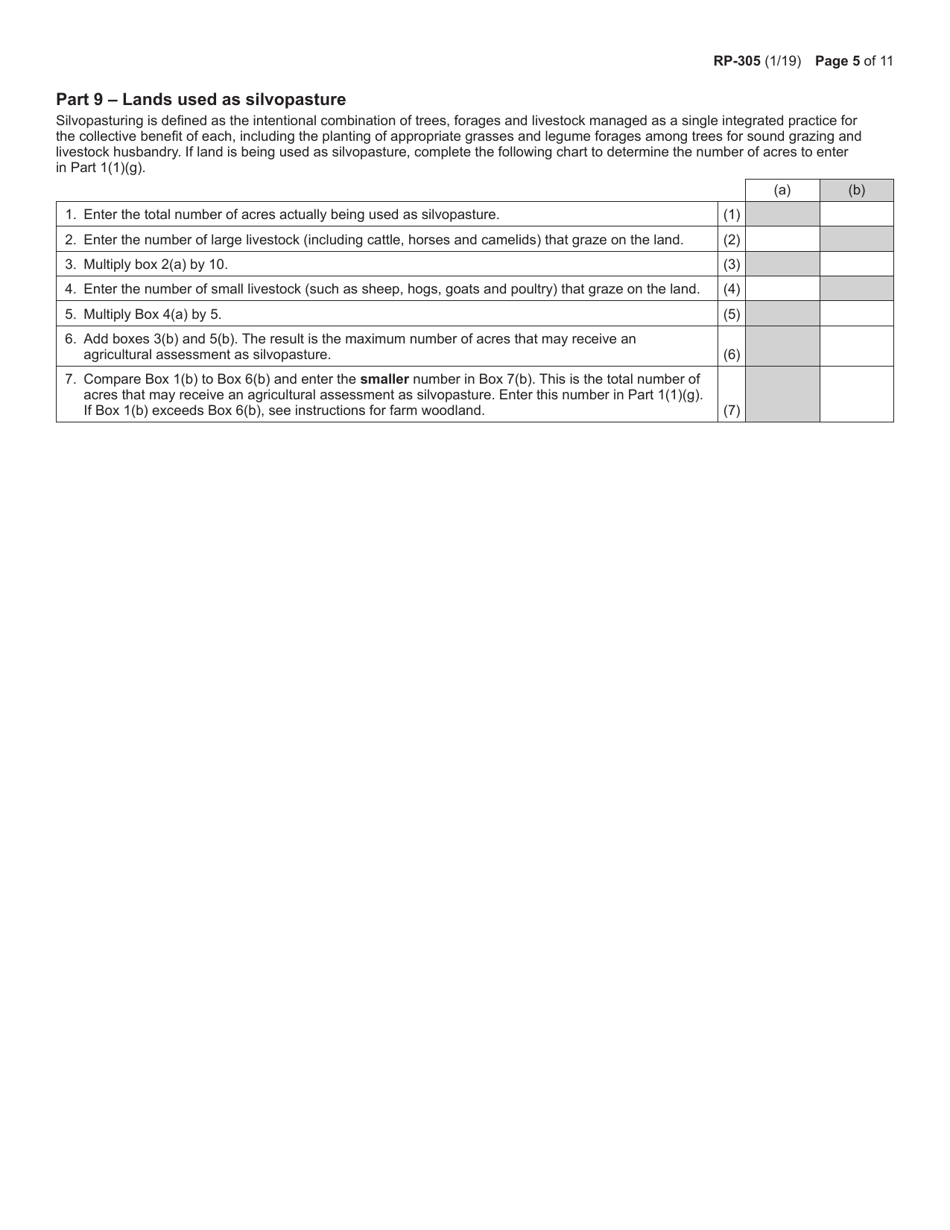

A: Form RP-305 is the Agricultural Assessment Application in New York.

Q: Who needs to fill out Form RP-305?

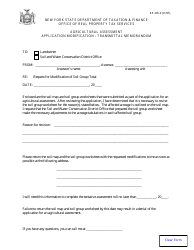

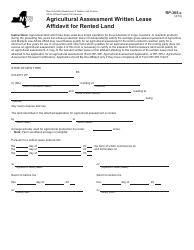

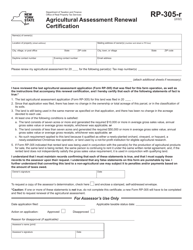

A: Landowners in New York who want to apply for an agricultural assessment need to fill out Form RP-305.

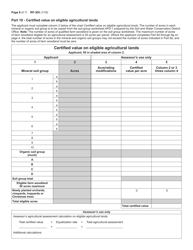

Q: What is an agricultural assessment?

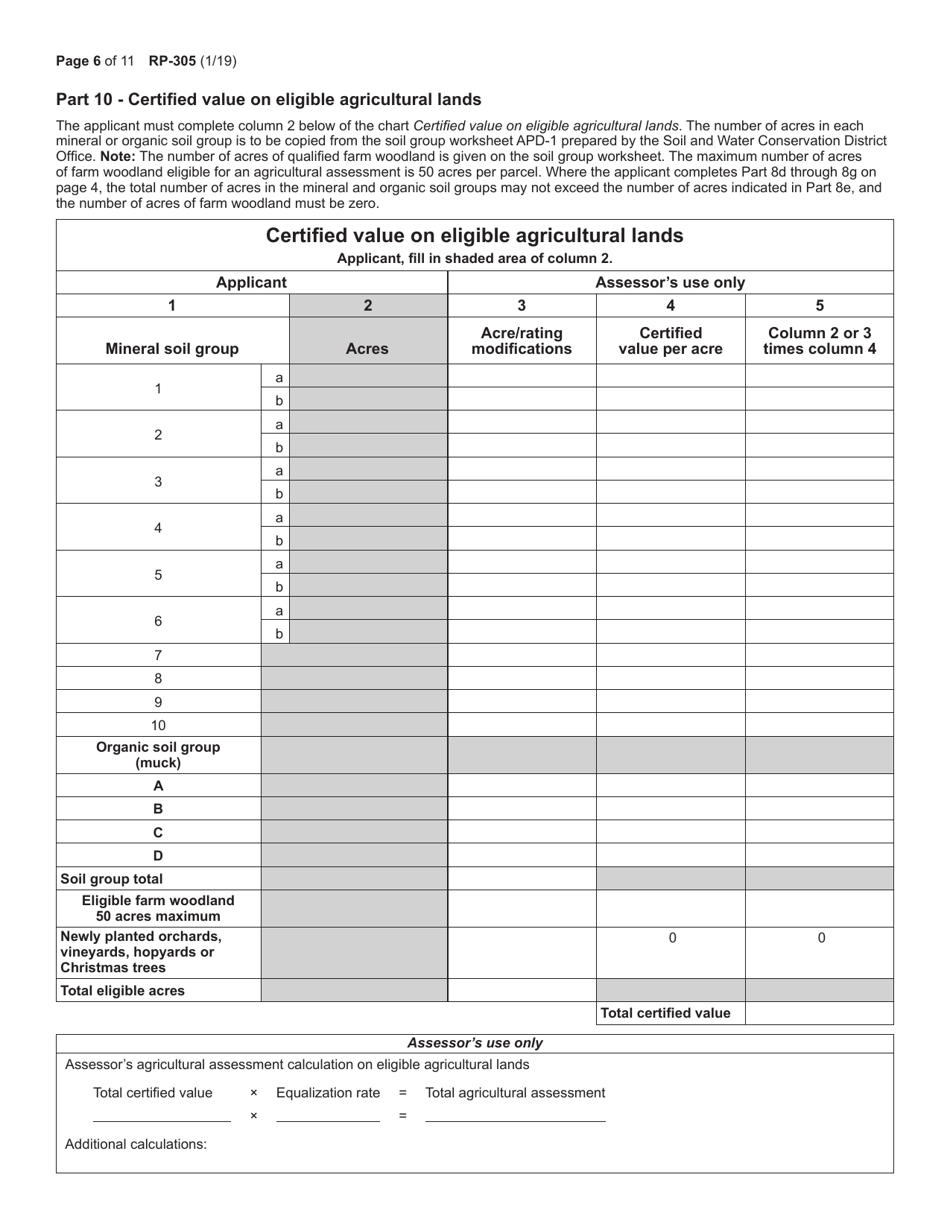

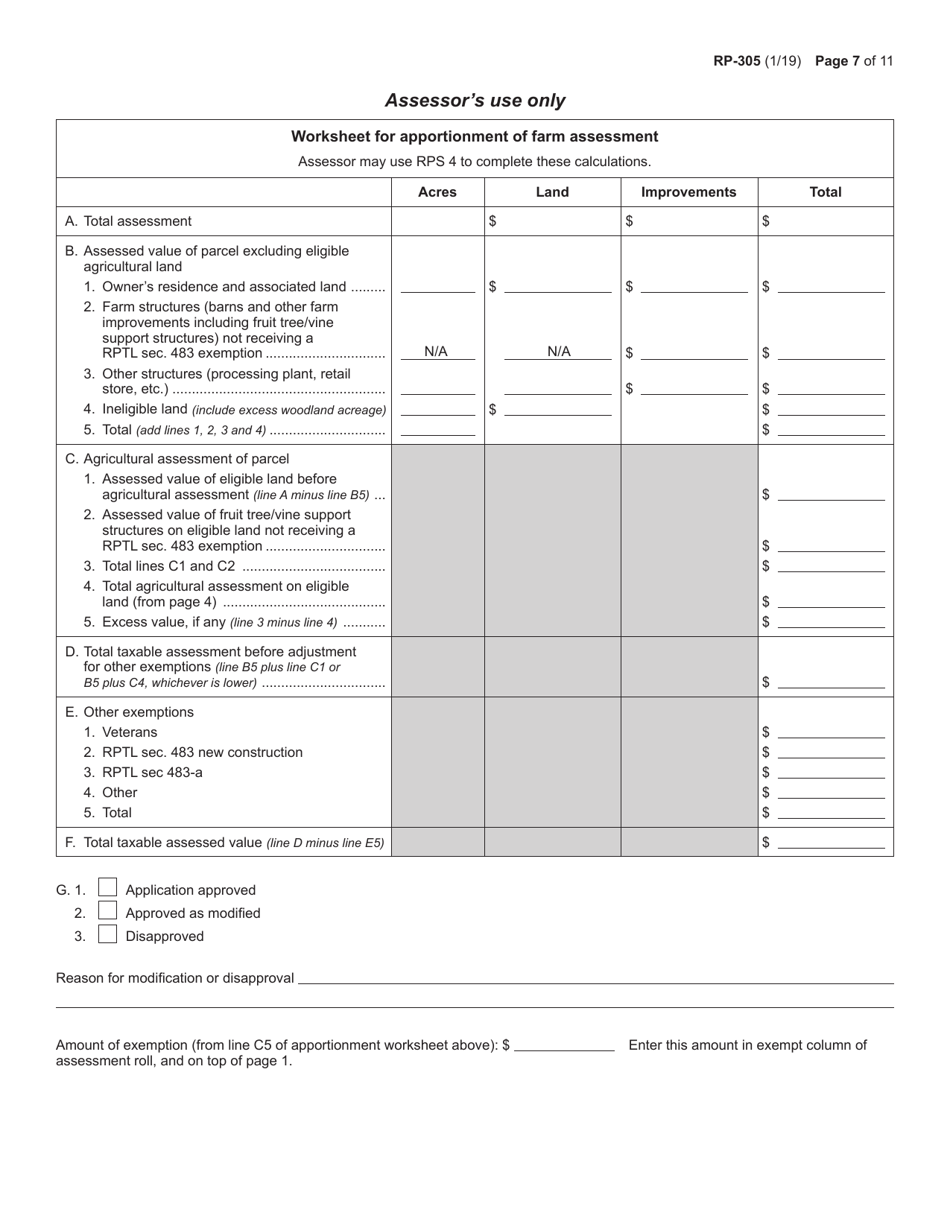

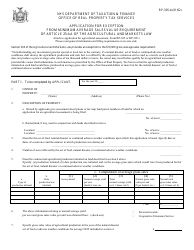

A: An agricultural assessment is a tax reduction program for eligible agricultural lands in New York.

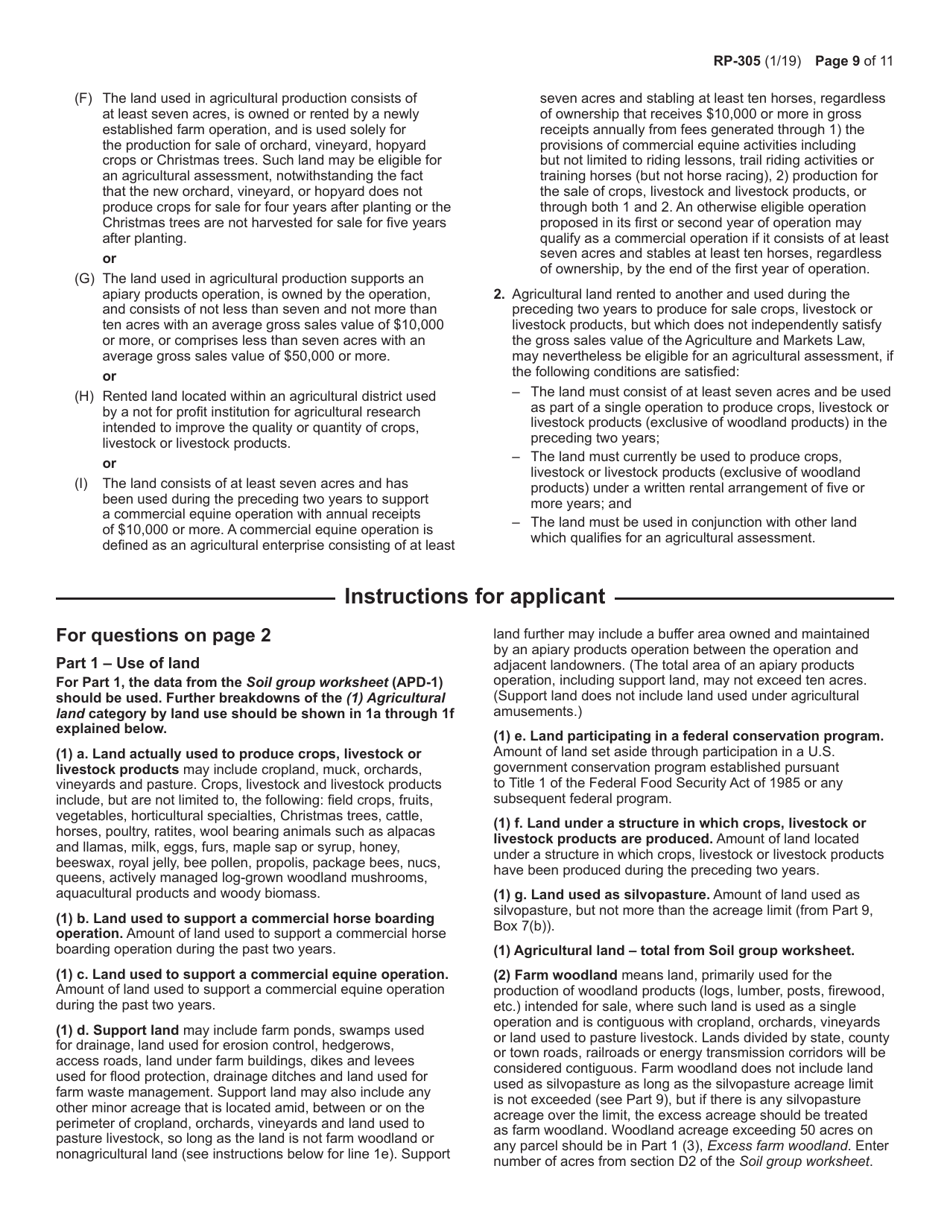

Q: What are the eligibility requirements for an agricultural assessment?

A: To be eligible for an agricultural assessment, the land must be used for agricultural production for the past two years and meet certain size requirements.

Q: When is the deadline to submit Form RP-305?

A: The deadline to submit Form RP-305 is March 1st of each year.

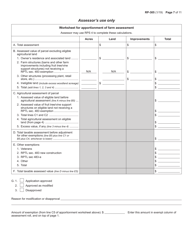

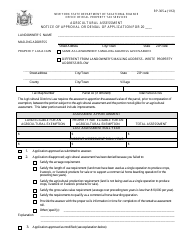

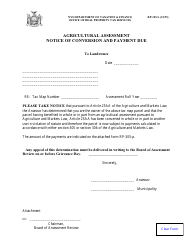

Q: What happens after I submit Form RP-305?

A: After submitting Form RP-305, the assessor will review your application and determine if you meet the eligibility requirements for an agricultural assessment.

Q: What are the benefits of an agricultural assessment?

A: The benefits of an agricultural assessment include lower property taxes for eligible agricultural lands.

Q: Can I appeal if my application for an agricultural assessment is denied?

A: Yes, if your application for an agricultural assessment is denied, you can appeal the decision.

Q: Are there any penalties for providing false information on Form RP-305?

A: Yes, providing false information on Form RP-305 can result in penalties and potential legal consequences.

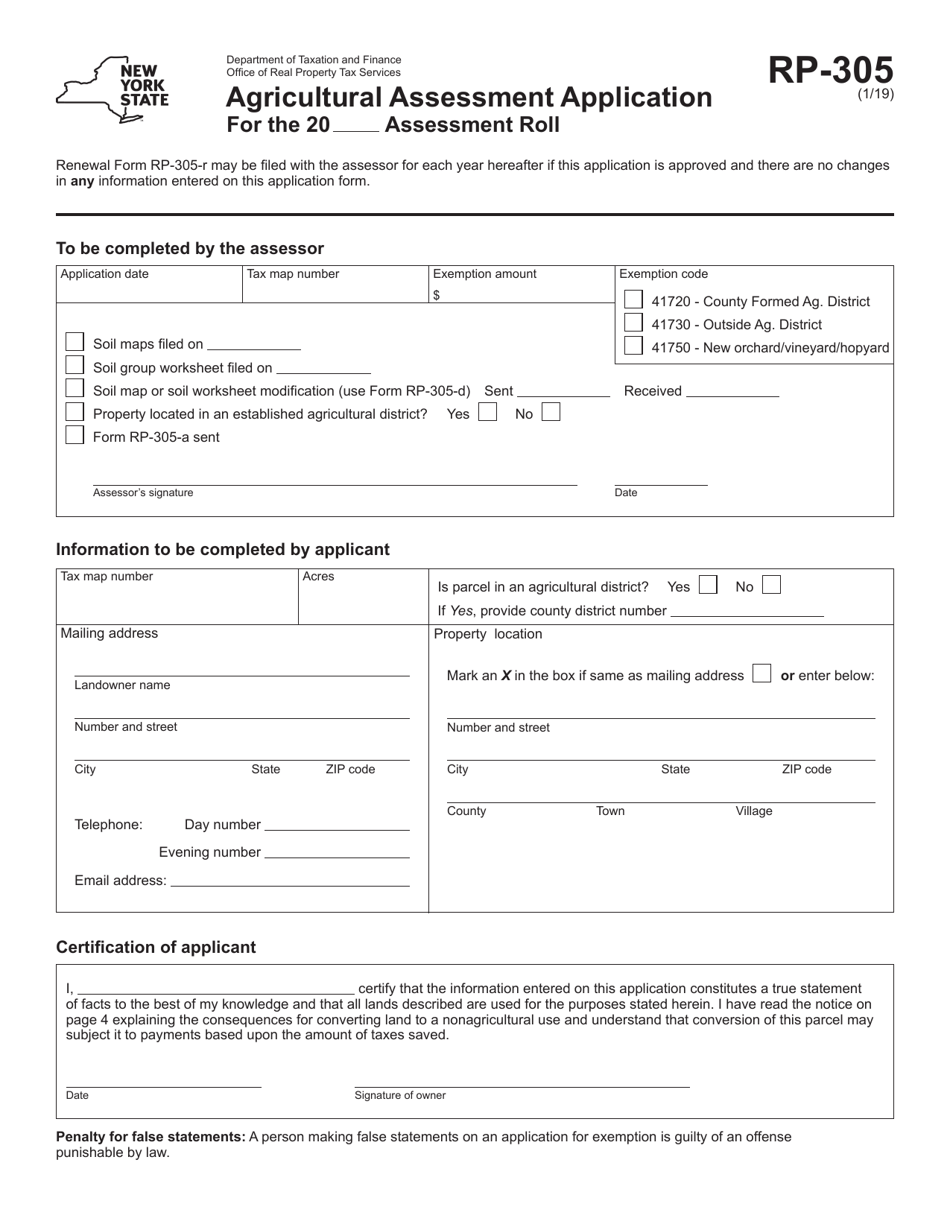

Form Details:

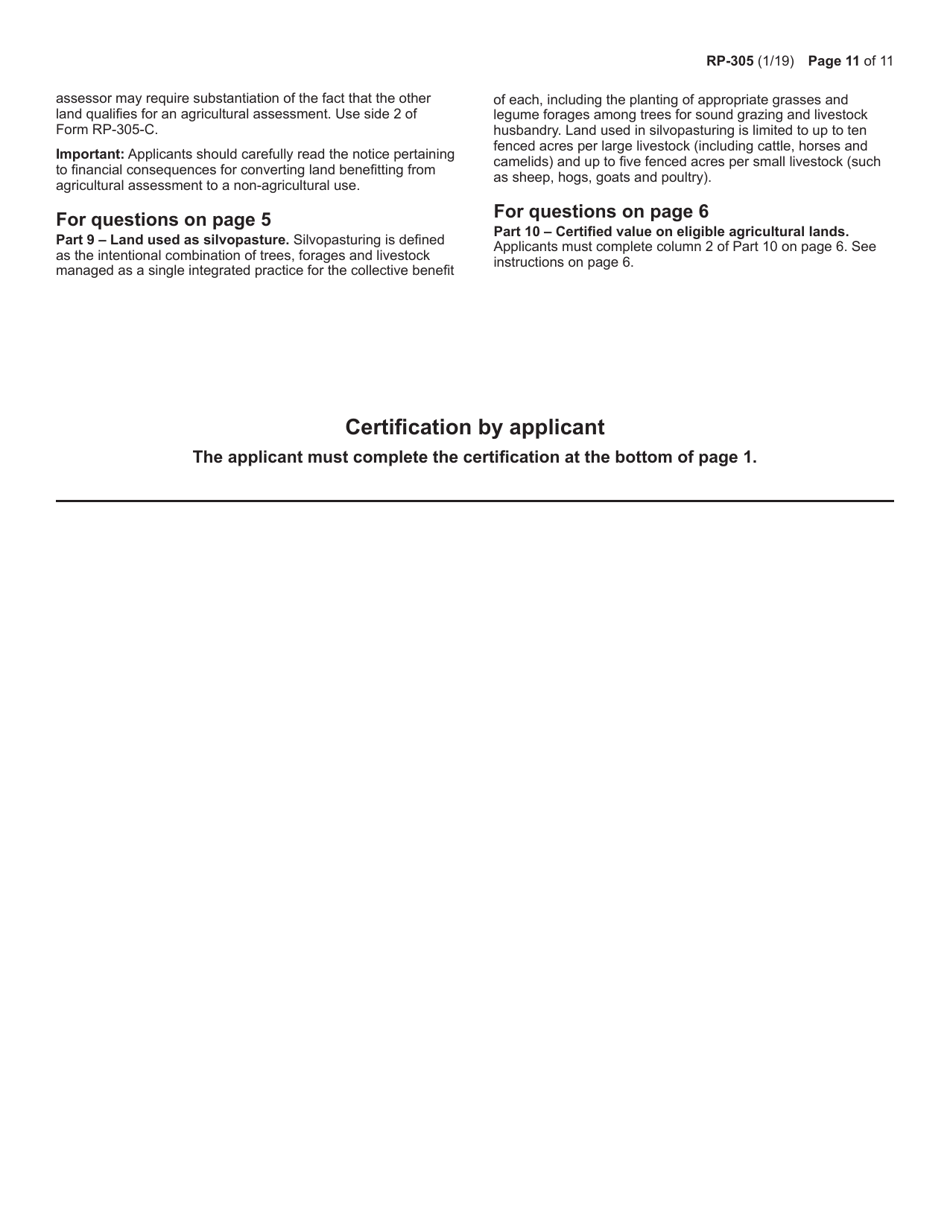

- Released on January 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-305 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.